- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Grade Silicone Market Size, Industry Report, 2030GVR Report cover

![Medical Grade Silicone Market Size, Share & Trends Report]()

Medical Grade Silicone Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Elastomers, Gels, Medical Adhesives, Medical Coatings, Foams), By Application (Prosthetics, Orthopedic, Contact Lens), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-639-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Grade Silicone Market Summary

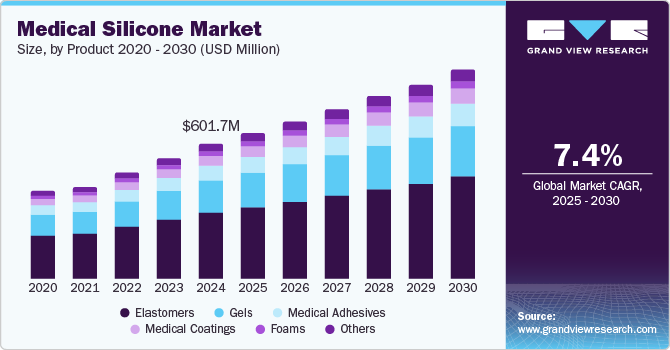

The global medical grade silicone market size was estimated at USD 601.7 million in 2024 and is projected to reach USD 922.7 million by 2030, growing at a CAGR of 7.4% from 2025 to 2030. This growth is attributed to the increasing healthcare expenditures in developed and developing regions.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Based on products, elastomers led the market and accounted for the largest revenue share of 48.0% in 2024.

- Gel is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 601.7 Million

- 2030 Projected Market Size: USD 922.7 Million

- CAGR (2025-2030): 7.4%

- North America: Largest market in 2024

In addition, the rising prevalence of chronic diseases, such as cardiovascular issues and diabetes, necessitates innovative medical solutions. Furthermore, the growing need for disposable medical devices and advancements in healthcare infrastructure further propel market expansion.

Medical grade silicone is a specialized type of silicone designed to meet stringent standards for safety and biocompatibility, making it suitable for medical applications. The market for medical-grade silicone-based implantable devices is rapidly expanding due to several factors. First, there is a growing focus on developing advanced medical devices that can support the body’s functions, particularly in areas such as orthopedics and cardiovascular health. This trend is driven by an increasing number of chronic disorders, which has led to a higher demand for implantable devices that utilize medical grade silicone.

In addition, the rise in healthcare facilities has improved the development of medical components, enhancing treatment options across various conditions. As hospitals expand their capabilities, incorporating medical-grade silicone into their offerings has become more prevalent, further driving market growth. Furthermore, the aging population also plays a significant role; as the number of elderly patients rises, so does the need for medical devices to assist with their health challenges.

Moreover, government support for innovative healthcare technologies is contributing to market expansion. Increased investments in research and development of medical-grade silicone devices foster advancements yielding better patient outcomes. This support includes funding new technologies that enhance device performance while ensuring safety and efficacy.

Product Insights

The elastomers led the market and accounted for the largest revenue share of 48.0% in 2024. This growth is attributed to their superior properties. Silicone elastomers exhibit excellent thermal stability, chemical resistance, and flexibility, making them ideal for various medical applications such as prosthetics, surgical devices, and drug delivery systems. In addition, their ability to withstand extreme temperatures and harsh environments enhances their reliability in long-term implantable devices. Furthermore, the rising demand for lightweight and durable materials in the healthcare sector further propels the adoption of silicone elastomers, contributing significantly to market expansion.

The gels product segment is expected to grow at a CAGR of 7.5% over the forecast period, owing to its unique characteristics that cater to specific medical needs. Silicone gels are known for their excellent hydrophobicity, biocompatibility, and resistance to pathogens, making them suitable for applications such as wound care and soft tissue implants. In addition, their ability to conform to body contours while providing cushioning enhances patient comfort during long-term use. Furthermore, the increasing prevalence of chronic conditions requiring innovative treatment solutions drives the demand for silicone gels in therapeutic applications, boosting their market presence.

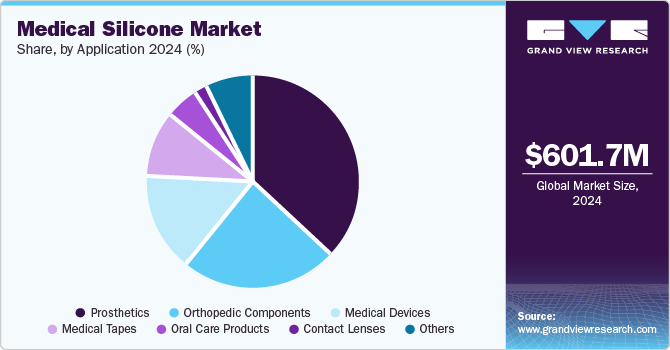

Application Insights

The prosthetics application segment dominated the market and accounted for the largest revenue share of 37.0% in 2024, driven by the increasing demand for advanced prosthetic devices. As the global population ages and the incidence of limb loss rises due to accidents or medical conditions, a heightened need for high-quality prosthetics that enhance mobility and improve quality of life is heightened. Furthermore, medical grade silicone's biocompatibility and ability to mimic human tissue properties make it ideal for creating comfortable, functional prosthetic limbs. Moreover, advancements in silicone technology have led to innovative designs that offer better fit and performance, further driving market growth.

The orthopedic components are expected to grow at a CAGR of 7.6% from 2025 to 2030, owing to the rising prevalence of orthopedic conditions and an aging population. As more individuals require joint replacements or support for degenerative diseases, the demand for orthopedic implants made from medical grade silicone increases. In addition, the material's excellent durability, flexibility, and shock absorption properties make it suitable for applications such as joint replacements and spinal implants. Furthermore, ongoing innovations in silicone formulations enhance the performance of orthopedic devices, enabling better integration with surrounding tissues and improving patient outcomes, thus contributing to the segment's expansion in the market.

Regional Insights

The North America medical grade silicone market dominated the global market and accounted for the largest revenue share of 44.0% in 2024. This growth is attributed to a combination of advanced healthcare infrastructure and high healthcare expenditure. In addition, the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions further drives the market growth in the region. This has led to a rising demand for medical devices, including prosthetics and implantable components, which utilize medical grade silicone for its biocompatibility and durability. Moreover, the presence of major manufacturers further enhances market growth.

U.S. Medical Grade Silicone Market Trends

The medical grade silicone market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, driven by significant healthcare spending and a robust demand for innovative medical devices. In addition, the aging population and the growing incidence of chronic health conditions are key factors driving the need for advanced prosthetics and orthopedic solutions. Furthermore, the ongoing development of new technologies and materials in the medical field enhances the application of medical grade silicone in various devices, ensuring continued growth in this vital healthcare industry segment.

Asia Pacific Medical Grade Silicone Market Trends

The Asia Pacific medical grade silicone market is expected to grow at a CAGR of 7.9% over the forecast period, owing to rising income levels and an aging demographic. Countries such as China and India are experiencing increased healthcare investments, leading to improved access to medical technologies. In addition, the prevalence of orthopedic conditions and a surge in road accidents further fuel demand for silicone-based medical devices. Furthermore, the region's growing medical tourism industry also contributes to heightened interest in advanced healthcare solutions, enhancing market opportunities.

The medical grade silicone market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by significant advancements in healthcare infrastructure and increasing government support for innovative medical technologies. In addition, the rising prevalence of chronic diseases necessitates improved medical devices that leverage the unique properties of medical grade silicone. Furthermore, China's large population drives demand for various applications, including prosthetics and orthopedic components, positioning it as a key player in the global market.

Europe Medical Grade Silicone Market Trends

Europe medical grade silicone market is expected to grow significantly over the forecast period, owing to stringent regulatory frameworks that promote high safety standards for medical devices. Furthermore, the region benefits from a strong emphasis on research and development, leading to innovative applications of silicone in healthcare. Moreover, increasing demand for minimally invasive surgical procedures and advanced prosthetic solutions also drives market growth.

The growth of the medical grade silicone market in Germany is driven by a well-established healthcare system and significant investments in R&D. The country's aging population contributes to an increased need for orthopedic implants and prosthetic devices that utilize medical grade silicone for its superior properties. Furthermore, Germany's commitment to innovation in healthcare technology fosters an environment conducive to developing advanced materials that enhance patient care and safety in various medical applications.

Key Medical Grade Silicone Company Insights

Key players in the global medical grade silicone Industry include Trelleborg AB, China National Bluestar (Group) Co. Ltd., 3M Company, and others. These companies are adopting various strategies to enhance their market presence. Strategies include new product launches to develop innovative silicone formulations tailored for specific medical applications. In addition, firms are investing in research and development to improve product performance and meet evolving regulatory standards. Furthermore, collaborations and partnerships are also being pursued to expand distribution networks and access new markets, ensuring that companies remain competitive and responsive to customer needs in the dynamic healthcare landscape.

-

Momentive Performance Materials Inc. manufactures silicone elastomers and liquid silicone rubbers (LSRs). The company focuses on providing innovative solutions for various healthcare applications, including dental devices, surgical instruments, and orthopedic components. With a commitment to meeting stringent biocompatibility standards, Momentive develops durable and flexible products designed to enhance patient care and improve manufacturing efficiencies across the medical device industry.

-

Zodiac Coatings SAS develops innovative solutions that cater to the unique requirements of medical devices, including biocompatibility and durability. It focuses on segments such as wound care, surgical instruments, and implantable devices, ensuring its products meet the rigorous standards for safe and effective use in medical settings. Its expertise in silicone technology positions it as a key contributor to advancements in the healthcare industry.

Key Medical Grade Silicone Companies:

The following are the leading companies in the medical grade silicone market. These companies collectively hold the largest market share and dictate industry trends.

- Momentive Performance Materials Inc.

- Trelleborg AB

- China National Bluestar (Group) Co. Ltd.

- 3M Company

- Henkel AG & Co. KGaA

- KCC Corporation

- Elkem Silicones

- Dow Corning Corporation

- Zodiac Coatings SAS

- Wacker Chemie AG.

Recent Developments

-

In October 2024, Elkem announced its participation in Compamed 2024, a leading trade fair for medical technology, scheduled for November 13-16, 2024, in Düsseldorf, Germany. The company is expected to showcase its advanced solutions, including medical grade silicone products designed for various applications in the healthcare sector. Elkem aims to highlight its commitment to innovation and sustainability in the medical field. This event provides an excellent platform for industry professionals to explore cutting-edge technologies and materials that improve patient care and safety.

-

In May 2024, KCC Corporation fully acquired Momentive Performance Materials, marking a significant transition in ownership. This acquisition resulted in the exit of minority shareholder SJL Partners, LLC, and allowed KCC to focus on a strategic long-term approach rather than a private equity mindset. Momentive's expertise in medical-grade silicone and specialty solutions will be pivotal as KCC aims to enhance its growth and innovation in advanced materials across various industries.

Medical Grade Silicone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 646.7 million

Revenue forecast in 2030

USD 922.7 million

Growth rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Volume in Tons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., China, India, Germany, France, and Brazil.

Key companies profiled

Momentive Performance Materials Inc.; Trelleborg AB; China National Bluestar (Group) Co. Ltd.; 3M Company; Henkel AG & Co. KGaA; KCC Corporation; Elkem Silicones; Dow Corning Corporation; Zodiac Coatings SAS; Wacker Chemie AG.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Grade Silicone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global medical grade silicone market report based on product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Elastomers

-

Gels

-

Medical Adhesives

-

Medical Coatings

-

Foams

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Prosthetics

-

Orthopedic Components

-

Medical Devices

-

Medical Tapes

-

Oral Care Products

-

Contact lenses

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.