- Home

- »

- Healthcare IT

- »

-

Medical Image Analysis Software Market Size Report, 2030GVR Report cover

![Medical Image Report]()

Medical Image Analysis Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Software Type (Integrated, Standalone), By Imaging Type (3D, 4D), By Modality, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-918-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Image Analysis Software Market Summary

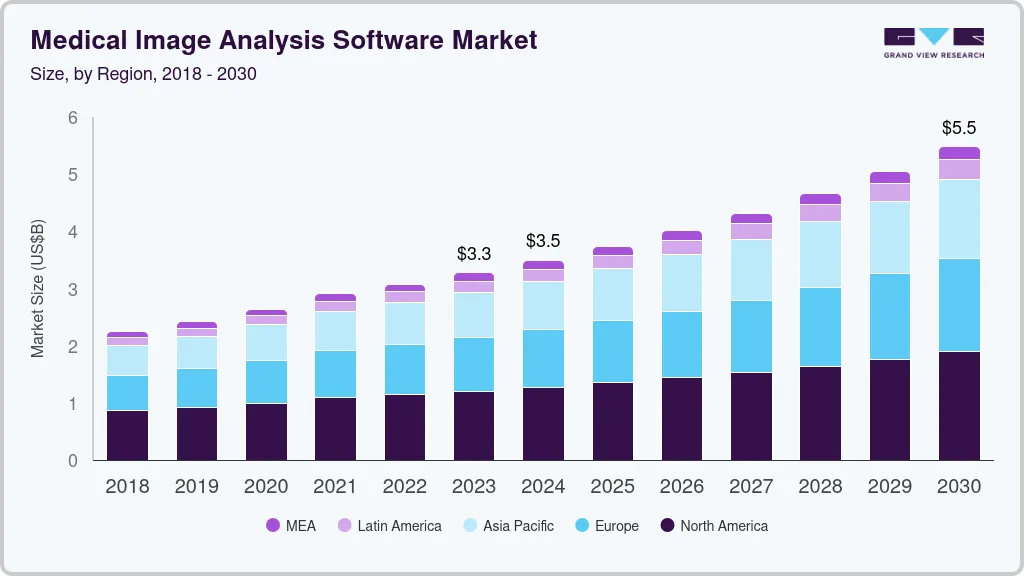

The global medical image analysis software market size was estimated at USD 3,273.6 million in 2023 and is projected to reach USD 5,486.0 million by 2030, growing at a CAGR of 7.7% from 2024 to 2030. An upsurge in the need for diagnostic imaging software within various medical specialties, including dental, urology, orthopedics, oncology, and neurology is expected to drive market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Canada is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, integrated accounted for a revenue of USD 1,774.3 million in 2023.

- Stand Alone is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3,273.6 million

- 2030 Projected Market Size: USD 5,486.0 million

- CAGR (2024-2030): 7.7%

- North America: Largest market in 2023

Furthermore, the increasing adoption of ultrasound imaging systems to facilitate faster diagnosis of chronic disease is projected to fuel this software demand.

Moreover, continuous innovations in imaging technology, including developments like Computer-Aided Diagnosis (CAD), are anticipated to further boost the demand for these solutions. The integration of Artificial Intelligence (AI) into medical imaging has reshaped market dynamics in recent times and is expected to have a positive impact on market growth over the forecast period.

The AI-based solutions have various applications in medical imaging, including diagnosis, detection, image analysis, and clinical decision support. Though AI adoption is in the early phase of MRI and CT technologies, rising demand for accuracy, efficiency, and patient safety is anticipated to boost the adoption of AI-enabled medical imaging over the forecast period. In addition, the market growth is significantly driven by the growing acceptance of technologically advanced products, such as multimodality imaging platforms and 3D imaging. These solutions come with several benefits, including high-resolution imaging, user-friendliness, and flexibility, which make them highly attractive for healthcare professionals and researchers. The introduction of advanced technological products and the emergence of efficient information management systems are expected to be significant catalysts for market growth during the forecast period.

Focus on innovation in medical image analysis has also given rise to certain measures that are being implemented. Furthermore, can assist in disease diagnosis, treatment, and early detection. It has been regarded as one of the most advanced technologies to combat the COVID-19 crisis. In the context of COVID-19 disease, numerous AI, machine learning, and deep learning approaches have been used in medical image processing, which is another significant factor contributing to the market growth. Diagnostic and research centers are projected to become vital end users of image analysis solutions due to the increasing demand for more efficient solutions that can improve patient outcomes.

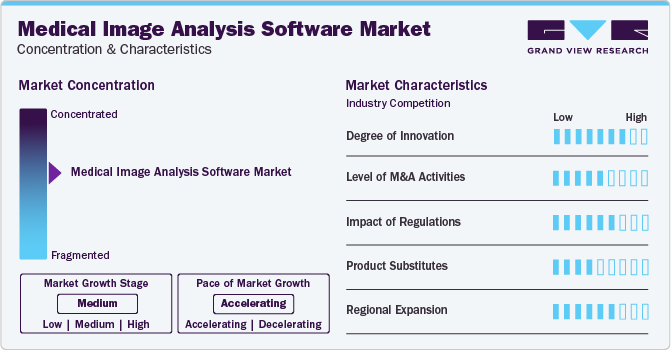

Market Concentration & Characteristics

The growing prevalence of chronic diseases is expected to drive the demand for medical imaging devices, thus necessitating the use of medical image analysis software. Medical imaging aids in the early and accurate diagnosis of diseases, enabling effective treatment. The U.S. National Center for Health Statistics estimates 1,958,310 new cancer cases and 609,820 cancer-related deaths in the country in 2023.

Medical professionals increasingly use medical imaging devices to generate visual data of a patient's organs, optimizing the surgical outcome. Surgeons rely on preoperative MRI & CT to visualize and determine tumor dimensions. Moreover, the rising prevalence of cancer worldwide is expected to drive the demand for medical imaging devices. For instance, as per the GLOBOCAN 2022 update on cancer incidence, around 19,965,054 new cancer cases were diagnosed at a global level in 2022. Some of the common cancers, along with their rank in 2022, include lung cancer (1), breast cancer (2), colorectal cancer (3), prostate cancer (4), and stomach cancer (5). In addition, it is estimated that by 2027, about 53,490,304 new cancer cases will be diagnosed across the globe.

The market have undergone significant innovation, driven by remarkable technological advancements. For instance, in October 2023, Philips introduced advancements in OB/GYN ultrasound technology aimed at improving early detection and diagnostic assurance. Their AI-powered point-of-care OB/GYN ultrasound solutions and intelligent workflows facilitate the earlier detection of abnormalities, boosting diagnostic confidence.

Manufacturers of medical image analysis software are increasingly considering merger and acquisition activities. This strategic approach is aimed to increase their technological capabilities, broadening market presence, and ensuring competitiveness in the rapidly evolving healthcare landscape. For instance, in January 2024, MIM Software announced an acquisition agreement with GE HealthCare. Through this, MIM Software and GE HealthCare align in their vision to enhance hospital efficiency, elevate clinical effectiveness, advance treatment precision, tailor therapy, and enhance patient outcomes.

In the U.S., the Food and Drug Administration (FDA) oversees the regulation of medical image analysis software. The applicable regulations vary based on the software's intended purpose and features.

An alternative to medical image analysis software could involve traditional manual image interpretation by healthcare professionals. Instead of depending on software algorithms for analyzing medical images, healthcare providers may opt to manually review and interpret images such as X-rays, MRI scans, CT scans, and ultrasounds.

The geographical reach of medical image analysis software has been expanding at a moderate to high level. For instance, in July 2022, Canon Medical Systems USA Inc. acquired NXC Imaging, a distributor and service provider of medical imaging equipment based in Minneapolis, Minnesota.

Software Type Insights

Based on software type, the integrated software segment led the market in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030. The significant market share is owing to the advantages linked with the utilization of these solutions. Specifically, the integrated toolkit is designed for diverse radiology applications, aiming to enhance workflow efficiency. For instance, Philip’s Xcelera Cardiology Information Management serves as an integrated software solution for image management, streamlining access to advanced clinical applications and enhancing clinical workflow processes. The increasing adoption of integrated systems, primarily due to their cost-effectiveness, centralized data storage capabilities, and the capacity to grant multiple users real-time access to data for processing, is anticipated to further drive growth of this segment.

The stand-alone platforms segment is anticipated to witness the fastest CAGR over the forecast period. These platforms are known for their user-friendliness and cost-effectiveness when compared to integrated solutions. They provide additional details and features, making them preferable for researchers, as they enable sharing and access to research data and analyses, thereby improving their capacity to research, diagnose, monitor, and treat disorders. For instance, GE Healthcare's ViewPoint 6, designed for dedicated ultrasound reporting and image management in the field of Maternal-Fetal Medicine (MFM), serves as an illustration of a standalone software solution.

Modality Insights

Based on modality, the tomography segment held the market with the largest revenue share of 33.0% in 2023, owing to its cost-effectiveness. The emergence of dual-source and AI-enabled CT scanners is expected to mark significant milestones in market expansion. The introduction of these advanced products is expected to drive demand for CT imaging software in the foreseeable future. The tomography segment is subdivided into CT, MRI, PET, and SPECT.

Owing to the early introduction of radiography X-ray systems, the adoption of these instruments has increased over the years. Radiography involves the use of X-rays and, as such, poses a related risk of harmful radiation through prolonged exposure. However, the benefits of radiography far exceed the risks posed by these procedures. The segment is expected to expand at a steady CAGR over the forecast period. The ultrasound image analysis software segment is anticipated to witness the fastest CAGR during the forecast years due to benefits such as rapid analysis and accuracy. In addition, ultrasound imaging is non-invasive, and there is no ionizing radiation exposure associated with it.

Imaging Type Insights

Based on the imagine type, the 4D imaging segment led the market with the largest revenue share of 45.9% in 2023. This segment is expected to continue its dominance over the forecast period owing to technological advancements in 4D imaging technology. These advancements enable efficient and precise real-time visualization of the human body, effectively eliminating distortions in medical procedures. 4D imaging technology involves the analysis of three-dimensional images with real-time movement, thereby enhancing the accuracy and effectiveness of medical imaging. Consequently, both the 3D and 4D imaging software solutions markets are anticipated to experience substantial growth rates during the forecast period, fueled by the increasing adoption of these advanced technologies.

In addition, shifting focus to provide enhanced care has led to the incorporation of various computer-aided diagnosis systems, which is further expected to contribute to market growth. The introduction of technologically advanced products and multimodality imaging platforms is also expected to drive the demand for the software in the coming years. For instance, in April 2021, the U.S. FDA granted 510(k) clearance to Philips’ SmartCT 3D imaging software.

Application Insights

Based on application, the cardiology segment led the market with the largest revenue share of 20.3% in 2023. The growth is attributed to the high prevalence of cardiovascular and congenital heart diseases and government support to improve the accessibility of treatments. Due to the higher incidence and mortality of heart disease, the use of cardiovascular imaging for condition assessment has increased in recent years. In February 2020, the U.S. FDA approved the marketing of software to help medical professionals in the acquisition of echocardiography or cardiac ultrasound images. The software, known as Caption Guidance, is an addition to compatible diagnostic ultrasound systems and utilizes artificial intelligence to help the user capture a patient’s heart images that are of normal diagnostic quality.

The oncology segment is anticipated to witness a significant CAGR over the forecast period, as the prevalence of cancer is increasing at an alarming rate. This is likely to result in a growing demand for diagnostic solutions over the forecast period. According to a study conducted by the American College of Surgeons Clinical Congress, surgeons are focusing on advancing computer technologies to improve the visualization of cancerous tumors. This is anticipated to boost the adoption of these software solutions.

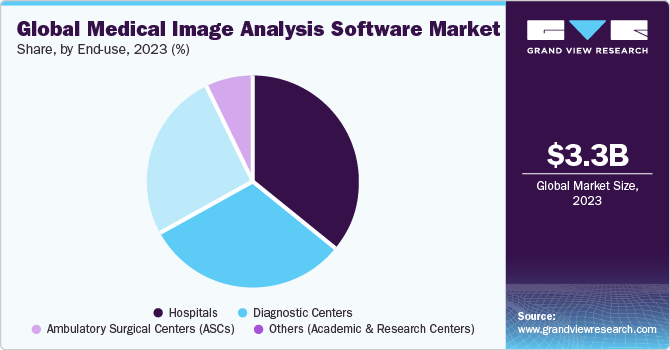

End-use Insights

Based on end-use, the hospitals segment held the market with the largest revenue share of 35.9% in 2023, and it is expected to maintain its dominant position throughout the forecast period. A primary factor contributing to the growth of this segment is the presence of supportive infrastructure, which is essential for conducting surgical interventions using medical imaging software. Hospitals have a greater number of installed diagnostic imaging systems and solutions compared to research and diagnostic centers, and they also receive a substantially higher volume of patients. These factors collectively ensure the continued dominance of the hospital segment in the market.

Furthermore, the presence of favorable reimbursement initiatives by governments worldwide has led to an increase in surgical procedures, consequently driving up the demand for medical imaging software. Rising healthcare costs represent a significant challenge in the healthcare sector, making it difficult for many patients to afford necessary treatments, including surgical procedures. This has necessitated healthcare providers to devise innovative approaches to make such services more affordable without compromising on quality. Ambulatory surgery centers (ASCs) have emerged as an effective solution to addressing these challenges. As a result, the ASC segment is expected to exhibit the fastest CAGR during the forecast period.

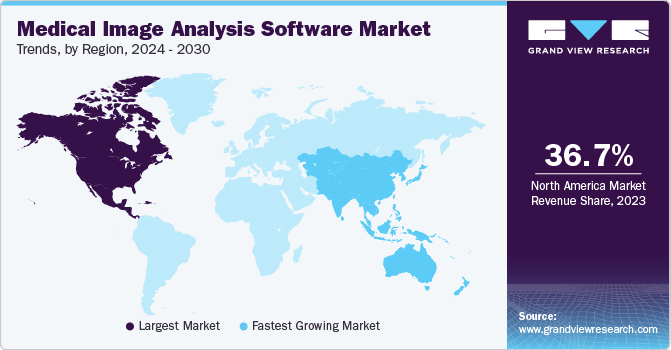

Regional Insights

North America dominated the market with the revenue share of 36.7% in 2023. The expansion in this region can be attributed to the presence of well-established healthcare facilities equipped with advanced diagnostic equipment and favorable government initiatives promoting the adoption of healthcare IT. Furthermore, the growth is further driven by increasing research and development investments and the presence of major market players. For instance, in February 2022, MIM Software Inc. announced a collaboration with GenesisCare, a global integrated cancer care provider, with the aim of broadening patient access on a global scale.

U.S. Medical Image Analysis Software Market Trends

The medical image analysis software market in the U.S. held the market with the largest revenue share in 2023, this can be contributed to the presence of major market players in the country and different initiatives undertaken by them. For instance, in May 2023, GE HealthCare received FDA approval for Precision DL which is a deep learning-based image processing software. It is part of GE Healthcare's expanding Effortless Recon DL portfolio.

Europe Medical Image Analysis Software Market Trends

The Europe medical image analysis software market is expected to grow at a significant CAGR over the forecast period. This growth is primarily attributed to ongoing advancements in medical imaging technology, including MRI, CT scans, and ultrasound, within the region. These advancements have resulted in a notable increase in both the volume and complexity of medical imaging. Consequently, the demand for medical image analysis software has become crucial for efficient interpretation and diagnosis of these images.

The medical image analysis software market in the UK is expected to grow at the fastest CAGR during the forecast period, owing to increasing prevalence of cancer, advancements in healthcare facilities, increased healthcare spending, and demand for precise and accurate medical imaging diagnosis and reports. As per Cancer Research UK, nearly 367,000 new cancer cases are detected every year.

The Germany medical image analysis software market is expected to grow at a fastest CAGR over the forecast period. The growth of the market can be attributed to the increasing adoption of medical image analysis software, which has been steadily rising. Several factors contribute to this, such as the presence of a robust healthcare system with a strong emphasis on innovation and technology.

The medical image analysis software market in France is expected to grow at the fastest CAGR during the forecast period, owing to the developed healthcare system that prioritizes innovation and technology integration in the country. With a strong emphasis on improving patient outcomes and increasing efficiency, there is a growing demand for medical image analysis software that can assist healthcare professionals in precise diagnosis.

Asia Pacific Medical Image Analysis Software Market Trends

Asia Pacific medical image analysis software market is expected to grow at a significant CAGR over the forecast period, owing to the increasing adoption of medical image analysis software by healthcare professionals in the region. The growing awareness about the associated benefits of these systems is a key factor expected to propel market growth. Furthermore, increasing healthcare expenditure and disposable income levels in countries such as China and India are contributing to the regional market growth.

The medical image analysis software market in China held the market with the largest revenue share within the Asia Pacific region in 2023. This was primarily attributed to growingdemand for online medical consultation and diagnosis, indicating a growing patient population in need of services provided by imaging cloud platforms.

The Japan medical image analysis software marketis expected to growat the fastest CAGR during the forecast period, owing to the rising prominence of companies based in Japan and the introduction of new image analysis software. For instance, in April 2022, Clairvo Technologies, Inc. a company based in Japan, received market authorization for VIDA Insights, an image analysis software to assist in the reading of chest CT images developed by VIDA Diagnostics Inc.

Latin America Medical Image Analysis Software Market Trends

The medical image analysis software market in Latin America is expected to grow at the fastest CAGR during the forecast period, as the region is witnessing an increase in healthcare investments and infrastructure development, driven by the need to address the healthcare needs of its growing population. This includes investments in advanced medical technologies, such as medical imaging equipment and software.

MEA Medical Image Analysis Software Market Trends

The medical image analysis software market in Middle East & Africa is anticipated to experience moderate CAGR during the forecast period, owing to the increased focus of countries such as Saudi Arabia and Kuwait towards enhancing their healthcare system.

The Saudi Arabia medical image analysis software marketis expected to grow at the fastest CAGR during the forecast period, due to factors such as the expanding population and a rising burden of chronic diseases. This shows the requirement for precise and efficient medical image analysis software tools, thereby highlighting the significance of medical image analysis software.

The medical image analysis software market in Kuwait is expected to grow at the fastest CAGR during the forecast period, due to the growing adoption of medical image analysis software. The country's commitment to enhancing healthcare services, coupled with advancements in technology, has paved the way for the integration of sophisticated medical imaging solutions.

Key Medical Image Analysis Software Company Insights

The industry is highly competitive, with a handful of companies dominating the global market. The industry is technology-driven, as there is continuous R&D being undertaken for the development of cost-effective diagnostic solutions. Competitors are adopting strategies, such as collaborative agreements, partnerships, mergers and acquisitions, regional expansions, and new product developments to gain an edge over the others. Mature players in the market include Koninklijke Philips N.V., Agfa-Gevaert Group, Bruker and others. The emerging players in the global market are MIM Software, Inc., Infervision Medical Technology Co., Ltd., Neusoft Medical Systems Co., Ltd; and others.

Key Medical Image Analysis Software Companies:

The following are the leading companies in the medical image analysis software market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Agfa-Gevaert Group

- Canon Medical Systems

- MIM Software, Inc.

- Bruker

- Siemens Healthineers AG

- ESAOTE SPA

- Deep Rui Medical (Deepwise)

- Infervision Medical Technology Co., Ltd.

- Neusoft Medical Systems Co., Ltd.

Recent Developments

-

In January 2023, Bruker Corporation acquired ACQUIFER Imaging GmbH, which will expand its portfolio to include big data management and high-content screening solutions for bioimaging applications.

-

In January 2023, Canon Medical Systems USA Inc., entered into a partnership with ScImage, Inc. Sclmage provides Cloud-native enterprise image management, PACS and image exchange solutions for the healthcare industry, based out of Los Altos, CA.

-

In September 2022, King Abdullah Medical City (KAMC), located in Mecca, Saudi Arabia, and a long-term customer of Agfa HealthCare, recently upgraded its image management system to Agfa HealthCare's Enterprise Imaging.

Medical Image Analysis Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.49 billion

Revenue forecast in 2030

USD 5.48 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Software type, modality, imaging type, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; Agfa-Gevaert Group; Canon Medical Systems; MIM Software, Inc.; Bruker; Siemens Healthineers AG; ESAOTE SPA; Deep Rui Medical (Deepwise); Infervision Medical Technology Co., Ltd.; Neusoft Medical Systems Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Image Analysis Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical image analysis software market report based on the software type, modality, imaging type, application, end use, and region:

-

Software Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated Software

-

Stand-alone Software

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Tomography

-

Computed Tomography

-

Magnetic Resonance Imaging

-

Positron Emission Tomography

-

Single-Photon Emission Tomography

-

-

Ultrasound Imaging

-

2D

-

3D&4D

-

Doppler

-

-

Radiographic Imaging

-

Combined Modalities

-

PET/MR

-

SPECT/CT

-

PET/MR

-

-

Mammography

-

-

Imaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Imaging

-

3D Imaging

-

4D Imaging

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic

-

Dental

-

Neurology

-

Cardiology

-

Oncology

-

Obstetrics & Gynecology

-

Mammography

-

Urology & Nephrology

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Ambulatory Surgical Centers (ASCs)

-

Others (Academic & Research Centers)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical image analysis software market size was estimated at USD 3.27 billion in 2023 and is expected to reach USD 3.49 billion in 2024.

b. The global medical image analysis software market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 5.48 billion by 2030.

b. North America dominated the medical image analysis software market with a share of over 36.7% in 2023. This is attributable to the presence of well-established healthcare facilities with advanced diagnostic equipment and favorable government initiatives to support the adoption of healthcare IT.

b. Some key players operating in the medical image analysis software market include Koninklijke Philips N.V., Agfa-Gevaert Group, Canon Medical Systems, MIM Software, Inc., Bruker, Siemens Healthineers AG, ESAOTE SPA, Deep Rui Medical (Deepwise), Infervision Medical Technology Co., Ltd., Neusoft Medical Systems Co., Ltd.

b. Key factors that are driving the medical image analysis software market growth include an increase in demand for diagnostic imaging software and the growing adoption of ultrasound imaging systems to facilitate faster diagnosis, particularly of chronic diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.