- Home

- »

- Medical Devices

- »

-

Oxygen Concentrator Market Size, Industry Report, 2033GVR Report cover

![Oxygen Concentrator Market Size, Share & Trends Report]()

Oxygen Concentrator Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Portable (New Purchase, Rental), Fixed (New Purchase, Rental)), By Application (Home Care, Non-homecare), By Technology, By Region, And Segment Forecasts

- Report ID: 978-1-68038-457-4

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oxygen Concentrator Market Summary

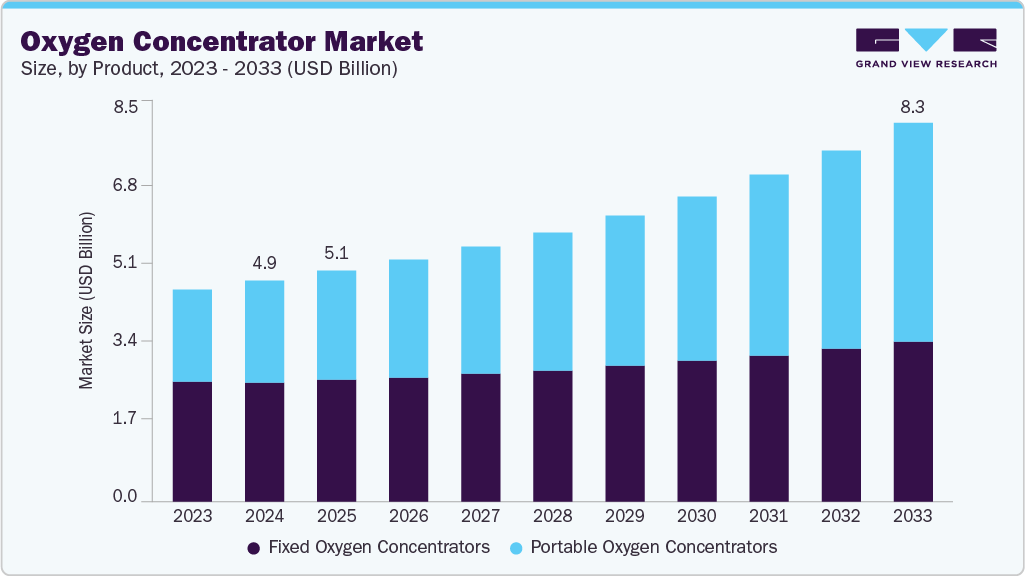

The global oxygen concentrator market size was estimated at USD 4.85 billion in 2024 and is projected to reach USD 8.31 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. This is attributed to the rising prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea, coupled with the increasing launch of technologically advanced devices.

Key Market Trends & Insights

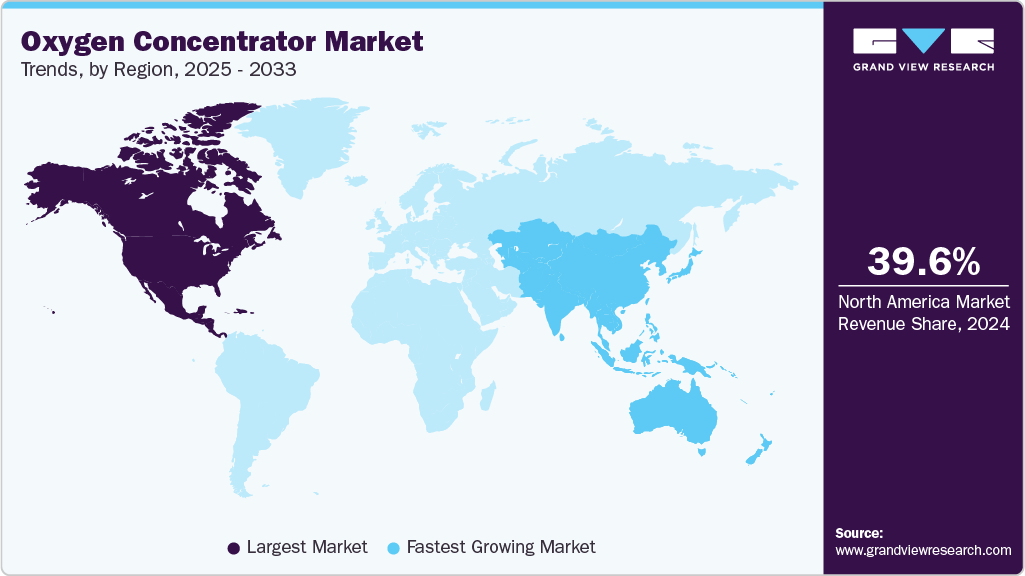

- North America dominated the market for patient access solutions with a share of 41.0% in 2024.

- The oxygen concentrator industry in the U.S. is fueled by rising cases of respiratory diseases such as COPD, asthma, and sleep apnea, along with an aging population requiring long-term oxygen therapy.

- Based on product, the fixed oxygen concentrators segment held the largest market share of 54.1% in 2024.

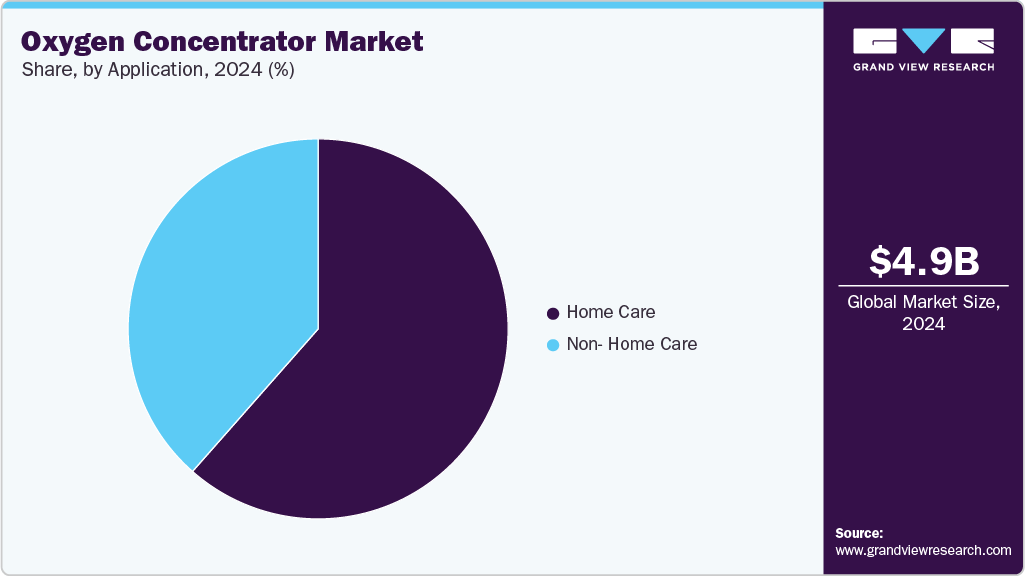

- Based on application, home care held the dominant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.85 Billion

- 2033 Projected Market Size: USD 8.31 Billion

- CAGR (2025-2033): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the Global Impact of Respiratory Disease study, around 200 million people suffer from COPD globally, resulting in 3.2 million deaths every year. Moreover, favorable reimbursement policies have enhanced the attractiveness of the oxygen concentrators market in the U.S. For instance, in March 2024, a U.S. Congressman introduced the Supplemental Oxygen Access Reform (SOAR) Act to reform and improve access to supplementary oxygen for Medicare beneficiaries. These policies have increased the adoption of oxygen concentrators. In addition, rising healthcare spending is driving the demand for effective diagnosis and treatment of respiratory diseases, thereby boosting the market for oxygen concentrators. According to a Cleveland Clinic article in the U.S, over 1.5 million people rely on supplemental oxygen therapy, using devices such as oxygen tanks and concentrators.

Regional governments offer reimbursement policies that cover the cost of POCs for patients with respiratory illnesses. For instance, according to Inogen's 10K form document for the fiscal year ending December 31, 2021, the international market (excluding the U.S.) is attractive for oxygen concentrators due to favorable reimbursement policies in certain countries such as the UK and France. In these countries, portable oxygen concentrators receive more favorable reimbursement than in the U.S.

Market players also employ strategies such as acquisitions, collaborations, expansions, and new product launches to extend their product offerings and geographical reach. For instance, in June 2025, Inogen launched the Voxi 5 stationary oxygen concentrator, offering an affordable, durable, and quiet continuous flow oxygen therapy solution for long-term care patients in the US, enhancing home respiratory care accessibility. The device features compact design, caster wheels for mobility, a 3-year sieve bed warranty, and advanced filtration technology.

COVID-19 had a limited positive impact on the market, driving increased demand for technologically advanced and cost-effective oxygen concentrators. For example, UNICEF distributed 62,046 concentrators to 104 nations worldwide in July 2021, with approximately 12,788 concentrators sourced from a Chinese trade company. Growing need for emergency treatment and prolonged care for lung diseases in children and adults further propels the industry.

Product Recalls: A Key Restraining Factor in the Oxygen Concentrator Market

Product recalls have emerged as a key restraining factor, hindering the growth of the market. Safety-related issues such as overheating, fire hazards, and material degradation have forced manufacturers to withdraw products from the market, creating supply disruptions and impacting patient and provider confidence. These recalls increase compliance and replacement costs and intensify regulatory scrutiny, ultimately slowing down market expansion.

The table below highlights major recalls

Company

Product Name

Date (Recall Notice or Initiation)

Reason

Impact

GCE Healthcare / Ohio Medical Corporation

ZenO lite Portable Oxygen Concentrator (Model RS-00608-X-S)

May 8, 2025 (initiated); Jun 13, 2025 (posted)

Calibration errors lead to inaccurate oxygen purity readings.

Affects ~36 units; raises concerns over device aging and reliability; prompts stricter QC for long-term performance.

Drive DeVilbiss Healthcare

iGo2 DV6X-619 DC Car Adapter (Rev E) (Accessory for iGo2 Portable Oxygen Concentrator)

Apr 11, 2025 (notice); Jul 17, 2025 (posted)

Car adapter cord overheating/melting due to an assembly defect.

Affects ~89,000 accessories; non-critical but raises safety concerns, replacement costs, and brand trust issues.

Caire, Inc.

FreeStyle Comfort Portable Oxygen Concentrator (Model #AS200-2)

Oct 4, 2024 (initiated); Nov 15, 2024 (posted)

Battery recharge failure due to a non-conforming component.

Small batch (~26 units); minimal direct impact but highlights QC issues in battery components.

Jiangsu Jumao X-Care Medical Equipment Co., Ltd.

JMC5A / TruAire-5 Oxygen Concentrator (Model O2C5L)

Nov 26, 2024 (notice); Dec 9, 2024 (recall initiation); Jan 3, 2025 (posted)

Units overheating, melting, or catching fire.

Class I recall; thousands of units affected; significant safety, regulatory, and reputational impact.

Market Concentration & Characteristics

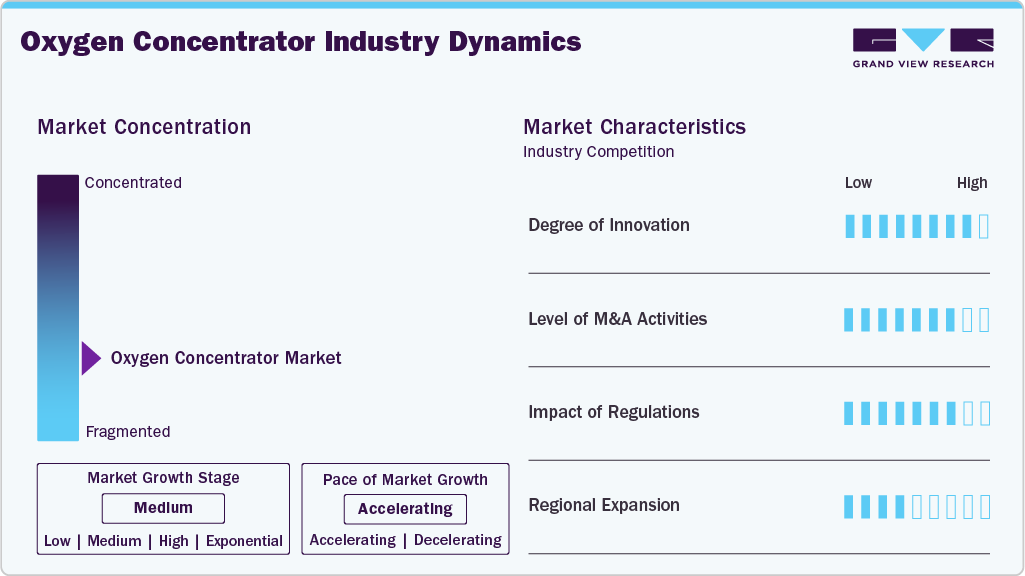

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the oxygen concentrator industry is fragmented, with many providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is high. The market is experiencing significant innovation as companies like Inogen are introducing cutting-edge products. For instance, In January 2025, Caire launched IntenOxy 5, a stationary oxygen concentrator in the U.S. and Puerto Rico. This delivers around 95.5% oxygen concentration and operates efficiently with low power consumption.

“The IntenOxy 5 Stationary Oxygen Concentrator has been an excellent addition to our oxygen therapy portfolio. The unit is a key component to how our DME and HME customers serve their respiratory patients, providing them with an at-home device that delivers the oxygen they need as they navigate activities of daily living,”

-Ken Hosako, president and CEO of Caire.

M&A activities facilitate geographic expansion and market entry for companies. For instance, React Health acquired Invacare's Respiratory line in February 2023. This strategic move bolsters React Health's market standing, broadens its product range, and enhances its ability to serve a wider customer base.

The impact of regulations on the market is high. The market for oxygen concentrator is significantly influenced by various regulations, which play a critical role in shaping the growth, innovation, and operational processes of oxygen concentrator. Regulatory framework for oxygen concentrators represents a significant barrier, particularly in terms of regulatory stringency impact. Companies such as Invacare Corporation and Philips have encountered prolonged consent decrees from the U.S. FDA, illustrating the stringent regulatory environment.

The level of regional expansion in industry is moderate. Expanding into new regions has become a key growth strategy for companies in the market, as it allows them to tap into underserved areas, increase device adoption, and respond to rising demand for respiratory care. For instance, in November 2024, Unitaid launched the East African Program on Oxygen Access (EAPOA) with a USD 22 million investment to expand liquid medical oxygen production in Kenya and Tanzania, aiming to increase regional supply, reduce prices by up to 27%, and save thousands of lives across East and Southern Africa.

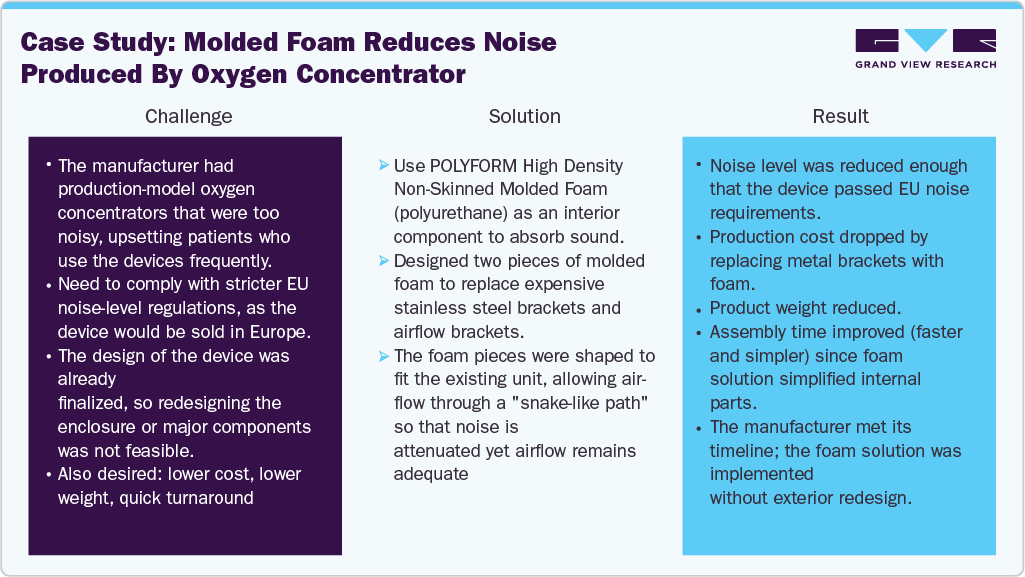

Case Study:Molded Foam Reduces Noise Produced by Oxygen Concentrator

Key Takeaways:

-

Adoption of high-density non-skinned foam by Polytech reflects a strategic focus on material-driven innovation that reduces noise, weight, and production complexity while enhancing patient comfort and regulatory compliance, positioning manufacturers for stronger market acceptance.

-

Similarly, Porex’s use of sintered porous plastic demonstrates how advanced materials can simultaneously improve device performance, durability, and sterilization capabilities, offering a competitive edge by enhancing user experience and meeting stringent regulatory standards.

Product Insights

The fixed oxygen concentrator segment dominated the market, accounted for the largest revenue share of 54.1% in 2024. Fixed oxygen concentrators deliver higher oxygen output, continuous flow therapy, and long-term reliability, making them the preferred choice for patients with severe COPD and chronic respiratory conditions. Their lower cost than portable models and extensive use in home care settings further contribute to the segment's dominance. Moreover, key market players focus on unveiling new fixed medical oxygen concentrator products. For instance, in October 2024, Drive DeVilbiss Healthcare launched the PulmO2 stationary concentrator for low- and middle-income countries, contributing to the large share of the segment.

The portable oxygen concentrators segment is anticipated to witness the fastest CAGR over the forecast period, driven by increasing demand for portable oxygen concentrators owing to their lightweight design, mobility, and battery-powered operation, enabling greater patient freedom and supporting the shift toward home healthcare. To cater to this demand, market players prioritize advancements in battery performance, oxygen purity, and device compactness. For instance, in September 2024, Oxymed introduced its P2 Portable Oxygen Concentrator in India, featuring five pulse flow settings, 90-95% purity, and up to 10 hours of battery life.

Technology Insights

Based on technology, the continuous flow segment accounted for the largest revenue share of 54.9% in 2024. Continuous flow technology provides reliable, uninterrupted oxygen delivery essential for patients with severe COPD and chronic respiratory conditions. Its widespread use in both clinical and home care settings, along with proven effectiveness and affordability compared to newer alternatives, supports the segment's dominant share. In addition, this technology is also widely used in residential and military applications, providing a safer alternative to storing oxygen under pressure.

The pulse flow technology segment is expected to experience the fastest CAGR during the forecast period. The growth is driven by the advantages offered by pulse flow technology, including high mobility, lightweight design, and suitability for patients with active lifestyles. Pulse flow technology is particularly beneficial for treating respiratory conditions that require a lower oxygen delivery rate per minute. It is extensively used in portable oxygen concentrators (POCs). For instance, in October 2024, Inogen, Inc. launched the Inogen Rove 4 portable oxygen concentrator. This oxygen concentrator utilizes pulse-dose intelligent delivery technology.

Application Insights

Based on application, the market is segmented into home care and non-home care. The home care segment held the largest revenue share in 2024. Technological advancements and the adoption of home therapy in developed countries contribute significantly to the market's revenue share. Availability of a wide range of concentrators for home therapy also plays a crucial role. Moreover, a sizable geriatric population in countries such as Japan, Germany, Italy, and others is expected to drive market growth. In addition, expanding healthcare insurance coverage for oxygen concentrators in many countries further fuels the market growth.

The non-homecare segment is expected to exhibit at a moderate CAGR over the forecast period, driven by the increased adoption of oxygen therapy in hospitals and clinics. Moreover, an increasing number of hospital admissions due to respiratory diseases contributes to the segment’s growth.

Regional Insights

North America oxygen concentrator industry held the largest revenue share of 41.0% in 2024, due to an increase in the prevalence of respiratory conditions such as COPD, asthma, and sleep apnea. For instance, according to the 2024 National Survey by Asthma Canada, over 4.6 million people in Canada are living with asthma, including 900,000 children under 19 and 800,000 adults over 65. Asthma is the third most prevalent chronic disease in the country, with an estimated 317 new diagnoses every day and around 250 deaths annually. In addition, the presence of prominent market leaders in North America are such as Healthcare, Inogen, Inc., and Caire Medical (a subsidiary of NGK Spark Plug), further contributes to the growth of oxygen concentrator industry in North America.

U.S. Oxygen Concentrator Market Trends

The oxygen concentrator industry in the U.S. is fueled by rising cases of respiratory diseases such as COPD, asthma, and sleep apnea, along with an aging population requiring long-term oxygen therapy. Increased preference for home-based healthcare and portable medical devices has shifted demand toward lightweight, user-friendly oxygen concentrators that enable greater mobility and independence for patients. Moreover, favorable reimbursement policies have enhanced the attractiveness of the oxygen concentrators in the U.S. market.

Europe Oxygen Concentrator Market Trends

The oxygen concentrator industry in Europe has been evolving rapidly, driven by regulatory advancements, technological innovations, and strategic initiatives by key industry players. For instance, in January 2023, Inogen, Inc. received European Medical Device Regulation (EU MDR) certification from the British Standards Institution (BSI) for its portable oxygen concentrators, enabling their commercialization across the EU. Furthermore, integrating Internet of Things (IoT) and remote monitoring systems into medical oxygen concentrators has seen an increase in adoption over the past years, enhancing real-time monitoring and predictive maintenance capabilities.

The oxygen concentrator industry in the UK is driven by regulatory updates and strategic industry initiatives. In November 2021, the UK government, in collaboration with UNICEF and Oxygen CoLab, launched a project to develop robust oxygen concentrators suitable for low-resource settings, addressing critical care needs during the COVID-19 pandemic. Such initiatives highlight the importance of oxygen therapy equipment in emergency healthcare provisioning, supporting the market growth.

Germany oxygen concentrator industry held a significant share in the European region in 2024, driven by an aging population, rising prevalence of chronic respiratory diseases, and increasing demand for home-based healthcare solutions. For instance, according to Eurostat Data, the Hospital discharge rate for inpatients with respiratory system diseases was 1,300 per 100,000 inhabitants in Germany in 2021. Moreover, strategic initiatives from key industry players and supportive government policies support the growth of the market. For instance, the implementation of the EU Medical Device Regulation in 2021 has elevated safety and efficacy standards for oxygen therapy devices, reinforcing Germany's position as a leader in the European oxygen concentrators market.

Asia Pacific Oxygen Concentrator Market Trends

Asia Pacific oxygen concentrators industry is anticipated to witness significant growth from 2025 to 2033. The growth is attributed to the rising prevalence of respiratory diseases, a rapidly aging population, and an increasing focus on home healthcare. For instance, according to the WHO, the ratio of population aged 60 years and above in the Asia-Pacific region is estimated to increase from 12.2% in 2024 to 22.9% by 2050. In addition, increasing adoption of portable oxygen concentrators, government initiatives, and strategic actions by key players. For instance, in July 2022, OMRON Healthcare, a Japan-based electronics company introduced a portable oxygen concentrator, offering a continuous supply of high-purity oxygen at 5 liters per minute, catering to homecare needs.

The oxygen concentrator industry in Japan is propelled by technological advancements, strategic initiatives by domestic companies, and a robust regulatory framework. Japanese firms such as Teijin Limited and Daikin Industries have focused on developing portable oxygen concentrators tailored for homecare use, aligning with the country's aging population and the government's emphasis on home-based medical care.

China oxygen concentrator industry is experiencing significant growth, driven by government initiatives and strategic collaborations. For instance, in March 2022, Belluscura, a UK-based medical device company, entered into a three-year manufacturing agreement with InnoMax Medical Technology in China to produce its X-PLO2R portable oxygen concentrators. This collaboration facilitated local production and aimed to cater to the growing demand for portable oxygen solutions in the region.

Latin America Oxygen Concentrator Market Trends

The oxygen concentrator industry in Latin America is growing significantly. The presence of untapped opportunities in emerging countries, such as Brazil, is expected to propel the growth of market. In addition, companies such as Caire and GCE are increasingly expanding their presence in the market by launching novel solutions. For instance, in May 2022, CAIRE announced to launch its NewLife Intensity 10 stationary oxygen concentrators & Companion 5 in Latin America in July, pending anticipated approval from the Brazilian Health Regulatory Agency (Anvisa).

“During the past two years, the COVID-19 pandemic oxygen shortages throughout South America have underscored the need to expand CAIRE’s portfolio of equipment available to providers to serve patients prescribed oxygen as they are discharged from the hospital”

-Barry Hassett, vice president of global marketing

Middle East & Africa Oxygen Concentrator Market Trends

The oxygen concentrator industry growth in the Middle East & Africa is attributed to government initiatives, technological advancements, and strategic actions by industry players. In the United Arab Emirates (UAE), the government has prioritized healthcare innovation, leading to increased adoption of portable oxygen concentrators, especially in homecare settings. This shift is supported by investments in advanced healthcare infrastructure and a focus on managing chronic respiratory conditions.

Key Oxygen Concentrator Company Insights

The market is fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Oxygen Concentrator Companies:

The following are the leading companies in the oxygen concentrators market. These companies collectively hold the largest market share and dictate industry trends.

- Respironics (a subsidiary of Koninklijke Philips N.V.) {Effective from January 25, 2024, Philips Respironics halted the sale of their POCs, with end of service scheduled for January 25, 2029.}

- GF Health Products, Inc.

- MedaCure Inc.

- Nidek Medical Products, Inc

- O2 Concepts

- React Health

- CAIRE Inc. (Acquired by Niterra Co., Ltd., formerly known as NGK SPARK PLUG CO., LTD.)

- DeVilbiss Healthcare (a subsidiary of Drive Medical)

- GCE Group

- Compass Health Brands

- Inogen, Inc.

- Belluscura

- Hoyo Scitech Co., Ltd.

- BPL Medical Technologies

- XNUO INTERNATIONAL GROUP (USA) HOLDING

- Teijin Limited

- BESCO MEDICAL LIMITED

- Oxymed India

- KALSTEIN FRANCE

- Foshan Keyhub Electronic Industries Co., Ltd

Recent Developments

- In March 2025, Unitaid and partners have expanded Africa’s first regional oxygen production network into Tanzania as part of the East African Program on Oxygen Access (EAPOA). This initiative aims to triple regional oxygen production and reduce prices by over 25%, enhancing access to medical oxygen in both urban and remote areas.

“This investment enhances our ability to meet growing demand, making our supply more self-sufficient and reducing reliance on external sources. Now more than ever, building long-term capacity within our region is essential. We welcome this collaboration with Unitaid, CHAI, TOL Gases Plc, and other key partners to improve access to medical oxygen in Tanzania and across neighboring countries.”

-Kassim Majaliwa Tanzanian Prime Minister

- In July 2023, VARON launched new portable oxygen concentrator VP-2 to the VP series of the company. This concentrator aims to provide efficient and reliable oxygen therapy regardless of their location.

“Our goal is to make oxygen therapy more accessible by providing reliable, efficient, and affordable solutions for anyone in need. With VP-2 coming out, we believe we are much closer to the goal."

- Darren Wang, CEO of VARON

-

In July 2023, Canta Medical introduced an entire oxygen product range to the FIME 2023 United States. FIME 2023 is one of the largest international medical exhibitions for the U.S. healthcare market. It attracts over 10,000 healthcare participants and hosts over 500 medical device manufacturers and distributors

-

In April 2022, CAIRE launched LifeStyle, a portable oxygen concentrator for improving the quality of life for oxygen concentrator uses.

“Pioneering the first portable oxygen concentrator has long been both a point of pride, and an ongoing incentive to continue to innovate and develop those technologies that will ensure clinically efficacious oxygen delivery and an improved quality of life for all of our users around the world.”

-said Earl Lawson, CEO of CAIRE Inc.

Oxygen Concentrator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.06 billion

Revenue forecast in 2033

USD 8.31 billion

Growth Rate

CAGR of 6.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in units (000’) and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Respironics (a subsidiary of Koninklijke Philips N.V.); GF Health Products, Inc.; MedaCure Inc.; Nidek Medical Products, Inc.; O2 Concepts; React Health; CAIRE Inc. (acquired by Niterra Co., Ltd., formerly known as NGK SPARK PLUG CO., LTD.); DeVilbiss Healthcare (a subsidiary of Drive Medical); GCE Group; Compass Health Brands; Inogen, Inc.; Belluscura; Hoyo Scitech Co., Ltd.; BPL Medical Technologies; XNUO International Group Holding; Teijin Limited; Besco Medical Limited; Oxymed India; Kalstein France; Foshan Keyhub Electronic Industries Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oxygen Concentrator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global oxygen concentrator market report based on product, application, technology, and region:

-

Products Outlook (Unit Volume, 000'; Revenue, USD Million, 2021 - 2033)

-

Portable Oxygen Concentrators

-

New Purchase

-

Rentals

-

-

Fixed Oxygen Concentrators

-

New Purchase

-

Rentals

-

-

-

Application Outlook (Unit Volume, 000'; Revenue, USD Million, 2021 - 2033)

-

Home Care

-

Non- Home Care

-

-

Technology Outlook (Unit Volume, 000'; Revenue, USD Million, 2021 - 2033)

-

Continuous Flow

-

Pulse Flow

-

-

Regional Outlook (Unit Volume, 000'; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oxygen concentrators market size was estimated at USD 4.85 billion in 2024 and is expected to reach USD 5.06 billion in 2025.

b. The global oxygen concentrators market is expected to grow at a compound annual growth rate of 6.41% from 2025 to 2033 to reach USD 8.31 billion by 2033.

b. Continuous flow technology held the highest market share of 54.9% in 2024. TContinuous flow technology provides reliable, uninterrupted oxygen delivery essential for patients with severe COPD and chronic respiratory conditions. Its widespread use in both clinical and homecare settings, along with proven effectiveness and affordability compared to newer alternatives, support the segment's dominant share.

b. Some key players operating in the oxygen concentrators market include Respironics (a subsidiary of Koninklijke Philips N.V.), GF Health Products, Inc., MedaCure Inc., Nidek Medical Products, Inc., O2 Concepts, React Health, CAIRE Inc. (acquired by Niterra Co., Ltd., formerly known as NGK SPARK PLUG CO., LTD.), DeVilbiss Healthcare (a subsidiary of Drive Medical), GCE Group, Compass Health Brands, Inogen, Inc., Belluscura, Hoyo Scitech Co., Ltd., BPL Medical Technologies, XNUO International Group Holding, Teijin Limited, Besco Medical Limited, Oxymed India, Kalstein France, and Foshan Keyhub Electronic Industries Co., Ltd.

b. Key factors that are driving the oxygen concentrators market growth include the rising prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea coupled with increasing launch of technologically advanced devices. In addition, increasing demand for portable oxygen concentrators owing to their lightweight design, mobility, and battery-powered operation, enabling greater patient freedom and supporting the shift toward home healthcare is further contributing to the markets growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.