- Home

- »

- Healthcare IT

- »

-

Oxygen Concentrators Market Size & Share Report, 2030GVR Report cover

![Oxygen Concentrators Market Size, Share & Trends Report]()

Oxygen Concentrators Market Size, Share & Trends Analysis Report By Product (Portable, Fixed), By Application (Home Care, Non-homecare), By Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-457-4

- Number of Report Pages: 298

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Oxygen Concentrators Market Size & Trends

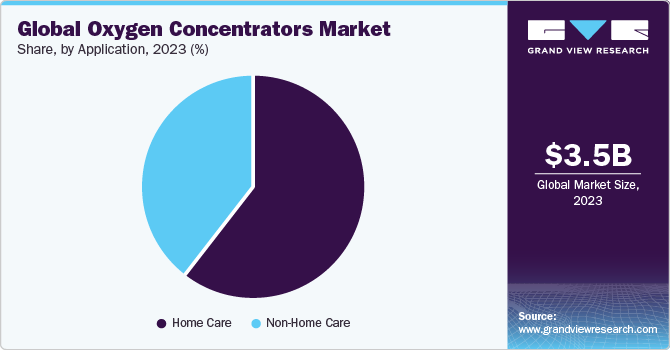

The global oxygen concentrators market size was estimated at USD 3.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.3 % from 2024 to 2030. This is attributed to rising prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea coupled with increasing launch of technologically advanced devices. According to the Global Impact of Respiratory Disease study, around 200 million people suffer from COPD globally, resulting in 3.2 million deaths every year. Moreover, growing preference for home-based therapy is anticipated to drive market growth from 2024 to 2030.

COVID-19 had a limited positive impact on the market, driving increased demand for technologically advanced and cost-effective oxygen concentrators. For example, UNICEF distributed 62,046 concentrators to 104 nations worldwide in July 2021, with approximately 12,788 concentrators sourced from a Chinese trade company. Growing need for emergency treatment and prolonged care for lung diseases in children and adults further propels the industry.

Market Dynamics

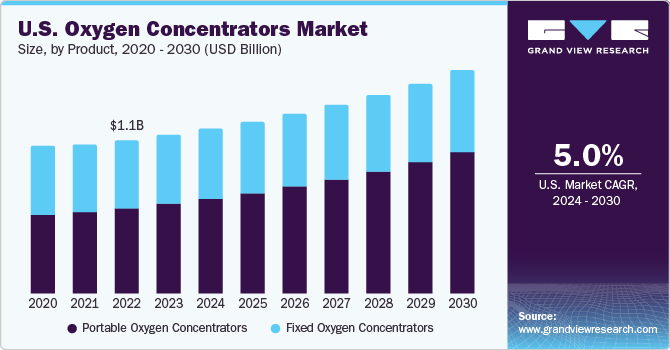

Oxygen therapy has become a preferred choice for managing respiratory disorders, offering medical intervention for acute and chronic patient care. Rising adoption of portable oxygen concentrators also supports the market. For instance, in the U.S., the market penetration of portable oxygen concentrators increased from 8% in 2015 to 22% in 2021, as reported by U.S. Medicare claims data, indicating these devices' growing popularity and usage.

Moreover, regional governments offer reimbursement policies that cover the cost of POCs for patients with respiratory illnesses. For instance, according to Inogen's 10K form document for the fiscal year ending December 31, 2021, the international market (excluding the U.S.) is attractive for oxygen concentrators due to favorable reimbursement policies in certain countries such as the UK and France. In these countries, portable oxygen concentrators receive more favorable reimbursement than in the U.S.

Cost is crucial in the oxygen concentrator industry, particularly in India, where it significantly influences device adoption. Competitors employ competitive pricing as a primary strategy. For example, in April 2021, Koninklijke Philips N.V. implemented a 7% price reduction on its oxygen concentrators in India, passing on benefits of a government-custom duty reduction to customers. This resulted in a decrease in maximum retail price (MRP) of their products. As of April 2021, the MRP of the company's oxygen concentrator is INR 68,120 (USD 940), down from INR 73,311 (USD 1,012) {exchange rate used (2021)- INR 1 = USD 0.0138}.

Product Insights

Based on product, the market is divided into two segments: portable medical oxygen concentrators and fixed medical oxygen concentrators. In 2023, fixed medical oxygen concentrators segment held the majority market share of 53.2%. This can be attributed to factors such as a growing geriatric population, a large base of long-term patients, and increasing demand for these devices in hospitals. Portable medical oxygen concentrators segment is expected to experience the fastest growth, with a CAGR of 7.2% during the forecast period. This growth is driven by increasing awareness of the benefits associated with use of portable concentrators.

Moreover, there is a rising demand for portable medical oxygen concentrators due to increasing number of mobile patients who require out-of-home solutions. According to Inogen's 10K form document for the fiscal year ended December 31, 2021, approximately 80% of U.S. long-term oxygen therapy users utilized ambulatory oxygen, while remaining 20% were considered stationary. This data highlights growing demand and utilization of portable medical oxygen concentrators.

Technology Insights

Based on technology, the market is segmented into continuous flow and pulse flow. In 2023, continuous flow segment held the largest revenue share of 56.6% due to the growing prevalence of long-term respiratory disorders such as asthma, COPD, bronchiectasis, and chronic sinusitis. Moreover, continuous flow technology is also being utilized for residential and military applications, which avoids hazard of storing oxygen under pressure.

Pulse flow segment is anticipated to show fastest growth of CAGR of 5.5% over the forecast period. The segment growth is attributed to its increasing preference among patients suffering from COPD owing to its wide applications in portable devices. According to the World Health Organization (WHO), around 3 million deaths were caused by COPD in 2019 globally and this number is expected to increase over the forecast period.

Application Insights

Based on application, the market is segmented into home care and non-home care. Home care segment held the largest share of over 60.9% in 2023 and is anticipated to grow at the fastest CAGR of 6.4% over the forecast period. Technological advancements and adoption of home therapy in developed countries contribute significantly to the market's revenue share. Availability of a wide range of concentrators for home therapy also plays a crucial role. Also, presence of a sizable geriatric population in countries such as Japan, Germany, Italy, and others is expected to drive market growth. In addition, expansion of healthcare insurance coverage for oxygen concentrators in many countries further fuels the market growth.

Non-homecare segment is expected to show moderate growth during the forecast period, owing to increased adoption of oxygen therapy in hospitals and clinics. The segment witnessed growth in 2020 due to increased usage of oxygen therapy for hospitalized COVID-19 patients.

Regional Insights

North America dominated the market with a market share of over 38.1% in 2023 owing to its advanced healthcare infrastructure, high investment in R&D, availability of the latest technologies, and product launches. Furthermore, the Medicare penetration rate for Portable Oxygen Concentrators (POCs) in the U.S. has significantly increased. In 2021, POCs penetration was 22.0% whereas that of stationary was 17%, based on analyzed Medicare claims data. This indicates a growing trend towards greater acceptance of POCs over fixed oxygen concentrators, driving the market growth. The growth in the region is further driven by government support, as the authorization of portable concentrators during air travel is given by the Federal Aviation Administration (FAA).

Asia Pacific region is anticipated to witness the fastest growth from 2024 to 2030 with a CAGR of 5.7%. The growth is attributed to rising prevalence of respiratory diseases, a rapidly aging population, and an increasing focus on home healthcare. This growth is supported by increasing adoption of portable oxygen concentrators.

Key Companies & Market Share Insights

The oxygen concentrators industry is highly competitive, with Inogen as a notable player in the U.S. market holding a dominant position. It competes with both portable oxygen concentrator manufacturers and long-term oxygen therapy providers, such as Respironics (a subsidiary of Koninklijke Philips N.V.), React Health (Respiratory Product Line from Invacare Corporation), Caire Medical (a subsidiary of NGK Spark Plug), and DeVilbiss Healthcare (a subsidiary of Drive Medical).

Key Oxygen Concentrators Companies:

- Inogen, Inc.

- Respironics (a subsidiary of Koninklijke Philips N.V.)

- Caire Medical (a subsidiary of NGK Spark Plug),

- DeVilbiss Healthcare (a subsidiary of Drive Medical).

- React Health (Respiratory Product Line from Invacare Corporation)

- O2 Concepts

- Nidek Medical Products, Inc.

Recent Developments

-

In February 2023, React Health, a company specializing in the development, manufacturing, and distribution of medical devices for treating sleep-disordered breathing and providing oxygen therapy, successfully acquired Invacare's Respiratory line. This strategic acquisition will enable React Health to further enhance its position in the market and expand its product portfolio to cater to a broader range of customers.

-

In January 2023, CAIRE Inc., a global manufacturer of oxygen therapy and on-site generation systems, acquired MGC Diagnostics Holdings, Inc., a company headquartered in St. Paul, Minnesota. The acquisition strengthened CAIRE's presence and commitment to diagnostic technologies, further enhancing its proficiency in catering to patients at all stages of pulmonary disease progression.

Oxygen Concentrators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.7 billion

Revenue forecast in 2030

USD 5.1 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Inogen, Inc.; Respironics (a subsidiary of Koninklijke Philips N.V.); Invacare Corporation; Caire Medical (a subsidiary of NGK Spark Plug); DeVilbiss Healthcare (a subsidiary of Drive Medical); React Health (Respiratory Product Line from Invacare Corporation); O2 Concepts; Nidek Medical Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oxygen Concentrators Market Report Segmentation

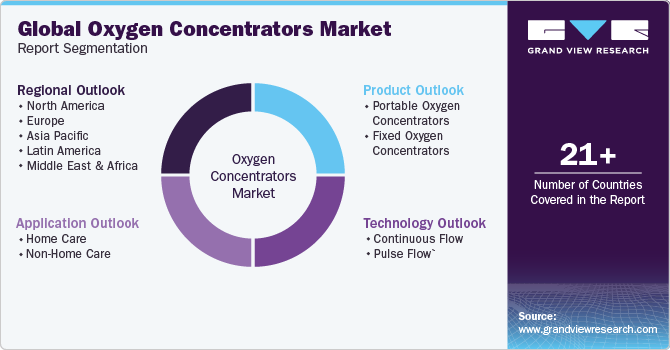

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oxygen concentrators market report based on product, application, technology, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Oxygen Concentrators

-

Fixed Oxygen Concentrators

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Care

-

Non- Home Care

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Continuous Flow

-

Pulse Flow

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global oxygen concentrators market size was estimated at USD 3.5 billion in 2023 and is expected to reach USD 3.7 billion in 2024.

b. The global oxygen concentrators market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 5.1 billion by 2030.

b. Continuous flow technology held the highest market share of 56.6% in 2023. This is attributed to the growing number of patients suffering from long-term respiratory disorders; obstructive sleep apnea and high preference for this technology by patients having minimal physical activity and oxygen requirement more than 5 LPM.

b. Some key players operating in the oxygen concentrators market include React Health (Respiratory Product Line from Invacare Corporation); Drive DeVilbiss Healthcare, Inc.; Philips Healthcare; Nidek Medical; Covidien Ltd.; AirSep Corporation; Inogen, Inc.; and ResMed.

b. Key factors that are driving the oxygen concentrators market growth include the increasing prevalence of Chronic Obstructive Pulmonary Disease (COPD) and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."