- Home

- »

- Healthcare IT

- »

-

Medical Rehabilitation Services Market Size Report, 2030GVR Report cover

![Medical Rehabilitation Services Market Size, Share, & Trends Report]()

Medical Rehabilitation Services Market Size, Share, & Trends Analysis Report By Therapy, By Setting (Outpatient, Inpatient), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-986-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

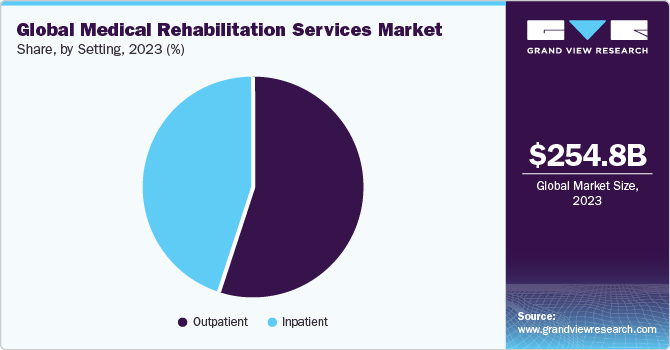

The global medical rehabilitation services market size was estimated at USD 254.82 billion in 2023 and is expected to grow at a CAGR of 6.14% during the forecast period. Increasing number of patients with neurological, musculoskeletal, and cardiologic conditions is expected to drive the growth of the market over the forecast. This contributes to the growing demand for comprehensive services to enhance functional improvement. It also helps in pain management, prevention of complications, improve quality of life, and optimize recovery for long-term self-management.

The growing incidence of road traffic accidents, particularly in urban and industrial settings, is contributing to an increased need for comprehensive rehabilitation to address the cognitive, physical, and vocational impairments experienced by survivors. According to the WHO factsheet of December 2023, around 20 to 50 million individuals globally every year suffer from non-fatal injuries due to road traffic accidents, with many of them reporting disabilities. The accident survivors often experience chronic disabilities that impact their cognitive, behavioral, psychosocial, physical, and vocational functioning. Effective physical and cognitive interventions enhance recovery and minimize functional disabilities. This is expected to drive the growth of the market over the forecast period.

According to the WHO article published in March 2024, neurological conditions affect more than 1 in 3 individuals globally, leading to be the primary cause of illness and disability globally. Rising government initiatives to improve access to rehabilitation boost the growth of the market. These initiatives focus on promoting personal mobility, addressing financial barriers, increasing manpower supply and training, and introducing government schemes. According to the WHO article published in December 2023, a nationwide campaign in Georgia launched to boost referrals for rehabilitation, targeting healthcare professionals nationwide, reaching around 1,000 healthcare professionals in all 11 regions of the U.S. Such government initiatives are expected to contribute to the growing importance and effectiveness, encouraging greater utilization and investment, thereby boosting the demand.

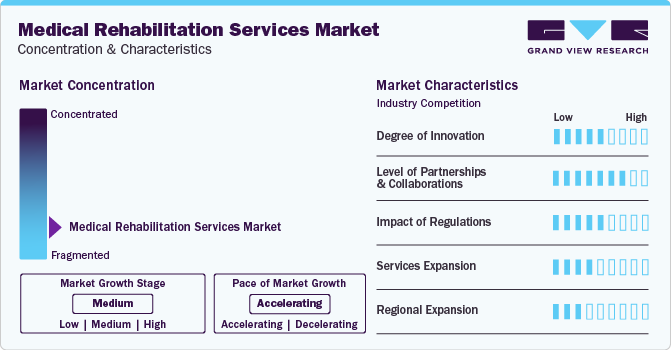

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, impact of regulations, service substitutes, and geographic expansion. For instance, the industry is fragmented, with many small players entering the industry and offering new services. The level of partnerships & collaboration activities is medium, and service expansion is high. The impact of regulations on the industry is medium, and the regional expansion of the industry is medium.

The degree of innovation within the sector is high, driven by advancements in technology, treatment modalities, and patient care approaches. This continuous innovation aims to enhance treatment effectiveness, improve patient outcomes, and optimize delivery. For instance, AI is being used to analyze vast amounts of data, predict patient outcomes, personalize treatment plans, and automate routine tasks.

Partnership and collaboration levels are currently moderate in the industry. This is primarily driven by the industry's effort to address the rising demand for temporary physician staffing through strategic alliances. Additionally, industry players are actively collaborating to mitigate staffing shortages, expand offerings, and adapt to the changing landscape of the healthcare sector. For instance, in August 2023, the Erada Center for Treatment and Rehabilitation collaborated with the University of Colorado's School of Medicine to enhance its treatment programs.

Regulations for these services impact the industry by ensuring quality and safety, which boosts patient trust and demand for the industry. Compliance with these regulations is crucial for healthcare providers to receive payment, thereby influencing the financial viability of these centers and the availability for patients.

Services encompass alternative therapies such as acupuncture, chiropractic care, and massage therapy, offering varied approaches to pain management and mobility improvement. The prevalence of these alternatives depends on regional availability and patient preferences, reducing their impact on the industry moderately.

The level of regional expansion varies, ranging from moderate to high, by increasing accessibility and availability of care. For instance, expanding coverage into rural areas helps to address unmet needs, thereby expanding the patient base. Initiatives, such as establishing new centers and adding advanced technologies in various regions, enhance local healthcare infrastructure.

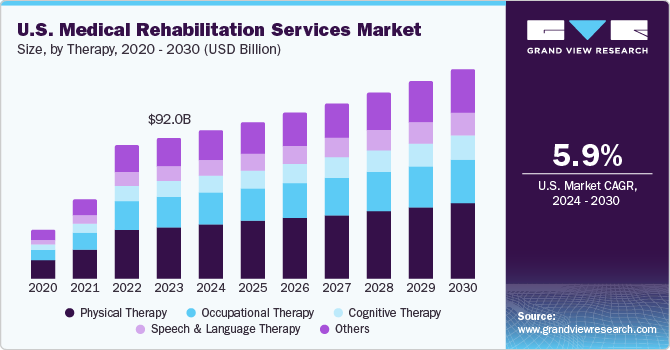

Therapy Insights

The physical therapy segment dominated the market with a revenue share of 37.36% in 2023. The segment growth can be attributed to its growing adoption for treating a range of conditions, including musculoskeletal, neurologic, sports injuries, and wound care. Moreover, lower back discomfort, spine, shoulder, rotator cuff injuries, knee diseases, and other sprains & strains are the most prevalent conditions treated with physical therapy.

According to the article published in Journal of the American Medical Association in January 2022, the number of individuals suffering from musculoskeletal disorders in need of rehabilitation increased to 1,713.6 million in 2019 from 1,060.6 million in 1990. As these trends are expected to continue, the demand for physical therapy is expected to boost over the forecast period.

The cognitive therapy segment is expected to grow at the fastest CAGR over the forecast period. Rising cases of drug abuse and alcoholism, linked with growing awareness of their detrimental health effects, are anticipated to drive the demand for cognitive therapy over the forecast period. According to the National Center for Drug Abuse Statistics of March 2024, more than 95,150 individuals in the U.S. died due to alcohol-related issues.

In addition, despite an estimated 15 million people fighting with Alcohol Use Disorder (AUD), less than 8% seek treatment for this condition. Cognitive therapy relieves individuals struggling with alcoholism and drug abuse by addressing underlying thought patterns and behaviors contributing to these conditions. Promoting healthier managing mechanisms and assisting in developing strategies to manage triggers, cognitive therapy plays a crucial role in addiction recovery. This effective approach, coupled with increasing awareness of its benefits, is driving heightened demand for cognitive therapy in addressing alcoholism abuse disorders.

Application Insights

The orthopedic segment dominated the market with a revenue share of 37.40% in 2023. The increasing prevalence of orthopedic conditions, including spinal injuries, arthritis, ankle injuries, and hip injuries, drive growth within the segment throughout the forecast period. According to an NCBI article published in June 2021, around 1.6 million people every year suffer from hip fractures globally. The geriatric population is expected to increase to 2.6 million by 2025 and 4.5 million by 2050. This segment's dominance is further supported by the availability of advanced technologies and equipment in outpatient centers, enhancing the quality of care and outcomes for orthopedic patients.

Sports-related injuries segment is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing number of sports participants, particularly children and adolescents. As more individuals engage in sports and recreational activities, the probability of experiencing injuries increases, leading to a higher demand for therapy adapted to address sports-related injuries.

For instance, in 2024, over 3.5 million children aged 14 and younger sustain injuries each year while participating in sports or recreational activities in the U.S. As the number of sports participants increases, so does the demand to address these injuries, driving growth.This is expected to contribute to the demand for specialized programs and therapy designed to meet the unique needs of athletes and active individuals, thereby driving the growth of the segment.

End-use Insights

Hospital and clinics segment dominated the market with a revenue share of 30.92% in 2023. This is due to the rising inflow of patients opting for these services at hospitals and clinics. Furthermore, hospitals and clinics provide widespread therapy coverage, including physical, occupational, and speech therapy, under one roof, which attracts a broad patient base. These facilities are equipped with advanced medical technology and staffed by highly trained healthcare professionals, ensuring high-quality care and effective outcomes.

Integrating acute care and rehabilitation within the same facility enhances patient continuity of care and recovery. Additionally, the launch of new settings offering advanced therapy is contributing to the growth of the industry. For instance, in March 2024, Trilife Hospital in Bengaluru, India, opened a new Neurorehabilitation and Sports Medicine Center with 40 beds.

The homecare settings segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by increasing demand for convenient and personalized services and technological advancements enabling home-based treatments. Factors such as cost-effectiveness, improved patient outcomes, and the need to reduce healthcare facility admissions contribute to expanding therapy in homecare settings. Moreover, technological innovations such as wearables, telemedicine platforms, and remote monitoring systems are making it easier to provide home services, further driving this segment's growth.

Setting Insights

The outpatient segment dominated the market with a revenue share of 55.04% in 2023. This can be attributed to the lower cost compared to inpatient settings and the integration of advanced neurorehabilitation technologies into outpatient treatment. The cost of the therapy in outpatient is slightly lower compared to inpatient settings, owing to costs associated with the hospital stay with inpatient care.

As per the article published in the Journal of Rehabilitation Medicine in April 2021, the cost of the therapy was approximately three times greater for inpatient than outpatient therapy in Europe. Physical therapy costs around USD 2,579, occupational costs around USD 2,061, and psychological costs around USD 1,835 in outpatient centers across Europe.

The inpatient segment is expected to grow at a significant rate as inpatient settings often have access to specialized equipment and resources unavailable in outpatient or homecare settings. These include advanced therapeutic devices, rehab technology, and specialized facilities to facilitate fast recovery. The settings offer intensive, long-term recovery therapy to a patient population recovering from severe injuries, complex surgeries, or chronic illnesses that significantly impact their ability to perform daily activities independently.

Regional Insights

North America region held the largest revenue share of 42.22% in 2023. The growth of the market in the region was supported by factors such as the accessibility of these therapies in-home care and outpatient facilities, along with favorable reimbursement policies.

U.S. Medical Rehabilitation Services Market Trends

The U.S. medical rehabilitation services market held the largest share in 2023 due to well-established healthcare infrastructure, including state-of-the-art facilities. The increasing demand for healthcare services, rising disposable income, and increased healthcare expenditure are expected to contribute to the growth of the industry.

As per the American Physical Therapy Association, since January 1, 2021, Medicare Part B allows physical therapists (PTs) and Physical Therapist Assistants (PTAs) to administer rehabilitative and skilled maintenance therapy, including in various settings such as homes, assisted and independent living facilities, and Skilled Nursing Facilities (SNFs). This change, implemented in the 2021 Physician Fee Schedule Final Rule, permits PTAs to provide skilled maintenance therapy for outpatient care under Medicare Part B.

Europe Medical Rehabilitation Services Market Trends

The medical rehabilitation services market in Europe is anticipated to grow significantly due to the increasing geriatric population to address age-related conditions and improve quality of life. Moreover, advancements in medical technology are enhancing treatment options, leading to improved patient outcomes and increased adoption.These trends are expected to drive industry’s growth, addressing the evolving healthcare needs of the population.

Germany's medical rehabilitation services market held the largest share in the Europe region in 2023. Supportive government policies and initiatives to improve healthcare infrastructure and expand access to rehabilitative therapy are expected to drive market growth. The increasing prevalence of chronic diseases and musculoskeletal disorders in Germany also creates greater demand, contributing to the growth.

The medical rehabilitation services market in UK is expected to witness the fastest growth over the forecast period. Growing awareness among healthcare professionals and patients about the benefits of managing chronic conditions and improving total health is expected to contribute to market growth.

Asia Pacific Medical Rehabilitation Services Market

Asia Pacific medical rehabilitation services marketis expected to witness the fastest growth over the forecast period. Increasing urbanization and sedentary lifestyles contribute to a higher incidence of injuries and musculoskeletal disorders, driving the need for these therapies in the region.

The medical rehabilitation services market in Japan held the largest share in 2023, owing to the rise in aging populations. Japan has one of the world's oldest populations, leading to a higher prevalence of age-related conditions and disabilities. This demographic trend is expected to drive the demand in the country.

India medical rehabilitation services market has witnessed high demand in recent years. The increasing prevalence of non-communicable diseases such as cardiovascular diseases, diabetes, and musculoskeletal disorders is driving demand in India.

Latin America Medical Rehabilitation Services Market

Themedical rehabilitation services market in Latin Americais anticipated to grow significantly due to greater emphasis on mental health rehab therapies to address conditions such as depression, anxiety, and Post-Traumatic Stress Disorder (PTSD).

Brazil medical rehabilitation services market held the largest share in 2023. Brazil has a high incidence of traumatic injuries, including those from road accidents and violence. This contributes to a growing demand for rehabilitative therapies to aid in the recovery of individuals with injuries.

MEA Medical Rehabilitation Services Market

The medical rehabilitation services market in MEA region is anticipated to witness significant growth due to the establishment of specialized centers focusing on specific conditions, such as spinal cord injuries, stroke recovery, and pediatric rehabilitation, addressing the needs of different patient groups.

South Africa medical rehabilitation services market held the largest share in 2023. A supportive regulatory framework that encourages the establishment and operation of centers contributes to the industry expansion. Regulations that standardize and ensure quality care also boost public confidence in these therapies.

Key Medical Rehabilitation Services Company Insights

The industry is highly fragmented and competitive, with the presence of a few major players and a small number of small- & medium-sized care centers. Some emerging companies are Centrex Rehab, BenchMark PT,Carrus Health, ATI Physical Therapy, and NovaCare Rehabilitation.

Key Medical Rehabilitation Services Companies:

The following are the leading companies in the medical rehabilitation services market. These companies collectively hold the largest market share and dictate industry trends.

- Shirley Ryan AbilityLab

- Prism Medical

- Icahn School of Medicine at Mount Sinai

- Paradigm Healthcare

- The University of Chicago Medical Center

- MindMaze Healthcare

- Lifespan Physical Therapy Services

- SuVitas

- nMotion Physical Therapy

- Therapy Solutions for Kids

- Athletico Physical Therapy

Recent Developments

-

In April 2024, Mumtada Medical Company partnered with the Mass General Brigham to provide advanced rehabilitative services and long-term post-acute care in Saudi Arabia. Mass General Brigham will help in establishing Mumtada Rehabilitation Hospital in Riyadh as the first step in their strategic collaboration.

-

In March 2024 , SportsMed Physical Therapy launched a new service, SportsMed HomeCare, expanding its outpatient physical therapy, occupational therapy, and speech therapy services to homebound patients in the New Jersey & Connecticut regions in the U.S.

-

In October 2023, The Health Service Executive (HSE) launched a new model of care for cardiac rehabilitation in Ireland, focusing on bringing services closer to patients' homes and integrating them across hospital and community settings. This approach emphasizes personalized care plans, early patient contact during hospital stays, and automatic referral to cardiac rehabilitation upon discharge.

-

In February 2023, Datos Health collaborated with Shirley Ryan AbilityLab to provide a remote care platform, Open Care, to the center for an outpatient remote therapeutic monitoring implementation study.

-

In August 2023, PureHealth expanded its offerings by incorporating the National Rehabilitation Center (NRC) into its network. This integration aims to enhance treatment programs, integrate innovative technologies, and establish a national strategy, aligning with Abu Dhabi's commitment to delivering comprehensive healthcare services.

Medical Rehabilitation Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 269.91 billion

Revenue forecast in 2030

USD 385.92 billion

Growth rate

CAGR of 6.14% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, setting, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Shirley Ryan AbilityLab; Prism Medical; Icahn School of Medicine at Mount Sinai; Paradigm Healthcare; The University of Chicago Medical Center; MindMaze Healthcare; Lifespan Physical Therapy Services; SuVitas; nMotion Physical Therapy; Therapy Solutions for Kids; Athletico Physical Therapy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Rehabilitation Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical rehabilitation services market report based on therapy, setting, application, end-use, and region.

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Physical Therapy

-

Occupational Therapy

-

Cognitive Therapy

-

Speech and Language Therapy

-

Others

-

-

Setting Outlook (Revenue, USD Million, 2018 - 2030)

-

Outpatient

-

Inpatient

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic

-

Cardiologic

-

Neurological

-

Pulmonary

-

Sports Related Injuries

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital and Clinics

-

Rehab Centers

-

Homecare Settings

-

Physiotherapy Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

Australia

-

India

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical rehabilitation services market was estimated at USD 254.82 billion in 2023 and is expected to reach USD 269.91 billion in 2024.

b. The global medical rehabilitation services market is expected to grow at a compound annual growth rate of 6.14% from 2024 to 2030 to reach USD 385.92 billion by 2030.

b. The outpatient rehabilitation segment held the largest share of 55.04% in 2023. This can be attributed to the lower cost compared to inpatient settings and the integration of advanced neurorehabilitation technologies into outpatient treatment.

b. The key players of medical rehabilitation services market are Shirley Ryan AbilityLab, Prism Medical, Icahn School of Medicine at Mount Sinai, Paradigm Healthcare, The University of Chicago Medical Center, MindMaze Healthcare, Lifespan Physical Therapy Services, SuVitas, nMotion Physical Therapy, Therapy Solutions for Kids, Athletico Physical Therapy

b. The key factors that are driving the market growth are growing demand for comprehensive services to enhance functional improvement, pain management, prevention of complications, improve quality of life, and optimize recovery for long-term self-management.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."