- Home

- »

- Medical Devices

- »

-

Medical Robotic Systems Market Size & Share Report, 2030GVR Report cover

![Medical Robotic Systems Market Size, Share & Trend Report]()

Medical Robotic Systems Market (2024 - 2030) Size, Share & Trend Analysis Report By Type (Cleanroom Robots, Robotic Prosthetics, Medical Service Robots), Region, and Segment Forecasts

- Report ID: 978-1-68038-231-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Robotic Systems Market Summary

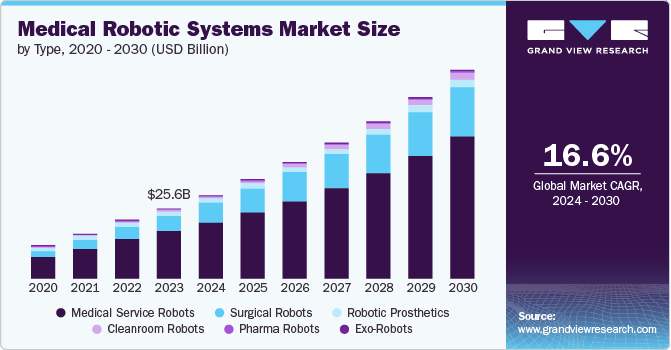

The global medical robotic systems market size was estimated at USD 25.56 billion in 2023 and is projected to reach USD 76.45 billion by 2030, growing at a CAGR of 16.55% from 2024 to 2030. The increasing prevalence of diseases, particularly cancer, neurological disorders, and orthopedic conditions, is creating an increased demand for accurate surgical procedures, especially among the aging population.

Key Market Trends & Insights

- The Asia Pacific medical robotic systems market dominated the overall global market with a revenue share of 52.3% in 2023.

- The U.S. medical robotic systems market held a significant share of North America market in 2023.

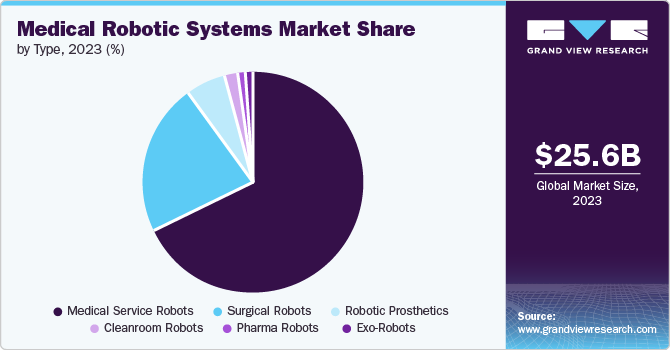

- Based on type, the medical service robots segment held the largest share of 68.15% in 2023.

- Based on type, the cleanroom robots segment is projected to grow fastest from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 25.56 Billion

- 2030 Projected Market Size: USD 76.45 Billion

- CAGR (2024-2030): 16.55%

- Asia Pacific: Largest market in 2023

The rise in geriatric patients requiring surgical interventions further propels the market. Patients and healthcare providers favor robotic surgical procedures due to their benefits, such as reduced pain, quicker recovery times, and lower risks of complications compared to traditional open surgeries. Robotic systems offer enhanced precision, flexibility, and control, allowing surgeons to perform complex procedures through small incisions. This shift towards minimally invasive techniques is supported by advancements in robotic technology, which continually improve surgical outcomes. As the population ages and the prevalence of chronic diseases rises, the demand for such sophisticated surgical options is expected to grow, thereby driving the market for medical robotic systems.

The rising demand for accurate laparoscopic surgeries and the increasing percentage of trauma injuries are the key factors propelling the market growth. Furthermore, growing technological advancement in medical equipment and a rise in per capita healthcare spending are projected to drive the market in emerging economies. For instance, in November 2023, Johnson & Johnson MedTech shared that they plan to seek an investigational device exemption (IDE) from the U.S. Food & Drug Administration (FDA) for their OTTAVA robotic surgical system. They aim to apply to the U.S. FDA in the second half of 2024, paving the way for clinical trials to begin.

In addition,technological innovations play a crucial role in the expansion of the medical robotic systems market. Continuous improvements in robotics, artificial intelligence, and machine learning enhance the capabilities of these systems, making procedures more efficient and effective. Features such as high-definition 3D visualization, augmented reality, and real-time data analytics assist surgeons in making precise decisions during operations.

Furthermore, the integration of AI allows for predictive analytics, improving preoperative planning and postoperative recovery. For instance, in September 2022 , Swiss tech company SEED Biosciences announced that its pipetting robot, DISPENCELL, has received approval for use in cleanrooms and sterile environments. These technological advancements increase the adoption of robotic systems in hospitals & clinics and open new avenues for their application in various surgical specialties, thereby broadening the market’s scope.

Furthermore, the growing awareness among healthcare professionals and patients about the benefits of robotic-assisted surgeries is accelerating market growth. Medical institutions and robotic system manufacturers are conducting extensive training programs to educate surgeons on the use of these advanced systems. These training initiatives ensure that healthcare providers are skilled and confident in performing robotic-assisted procedures, thereby increasing their adoption. For instance, in May 2023 , the All-India Institute of Medical Sciences (AIIMS) in New Delhi, India inaugurated its advanced surgical robotics training center, designed for resident doctors and faculty.

This facility includes a wet lab and a SET (Skills, e-learning, telemedicine) facility. Additionally, positive patient outcomes and word-of-mouth endorsements contribute to greater acceptance and demand for robotic surgeries. As more surgeons become proficient in using robotic systems, and as patient awareness increases, the market for medical robotic systems is expected to expand significantly.

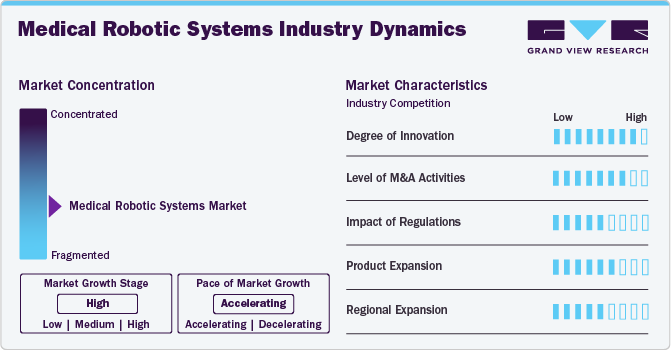

Market Concentration & Characteristics

The market is marked by a high degree of innovation, driven by advancements in artificial intelligence, machine learning, and high-definition imaging technologies. These innovations enhance surgical precision, flexibility, and control, allowing for minimally invasive procedures with improved patient outcomes. Continuous research and development efforts are leading to more sophisticated, user-friendly robotic systems, expanding their application across various surgical specialties and boosting market growth.

Regulations significantly impact the market by ensuring safety, efficacy, and quality. Stringent approval processes by regulatory bodies such as the FDA and CE mark requirements can delay market entry but also build trust and reliability. Compliance with these regulations demands substantial investment in research and development. However, successful navigation of regulatory frameworks enhances market credibility, encourages adoption by healthcare providers, and ultimately drives market growth.

The market is witnessing a high level of mergers and acquisitions (M&A) activity. Major healthcare and technology companies are acquiring smaller, innovative firms to enhance their product portfolios and leverage advanced technologies. For instance, in October 2022, igus acquired Commonplace Robotics, a company specializing in intuitive control systems, software, and power electronics for robotics, catering to both industrial and educational sectors. These M&As facilitate rapid market expansion, drive innovation, and create synergies in research and development. Such consolidation also helps companies gain competitive advantages, expand their global presence, and better meet the growing demand for advanced surgical solutions.

Product expansion in the market involves introducing new and advanced robotic solutions tailored to various surgical specialties. For instance, in July 2022, Comau launched its latest six-axis articulated robot, the Racer-5SE, designed specifically for industries such as healthcare. It is certified with IP67 for ingress protection and meets high standards for cleanroom environments with ISO 5 classification (ISO 14644-1). Companies are diversifying their offerings with innovations in robotics-assisted procedures, enhancing functionality, precision, and ease of use, thus broadening their market reach and addressing a wider range of medical needs.

Global expansion in the market is driven by increasing adoption in emerging economies, improved healthcare infrastructure, and supportive government policies. Companies are targeting regions like Asia-Pacific, Latin America, and the Middle East, leveraging local partnerships and investments to tap into growing demand and enhance their international market presence.

Type Insights

The medical service robots segment held the largest share of 68.15% in 2023. Medical service robots significantly enhance patient care by supporting healthcare professionals, increasing operational efficiencies, and mitigating labor shortages while reducing human error. Moreover, the growth of this segment is driven by ongoing developments in robotic technology by key industry players. These advancements are expanding the capabilities of medical robots, making them indispensable in modern healthcare settings.

For instance, in May 2024, Richtech Robotics Inc., based in Nevada and known for its AI-driven service robots, introduced the Medbot. This elevator delivery robot aims to optimize pharmacy operations by ensuring continuous, round-the-clock medication delivery. Medbot enhances healthcare facility efficiency through precise operations, enhancing security in deliveries, cutting operational expenses, and elevating the overall patient care experience.

The cleanroom robots segment is projected to grow fastest from 2024 to 2030. These robots are crucial for maintaining sterile environments in sensitive medical settings such as hospitals, pharmaceutical manufacturing facilities, and research laboratories. They automate tasks such as handling and transporting materials and instruments within cleanrooms, minimizing contamination risks, and ensuring compliance with stringent cleanliness standards.

For instance, in April 2024, Roborock revealed the upcoming launch of its highly anticipated robotic cleaner, the S8 MaxV Ultra. Previously acclaimed at CES 2024, this advanced model has captured attention for its intelligent features. The increasing demand for precision in healthcare operations and the emphasis on infection control are driving the adoption of cleanroom robots. Companies are investing in advanced robotic technologies to meet these requirements, further propelling the growth of this specialized segment in the medical robotics industry.

Regional Insights

North America medical robotic systems market is witnessing significant growth, driven by robust investments in research and development. Key players in this market include Intuitive Surgical, Inc., known for its da Vinci Surgical System, and Stryker Corporation, which offers robotic-assisted surgical platforms such as Mako. These companies dominate the market with their innovative robotic technologies designed to enhance surgical precision and patient outcomes. Other significant players include Medtronic plc, Zimmer Biomet Holdings, Inc., and Verb Surgical Inc., each contributing to the region's dynamic medical robotics landscape through continuous technological advancements and strategic collaborations.

U.S. Medical Robotic Systems Market Trends

TheU.S. medical robotic systems marketheld a significant share of North America market in 2023, driven by substantial investments in advanced technologies. Companies are focusing on expanding their robotic-assisted surgical platforms to enhance precision and improve patient outcomes.For instance, in December 2023, Stafford Hospital announced the acquisition of a da Vinci XI surgical robot system, representing the initial phase of its ambitious robotics program development. The hospital invested USD 2 million in this advanced robotic system. This market growth is fueled by increasing demand for minimally invasive procedures and the ongoing development of innovative robotic technologies tailored to various medical specialties.

Europe Medical Robotic Systems Market Trends

The Europe medical robotic systems market is witnessing increasing demand, propelled by advancements in technology and rising adoption of minimally invasive surgeries. Innovative robotic platforms are enhancing surgical precision and patient safety across various specialties.For instance, in April 2024 , HCA Healthcare UK became the inaugural healthcare provider in the UK to provide patients with access to robotic-assisted surgery using the da Vinci Single Port (SP) system, enabling complex minimally invasive procedures through a single incision. Countries including Germany, the UK, and France are leading in robotic technology adoption, supported by favorable healthcare policies and investments.

The medical robotic systems market in the UK is one of the major markets in the European region, and is experiencing notable growth, driven by advancements in technology and a growing preference for minimally invasive procedures. Healthcare providers are integrating robotic-assisted surgical systems to enhance surgical precision and patient outcomes. For instance, June 2023, the Hugo robotic-assisted surgery (RAS) system from Medtronic made its debut in the UK at Guy’s and St Thomas’ Hospital. This trend reflects a broader shift towards innovative medical technologies in the UK healthcare sector.

The Germany medical robotic systems market is advancing rapidly with cutting-edge technologies. Innovations such as AI integration, enhanced surgical precision, and improved patient outcomes are driving the adoption of robotic-assisted surgeries across various medical specialties.For instance, in February 2021, CMR Surgical (CMR) introduced its Versius Surgical Robotic System in Germany at Klinikum Chemnitz, a public hospital in Saxony and the first installation of Versius in the country.

Asia Pacific Medical Robotic Systems Market Trends

The Asia Pacific medical robotic systems market isgrowing through partnerships with hospitals to advance medical treatments. These collaborations aim to integrate advanced robotic technologies into healthcare settings, enhancing surgical precision and patient care. For instance, in August 2023, CK Birla Hospital collaborates with Intuitive India to introduce a surgical robot aimed at advancing medical treatment capabilities. Such initiatives are pivotal in ensuring that patients across the region benefit from state-of-the-art medical innovations and improved treatment outcomes.

The China medical robotic systems market is witnessing increased awareness and robust training programs. These initiatives are crucial in familiarizing healthcare professionals with advanced robotic technologies, fostering their adoption in hospitals and clinics across the country. Such efforts are instrumental in enhancing surgical precision and patient outcomes in China's healthcare landscape.

The medical robotic systems market in Japan is advancing with cutting-edge technologies, including telesurgery. For instance,in October 2023 , Singapore's National University Hospital and the Yong Loo Lin School of Medicine at the NUS Medicine (National University of Singapore) partnered with Fujita Health University (FHU) for their inaugural robotic telesurgery trial linking Singapore and Japan. These innovations enable remote surgical procedures conducted by surgeons from different locations, enhancing access to specialized medical expertise and improving patient care outcomes across the country.

Latin America Medical Robotic Systems Market Trends

The Latin Americamedical robotic systems marketis expanding with significant investments in healthcare infrastructure. These investments drive the adoption of cleanroom robots to enhance sterile manufacturing environments, meeting stringent regulatory standards and improving operational efficiency in pharmaceutical and medical device sectors. For instance, in May 2022, CMR Surgical began its expansion into Latin America with the introduction of Versius at Hospital e Maternidade São Luiz Itaim, part of the Rede D’Or network in Brazil. The robotic system is integrated into a comprehensive multidisciplinary surgical program at the hospital.

The Brazil medical robotic systems market is driven by robust training programs. These initiatives are pivotal in equipping healthcare professionals with the skills needed to effectively utilize advanced robotic technologies in surgical settings. Such training programs enhance surgical precision and contribute to improved patient outcomes nationwide.

MEA Medical Robotic Systems Market Trends

The medical robotic systems market in MEA is experiencing increasing demand. Healthcare providers are adopting advanced robotic technologies to enhance surgical precision, improve patient outcomes, and meet the region's growing healthcare needs effectively. For instance,Stellenbosch University’s Faculty of Medical and Health Sciences (FMHS) achieved a milestone in February 2022 with the inaugural use of the newly acquired Da Vinci Xi robot at Tygerberg Hospital in Cape Town, marking a significant advancement in surgical training and complex procedure capabilities through robotics.

The Saudi Arabia medical robotic systems market is witnessing significant investment, driven by the country's focus on enhancing healthcare infrastructure. These investments aim to incorporate advanced robotic technologies into medical practice, improving surgical precision and patient care, and positioning Saudi Arabia as a leader in medical innovation within the region.

Key Medical Robotic Systems Company Insights

The scenario in the market is highly competitive. The major companies are adopting various strategies such as product launches, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Medical Robotic Systems Companies:

The following are the leading companies in the medical robotic systems market. These companies collectively hold the largest market share and dictate industry trends.

- iRobot Corporation

- Medrobotics Corporation

- Titan Medical Inc.

- Renishaw Plc

- Health Robotics SLR

- OR Productivity plc

- Intuitive Surgical

- Mako Surgical Corp.

- Varian Medical Systems

- Stereotaxis Inc.

- Mazor Robotics

- Medtronic

- Stryker

- Zimmer Biomet

- Smith & Nephew

Recent Developments

-

In July 2024, Intuitive Surgical reported a strong second quarter, driven by the rapid rollout of its da Vinci 5 robotic surgery system, which surpassed Wall Street expectations.

-

In June 2024, Globus Medical obtained 510(k) clearance from the FDA for its ExcelsiusFlex orthopedic robot.

-

In May 2024, Sony announced the development microsurgery robot to enhance surgical precision. The robot is designed to assist surgeons in performing intricate procedures with greater accuracy.

-

In November 2023, Syrius Technology announced a strategic partnership with SoftBank Robotics and IRIS OHYAMA to introduce a new commercial cleaning robot. This collaboration aims to enhance cleaning services with improved efficiency, convenience, eco-friendliness, and high-quality results for the public.

Medical Robotic Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.50 billion

Revenue forecast in 2030

USD 76.45 billion

Growth rate

CAGR of 16.55% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand;; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

iRobot Corporation; Medrobotics Corporation; Titan Medical Inc.; Renishaw Plc; Health Robotics SLR; OR Productivity plc; Intuitive Surgical; Mako Surgical Corp.; Varian Medical Systems; Stereotaxis Inc.; Mazor Robotics; Medtronic; Stryker; Zimmer Biomet; Smith & Nephew

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Robotic Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical robotic systems market report based on the type and region.

-

Medical Robotic Systems Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Surgical Robots

-

Surgical Robots, By Application

-

Orthopedics

-

Neurology

-

Urology

-

Gynecology

-

Others

-

-

-

Exo-Robots

-

Exo-Robots, By Extremities

-

Upper Body

-

Lower Body

-

Full Body

-

-

Pharma Robots

-

Traditional Robots

-

Articulated Robots

-

Delta/Parallel Robots

-

SCARA Robots

-

Dual-Arm Robots

-

Cartesian Robots

-

-

Collaborative Robots

-

-

Cleanroom Robots

-

Traditional Robots

-

Articulated Robots

-

SCARA Robots

-

Parallel Robots

-

Cartesian Robots

-

-

Collaborative Robots

-

-

Robotic Prosthetics

-

MPC Prosthetics

-

Myoelectrical Prosthetics

-

-

Medical Service Robots

-

-

Medical Robotic Systems Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical robotic systems market size was estimated at USD 25.56 billion in 2023 and is expected to reach USD 30.5 billion in 2024.

b. The global medical robotic systems market is expected to grow at a compound annual growth rate of 16.6% from 2024 to 2030 to reach USD 76.45 billion by 2030.

b. Medical service robots dominated the medical robotic systems market with a share of 68.2% in 2023. This is attributable to widespread adoption during the ongoing pandemic in disinfecting care facilities and treatment units.

b. Some key players operating in the medical robotic systems market include MAKO Surgical Corp.; Reninshaw Plc.; Varian, Accuray; Intuitive Surgical Inc.; and Health robotics S.R.L.

b. Key factors that are driving the medical robotic systems market growth include increasing demand for accurate laparoscopic surgeries, growing need for surgical procedures in the geriatric population, and rising cases of trauma injuries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.