- Home

- »

- Medical Devices

- »

-

Medical Spa Market Size And Share, Industry Report, 2033GVR Report cover

![Medical Spa Market Size, Share & Trends Report]()

Medical Spa Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Facial Treatment, Body Shaping & Contouring), By Age Group, By Gender, By Service Provider, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-315-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Spa Market Summary

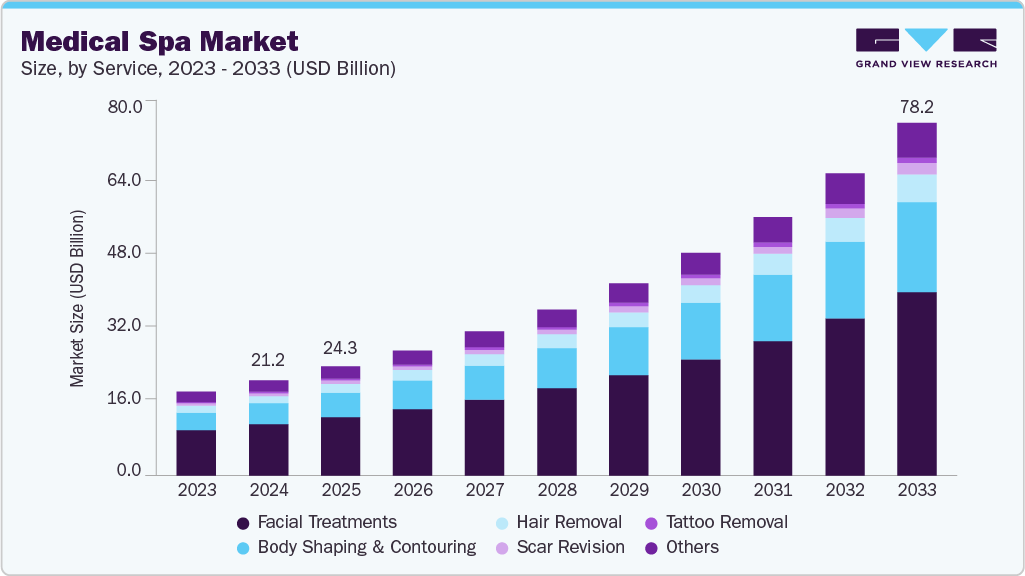

The global medical spa market size was estimated at USD 21.21 billion in 2024 and is projected to reach USD 78.23 billion by 2033, growing at a CAGR of 15.77% from 2025 to 2033. The market growth can be attributed to the rising awareness among consumers about self-care & antiaging services and the rapid growth of the wellness tourism sector.

Key Market Trends & Insights

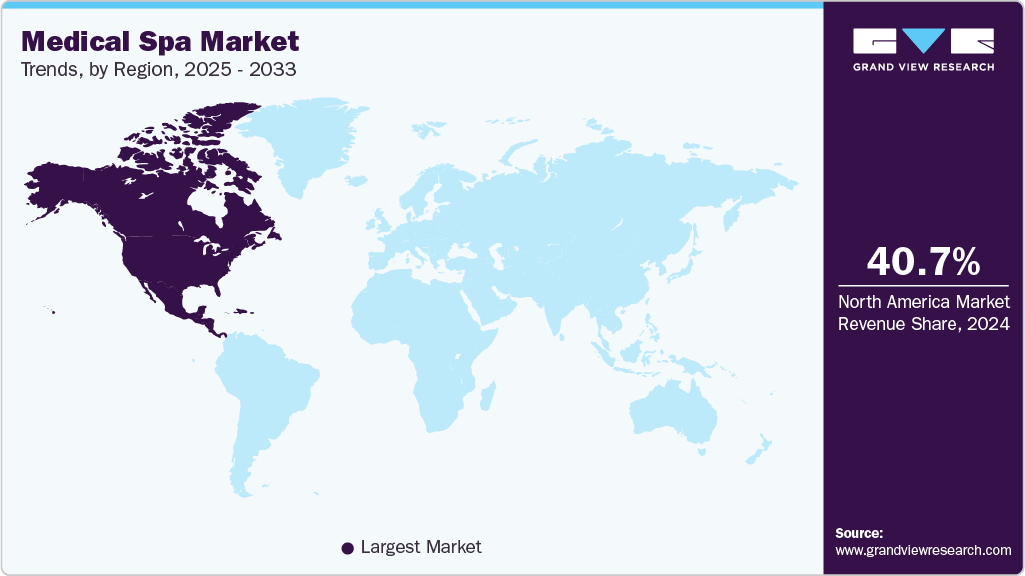

- The North America medical spa market accounted for the largest global revenue share of 40.68% in 2024.

- The U.S. medical spa industry is anticipated to register the fastest CAGR from 2025 to 2033.

- By service, the facial treatments segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.21 Billion

- 2033 Projected Market Size: USD 78.23 Billion

- CAGR (2025-2033): 15.77%

- North America: Largest market in 2024

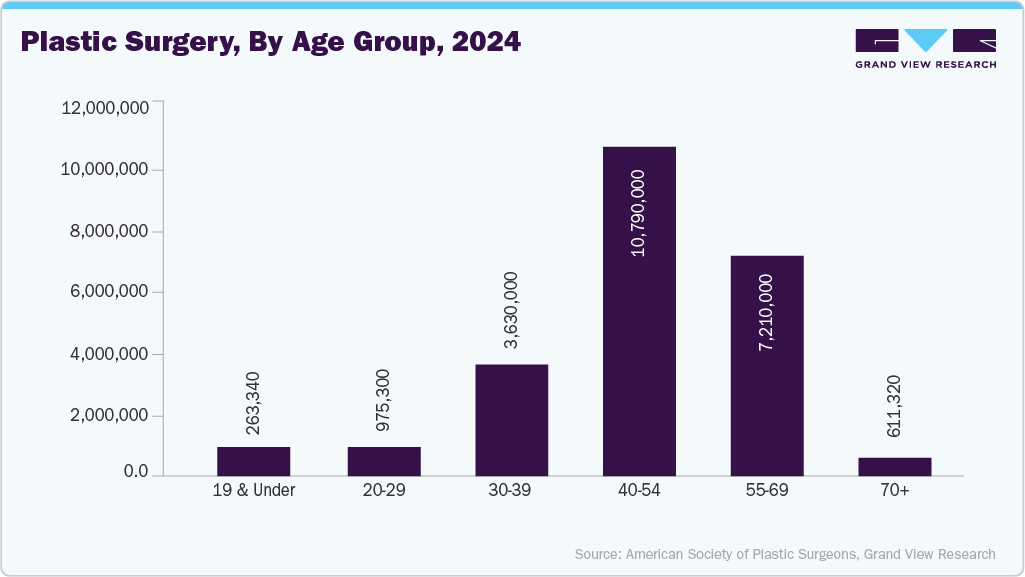

The American Med Spa Association (AMSA) reports a significant demand for minimally invasive treatments, encompassing procedures such as chemical peels, nonsurgical skin tightening, body sculpting, and tattoo removal. In addition, increase in popularity of wellness-themed vacations, often bundled with wellness packages in hotels, contributes to the swift growth in demand for such services.The medical spa industry has been shaped by constantly changing customer demands. With customers becoming more social media savvy, awareness about anti-aging solutions is on the rise. Increasing demand for anti-aging skincare solutions remains the key driver in this market. As per 2024 ASPS Procedural Statistics, patients aged 55-69 years account for a significant share of cosmetic procedures, reflecting the strong influence of the geriatric population on market demand. This is the stage of life when age-related changes such as deep wrinkles, sagging skin, and volume loss become more prominent, driving interest in corrective treatments.

Moreover, individuals in this age group often enjoy greater financial stability, enabling them to invest in elective aesthetic care. The growing availability of safe and minimally invasive procedures further supports adoption, positioning the 55-69 age group as a key driver of demand in the medical spa market.

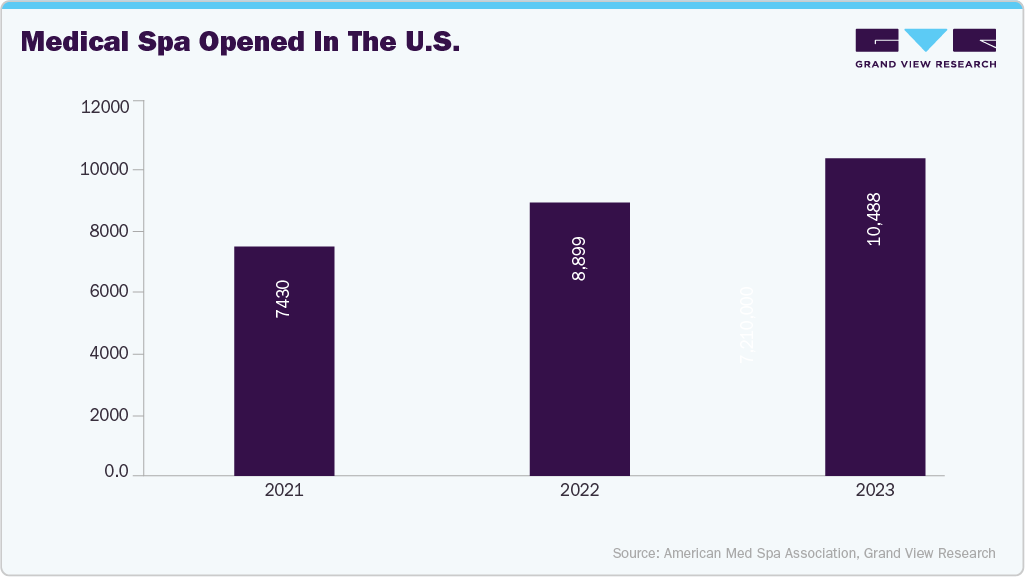

The growing awareness and acceptance of aesthetic treatments have propelled the success and expansion of cosmetic clinics, driving the demand for medica spa. According to an article published by the American Medical Spa Association (AmSpa) in November 2024, the medical spa industry has experienced steady growth over the past 15 years. The number of medical spas increased from 8,899 in 2022 to approximately 10,488 in 2023. This reflects a dynamic and expanding industry with several new participants fueling its growth. The rapid growth in the medical spa industry and convenient access to a range of skin treatments and services are predicted to improve demand by offering innovative procedures and personalized solutions catering to client needs.

The rising consumer disposable income, especially in emerging countries, and the expansion of the tourism sector are also boosting the demand for such services. Key companies offer personalized beauty treatments to justify premium prices and aim to leverage their position. An emerging trend in the sector is the incorporation of biophilic design and wellness architecture into the complete structural design of the property.

Rapid growth in the wellness tourism industry is creating potential growth opportunities for new entrants that offer a unique integration of business areas, such as hospitality, travel, beauty treatments, and fitness. Furthermore, the increasing adoption of dermal fillers among women in their late 20s and the rising demand for laser hair removal and facial procedures are likely to fuel the market growth.

The launch of the Indian Medical and Wellness Tourism Roadmap in July 2025, by the Federation of Hotel & Restaurant Associations of India (FHRAI) and KPMG is expected to act as a major catalyst for the growth of the medical spa market in India. The roadmap emphasizes integrating healthcare, hospitality, and wellness infrastructure to position India as a global destination for holistic medical and wellness treatments. This alignment directly benefits medical spas, as they sit at the intersection of clinical care and luxury wellness services. By promoting medical tourism hubs and standardizing service quality across wellness centers, the initiative will attract international patients seeking rejuvenation therapies, aesthetic procedures, and non-invasive treatments in a medically supervised yet relaxing environment.

Moreover, enhanced collaboration between hospitals, hotels, and spa operators supported by policy incentives and accreditation standards is expected to boost investment in advanced facilities, skilled personnel, and technology-driven treatments.

Trends in the U.S. Medical Spa Market (2024):

In November 2024, the American Med Spa Association (AmSpa) released its Medical Spa State of the Industry Report, built on a survey of medical spa professionals. Below are the various findings extracted:

Industry Expansion and Market Confidence:

-

Growth in Number of Medical Spas: The total number of medical spas in the U.S. increased from 8,899 in 2022 to 10,488 in 2023, reflecting a strong and sustained expansion of the industry.

-

Trend Implication: This continuous growth underscores the robust consumer demand for medical aesthetics treatments, indicating that the market remains far from saturation. The rise in new facilities highlights increasing investor and entrepreneurs’ confidence in the profitability and longevity of the sector.

Dominance of Independent, Single-Location Operators:

-

81% of Medical Spas Operate as Single Locations: The majority of U.S. medical spas are independently owned, single-location businesses, representing the entrepreneurial backbone of the industry.

-

Trend Implication: This structure demonstrates that medical aesthetics remains a small-business-driven industry, offering individuals and practitioners a low-barrier path to entrepreneurship. The ability of single-location operators to achieve strong revenue levels reflects a favorable business environment and steady consumer loyalty at the local level.

Emergence of Larger Chains and Industry Consolidation:

-

Growth in Multi-Location Operators: Multi-location medical spa operators now average nine locations per group, up from six in 2022.

-

Trend Implication: This indicates a gradual consolidation trend, where successful brands are scaling operations and expanding regionally or nationally. While mergers and acquisitions (M&A) activity remains relatively low, the rise of chain ownership points toward increasing professionalization and corporate involvement in the industry. Larger networks are likely to gain market share by leveraging operational efficiency, brand recognition, and consistent service standards.

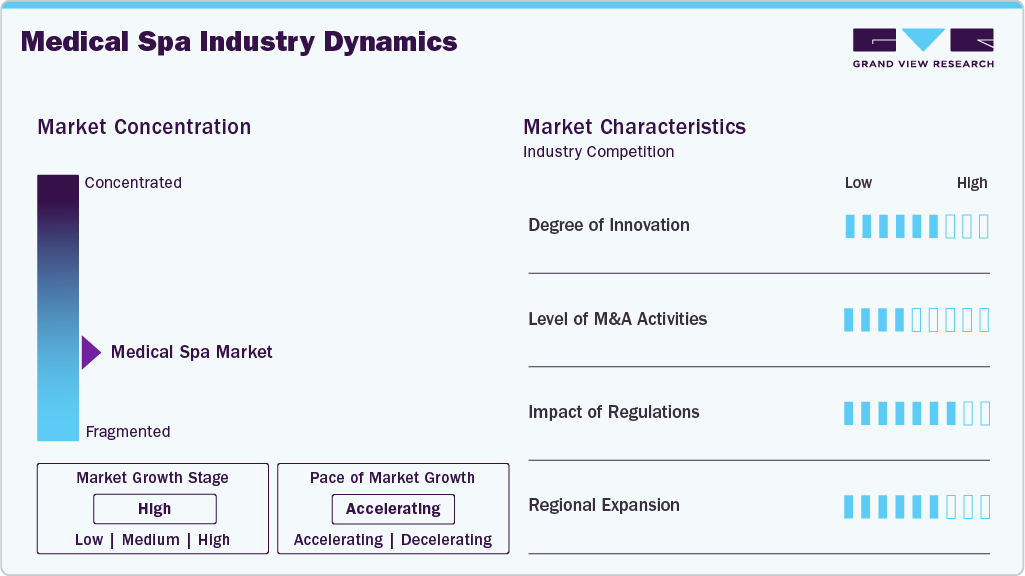

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, characteristics, and participants. There is a high degree of innovation, moderate level of merger & acquisition activities, high impact of regulations, and moderate expansion of industry.

The medical spa industry is experiencing a high degree of innovation. In June 2025, Oriflame announced the extension of its Personalised Wellness Pack into two additional European markets including the Czech Republic and Romania in response to strong consumer engagement. The offering, under the Wellosophy brand, is built around a digital assessment that evaluates individuals’ lifestyle, diet, and health goals. Using an advanced algorithm, the assessment generates custom supplement recommendations from a portfolio of 30 science-backed options, covering 14 key health areas such as sleep, immunity, energy, skin, and stress. Delivered via a monthly subscription model, these packs include premium active ingredients such as Verisol collagen peptides and SkinAx2 antioxidant complex.

Several key players are actively engaging in partnerships & collaborations to promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in August 2024, Northrim Horizon completed the acquisition of Allure Medspa, a multi-location medical aesthetics provider, marking a strategic expansion move within the fast-growing U.S. medical spa market. This acquisition strengthens Northrim Horizon’s presence in the medical aesthetics sector, allowing it to capitalize on the industry’s rising consumer demand for non-invasive cosmetic procedures and wellness treatments.

The market is regulated by a variety of guidelines designed to ensure patient safety, quality of care, and ethical business practices.

-

In the U.S., ownership and operational models depend largely on state medical regulations-some states allow non-physicians to invest in or own medical spas under specific conditions, while others restrict ownership exclusively to licensed physicians. For instance, in Alaska, non-physicians can own medical spas through management services organizations (MSOs) that handle business operations, provided that licensed medical directors and practitioners perform all clinical procedures.

-

In response to growing concerns over patient safety and the proliferation of unregulated practices, the UK government has initiated steps to introduce more comprehensive regulation:

-

Health and Care Act 2022: This legislation grants the government the authority to establish a licensing scheme for non-surgical cosmetic procedures. The scheme aims to categorize procedures based on risk levels and set corresponding standards for practitioners and premises.

- Botulinum Toxin and Cosmetic Fillers (Children) Act 2021: This act makes it a criminal offense to administer botulinum toxin or cosmetic fillers to individuals under the age of 18 for cosmetic purposes, even with parental consent.

-

Key market players in different regions are expected to increase due to their high capacity, established geographical presence and high customer base. For instance, in October 2023, SHA Wellness Clinic announced plans for regional expansion, with SHA Emirates set to debut in the UAE, aiming for completion around 2024-25.

Service Insights

The facial treatment segment dominated the medical spa market with a revenue share of 53.81% in 2024. This is driven by a combination of evolving consumer preferences, technological advancements, and increasing awareness of skincare and anti-aging solutions. Rising concerns about skin health, premature aging, hyperpigmentation, and acne have encouraged individuals to seek professional-grade facial treatments that deliver visible results beyond what over-the-counter products can achieve. Innovations in non-invasive and minimally invasive technologies, such as laser therapy, microdermabrasion, chemical peels, and hydrafacials, have made these treatments safer, more effective, and accessible to a broader audience.

The body shaping and contouring segment is anticipated to witness the fastest CAGR during the forecast period. Increasing consumer awareness about physical appearance and body image, fueled by social media and celebrity influence, has heightened demand for non-invasive or minimally invasive procedures that enhance body contours without the need for surgery. In addition, advances in medical technology, such as cryolipolysis, radiofrequency, ultrasound, and laser-based treatments, have made body shaping procedures safer, more effective, and accessible to a broader audience, encouraging repeat visits and expanding the customer base. The rising prevalence of obesity and sedentary lifestyles has also contributed to growing interest in fat reduction and body contouring treatments as convenient alternatives to traditional weight loss methods.

Gender Insights

The female segment accounted for the largest revenue share of the medical spa industry in 2024. Women being the primary customers, various women-oriented services are being increasingly designed, which is positively impacting segment growth. The rising adoption of various aesthetic treatments by females is boosting segment growth. As per the medisonps.com updates published in August 2025, South Korea stands out as a global leader in cosmetic procedures, with one of the highest per capita rates worldwide, approximately 8.90 procedures per 1,000 people. This prevalence is particularly notable among young women, with estimates indicating that one in three women aged 19-29 has undergone some form of plastic surgery.

The male segment is expected to witness lucrative growth during the forecast period. The adoption of services among men has increased as they have realized that these treatments are healthy and relaxing. As a result, the industry is developing skin care products and services focused on men. An increasing number of male customers and the development of targeted market strategies for males are likely to boost segment growth.

Age Group Insights

The adult segment led the medical spa market with the largest share of 70.69% in 2024 and is projected to witness the fastest CAGR over the forecast period. Most of the med spas have their customers in their mid-30s, 40s, and 50s due to the increasing focus of adults on body contouring and anti-aging treatments. Nearly 26.0% of all the female customers in the U.S. belonged to the age group of 35-54 as per the 2022 AmSpa Medical Spa State of the Industry Report. The high spending capacity of people aged 35 to 50 and increasing demand for dermal fillers among this age group are propelling the segment's growth.

High influence of social media leads to increase in demand for facial treatments among adolescents. Teenagers are increasingly incorporating anti-aging products and treatments into their beauty regimes. Moreover, they want scar-less skin permanently and opt for nonsurgical scar revisions.

The geriatric segment is estimated to witness substantial growth during the forecast period. As per WHO updates 2025, the global population is expected to age significantly, with one in six people projected to be 60 years or older by 2030. This demographic shift reflects a substantial increase in the share of older adults, rising from 1 billion in 2020 to 1.4 billion by 2030. The trend is set to continue, and by 2050, the number of people aged 60 and above is expected to double, reaching 2.1 billion. The desire to look young and attractive even in old age is favoring the growth of the geriatric segment. People aged above 60 are more interested in maintaining a healthy lifestyle, which leads to an increase in the number of med spa visits.

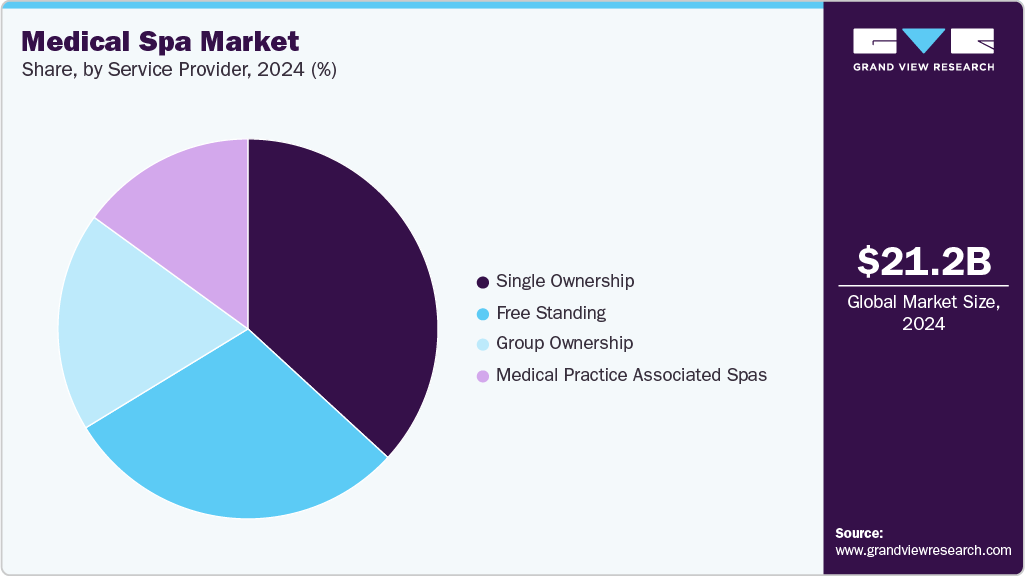

Service Provider Insights

The single ownership segment held the largest revenue share of 36.83% in 2024 and is projected to witness highest growth rate over the forecast period. The single ownership segment in the medical spa (MedSpa) market is primarily driven by growing entrepreneurial activity among physicians, dermatologists, and aesthetic practitioners who seek greater control over their service offerings, branding, and profitability. These independently owned MedSpas can tailor treatments and pricing strategies to local client preferences, ensuring personalized service and stronger patient loyalty. Lower setup costs, availability of Turnkey MedSpa solutions, and easier access to financing have further encouraged solo practitioners to enter the market.

The medical practice associated spas is estimated to witness substantial growth during the forecast period due to the increasing integration of medical expertise with aesthetic and wellness services. One of the primary drivers is consumer preference for medically supervised treatments, as clients seek safer, more effective, and evidence-based aesthetic procedures such as injectables, laser therapies, and skin rejuvenation. The rising credibility and trust associated with licensed medical professionals, especially dermatologists, plastic surgeons, and cosmetic physicians-encourage patients to choose these settings over traditional spas.

Regional Insights

North America dominated the medical spa market with a share of 40.68% in 2024. Technological advancements have greatly improved the safety, effectiveness, and accessibility of both surgical and non-surgical treatments. Innovations such as 3D imaging, virtual consultations, and AI-driven personalized treatment plans have led to better patient outcomes and increased satisfaction. In addition, societal acceptance of cosmetic procedures has grown, driven by media portrayals, celebrity endorsements, and the normalization of aesthetic enhancements. Social media platforms have played a crucial role in driving beauty standards and increasing demand for procedures such as Botox, dermal fillers, and body contouring.

U.S. Medical Spa Market Trends

The U.S. medical spa industry is experiencing significant growth, driven by the growing strategic initiatives. In July 2024, Dr. Lee B. Daniel, founder of Aesthetic Plastic Surgery, The Spa Side, and The Guy Side in Eugene, Oregon, announced a partnership with Cosmetic Physician Partners (CPP), a leading network of physician-led medical aesthetic clinics in the U.S. This collaboration aims to raise the standards of aesthetic medicine by merging Dr. Daniel's dedication to personalized, high-quality patient care with CPP's operational expertise and support. Dr. Daniel emphasized that this partnership would enable his team to concentrate more on patient outcomes. It will ensure that staff members are well-trained and up to date with the latest scientific advancements, thereby enhancing their treatment capabilities and providing a more efficient, patient-centered approach.

Asia Pacific Medical Spa Market Trends

Asia Pacific accounted for the largest revenue share of the medical spa industry in 2024. The expansion of cosmetic surgery facilities in developing nations, rising healthcare costs, an aging population, and an increased emphasis on aesthetics are some of the major drivers of the regional industry. The demand for cosmetic procedures in China has increased recently due to the country's growth in obesity rate, which has resulted in people opting for more extreme weight-loss techniques such as liposuction.

The Japan medical spa market held a significant revenue share in 2024. In January 2023, establishment Labs launched its innovative Mia Femtech breast enhancement procedure in Japan, partnering with Seishin Plastic and Aesthetic Surgery Clinic as its first collaborator. Seishin is a prominent network of 10 premium plastic surgery clinics and is expected to offer the Mia procedure at its flagship clinic in Roppongi and its newest location in Ginza. This collaboration marks a strategic entry into the Asian market, with plans to expand Mia Femtech offerings to additional clinics in Japan and Europe. This partnership highlights Establishment Labs' commitment to redefining breast aesthetics through innovative, patient-centric solutions.

Europe Medical Spa Market Trends

The medical spa industry in Europe is expected to witness high growth due to the growing popularity of aesthetic procedures, influenced by social media and celebrity culture, which has led to greater acceptance and demand for cosmetic enhancements. Economic factors also play a crucial role; rising disposable incomes and economic stability across Europe allow more individuals to afford cosmetic surgeries. Furthermore, the aging population is seeking anti-aging treatments such as facelifts and Botox, contributing to the market's expansion.

The UK medical spa market held a significant revenue share in 2024. In August 2025, the UK government partnered with TikTok to address the growing trend of "cosmetic tourism," where residents seek cheaper procedures abroad, often leading to complications that strain the NHS. The campaign features influencers such as Midwife Marley and Doc Tally to educate the public on the risks of overseas treatments, emphasizing the importance of consulting UK professionals and verifying clinic credentials. It also advises securing travel insurance and being cautious of social media promotions, aiming to protect consumers and reduce NHS costs from treatment complications.

Latin America Medical Spa Market Trends

The medical spa industry in Latin America is anticipated to grow significantly due to the rise of medical tourism. It has positioned Latin America as a destination for individuals seeking affordable cosmetic procedures without compromising on quality, attracting patients from North America and beyond. The increasing acceptance of aesthetic treatments among both men and women, coupled with a growing middle class and improved access to cosmetic services, further contributes to the market's expansion.

The medical spa market in Argentina held a significant revenue share in 2024. Argentina's recent decision to eliminate export duties on over 4,000 manufactured goods, including cosmetics and personal care products, has significant implications for Argentina cosmetic surgery and procedures market. This policy shift enhances Argentina's competitiveness in the global beauty industry by reducing trade costs for local manufacturers, making it easier for them to access international markets. As a result, Argentina is positioned to become a more attractive sourcing hub for global beauty brands, potentially diverting some production away from Brazil.

Middle East and Africa Medical Spa Market Trends

The medical spa industry in MEA is anticipated to grow significantly over the forecast period. Innovative funding is revolutionizing the Middle East to become a hub for healthcare progress and access. Between 2021 and 2023, the Middle East saw about USD 103 million worth of healthcare investment added to a worldwide total of USD 48 billion. Governments, particularly Saudi Arabia and the UAE, are heavily investing in digital health and infrastructure. Private sector investors, including the Abu Dhabi Investment Authority, are making large bets too, with significant commitments to medical tech. Growth of health tech startups worth more than USD 1.5 billion indicates the direction towards new-age solutions. These projects are improving healthcare infrastructure and driving the uptake of cutting-edge technologies such as AI, giving rise to a viable healthcare ecosystem in the region.

Saudi Arabia medical spa market’s growth is driven by evolving beauty standards, increased disposable income, and advancements in medical technology. Moreover, in April 2025, Saudi Arabia launched 28 healthcare projects in Riyadh, as part of its Vision 2030 initiative. These projects aim to enhance healthcare infrastructure and services, significantly impacting the cosmetic surgery market. With advanced technologies and state-of-the-art facilities, demand for specialized services, including cosmetic procedures, is expected to rise. The increased private sector investment and promotion of medical tourism will position Saudi Arabia as a regional hub for aesthetic treatments, benefiting both local and international patients.

Key Medical Spa Company Insights

The market is fragmented, with the presence of many regional and country-level medical spa providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Medical Spa Companies:

The following are the leading companies in the medical spa market. These companies collectively hold the largest market share and dictate industry trends.

- Chic La Vie

- Clinique La Prairie

- Kurotel-Longevity Medical Center and Spa

- Lanserhof

- The Orchard Wellness Resort

- Biovital Medspa

- Allure Medspa

- Longevity Wellness Worldwide

- Serenity Medspa

- Vichy Celestins Spa Hotel

- Brenners Park-Hotel & Spa

- SHA Wellness Clinic

- Cocoona Centre Of Aesthetic Transformation

- Mezzatorre

- Aesthetics Medispa

- Lily’s Medi Spa

- Lisse

- Drx Clinic

- Westchase Medspa;

- Chiva Som

- Mandarin Oriental Hotel Group Limited

Recent Developments

-

In May 2025, The Laser Lounge Spa in Sarasota introduced a new range of medical-grade aesthetic treatments to cater to the rising demand for non-surgical beauty solutions. This launch reflects the growing consumer preference for minimally invasive procedures that deliver effective results with little to no downtime. The spa’s new offerings include advanced laser therapies, injectables, skin rejuvenation treatments, and body contouring solutions designed to enhance natural beauty safely and efficiently.

-

In December 2024, Empower Aesthetics entered a partnership with Livio Med Spa, a leading skincare and wellness provider operating in Cincinnati, Ohio and Covington, Kentucky. Through this collaboration, Empower will bring to Livio its operational, strategic, and financial capabilities, enabling greater scaling while aiming to preserve the local brand identity, clinical quality, and personalized care that Livio’s clientele appreciates.

"The values of the team at Livio Med Spa, led by the superb Lisa McMillan, that emphasize clinical excellence, clinical education, and clinical outcomes, tailored to clients' individual needs, align perfectly with the values and mission of Empower Aesthetics," said Rapp. "We're confident that Livio Med Spa will continue to thrive within the Empower Aesthetics ecosystem."

-

In August 2024, Northrim Horizon, an Arizona-based permanent capital investment firm, recently announced that it has completed the acquisition of Allure Medspa, a multi-location medical spa operator. With this deal, Allure Medspa becomes the sixth platform acquisition by Northrim under its Fund II.

"I'm thrilled to join Allure Medspa and to partner with Northrim to accelerate growth in this exciting industry," said Ms. Tan. "I'm inspired by Allure's team of passionate and talented professionals, who are deeply committed to providing high-quality, personalized care for individuals on their aesthetics journey."

Medical Spa Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.25 billion

Revenue forecast in 2033

USD 78.23 billion

Growth rate

CAGR of 15.77% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, gender, age group, service provider, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Chic La Vie; Clinique La Prairie; Kurotel-Longevity Medical Center and Spa; Lanserhof; The Orchard Wellness Resort; Biovital Medspa; Allure Medspa; Longevity Wellness Worldwide; Serenity Medspa; Vichy Celestins Spa Hotel; Brenners Park-Hotel & Spa; SHA Wellness Clinic; Cocoona Centre Of Aesthetic Transformation; Mezzatorre; Aesthetics Medispa; Lily’s Medi Spa; Lisse; Drx Clinic; Westchase Medspa; Chiva Som; Mandarin Oriental Hotel Group Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Spa Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical spa market report based on service, gender, age group, service provider, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Facial Treatment

-

Body Shaping & Contouring

-

Hair Removal

-

Scar Revision

-

Tattoo Removal

-

Other Services

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Adolescent

-

Adult

-

Geriatric

-

-

Service Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Ownership

-

Group Ownership

-

Free-standing

-

Medical Practice Associated Spas

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.