- Home

- »

- Water & Sludge Treatment

- »

-

Membrane Filtration Market Share Analysis, Industry Report, 2026 - 2033GVR Report cover

![Membrane Filtration Market Size, Share & Trends Report]()

Membrane Filtration Market (2026 - 2033) Size, Share & Trends Analysis Report By Membrane Material (Ceramic, Polymeric), By Module Design (Spiral Wound, Tubular Systems, Plate & Frame, Hollow Fiber), By Technology (Reverse Osmosis, Ultrafiltration, Microfiltration, Nanofiltration), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-841-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Membrane Filtration Market Summary

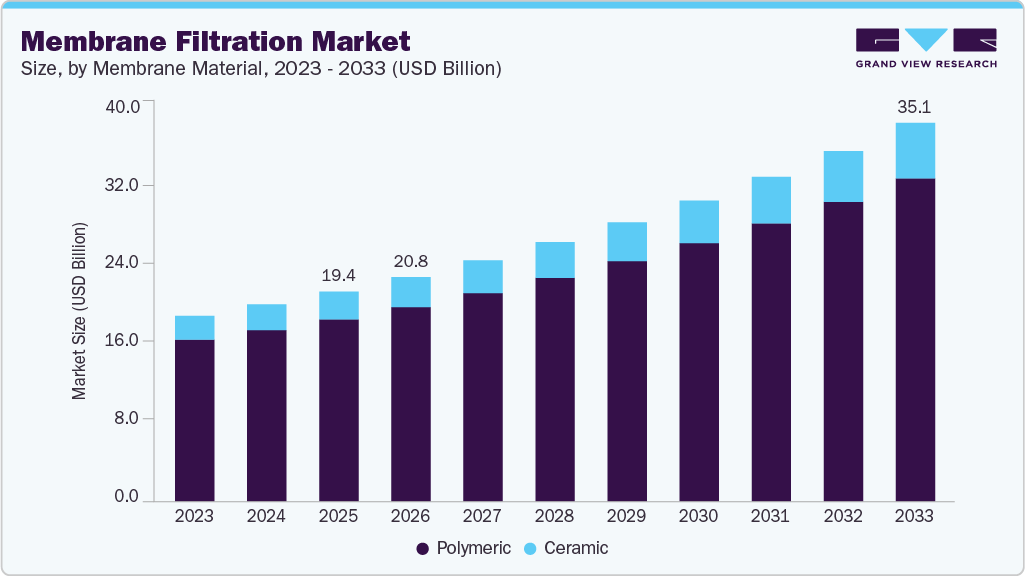

The global membrane filtration market size was estimated at USD 19,405.0 million in 2025 and is expected to reach USD 35,059.7 million by 2033, growing at a CAGR of 7.8% over the forecast period from 2026 to 2033. Driven by increasing demand for clean water, wastewater treatment, and industrial process applications. Rapid urbanization, population growth, and industrialization are creating pressure on existing water resources, prompting adoption of efficient filtration technologies.

Key Market Trends & Insights

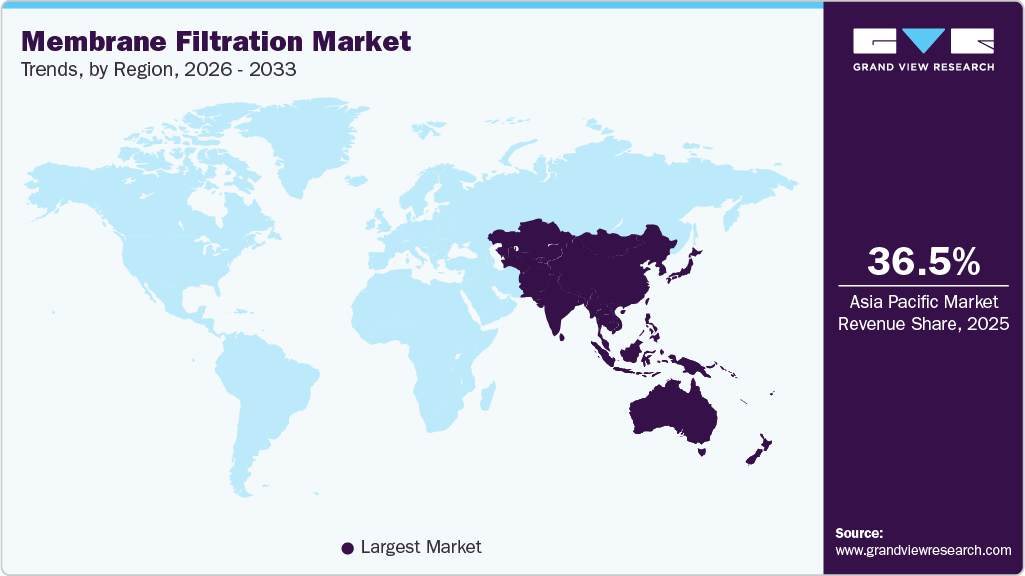

- Asia Pacific dominated the membrane filtration market with the largest revenue share of 36.5% in 2025.

- By membrane material, ceramic segment is expected to grow at a considerable CAGR of 9.2% from 2026 to 2033 in terms of revenue.

- By module design, hollow fiber segment is expected to grow at a considerable CAGR of 7.7% from 2026 to 2033 in terms of revenue.

- By application, pharmaceutical segment is expected to grow at a considerable CAGR of 9.0% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 19,405.0 Million

- 2033 Projected Market Size: USD 35,059.7 Million

- CAGR (2025-2033): 7.8%

- Asia Pacific: Largest market in 2025

- Asia Pacific: Fastest growing region

Membrane filtration offers high separation efficiency, low energy consumption, and scalability, making it suitable for municipal, industrial, and healthcare applications. Additionally, stringent regulations on water quality, environmental protection, and effluent discharge are compelling industries and municipalities to invest in advanced filtration systems.

Technological advancements such as ultrafiltration, nanofiltration, and reverse osmosis membranes, along with growing awareness of water sustainability, are further accelerating market expansion globally across regions like North America, Europe, and Asia-Pacific.

Industry Concentration & Characteristics

The membrane filtration market is moderately fragmented, with a mix of global manufacturers and numerous regional players competing for market share. Large companies focus on technological innovation, high-performance membranes, and comprehensive service offerings, while smaller regional firms provide cost-effective, niche, or specialized solutions. This structure maintains competition without complete consolidation, as customers choose between established brands for reliability and smaller providers for customized or localized solutions. Moderate fragmentation also encourages continuous product development and market diversification.

The membrane filtration market shows high degree of innovation, driven by the development of high-performance membranes such as ultrafiltration, nanofiltration, and reverse osmosis. Innovations focus on improving filtration efficiency, energy consumption, fouling resistance, and lifespan. Companies are also integrating smart monitoring systems and modular designs to optimize operations. Continuous research and adoption of advanced materials support diverse applications in water treatment, food & beverage, pharmaceuticals, and industrial processes.

Merger and acquisition activity in the market is significant and largely strategic. Large players often acquire regional or specialized membrane manufacturers to gain market share, enhance R&D, and integrate complementary solutions. These strategic activities allow firms to offer comprehensive filtration systems, improve competitiveness, and respond to growing global demand efficiently.

Regulations significantly influence the membrane filtration market, particularly in water quality, wastewater treatment, and industrial effluent management. Governments worldwide impose strict standards for potable water, environmental protection, and industrial discharges. Compliance with these regulations drives adoption of advanced filtration technologies. Regulatory pressure encourages innovation, investment in high-efficiency membranes, and the expansion of monitoring and maintenance services to ensure safe, clean, and sustainable water management practices globally.

Drivers, Opportunities & Restraints

Rising global demand for clean water is a primary driver for the membrane filtration market. Population growth, urbanization, and industrial expansion are putting pressure on freshwater resources, prompting municipalities and industries to adopt efficient filtration technologies. Membrane systems, such as ultrafiltration and reverse osmosis, provide high purification efficiency, lower energy consumption, and scalability, making them increasingly preferred for water treatment, wastewater recycling, and industrial process applications.

Emerging economies present significant growth opportunities for the market. Expanding industrialization, urban water infrastructure projects, and increasing awareness of water scarcity encourage adoption of advanced filtration solutions. Technological advancements in durable, fouling-resistant, and energy-efficient membranes allow companies to target municipal, industrial, and healthcare sectors. Investment in smart filtration systems and modular solutions further expands market potential in regions with growing water treatment demands.

High capital and operational costs are a major challenge for the market. Advanced membrane systems require significant upfront investment, periodic maintenance, and replacement of membranes to maintain efficiency. Fouling, scaling, and energy consumption further increase operational expenses, especially for smaller municipalities or cost-sensitive industries. These factors can slow adoption, limit market penetration in developing regions, and push customers to consider alternative or lower-cost water treatment methods.

Membrane Material Insights

“The ceramic segment is expected to grow at a considerable CAGR of 9.2% from 2026 to 2033 in terms of revenue”

The polymeric segment dominated the market with a revenue share of 86.8 % in 2025 due to its cost-effectiveness, flexibility, and ease of fabrication. Polymeric membranes, such as polyethersulfone (PES), polyvinylidene fluoride (PVDF), and polypropylene, are widely used in water treatment, wastewater recycling, and industrial processes. Their high permeability, chemical resistance, and adaptability to ultrafiltration and microfiltration applications drive adoption across municipal and industrial sectors, particularly in emerging economies with growing demand for affordable and scalable filtration solutions.

The ceramic membrane segment is expected to expand due to its durability, high thermal stability, and resistance to harsh chemical and abrasive conditions. Ceramic membranes are increasingly used in industries such as food and beverage, pharmaceuticals, and wastewater treatment, where long-term performance and low maintenance are critical. Despite higher costs, their longevity, fouling resistance, and ability to handle extreme conditions make them attractive for high-value industrial applications, supporting steady market growth globally.

Module Design Insights

“The hollow fiber segment is expected to grow at a considerable CAGR of 7.7% from 2026 to 2033 in terms of revenue”

The spiral wound segment accounted for a revenue share of 45.8% in 2025 due to its compact design, high surface area, and efficiency in water and wastewater treatment applications. Widely used in reverse osmosis, nanofiltration, and ultrafiltration systems, spiral wound membranes offer cost-effective performance and easy scalability. Industries and municipalities prefer them for desalination, industrial process water, and purification systems, driving adoption globally, particularly in regions with increasing water scarcity and regulatory pressure for clean water.

The hollow fiber segment is anticipated to expand due to its high packing density, self-supporting structure, and superior filtration efficiency. Hollow fiber membranes are suitable for ultrafiltration and microfiltration applications, including municipal water treatment, wastewater recycling, and industrial processes. Their ability to handle high volumes, ease of backwashing, and modular scalability make them attractive for both small and large-scale systems, supporting growth in regions emphasizing sustainable water management and advanced purification solutions.

Technology Insights

“The nanofiltration segment is expected to grow at a considerable CAGR of 8.4% from 2026 to 2033 in terms of revenue”

The reverse osmosis segment accounted for a revenue share of 36.3% in 2025. Market demand continues rising for high‑purity water in desalination, municipal, and industrial water treatment. Its ability to remove nearly all salts and contaminants makes it indispensable for potable and process water, driving adoption especially in water‑scarce regions and large infrastructure projects. Technological advances and efficiency improvements further support RO’s expansion.

Nanofiltration (NF) is projected to grow rapidly as industries adopt it for selective removal of organic compounds and divalent ions with lower energy needs than RO. NF’s efficiency in water softening, wastewater reuse, and compliance with tightening discharge standards boosts its appeal. Growth is amplified by expanding applications in food & beverage, pharmaceuticals, and industrial water treatment, along with increasing investments in advanced membrane technologies.

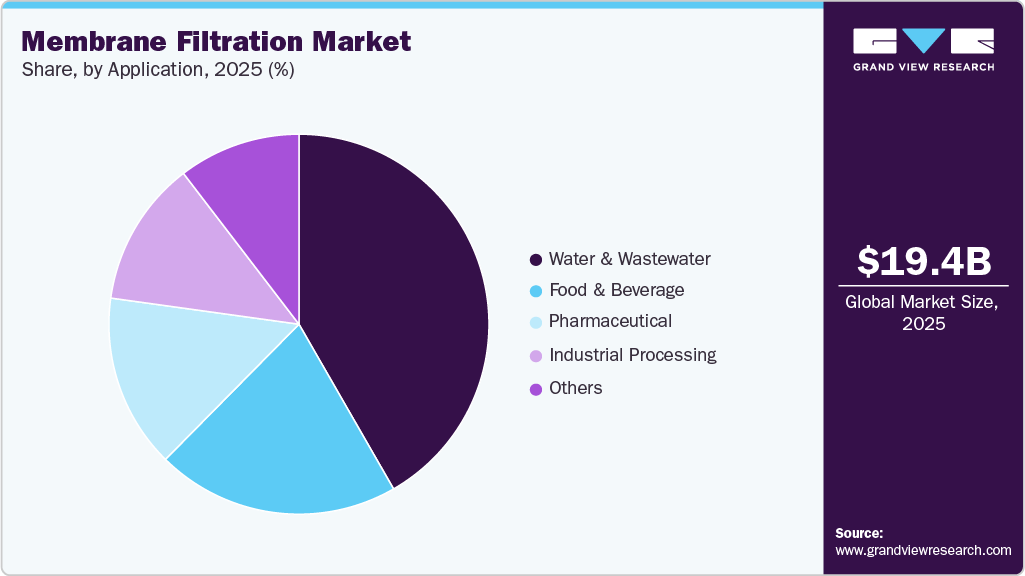

Application Insights

“The pharmaceutical segment is expected to grow at a considerable CAGR of 9.0% from 2026 to 2033 in terms of revenue”

The water & wastewater segment accounted for a revenue share of 41.7% in 2025. Rising global water scarcity, stringent environmental regulations on discharge quality, and the need for efficient wastewater recycling are driving increased adoption of membrane systems by municipal and industrial sectors. Advanced filtration offers scalable, chemical‑free treatment that removes contaminants effectively, supporting sustainable water reuse and infrastructure expansion worldwide.

Pharmaceutical segment is expected to grow significantly during the forecast period due to growing demand for high‑purity filtration in drug manufacturing, biologics production, and sterile processing. Membrane technology ensures removal of microbes, proteins, and particulates to meet strict regulatory and quality standards. Expansion of biopharmaceuticals, vaccines, and advanced therapeutics fuels investments in membrane systems for sterile filtration, purification, and process efficiency.

Regional Insights

Asia Pacific Membrane Filtration Market Trends

Asia Pacific region dominated the market and accounted for 36.5% of the global market share in 2025 driven by population expansion, urbanization, and increasing water scarcity. Countries invest heavily in water and wastewater treatment infrastructure to meet rising demand and regulatory requirements. Industrialization in sectors such as textiles, chemicals, and food processing fuels the need for efficient filtration and reuse solutions. Government incentives and public–private partnerships accelerate project deployment. Technological advancements and lower costs make membrane systems more attractive. Regional focus on sustainable water management supports long‑term market expansion.

China’s membrane filtration market is growing rapidly as environmental protection and water resource management become national priorities. The government enforces stringent water quality standards and invests in large‑scale water and wastewater treatment infrastructure. Rapid industrial growth in manufacturing, chemicals, and electronics drives demand for high‑efficiency membrane systems. Urbanization increases municipal water treatment projects and reuse initiatives. Domestic innovation in membrane materials and technology reduces costs and enhances performance. China’s focus on sustainable development and pollution control further accelerates adoption across sectors.

India’s membrane filtration market is expanding due to rising demand for potable water, wastewater treatment, and industrial use. Water scarcity, urbanization, and pollution challenges prompt government and private investment in advanced membrane technologies. Municipal programs focus on wastewater reuse and improving access to clean water. Industries such as pharmaceuticals, food processing, and textiles increasingly adopt membrane systems for efficient separation. Cost‑effective and energy‑efficient solutions attract widespread use.

North America Membrane Filtration Market Trends

North America’s membrane filtration market is growing rapidly due to strict water quality regulations, expanding municipal treatment infrastructure, and rising industrial demand. The region emphasizes advanced water and wastewater treatment solutions to address aging systems, water scarcity, and environmental compliance. Growing industries including food & beverage, chemicals, and power are adopting membrane technologies for efficient separation and reuse. Investment in research, government incentives, and technological innovation in membranes further drive market expansion, with both public and private sectors prioritizing sustainable water management.

U.S. is expected to experience strong growth in the membrane filtration market as federal and state regulations demand higher water quality and wastewater reuse. Aging water infrastructure requires modernization with efficient membrane systems, increasing public and private investment. Strong industrial growth in pharmaceuticals, food processing, and electronics fuels demand for high‑precision filtration. Innovation in membrane materials and energy‑efficient systems enhances adoption. Funding programs and sustainability goals encourage implementation of advanced technologies. Overall focus on water security and environmental protection supports steady market growth.

Mexico’s membrane filtration market is growing as the country addresses water scarcity and contamination challenges. Municipalities and industries are increasingly adopting membrane systems for potable water production and wastewater treatment. Regulatory pressure to improve water quality and reduce pollution promotes investment in advanced filtration technologies. Growth in manufacturing, food processing, and pharmaceuticals stimulates demand for reliable separation solutions.

Europe Membrane Filtration Market Trends

The Europe membrane filtration market is expected to grow at 7.7% CAGR during forecast period and is expanding due to stringent environmental standards, water reuse targets, and industrial demand. European Union directives on wastewater discharge and reuse are pushing municipalities to adopt advanced membrane systems. Industries including chemicals, food & beverage, and pharmaceuticals require high‑purity water for processes, increasing filtration demand. Investment in innovation and sustainability initiatives supports cutting‑edge membrane technologies. Aging infrastructure upgrades and climate resilience efforts further drive growth.

Germany's membrane filtration market is one of the most advanced in Europe, emphasizes high environmental standards and efficient water management. German industries such as automotive, chemicals, and pharmaceuticals require advanced filtration for process water and wastewater treatment. Municipal efforts to modernize aging infrastructure boost demand for membrane solutions. Strict regulations on effluent quality and resource reuse drive technology adoption. German research institutions and companies lead in membrane innovation, improving energy efficiency and performance.

UK membrane filtration market is expanding due to regulatory pressure to improve water quality and increase wastewater recycling. Utility companies are investing in advanced treatment technologies to address aging infrastructure and environmental targets. Industrial sectors including food & beverage, pharmaceuticals, and energy require high‑precision filtration for process water and effluent management. Demand for energy‑efficient, high‑performance membranes grows with focus on sustainability, circular water use, and resilience to climate‑related water challenges.

Middle East & Africa Membrane Filtration Market Trends

Middle East & Africa membrane filtration market is growing as water scarcity and desert climates drive demand for reliable water treatment solutions. Many countries invest in desalination, brackish water treatment, and wastewater reuse to support population and industrial needs. Government programs emphasize infrastructure development and sustainable water management. Industries such as oil & gas, chemicals, and food processing adopt membrane technologies for efficient separation and reuse.

Saudi Arabia’s membrane filtration market is expanding due to acute water scarcity and heavy reliance on desalination and reuse. The government invests significantly in large‑scale water treatment and wastewater recycling projects to support population growth and economic development. Industries including petrochemicals, energy, and manufacturing adopt membrane technologies for efficient separation and process water reuse.

Latin America Membrane Filtration Market Trends

Latin America’s membrane filtration market is growing as countries seek to improve water quality, address scarcity, and modernize treatment infrastructure. Municipalities invest in advanced filtration for potable water and wastewater reuse, driven by regulatory improvements and environmental concerns. Industrial sectors like mining, food & beverage, and chemicals adopt membrane systems for efficient separation and compliance.

Brazil’s membrane filtration market is expanding as water challenges and regulatory demands increase demand for advanced treatment solutions. Municipal initiatives prioritize drinking water quality and wastewater reuse, especially in urban areas facing scarcity. Industrial growth in agriculture, food processing, and chemicals fuels adoption of membrane technologies. Government programs and investment in infrastructure upgrades support deployment.

Key Companies & Market Share Insights

Some of the key players operating in the market include Alfa Laval, GEA Group and 3Mamong others.

-

3M is a diversified global technology company known for its innovative membrane filtration solutions used across water treatment, healthcare, and industrial sectors. Their membranes focus on improving water purity, filtration efficiency, and contaminant removal, supporting applications from potable water to wastewater treatment. Leveraging advanced materials and proprietary technology, 3M develops durable, high-performance membranes that address evolving regulatory standards and sustainability goals. Strong R&D capabilities and global presence enable 3M to meet diverse market needs with reliable, scalable filtration products.

-

Alfa Laval specializes in advanced membrane filtration technologies, serving industries like food & beverage, pharmaceuticals, and water treatment. Renowned for energy-efficient and sustainable separation solutions, Alfa Laval offers ultrafiltration, microfiltration, and reverse osmosis systems tailored for process optimization and environmental compliance. Their innovations enhance water reuse, reduce operational costs, and improve product quality. With decades of expertise, Alfa Laval combines engineering excellence and global service networks to deliver reliable, high-quality membrane filtration solutions supporting circular economy initiatives.

Key Membrane Filtration Companies:

The following are the leading companies in the membrane filtration market. These companies collectively hold the largest Market share and dictate industry trends.

- Alfa Laval

- GEA Group

- DuPont

- Pall Corporation

- Veolia

- 3M

- Pentair

- Porvair Filtration Group

- Donaldson Company, Inc.

- MMS Membrane Systems

- Koch Separation Solutions

- ProMinent

- SPX Flow

- TORAY INDUSTRIES, INC.

- MANN+HUMMEL

Recent Developments

-

In September 2025, Pall Corporation launched Membralox GP-IC, a ceramic membrane system with graduated permeability along the filter length. This innovative design boosts processing efficiency reduces capital and operating costs, and can recover up to 95% of value-added products. It significantly enhances filtration performance, supporting more sustainable and cost-effective food production processes.

-

In January 2025, Toray developed a high-efficiency membrane that doubles filtration performance, enhancing pharmaceutical manufacturing productivity and product quality. This innovation enables faster, more reliable filtration processes, supporting stricter quality standards and increased output in pharma production.

Membrane Filtration Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 20,770.7 million

Revenue forecast in 2033

USD 35,059.7 million

Growth Rate

CAGR of 7.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Membrane material, module design, technology, application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, China, India, Japan, Australia, Brazil, Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Alfa Laval, GEA Group, DuPont, Pall Corporation, Veolia, 3M, Pentair, Porvair Filtration Group, Donaldson Company, Inc., MMS Membrane Systems, Koch Separation Solutions, ProMinent, SPX Flow, TORAY INDUSTRIES, INC., MANN+HUMMEL.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Membrane Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the membrane filtration market on the basis of membrane material, module design, technology, application, and region:

-

Membrane Material Outlook (Revenue, USD Million; 2021 - 2033)

-

Ceramic

-

Polymeric

-

-

Module Design Outlook (Revenue, USD Million; 2021 - 2033)

-

Spiral Wound

-

Tubular Systems

-

Plate & Frame

-

Hollow Fiber

-

-

Technology Outlook (Revenue, USD Million; 2021 - 2033)

-

Reverse Osmosis

-

Ultrafiltration

-

Microfiltration

-

Nanofiltration

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Water & Wastewater

-

Food & Beverage

-

Pharmaceutical

-

Industrial Processing

-

Other

-

- Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global membrane filtration market size was estimated at USD 19,405.0 million in 2025 and is expected to reach USD 20,770.7 million in 2026.

b. The membrane filtration market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.8% from 2026 to 2033 and reach USD 35,059.7 million by 2033.

b. The reverse osmosis segment dominated the market with a revenue share of 36.3 % in 2025 demand continues rising for high‑purity water in desalination, municipal and industrial water treatment. Its ability to remove nearly all salts and contaminants makes it indispensable for potable and process water, driving adoption especially in water‑scarce regions and large infrastructure projects. Technological advances and efficiency improvements further support RO’s expansion.

b. Some of the key players operating in the membrane filtration market include Alfa Laval, GEA Group, DuPont, Pall Corporation, Veolia, 3M, Pentair, Porvair Filtration Group, Donaldson Company, Inc., MMS Membrane Systems, Koch Separation Solutions, ProMinent, SPX Flow, TORAY INDUSTRIES, INC.., MANN+HUMMEL.

b. Key factors driving the membrane filtration market include rising water scarcity, stringent environmental regulations, growing demand for clean and safe water, industrialization, and wastewater treatment needs. Technological advancements, energy-efficient membranes, and increasing applications in pharmaceuticals, food & beverage, and chemicals further accelerate market growth globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.