- Home

- »

- Electronic Devices

- »

-

MEMS Microphones Market Size, Industry Report, 2030GVR Report cover

![MEMS Microphones Market Size, Share & Trends Report]()

MEMS Microphones Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Dialog, Analog), By SNR (Very High (>=64dB), High (>=60dB, <64dB)), By Technology (Capacitive, Piezoelectric), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-520-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

MEMS Microphones Market Summary

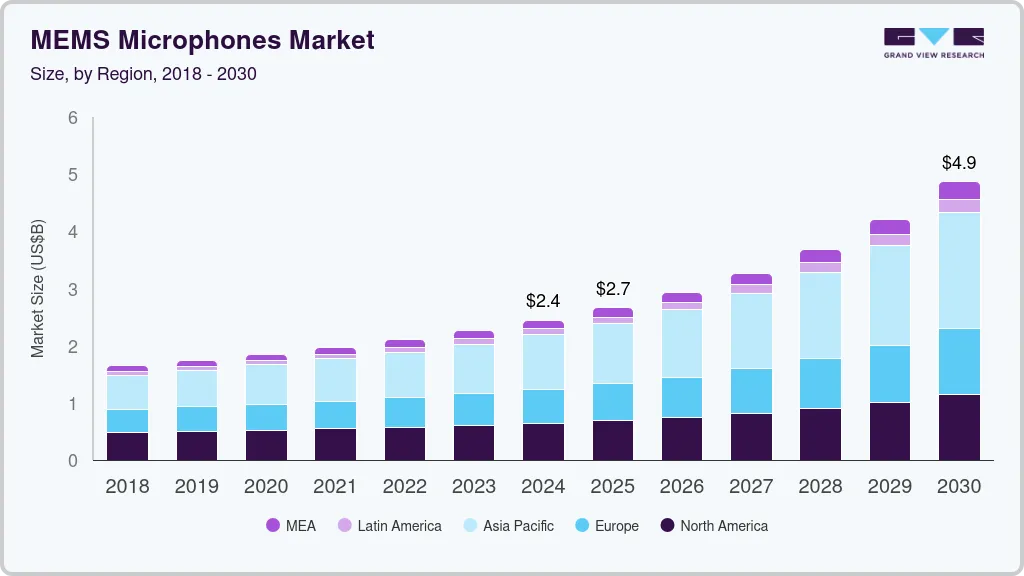

The global MEMS Microphones market size was valued at USD 2.26 billion in 2023 and is projected to reach USD 4.86 billion by 2030, growing at a CAGR of 12.2% from 2024 to 2030. The growing adoption of voice-activated virtual assistants, such as Amazon Alexa, Google Assistant, and Apple Siri, significantly drives the demand for micro-electro-mechanical systems (MEMS) microphones with superior sound capture capabilities.

Key Market Trends & Insights

- Asia Pacific MEMS microphones market held the largest revenue market share of 38.5% in 2023.

- China MEMS microphones market held a substantial share in 2023.

- By type, The digital segment dominated the market and accounted for a revenue share of 67.9% in 2023.

- By SNR, the high (>=60dB, <64dB) SNR accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.26 Billion

- 2030 Projected Market Size: USD 4.86 Billion

- CAGR (2024-2030): 12.2%

- Asia Pacific: Largest market in 2023

These virtual assistants rely on highly accurate and sensitive microphones to recognize and process voice commands efficiently, even in noisy environments. MEMS microphones, known for their small size, low power consumption, and excellent acoustic performance, are essential for ensuring clear and precise voice capture. As consumers increasingly integrate these voice-activated assistants into their daily lives through smart speakers, smartphones, and other connected devices, the need for advanced MEMS microphones increases. Increasing inclination toward the popularity of consumer electronics and accessories is contributing to the rising demand for the MEMS microphone industry. MEMS microphones are excessively utilized in smartphone video and FaceTime applications for transmitting information due to their small size and advancements in sound quality. Numerous consumer applications support voice control or voice calls, as most people prefer to manage and interact with their devices through their voices. Moreover, sophisticated MEMS microphones can improve audio quality in mobile phones and laptops, driving the market growth to adopt MEMS microphones.

Furthermore, constant technological advances in audio technology, such as high-precision audio capture and noise cancellation technology, are driving the demand for high-quality microphones in numerous industries. The growing popularity of smart speakers, driven by trending smart home products and the use of MEMS microphones to enhance user satisfaction, will fuel the market's growth during the forecast period. The market is anticipated to grow due to significant players launching more products in response to rising consumer electronics demand, especially smartphones and tablets. For instance, in January 2022, TDK introduced a MEMS microphone, MIPI SoundWire compliant, that can be used for mobile, IoT, True Wireless Stereo (TWS), and other consumer devices.

Type Insights

The digital segment dominated the market and accounted for a revenue share of 67.9% in 2023. This growth is attributable to the increasing demand for MEMS microphones due to their benefits in improving audio quality in various devices. Digital components such as a microcontroller or Digital Signal Processor (DSP) utilize an ideal digital MEMS microphone. Digital output signals are advantageous in electrically noisy settings due to their higher immunity to electrical noise than analog signals, contributing to market demand.

The analog segment is anticipated to register a significant CAGR of 10.0% over the forecast period. MEMS microphones with analog outputs generally have lower power consumption due to the lack of an analog-to-digital converter (ADC) than those with digital outputs. These types of MEMS microphones are used in space-constrained devices and mobile devices due to their smaller packages than digital microphones. The market is driven by the utilization of analog MEMS microphones in devices such as radio communication systems, simple loudspeakers, and other devices.

SNR Insights

The high (>=60dB, <64dB) SNR accounted for the largest revenue share in 2023. The high (>=60dB, <64dB) SNR MEMS microphones are usually used in camcorders, tablets, laptops, smartphones, and earphones, among others. MEMS microphones with a high SNR (>=64dB) are excellent at capturing sounds with outstanding audio quality and can accurately differentiate sound from surrounding noise. Therefore, they are widely utilized for recording audio in distant settings, driving the market growth during the forecast period.

The very high (>=64dB) SNR is anticipated to register the fastest CAGR over the forecast period. The very high (>=64dB) SNR transmits a large amount of data over a given channel. It enhances the performance and quality standards of systems such as audio, communication, imaging, and other systems. A very high signal depicts a clear signal and is easy to detect from a long distance, driving market growth.

Technology Insights

Capacitive technology accounted for the largest revenue share in 2023. The capacitive technology is considered the best choice for high (>= 64dB) SNR MEMS microphones as it does not compromise the MEMS microphones' size and form factor. Microphones based on capacitive technology capture sounds using a capacitor made of a rigid back plate and flexible diaphragm. The electret microphone is a distinct capacitive microphone that maintains a constant charge across its plates using an electret material. Due to its affordable price, high performance, and simple manufacturing process, the electret microphone is the most widely produced microphone type, driving the demand for the MEMS microphone market.

The piezoelectric technology is projected to grow at the fastest CAGR over the forecast period. Piezoelectric technology offers a better SNR due to the usage of scandium-doped AIN film, which also aids in eliminating sound damping. The primary feature of piezoelectric products is that they contribute to a steady performance and are less susceptible to deterioration even after being used for extended periods. The piezoelectric segment is expected to gain more traction over the forecast period owing to the high demand for piezoelectric technology-based microphones to be used in audio devices, such as portable smart speakers, car infotainment systems, and loudspeakers.

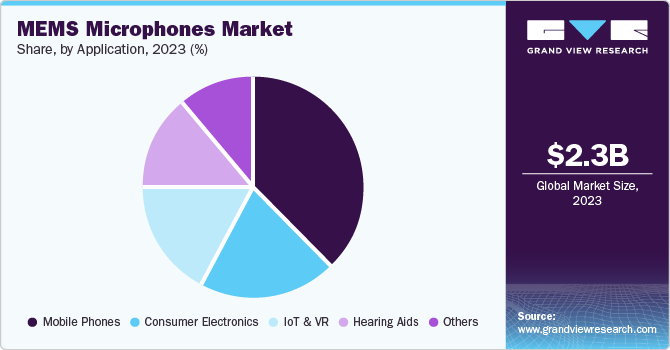

Application Insights

Mobile phones accounted for the largest revenue share in 2023. A rise in disposable income levels, particularly in emerging economies, has led to an increase in the demand for smartphones and other sophisticated consumer electronics. Mobile phones incorporate electret condenser microphones, which require low power to function and can be easily supplied by phone batteries. Therefore, an increase in the adoption of MEMS microphones in mobile phones is anticipated over the forecast period.

Hearing aids are anticipated to register the fastest CAGR over the forecast period. The miniaturization has resulted in an upsurge in the adoption of superior-quality microphones for hearing aids. Miniaturization has particularly aided in maintaining the aesthetics of hearing aids without compromising the capability to capture the right audio sounds and cancel the background noise, thereby helping aging people and others with hearing impairments.

Regional Insights & Trends

Asia Pacific MEMS microphones market held the largest revenue market share of 38.5% in 2023. The market is driven by the presence of well-established manufacturing facilities in China, Japan, India, South Korea, and Australia. The continued proliferation of smartphones, hearing aids, other consumer electronics, and IoT & VR devices in the region is contributing to the rising demand for the adoption of MEMS microphones. Additionally, MEMS microphones are anticipated to proliferate in industries and end-use verticals, including agriculture, automotive, telepresence, oil & gas, industrial manufacturing, medical telemetry, construction, among others.

China MEMS Microphones Market Trends

China MEMS microphones market held a substantial share in 2023. The key factors include rising disposable income, increasing popularity of consumer electronics such as smartphones and other devices, and diverse use of MEMS microphones in numerous industries are driving the market growth for MEMS microphones.

North America MEMS Microphones Market Trends

The North America market was identified as a lucrative region in 2023. With increasing smartphone penetration rates in the U.S., MEMS microphone is anticipated to be widely adopted in the large consumer electronics market. Since the smartphone market is a major user of MEMS microphone technology, the rate of adoption of this technology is expected to increase significantly. With continuous improvements in hearing aids, smartphones, and other consumer electronics, as well as the increasing usage of IoT and VR devices, the region is projected to experience notable market growth during the forecast period.

The U.S. MEMS microphones market dominated the North America market with a revenue share of 73.3% in 2023 due to the increasing penetration of IoT-enables and smartphone devices in the region. Also, the rising focus of the vendors on new product development incorporating the latest technologies in their products to cater to a broad customer base is encouraging these vendors to invest in research & development activities. Furthermore, the market is experiencing growth due to introducing shockproof, waterproof, particle-resistant, and high-temperature-resistant piezoelectric MEMS microphones. Moreover, the increasing aging population in the U.S. is anticipated to drive the demand for hearing aids during the forecast periods. According to the Population Reference Bureau, it is estimated that the population of Americans aged 65 and over is anticipated to grow from 58 million in 2022 to 82 million by 2050, which represents a 47% increase. Additionally, the proportion of people in the 65-and-older age group in the total population is projected to increase from 17% to 23% by 2050.

Latin MEMS Microphones Market Trends

The Latin America MEMS microphones market is anticipated to grow significantly during the forecast period. The growth is attributed to continuous advances in audio technology, rising disposable income, and the rising preference for establishing smart homes equipped with voice assistance-enabled devices. Moreover, the increasing penetration of IoT-enabled devices drive the demand for MEMS microphones. The increasing inclination towards mobile devices such as smartphones, tablets, and laptops is also contributing to the rising demand for the market.

Key MEMS Microphones Company Insights

Some of the key companies in the MEMS microphones market include AAC Technologies, CUI Devices, DB Unlimited, LLC., Goertek, Infineon Technologies AG, InvenSense., and others. Major companies are focusing on investing in research and development initiatives and forming partnerships with established companies.

-

AAC Technologies specializes in manufacturing, designing, and developing various compact components such as receivers, speakers, and microphones for the acoustic industry. The company's offerings include various types of analogs, digital, and differential microphones, manufactured for devices such as wearables, smartphones, notebooks, tablets, e-readers, and other devices.

Key MEMS Microphones Companies:

The following are the leading companies in the MEMS microphones market. These companies collectively hold the largest market share and dictate industry trends.

- AAC Technologies

- CUI Devices

- DB Unlimited, LLC.

- Goertek

- Infineon Technologies AG

- InvenSense.

- Knowles Electronics, LLC.

- Nisshinbo Micro Devices Inc. (New Japan Radio Co.,)

- Projects Unlimited Inc.

- Sonion.

- STMicroelectronics

- Qualcomm Technologies, Inc. (Vesper Technologies, Inc.)

Recent Developments

-

In June 2024, TDK Corporation announced the global availability of the InvenSense SmartSoundTM T5848 I²S microphones for smart keyword, sound detection, and voice command, at ultra-low power

-

In September 2023, CUI Devices’ Audio Group announced the launch of a new waterproof MEMS microphone ideal for challenging conditions. The MEMS microphone CMM-3424DT-26165-TR has IPX7 waterproof rating, and ideal for moisture and constant liquid entry conditions.

MEMS Microphones Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.44 billion

Revenue forecast in 2030

USD 4.86 billion

Growth rate

CAGR of 12.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, SNR, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Arabia, UAE, and South Africa

Key companies profiled

AAC Technologies; CUI Devices; DB Unlimited, LLC.; Goertek; Infineon Technologies AG; InvenSense.; Knowles Electronics, LLC.; Nisshinbo Micro Devices Inc. (New Japan Radio Co.,); Projects Unlimited Inc.; Sonion.; STMicroelectronics; Qualcomm Technologies, Inc. (Vesper Technologies, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global MEMS Microphones Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global MEMS microphones market report based on type, SNR, technology, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

-

SNR Outlook (Revenue, USD Million, 2018 - 2030)

-

Very High (>=64dB)

-

High (>=60dB, <64dB)

-

Low (<=59 dB)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Capacitive

-

Piezoelectric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Phones

-

Consumer Electronics

-

IoT & VR

-

Hearing Aids

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.