- Home

- »

- Clothing, Footwear & Accessories

- »

-

Men's Swimwear Market Size, Share & Growth Report, 2030GVR Report cover

![Men's Swimwear Market Size, Share & Trends Report]()

Men's Swimwear Market Size, Share & Trends Analysis Report By Fabric (Nylon, Polyester, Spandex, Others), By Distribution Channel (Online, Offline), By Region (North America, APAC, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-242-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Men's Swimwear Market Size & Trends

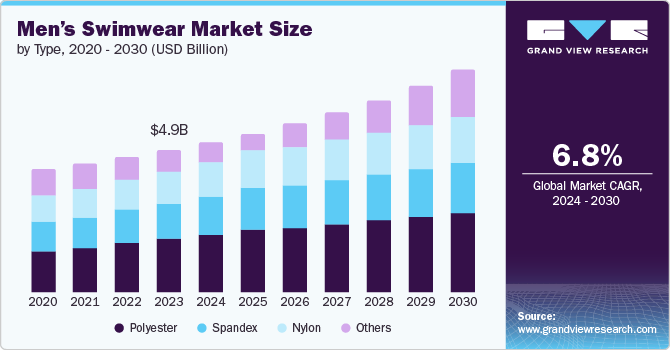

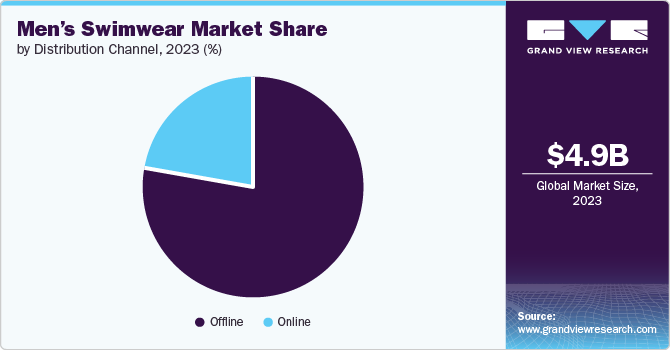

The global men’s swimwear market size was valued at USD 4.97 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The evolving fashion trends and styles in men's clothing drives the demand for men’s swimwear. Swimwear has become a focal point of men's fashion, with designers and brands introducing new designs, colors, and patterns that cater to varying tastes and preferences. This expansion in design choices has made swimwear more versatile and suitable to a broader demographic beyond traditional beachgoers.

Evolving consumer habits and an increased focus on recreation and physical activity are driving the need for adaptable and practical swimwear. Men are no longer content with swimwear intended only for beach trips; they seek attire that can seamlessly shift from aquatic pursuits to informal occasions. This demand has resulted in swimwear styles incorporating fast-drying materials, moisture-wicking capabilities, and ergonomic cuts, guaranteeing comfort during dynamic activities. Furthermore, Moreover, a cultural shift towards wellness and fitness has influenced men to engage more actively in outdoor activities, including swimming and water sports. This trend has driven the demand for functional swimwear that looks stylish and offers performance features such as quick-drying fabrics, UV protection, and enhanced durability. As men increasingly prioritize health and fitness, swimwear has become a practical yet fashionable choice for various water-related activities.

Additionally, the growing emphasis on travel and leisure activities has contributed to the rise in demand for men's swimwear. As more people seek out beach destinations and engage in recreational water activities, there is a corresponding need for stylish and functional swimwear options. Brands have responded by offering collections that cater to different travel preferences, whether it's tropical vacations or adventurous water sports, thereby expanding their market reach and meeting varied consumer demands.

Fabric Insights

The polyester segment held the largest market revenue share of 35.1% in 2023. Attributing to its durability and resistance to wear and tear. The demand for polyester in the fabric segment of the men's swimwear market is on the rise primarily due to its inherent properties that cater well to the needs of swimwear. Polyester is known for its durability and resistance to shrinking and stretching. It also dries quickly, enhancing comfort for swimmers in and out of the water. Moreover, polyester fabrics often incorporate UV protection and chlorine resistance technologies, enhancing their appeal in swimwear.

The spandex segment is expected to grow at a significant CAGR over the forecast period. Spandex, known for its superior elasticity and strength, allows for a snug fit that enhances comfort and flexibility during swimming and other water activities. It provides stretch recovery, ensuring the swimwear retains its shape even after repeated use and exposure to water. Moreover, spandex fabric dries quickly, a significant advantage in swimwear as it prevents discomfort and allows for prolonged wear.

Distribution Channel Insights

The offline segment dominated the market with largest market revenue share in 2023. Offline retail offers customers the opportunity to physically touch and try on products, which is necessary for items like swimwear, where fit and comfort are important. Additionally, offline stores provide a personalized shopping experience, with knowledgeable staff who can offer advice on sizing and style, further enhancing customer satisfaction. Moreover, many consumers still prefer the proximity of purchasing products in-store rather than waiting for delivery, particularly for items needed urgently or for specific occasions.

The online segment is expected to grow at a significant CAGR during the forecast period. Online shopping offers convenience and accessibility, allowing consumers to browse and purchase swimwear from the comfort of their homes, which aligns with evolving consumer preferences for hassle-free shopping experiences. Furthermore, the online channel provides a broader range of choices and easy price comparisons, benefiting price-sensitive consumers looking for value. The digital space also enables brands and retailers to engage with a wider audience through targeted marketing campaigns and personalized recommendations, enhancing customer loyalty and satisfaction.

Regional Insights

The North America market accounted for a significant revenue share in 2023. Shifting cultural attitudes towards leisure and wellness have elevated the importance of outdoor activities and fitness, drivies more men to engage in swimming and related water sports. Additionally, there's a growing emphasis on fashion and personal style among men, with swimwear becoming a part of expressing individuality and confidence. Moreover, advancements in fabric technology have led to more comfortable and functional swimwear options, appealing to men seeking performance.

U.S. Men's Swimwear Market Trends

U.S. men’s swimwear market is projected to witness a significant growth over the forecast period. The growing emphasis on fitness and outdoor activities among men has expanded the demand for swimwear beyond leisure to include active and performance-oriented designs. Cultural shifts towards more frequent travel and beach vacations have increased the need for stylish yet functional swimwear options. Additionally, the influence of social media and fashion trends has spurred greater awareness and acceptance of varied swimwear styles among men, encouraging experimentation with different cuts, colors, and materials. Lastly, advancements in fabric technology, such as quick-drying and UV protection features, cater to practical needs while enhancing comfort, further driving the demand for men's swimwear in the U.S.

Europe Men's Swimwear Market Trends

Europe men’s Swimwear market is anticipated to experience a remarkable growth. The rising popularity of water-based sports and fitness activities, such as swimming, surfing, and water polo, drives the demand for performance-oriented swimwear. Contemporary fashion trends highly influence European consumers. The integration of stylish modern design in swimwear is driving the market growth. Major sports events such as the Olympics and international competitions increase the interest among local athletes in swimming, which significantly drives the market growth.

UK men’s swimwear market is projected to experience a rapid growth. Changing fashion trends and a growing emphasis on fitness and wellness have encouraged men to invest in stylish and functional swimwear. Moreover, the influence of social media and fashion influencers has played a significant role in promoting diverse swimwear styles and designs, catering to varying preferences among UK consumers. The availability of a wide range of options, from classic board shorts to more contemporary designs, has also contributed to the increasing demand as men seek comfort and style in their swimwear choices.

Men’s swimwear market in Germany is expected to witness a slight growth. The growing popularity of outdoor activities such as beach vacations and water sports has increased men's need for suitable swimwear. Moreover, the emphasis on health and fitness has spurred interest in activities like swimming, prompting men to invest in quality swimwear that supports their active lifestyles. Lastly, social media and digital platforms have played a significant role in promoting diverse swimwear styles, encouraging men to explore and adopt new trends in their swimwear choices.

Asia Pacific Men's Swimwear Market Trends

Asia Pacific held the largest market revenue share of 43.44% in 2023. Changing lifestyles and increasing disposable incomes have increased participation in leisure activities such as swimming and beach vacations. As countries in the region experience economic growth, more individuals engage in outdoor activities, driving the demand for suitable swimwear. Additionally, evolving fashion trends and a growing awareness of fitness and health have encouraged men to invest in stylish, functional swimwear that complements their active lifestyles. Social media and digital platforms also significantly shape consumer preferences, as they showcase diverse swimwear options and encourage fashion-conscious choices among men.

India men’s swimwear market is witnessed as lucrative in this industry. The increasing demand for men's swimwear in India can be attributed to a notable shift in cultural attitudes towards leisure and fitness activities, with more Indian men engaging in swimming and water-based sports as part of a healthier lifestyle. This trend is supported by rising awareness of physical fitness and wellness, driven urbanization, and changing lifestyles among India's younger demographic. Furthermore, the tourism sector, particularly coastal destinations and water-based recreational activities, has expanded significantly, creating a demand for stylish and functional swimwear among domestic and international tourists visiting India's beaches and resorts.

Men’s swimwear market in China is expected witness a rapid growth. The rise in domestic tourism and leisure activities, including beach vacations and water sports, has created a robust market for functional yet stylish swimwear. This trend is further amplified by an increasing emphasis on health and wellness, where outdoor activities like swimming are seen as part of a balanced lifestyle. As a result, local and international brands are innovating their offerings to cater to these evolving preferences, introducing designs that incorporate advanced materials for comfort and performance.

Latin America Men's Swimwear Market Trends

Latin America is anticipated to witness the fastest growth over the forecast period. Latin America's growing trend towards health and fitness has increased participation in water sports and recreational activities such as swimming and beach-going. As more men engage in these activities, there is a corresponding need for functional and stylish swimwear that offers comfort and performance. Moreover, cultural shifts towards more active lifestyles and outdoor leisure have further fueled the demand for swimwear that fits well and reflects personal style. Economic growth in various Latin American countries has also boosted disposable incomes, encouraging consumers to spend more on recreational items like swimwear.

Key Men's Swimwear Company Insights

Some of the key companies in the global men’s swimwear market include Jack Wills; Mr Porter; Male-HQ; Calvin Klein; Topman

-

Jack Wills provides an eco-friendly mid length swim shorts for men made form more than 95% of recycled polyester featured with an elasticated west band with drawstring for an adjustable fit. It is made from made from sustainably sourced recycled plastic bottle.

-

Mr Porter with its range of men’s swimwear Orlebar Brown, Vilebrequin, and Polo Ralph Lauren gives a wide range of swimwear which protects from UV radiation and comes in a smarter style and is also available in a printed design options.

Key Men's Swimwear Companies:

The following are the leading companies in the men’s swimwear market. These companies collectively hold the largest market share and dictate industry trends.

- Jack Wills

- MR.G'S Designs

- Male-HQ

- Mr Porter

- Marcuse

- Calvin Klein

- Topman

- Helly Hansen

- Everlane

- Faherty Brand

Recent Developments

-

In November 2022, Puma Private Equity completed over USD 2 million follow-on investment into Ron Dorff, a premium bodywear brand, in 2020. This investment follows a previous USD 4 million investment in 2020, supporting Ron Dorff's expansion plans, particularly in the U.S. market. The brand has grown significantly since its inception, with a strong online presence in menswear like swimwear & underwear and a network of global high-end wholesale partners.

Men's Swimwear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.24 billion

Revenue forecast in 2030

USD 7.78 billion

Growth Rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fabric, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Jack Wills; MR.G'S Designs; Male-HQ; Mr Porter; Marcuse; Calvin Klein; Topman; Helly Hansen; Everlane; Faherty Brand

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Men's Swimwear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global men’s swimwear market report based on fabric, distribution channel, and region:

-

Fabric Outlook (Revenue, USD Million, 2018 - 2030)

-

Nylon

-

Polyester

-

Spandex

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."