- Home

- »

- Healthcare IT

- »

-

Mental Health Apps Market Size, Share, Industry Report, 2030GVR Report cover

![Mental Health Apps Market Size, Share & Trends Report]()

Mental Health Apps Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform Type (Android, iOS), By Application Type (Depression And Anxiety Management, Stress Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-911-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mental Health Apps Market Summary

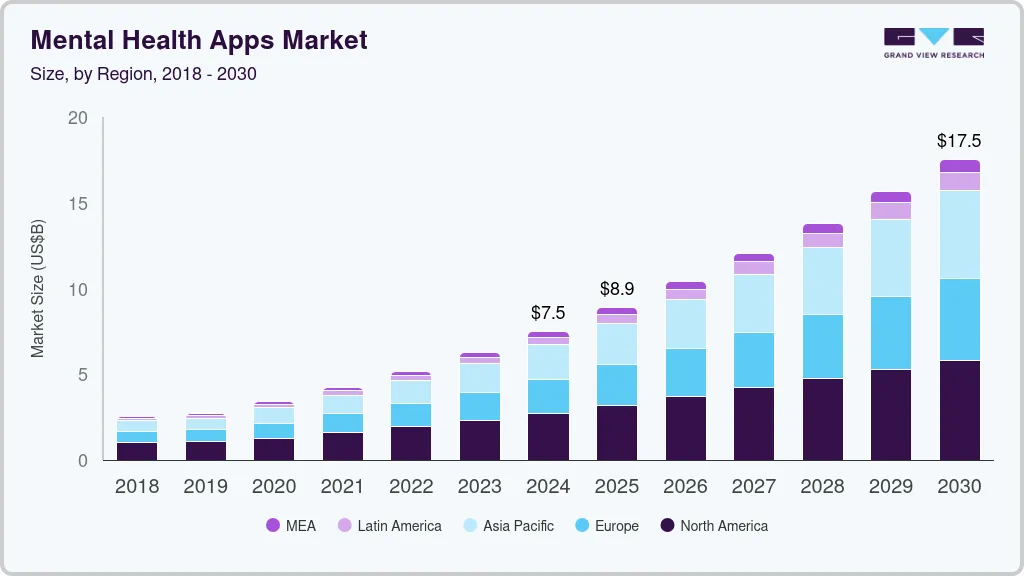

The global mental health apps market size was estimated at USD 7.48 billion in 2024 and is projected to reach USD 17.52 billion by 2030, growing at a CAGR of 14.6% from 2025 to 2030. The growing adoption of mental health apps owing to their benefits in improving treatment outcomes & lifestyle and increasing awareness regarding mental health as a significant health condition are major factors driving the market growth.

Key Market Trends & Insights

- North America dominated the mental health apps market with a revenue share of 36.4% in 2024

- The U.S. dominated the mental health apps market in North America region in 2024.

- By platform, the iOS segment dominated the market with the largest revenue share of 48.3% in 2024.

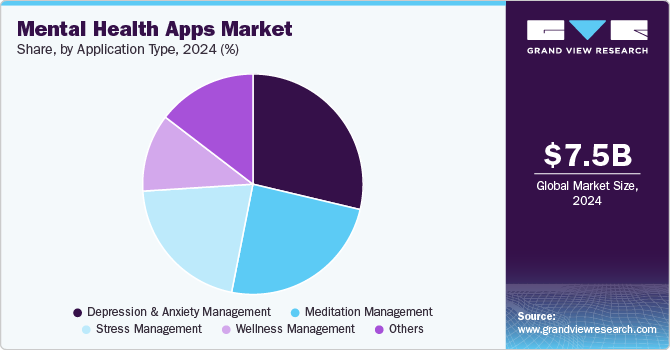

- By application, the depression and anxiety management segment dominated the market with a revenue share of 28.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.48 Billion

- 2030 Projected Market Size: USD 17.52 Billion

- CAGR (2025-2030): 14.6%

- North America: Largest market in 2024

- Europe: Largest market in 2023

In addition, these apps promote well-being, boosting individuals' productivity, particularly professionals in the workforce. Moreover, surge in downloads of mental health apps, particularly during the COVID-19 pandemic, is another significant factor that accelerated market expansion. Shifting trends from traditional care methods to patient-centric and personalized care support adopting mental health apps. Apps such as meditation management, depression & anxiety management, and wellness management are beneficial in maintaining an individual's overall health, thereby promoting a better lifestyle, and reducing stress. For instance, in June 2023, HuddleHumans, a Singapore-based company, launched a social mental health app globally. The app aims to create a supportive and connected community for individuals facing mental health challenges. Users can join group discussions, share personal stories, and encourage others. The app also offers resources such as mental health articles and self-care tools.

Rising funding opportunities for developing various mental health apps signify market growth opportunities. For instance, total funding statistics published by Crunchbase for Calm, a meditation app, increased from USD 28 million in 2018 to USD 218 million in 2020. In addition, funding for the app increased by around 52% from 2019 to 2020. This substantial rise in funding signifies market growth potential from 2024 to 2030. Furthermore, mental health challenges are on the rise globally, according to the World Health Organization (WHO), approximately 1 in every 8 people suffer from mental health disorders. India is home to 446 mental Healthtech startups, representing more than 6% of the total number of startups in this field worldwide. Indian mental healthtech startups have raised a total of USD 3.4 million in funding for 2023, lower than the global total of USD 824 million. However, in the first 10 days of 2024 alone, the sector has witnessed funding of USD 4.4 million, a growth over 31% compared to the previous year. Ventures such as Amaha, securing USD 5.2 million, and Urban Health, securing USD 3.4 million, have attracted investor attention in this sector.

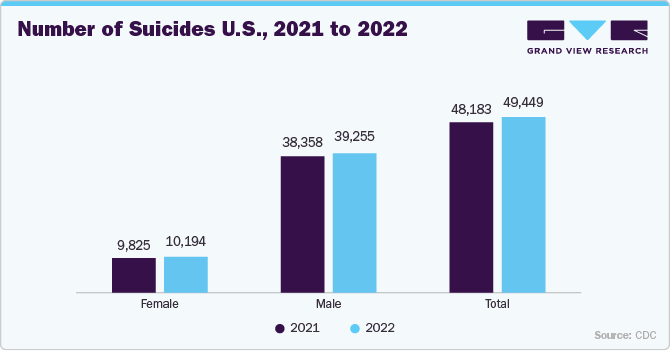

The rise in suicide rates has fueled the expansion of the mental health apps industry. This expansion is attributed to a growing recognition of mental health concerns, resulting in an increased need for readily available support options. Mental health applications provide accessible early intervention options, including self-evaluation tools and private assistance. These apps prioritize user privacy and confidentiality, motivating people to reach out for assistance with suicidal ideation and various mental health issues.

Numerous organizations, including the WHO, have implemented e-learning initiatives complemented by remote supervision to train healthcare workers in mental health care. This includes administering clinical treatments, ensuring care adheres to human rights principles, and providing psychological therapies. The Virtual Campus for Public Health (VCPH), a Pan American Health Organization (PAHO) project, acts as a hub for this educational content. Through the VCPH, medical professionals can engage with online modules and interactive resources on a wide array of public health issues, with a significant focus on mental health subjects such as preventing suicide, providing mental health and psychosocial support during emergencies, and combating stigma. The platform is accessible in four languages and caters to participants from American countries. Since its inception in 2008, the VCPH has been pivotal in advancing public health education, attracting over a million enrollees to its programs.

Advancements in smartphone technology to improve mental health-related problem diagnostics are anticipated to drive market growth. According to the GSM Association (GSMA) report statistics published in the Mobile Economy 2023 report, around 5.4 billion people across the globe subscribed to mobile services in 2022, and the number of unique mobile subscribers is expected to reach 6.3 billion by 2030 (73% of the global population). Moreover, the increasing penetration of smartphones is another key factor expected to facilitate market growth. As per the Mobile Economy 2023 report, smartphone penetration was around 55% in 2021 and is expected to reach 64% by 2025. Hence, the growing adoption of smartphones is expected to drive market growth over the forecast period.

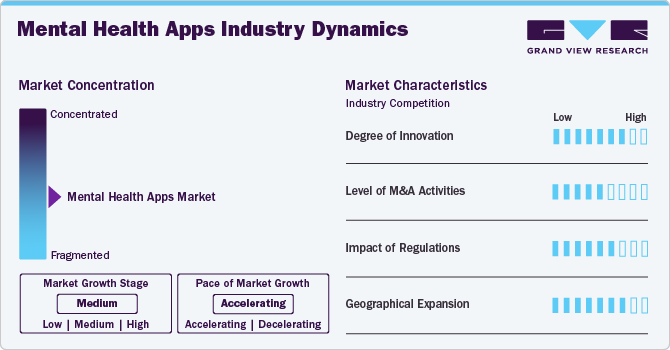

Market Concentration & Characteristics

The degree of innovation in the mental health apps market is high. The innovation is due to increasing technological advancements, integrating AI/ML with mental health apps, and more. For instance, in May 2023, GALVAN DAO LLC partnered with Canary Speech and launched an AI-based mental health app with the help of the Amazon Alexa speech group's manager.

Industry players implement various business strategies to increase revenues, promoting global market growth. The market players undertake partnerships, mergers & acquisitions, and product launches to expand their product portfolio, further contributing to industry growth. For instance, in July 2023, Big Health acquired Limbix, a firm developing apps to address young adult and teen mental health.

The mental health app companies are mandated to abide by several regulations. These regulations ensure patient and data safety. Moreover, several regulatory bodies are also undertaking initiatives to streamline the regulations for digital health apps. For instance, in December 2022, the Federal Trade Commission (FTC), alongside OCR, the HHS Office of National Coordinator for Health Information Technology (ONC), and the Food and Drug Administration (FDA), collaborated to revise the widely used Mobile Health Apps Interactive Tool. This resource is specifically crafted to assist developers of health-related mobile applications, including entities regulated by HIPAA, in comprehending the federal laws and regulations that may be relevant to their operations.

Companies within the mental health apps sector seek geographic expansion strategies to maintain their foothold in emerging markets, attracting customers from these regions. This expansion may entail the establishment of research and development (R&D) or offices in new areas, as well as forming partnerships and collaborations to access advanced technologies and broaden their customer reach.

Platform Insights

By platform, the iOS segment dominated the market with the largest revenue share of 48.3% in 2024, due to the increasing iOS adoption among consumers. For instance, in June 2023, Apple announced enhanced health functionalities in iPadOS 17, iOS 17, and watchOS 10, extending its reach into vision health and mental health feature areas and delivering innovative tools and experiences across its platforms. The new mental health features enable users to log their immediate emotions and daily moods, access insightful analyses, and conveniently access assessments and resources. Thus, such instances demonstrate the segment's growth during the forecast period.

The Android segment is anticipated to grow at the fastest CAGR over the forecast period. Major factors contributing to the segment's growth include the rising usage rate of Android-based smartphones and the cost-effectiveness of android smartphones. A growing number of Android users is anticipated to boost the market growth, signifying a higher growth rate. For instance, according to BankMyCell.com, in 2024, the world's population reaches 8.1 billion, with 48.2%, equivalent to 3.9 billion individuals, using Android smartphones. Furthermore, over 1 billion Android mobile devices were purchased in 2021. Moreover, in 2023, Google Play hosted more than 2.6 million applications, which saw a total of 113 billion downloads. Hence, owing to such a high penetration rate, the segment is expected to grow significantly in the upcoming years.

Application Insights

By application, the depression and anxiety management segment dominated the market with a revenue share of 28.7% in 2024. The growing prevalence of anxiety and depression disorders and increasing awareness about mental health apps for the treatment of these conditions are some of the major factors supporting the segment's growth. For instance, according to the WHO article published in March 2023, depression was one of the most common mental health disorders, with around 280 million individuals suffering from it globally.

The stress management segment is expected to grow at the fastest rate during the forecast period. The rising prevalence of stress & related disorders and the increasing adoption of applications beneficial in stress reduction & management are pioneering factors fueling the segment's growth during the forecast period. For instance, according to statistics provided by the Gallup survey, four in 10 adults across the globe reported feeling worried and stressed in 2021. Moreover, according to the Workplace Health Report 2024, approximately 79% of employees suffer from moderate to high stress levels. Hence, to manage stress, market players are taking several initiatives. For instance, in October 2023, ŌURA introduced three new functionalities: Reflections, Daytime Stress, and Resilience, designed to enable users to comprehend the timing & nature of stress and healing in their daily routines, maintain equilibrium through daily practices that enhance resilience, and mitigate the adverse effects associated with prolonged stress.

Regional Insights

North America dominated the mental health apps market with a revenue share of 36.4% in 2024. Key drivers such as the increasing prevalence of smartphone usage, network coverage advancements, and internet and social media penetration are driving the market expansion. According to GSMA’s The Mobile Economy Report 2023, smartphone adoption in the North American region was around 84% in 2022 and is expected to reach 90% by 2030.

U.S. Mental Health Apps Market Trends

The U.S. dominated the mental health apps market in North America region in 2024. The growth is due to increased initiatives in merging digital technology with the healthcare industry. For instance, in January 2024, the Department of Health Care Services (DHCS) introduced the Behavioral Health Virtual Services Platform, encompassing two complimentary applications for families with children, adolescents, and young adults aged 0-25. This initiative is foundational for Kids’ Mental Health and the Children and Youth Behavioral Health Initiative (CYBHI).

Europe Mental Health Apps Market Trends

The mental health apps market in Europe is expected to grow significantly over the forecast period. The growth is due to increased initiatives by government bodies. For instance, in June 2023, the EU Commission allocated approximately USD 1.30 billion for mental health initiatives spanning the 27-member European Union, establishing mental health as a fundamental component of health policy.

Germany mental health apps industry led in term of revenue in Europe mental health apps market in 2024, due to the active adoption of digital apps to deal with mental health issues. For instance, in March 2021, Germany approved Deprexis, an app to help with mental health issues. It was the 11th app approved for medical prescription and reimbursement in Germany via DiGA.

The mental health apps industry in the UK is expected to grow significantly during the forecast period. The growth is attributed to technological advancements in the mental health field. For instance, in December 2023, the Medical and Healthcare Products Regulatory Agency (MHRA) authorized BlueSkeye AI to start a clinical trial examining its mental health app, TrueBlue, for women at various pregnancy stages.

Asia Pacific Mental Health Apps Market Trends

The Asia Pacific region is expected to register the fastest growth rate over the forecast period, owing to rising demand for connected devices and the growing adoption of smartphones. Furthermore, various countries in the region are adopting digital and mobile health technologies to ensure better outcomes and manage healthcare delivery. Thus, such initiatives are projected to boost the adoption of mental health apps over the forecast period.

China mental health apps market is anticipated to register considerable growth during the forecast period. The growth is due to the increasing burden of mental health issues. For instance, according to the WHO, around 54 million individuals in China suffer from depression, and nearly 41 million suffer from anxiety disorders. Moreover, the WHO estimated that 80% of individuals with depression are expected to seek treatment by 2030.

Japan's mental health apps industry is expected to grow significantly during the forecast period. The growth is due to increased initiatives by the market players. For instance, in January 2022, Hakali Inc., a Japanese startup headquartered in Tokyo, Japan, launched an English edition of its mental and emotional self-care application, "Awarefy." The company is now progressing with the worldwide deployment of Awarefy as a mental health care application developed in Japan.

Latin America Mental Health Apps Market Trends

The Latin America mental health apps market is anticipated to witness considerable growth over the forecast period. The increasing awareness of mental health and wellness among the region’s population has driven the demand for mental health apps. In addition, the widespread adoption of smartphones and improved Internet connectivity have made mental health apps more accessible to a broader audience.

Brazil mental health apps industry is anticipated to register considerable growth during the forecast period. The increasing adoption of digital technology and the growing healthcare sector are key factors boosting Brazil's mental health apps market. As per the Kepios estimates, in January 2023, Brazil had 181.8 million internet users. This indicates a large pool of users turning to mental health apps. Thus, Brazil’s mental health apps market is growing significantly due to the availability of mobile health services & solutions.

Middle East and Africa Mental Health Apps Market Trends

The Middle East and Africa mental health apps market is anticipated to witness considerable growth over the forecast period. With the increasing penetration of smartphones & government initiatives, entrepreneurs and healthcare professionals are inclined toward smartphones for better & healthier lifestyles. In addition, the rising awareness among people has increased the potential for mental health apps.

UAE mental health apps industry is anticipated to register considerable growth during the forecast period. Several healthcare professionals and researchers in the UAE are embracing mental health apps, revolutionizing the healthcare industry. In February 2023, Emirates Health Services (EHS) introduced its IT Innovation Strategy for 2023-2026, with the primary objective of modernizing healthcare delivery and fostering a culture of innovation within the organization. This strategic plan helps respond to the ever-changing healthcare landscape, aiming to enhance sustainability and bolster internal capabilities over the next few years.

Competition is strong among the existing players owing to the rising demand for mental health applications and technological advancements. The rising demand for mental health apps is projected to promote the entry of newer companies, propelled by the rising awareness and acceptance of digital and mobile health technology. Furthermore, strategic developments and initiatives by companies in product launches, mergers, acquisitions, and partnerships are anticipated to boost competition and fuel market growth.

App Name

Price

Features

Calm

USD 14.99 per month or USD 69.99 annual subscription

Meditations, masterclasses, music, soothing sounds, sleep stories, gentle exercises and educational guides

Headspace

USD 12.99 per month or USD 69.99 annual subscription

Meditations, exercises, inspiring wake-up stories, sleepcasts, music, audio experiences and courses

Sanvello

Free to USD 8.99 per month

Mood tracking, guided journeys, coping tools, progress assessments and peer support; optional coaching and therapy

Happify

Free to USD 14.99 per month and up

Assessments, evidence-based mental health exercises, games and progress tracking

Bearable

Free to USD 4.49 per month or USD 27.99 for annual subscription

Mood tracking, symptoms tracking, medication log, activity log, behavior trends, reminders and journaling

Key Mental Health Apps Companies:

The following are the leading companies in the mental health apps market. These companies collectively hold the largest market share and dictate industry trends.

- Mindscape

- Calm

- MoodMission Pty Ltd.

- Sanvello Health

- Headspace Inc.

- Youper, Inc.

- Happify

- Bearable

- BetterHelp

- Talkspace

- MindShift

- MoodKit

Recent Developments

-

In September 2024, Magellan Health, Inc., a healthcare company, introduced a Teen Mental Wellbeing app to help the emotional and mental well-being of teenagers and young adults aged between 13-22.

-

In September 2023, Headspace and One Medical, a U.S.-based in-office and virtual primary care provider entered a strategic partnership. Under this partnership, the two companies would focus on devising solutions to reduce anxiety and spread awareness towards preventive health screenings.

-

In October 2022, Diago launched a global mental health app, Unmind, to all its employees on World Mental Health Day. The application offers access to various resources to promote mental health and well-being. These resources include interactive courses, real-time exercises, and evidence-based assessments designed to assist with various aspects such as sleep, nutrition, and managing life stressors.

-

In September 2022, Headspace Health, an American online company specializing in meditation announced its agreement to acquire Shine App, a mental health and well-being platform in order to deliver mental health support to people around the world.

-

In January 2022, Mayo Clinic, a non-profit American academic medical center announced its collaboration with the K Health team for using Artificial Intelligence to treat hypertension in a better way and the right manner.

Mental Health Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.87 billion

Revenue forecast in 2030

USD 17.52 billion

Growth rate

CAGR of 14.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mindscape; Calm; MoodMission Pty Ltd.; Sanvello Health; Headspace Inc.; Flow and Youper, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

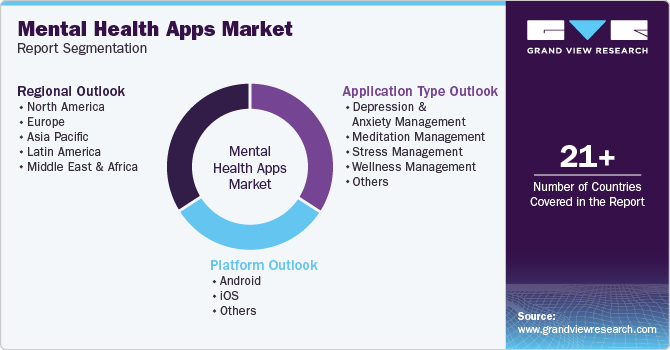

Global Mental Health Apps Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mental health apps market report based on platform, application, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Application Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Depression and Anxiety Management

-

Meditation Management

-

Stress Management

-

Wellness Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mental health apps market is expected to grow at a compound annual growth rate of 14.59% from 2025 to 2030 to reach USD 17.52 billion by 2030.

b. North America dominated the market with a revenue share of 36.43% in 2024. Prominent factors such as the growing adoption of smartphones, developments in coverage networks, growing penetration of the internet and social media are driving the mental health apps market growth.

b. Some of the key players operating in the market are Mindscape, Calm, MoodMission Pty Ltd., Sanvello Health, Headspace Inc., Youper, Inc., Happify, Bearable, BetterHelp, Talkspace, MindShift, and MoodKit.

b. Rising utilization of mental health apps owing to their benefits in improving treatment outcomes and lifestyle and increasing awareness regarding mental health as a significant health condition are some of the major factors boosting the market growth.

b. The global mental health apps market size was estimated at USD 7.48 billion in 2024 and is expected to reach USD 8.87 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.