- Home

- »

- Biotechnology

- »

-

Mesenchymal Stem Cell Therapy Market Size Report 2030GVR Report cover

![Mesenchymal Stem Cell Therapy Market Size, Share & Trends Report]()

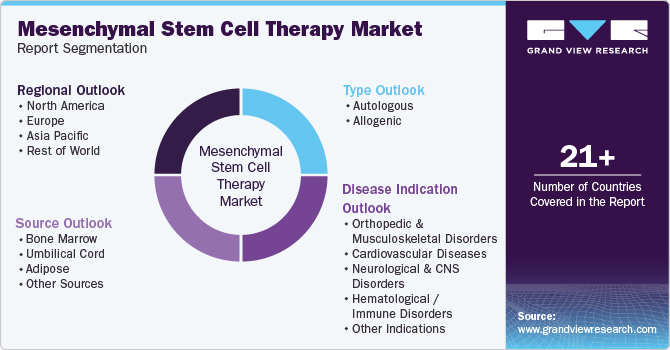

Mesenchymal Stem Cell Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Autologous, Allogenic), By Source (Bone Marrow, Umbilical Cord, Adipose), By Disease Indication, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-554-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

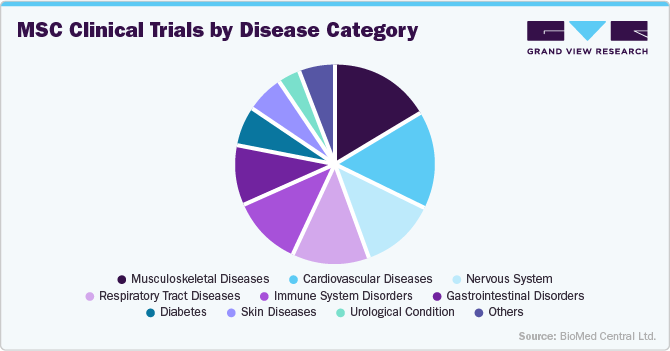

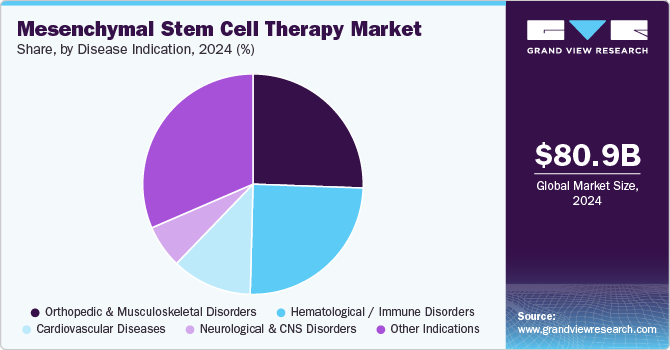

The global mesenchymal stem cell therapy market size was estimated at USD 80.9 million in 2024 and is projected to grow at a CAGR of 23.5% from 2025 to 2030. The mesenchymal stem cell (MSC) therapy market is primarily driven by its wide-ranging therapeutic potential. MSCs possess anti-inflammatory, immunomodulatory, and tissue repair capabilities, making them highly versatile for treating a variety of conditions-including orthopedic disorders, cardiovascular diseases, autoimmune conditions, and wound healing. This multi-lineage potential has encouraged robust R&D investment from both public institutions and private firms. Additionally, MSCs can be sourced from various tissues such as bone marrow, adipose tissue, umbilical cord, etc., which adds flexibility and scalability for therapeutic development. As clinical data supporting their safety and efficacy accumulates, regulatory interest and healthcare provider adoption continue to grow.

The COVID-19 pandemic had a profound impact on the MSC therapy market, positioning these therapies as potential treatments for the severe inflammation and cytokine storms seen in critically ill COVID-19 patients. Multiple clinical trials were initiated globally to evaluate the efficacy of MSCs in COVID-19-related acute respiratory distress syndrome (ARDS). Notably, Mesoblast’s Remestemcel-L entered a Phase 3 trial in the U.S. for COVID-19 ARDS, supported by the FDA under the Expanded Access Program. In China, Beike Biotechnology and Hope Biosciences conducted early-phase trials that showed improved lung function, reduced inflammation, and higher survival rates. Though some trials faced challenges or failed to meet endpoints, these efforts showcased MSCs’ rapid adaptability to emerging health crises. The pandemic also encouraged regulators to adopt more flexible pathways for cell therapies, such as the FDA’s Regenerative Medicine Advanced Therapy (RMAT) designation, and led to new collaborations between pharma companies, governments, and academic centers. This momentum continues to support MSC development for other inflammatory and immune-related conditions post-pandemic.

Technological Advancements in Cell Processing & Delivery

The mesenchymal stem cell therapy industry has been bolstered by major advancements in manufacturing and delivery technologies. Traditional challenges, such as variability in cell potency and viability, are being addressed through optimized bioprocessing methods, including 3D culture systems, microcarrier-based expansion, and closed-system bioreactors. These techniques ensure standardized, GMP-compliant production at a clinical scale. Additionally, innovations in cryopreservation, enabling long-term storage and “off-the-shelf” allogeneic products, have significantly improved distribution and shelf-life. ExoCoBio and Direct Biologics are pushing the field further by developing MSC-derived extracellular vesicle (EV) therapies, which offer similar regenerative benefits with easier storage and administration profiles. Companies are also exploring scaffold-based delivery and injectable hydrogels to improve the targeting and persistence of MSCs at the site of injury, increasing clinical efficacy.

Increasing Therapeutic Applications Across Disease Areas

Mesenchymal stem cell (MSC) therapies are gaining traction due to their broad therapeutic applicability, which is a key growth driver for the market. MSCs can differentiate into various cell types and exert potent anti-inflammatory and immunomodulatory effects, making them ideal for treating diverse diseases such as osteoarthritis, Crohn’s disease, graft-versus-host disease (GvHD), cardiovascular disorders, and type 1 diabetes. For instance, TiGenix’s MSC-based therapy Alofisel (darvadstrocel) became the first allogeneic stem cell therapy approved in Europe for treating complex perianal fistulas in Crohn’s disease, setting a regulatory precedent for MSC approvals. Furthermore, companies like Mesoblast are advancing products such as Remestemcel-L, which is in late-stage development for treating steroid-refractory GvHD in pediatric patients and chronic low back pain-demonstrating the increasing clinical and commercial scope of MSC applications.

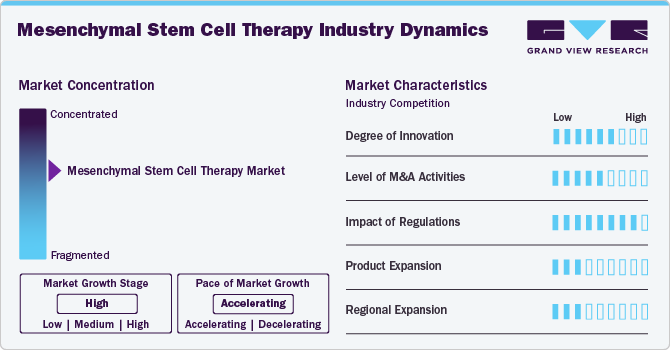

Market Concentration & Characteristics

The mesenchymal stem cell therapy industry shows a moderate to high innovation, largely driven by its regenerative potential across a wide range of therapeutic areas, including orthopedics, cardiovascular diseases, and autoimmune disorders. While numerous early-stage startups and academic institutions are advancing research on improved cell sourcing, ex vivo expansion, and delivery mechanisms, commercial translation has been relatively slow due to challenges in scalability and consistency. Nonetheless, novel delivery platforms (e.g., scaffolds and hydrogels), engineered MSCs, and combination therapies are pushing the frontier of innovation forward.

The mesenchymal stem cell therapy industry is characterized by a high level of collaboration, particularly between academic institutions, biotech startups, and large pharmaceutical companies. These partnerships are crucial for overcoming technical and regulatory hurdles, pooling expertise, and accelerating clinical development. Additionally, collaborations with contract development and manufacturing organizations (CDMOs) are rising to support GMP-compliant manufacturing and global distribution capabilities. Government-backed research consortia and international multicenter clinical trials also reflect a strong collaborative ecosystem.

Regulations significantly impact the mesenchymal stem cell therapy industry, often acting as both a bottleneck and a safeguard. Stringent rules surrounding cell manipulation, donor eligibility, and manufacturing standards-particularly in the U.S., EU, and Japan-create high barriers to entry. However, evolving frameworks like Japan's fast-track approval system for regenerative medicine and the FDA's Regenerative Medicine Advanced Therapy (RMAT) designation are enabling faster pathways for promising therapies. Compliance with global harmonization standards like GMP and GTP is essential for market participation.

Product expansion is moderate, with most MSC therapies still in clinical phases. Approved therapies (such as Alofisel for Crohn’s fistula) remain limited, but numerous candidates are being explored for newer indications like COVID-19 complications, neurodegenerative diseases, and diabetes. Companies are focusing on enhancing the potency and persistence of MSCs via genetic modifications, extracellular vesicles, and preconditioning strategies. The lack of standardized protocols, however, continues to limit widespread product diversification.

Regional expansion is robust, with North America, Europe, and East Asia (especially Japan and South Korea) being the primary hubs. Companies are increasingly targeting emerging markets in Southeast Asia, Latin America, and the Middle East due to favorable regulatory adaptations and unmet clinical needs. Cross-border licensing deals and international trial networks are supporting this expansion. Local manufacturing partnerships and regional subsidiaries are also helping global players enter less saturated markets.

Type Insights

The allogenic segment dominated the global market with the largest revenue share of 73.83% in 2024 and is expected to grow at the highest CAGR during the forecast period. The allogeneic mesenchymal stem cell therapy market is the growing demand for off-the-shelf, scalable, and cost-effective treatment options. Unlike autologous therapies, which require individualized cell extraction and processing, allogeneic MSCs can be derived from healthy donors, expanded in large batches under GMP conditions, and stored for immediate use, making them ideal for rapid clinical deployment. This approach significantly reduces manufacturing time, cost, and complexity while enabling broader patient access. Additionally, allogeneic MSCs have shown low immunogenicity, allowing for safe use across diverse populations without HLA matching. Several leading companies, such as Mesoblast, Athersys, and Pluristem Therapeutics, are advancing late-stage allogeneic MSC therapies for indications like GvHD, ARDS, and ischemic stroke, further validating this model and attracting regulatory and investor interest.

The autologous segment is expected to grow at the significant CAGR during the forecast period. Autologous MSC therapies are increasingly used in outpatient and point-of-care settings, supported by advancements in minimally invasive harvesting techniques and closed-system processing platforms. Companies like Vericel Corporation (with MACI for cartilage repair) and Cynata Therapeutics are demonstrating clinical success and regulatory progress in this space, further driving mesenchymal stem cell therapy industry adoption. As regulatory pathways for personalized therapies become clearer and processing costs decrease, the demand for autologous MSC treatments is expected to grow, particularly in specialized and elective care markets.

Source Insights

The adipose segment dominated the overall market with the largest revenue share of 37.71% in 2024 and is expected to grow at the highest CAGR during the forecast period. Adipose tissue provides a significantly higher concentration of MSCs than bone marrow, and harvesting it via liposuction is minimally invasive, with lower patient discomfort and risk. Additionally, ADMSCs exhibit strong regenerative and immunomodulatory properties, making them effective in treating conditions like osteoarthritis, wound healing, and autoimmune diseases. The growing popularity of cosmetic and reconstructive procedures has further supported the collection and application of adipose derived MSCs.

The bone marrow segment is expected to grow at the significant CAGR during the forecast period. Bone marrow-MSCs were among the first mesenchymal stem cells to be studied and utilized in clinical trials, leading to a well-characterized understanding of their biology, differentiation potential, and immunomodulatory effects. They are particularly effective in treating hematological disorders, graft-versus-host disease (GvHD), and orthopedic conditions such as bone and cartilage repair. Despite being more invasive to harvest compared to adipose tissue, bone marrow remains a preferred source in academic and regulatory circles due to its extensive validation. Companies like Osiris Therapeutics (acquired by Smith & Nephew) and Gamida Cell have leveraged bone marrow -MSCs in their product pipelines, while ongoing clinical studies continue to support their efficacy in a wide range of therapeutic applications-driving continued investment and adoption in the mesenchymal stem cell therapy industry.

Disease Indication Insights

In 2024, orthopedic and musculoskeletal disorders held the second largest market share of 25.56% in the disease indication segment. The market for orthopedic and musculoskeletal disorders is the growing demand for minimally invasive, regenerative solutions to address conditions like osteoarthritis, cartilage damage, tendon injuries, and spinal disorders-particularly among aging populations and active individuals. MSCs offer a promising alternative to conventional treatments by promoting tissue regeneration, reducing inflammation, and potentially delaying or eliminating the need for joint replacement surgeries. Clinical trials have shown encouraging outcomes with intra-articular MSC injections for knee osteoarthritis, leading to pain reduction and functional improvement. Products Cartistem by Medipost (allogeneic umbilical cord MSCs for cartilage regeneration) have received regulatory approvals in South Korea, respectively demonstrating clinical and commercial viability. As the burden of musculoskeletal diseases rises globally, the orthopedic segment continues to be a major growth area within the MSC therapy landscape.

The hematological / immune disorders segment is expected to grow at the fastest CAGR in the market. the strong immunomodulatory and anti-inflammatory properties of MSCs, which make them especially effective in treating conditions like graft-versus-host disease (GvHD), systemic lupus erythematosus (SLE), multiple sclerosis, and Crohn’s disease. MSCs can regulate immune cell activity and suppress excessive immune responses without compromising overall immunity, offering a powerful alternative to immunosuppressive drugs that often carry severe side effects. Clinical success stories-such as Mesoblast’s Remestemcel-L, which has shown promise in steroid-refractory GvHD and received Fast Track and Orphan Drug designations from the FDA-have significantly boosted confidence in MSC-based immune therapies. Additionally, the rise in autoimmune disease prevalence globally and the increasing number of allogeneic transplants have created a growing patient pool in need of safer, more targeted immunotherapies, positioning MSCs as a compelling treatment option in this high-need area.

Regional Insights

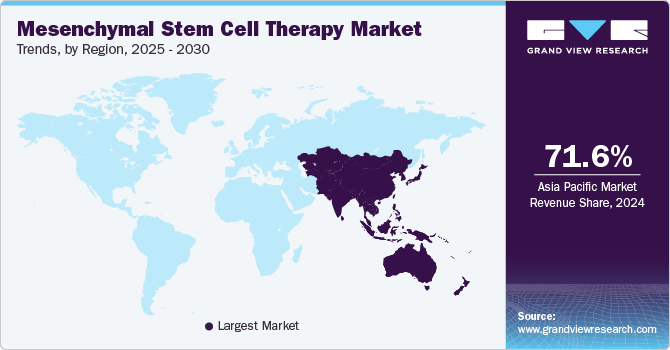

Asia Pacific accounted for the largest market share of 71.56% in 2024. The market is experiencing rapid growth fueled by government support, rising healthcare investments, and increasing local clinical activity. Countries like Japan & South Korea, are emerging as key players, owing to regulatory reforms and a strong push toward regenerative medicine. Japan's early adoption of conditional approvals for regenerative therapies has made it an attractive market for MSC developers. The region also benefits from large patient pools and lower operational costs, making it ideal for conducting early- to mid-phase clinical trials.

South Korea Mesenchymal Stem Cell Therapy Market Trends

South Korea is a leading MSC therapy innovator in Asia, driven by agile regulatory frameworks, strong government funding, and advanced cell therapy infrastructure. The Ministry of Food and Drug Safety (MFDS) has streamlined the approval process for regenerative medicines, resulting in approvals like Cartistem (by Medipost) for knee cartilage repair. South Korea’s biotech firms, such as Nature Cell, Corestem, and Anterogen, are actively commercializing MSC therapies both domestically and for export. High public awareness and integration of regenerative therapies into mainstream hospitals further stimulate domestic demand.

Europe Mesenchymal Stem Cell Therapy Market Trends

Europe’s MSC therapy market is driven by strong government support, Pan-European research networks, and early product approvals. The region witnessed the first-ever approval of an allogeneic MSC therapy-Alofisel for complex perianal fistulas in Crohn’s disease, setting a precedent for cell therapy regulation. The EU’s advanced regulatory framework for ATMPs (Advanced Therapy Medicinal Products), along with funding from Horizon Europe and the European Medicines Agency (EMA)'s innovation support programs, are facilitating new MSC-based developments. Increasing demand for regenerative and personalized treatments is also bolstering growth.

Germany acts as a regional hub within Europe due to its well-established biotech ecosystem, strict but progressive regulatory environment, and strong academic-industry collaborations. The country hosts several GMP-certified manufacturing sites and supports public-private partnerships for cell therapy innovation. Research institutes like the Fraunhofer Institute and Charité - Universitätsmedizin Berlin are actively involved in clinical trials and translational MSC research. Germany’s large aging population and high prevalence of orthopedic and autoimmune conditions also fuel demand for MSC-based interventions.

North America Mesenchymal Stem Cell Therapy Market Trends

The North American MSC therapy market is primarily driven by strong R&D infrastructure, favorable regulatory pathways, and significant investment by biotech firms. The region is home to major players like Mesoblast, Athersys, and Capricor Therapeutics, which are actively conducting advanced-phase clinical trials for a range of conditions including cardiovascular, orthopedic, and immune disorders. The presence of FDA programs such as RMAT (Regenerative Medicine Advanced Therapy) designation and the 21st Century Cures Act has also accelerated the clinical and commercial progress of MSC-based therapies. High disease burden and growing awareness among physicians and patients further contribute to demand.

Within North America, the U.S. leads the MSC therapy market due to its robust clinical trial activity, high healthcare expenditure, and regulatory innovation. The country has the highest number of registered MSC trials globally and a growing focus on allogeneic, off-the-shelf products for broader accessibility. FDA’s flexibility during the COVID-19 pandemic, particularly in allowing emergency use of MSCs for ARDS and GvHD, has strengthened industry confidence. Academic institutions like Mayo Clinic and Harvard Medical School, along with major hospitals, are also key enablers of translational research and early adoption.

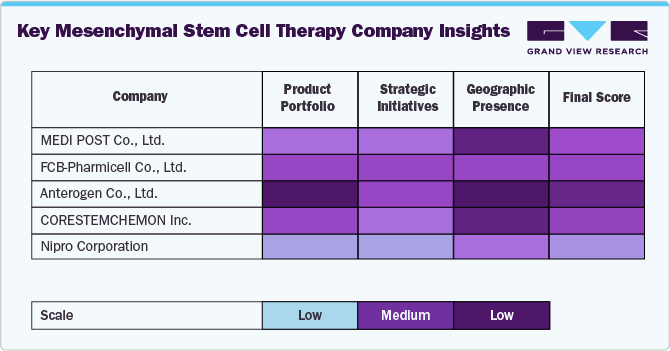

The MSC therapy market position of companies like MEDIPOST Co., Ltd., FCB-Pharmicell Co., Ltd., Anterogen Co., Ltd., CORESTEMCHEMON Inc., and Nipro Corporation reflects a strong regional dominance in Asia, particularly South Korea and Japan, alongside growing global ambitions. MEDIPOST leads with its allogeneic umbilical cord-derived MSC product Cartistem, approved in South Korea for knee cartilage defects, making it a commercial pioneer in MSC therapies. FCB-Pharmicell was the first globally to gain regulatory approval for an autologous MSC therapy (Hearticellgram-AMI) for acute myocardial infarction, showcasing leadership in cardiovascular applications.

Anterogen holds competitive strength in developing adipose-derived MSCs for chronic and rare diseases and is active in both domestic and international clinical trials. CORESTEMCHEMON Inc. focuses on neurodegenerative disorders, particularly ALS, and has obtained South Korean approval for NeuroNata-R, the world’s first stem cell drug for ALS, giving it a niche but impactful market presence. Nipro Corporation, with its robust regenerative medicine infrastructure in Japan, leverages bone marrow-derived MSCs and is advancing its pipeline in orthopedic and renal disease applications. Collectively, these companies are key players in advancing MSC therapies across a range of indications, with a strong emphasis on localized regulatory successes and increasing international expansion.

The market players operating in the mesenchymal stem cell therapy market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Mesenchymal Stem Cell Therapy Companies:

The following are the leading companies in the mesenchymal stem cell therapy market. These companies collectively hold the largest market share and dictate industry trends.

- MEDIPOST

- FCB-Pharmicell Co., Ltd.

- Anterogen

- CORESTEMCHEMON Inc.

- Nipro Corporation

- Stempeutics Research Pvt. Ltd.

- JCR Pharmaceuticals Co., Ltd.

- Mesoblast Limited

- Cell Tech Pharmed

- HOLOSTEM S.r.l.

- Takeda Pharmaceutical Company Limited

Recent Development

-

In February 2025, BioRestorative Therapies’ BRTX-100, an autologous mesenchymal stem cell (MSC) therapy, has been granted FDA Fast Track designation for the treatment of chronic lumbar disc disease (cLDD).

-

In January 2025, in China, the National Medical Products Administration (NMPA) granted conditional approval to Ruibosheng (Amimestrocel Injection, PLEB-001) Developed by Platinum Life Excellence Biotech Co., Ltd., Ruibosheng uses human umbilical cord-derived MSCs and is also approved for the treatment of steroid-refractory aGVHD. This marks the first MSC therapy approval in China, signaling a significant milestone in the country’s efforts to advance stem cell-based therapies.

-

In Decmeber 2024, In the U.S., the FDA approved Ryoncil (remestemcel-L) developed by Mesoblast, Inc. This therapy is indicated for the treatment of steroid-refractory acute graft-versus-host disease (SR-aGVHD) in pediatric patients aged two months and older. Derived from allogeneic bone marrow-derived MSCs, Ryoncil is the first MSC-based therapy to gain FDA approval, highlighting a major breakthrough in immune and inflammatory disease management.

Mesenchymal Stem Cell Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 103.2 million

Revenue forecast in 2030

USD 296.6 million

Growth rate

CAGR of 23.5% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, disease indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; UK; Germany; Japan; South Korea; Rest of World

Key companies profiled

MEDIPOST Ltd.; FCB-Pharmicell Co., Ltd.; Anterogen; CORESTEMCHEMON Inc.; Nipro Corporation; Stempeutics Research Pvt. Ltd.; JCR Pharmaceuticals Co., Ltd.; Mesoblast Limited; Cell Tech Pharmed; HOLOSTEM S.r.l; Takeda Pharmaceutical Company Limited

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Mesenchymal Stem Cell Therapy Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mesenchymal stem cell therapy market based on type, source, disease indication, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Autologous

-

Allogenic

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone Marrow

-

Umbilical Cord

-

Adipose

-

Other Sources

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic & Musculoskeletal Disorders

-

Cardiovascular Diseases

-

Neurological & CNS Disorders

-

Hematological / Immune Disorders

-

Other Indications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

Japan

-

South Korea

-

-

Rest of World

-

Frequently Asked Questions About This Report

b. The global mesenchymal stem cell therapy market size was valued at USD 80.9 million in 2024 and is expected to reach USD 103.2 million in 2025.

b. The global mesenchymal stem cell therapy market is projected to witness a compound annual growth rate (CAGR) of 23.50% from 2025 to 2030 , reaching USD 296.6 million by 2030.

b. The adipose segment dominated the overall market with the largest revenue share of 37.71% in 2024 and is expected to grow at the highest CAGR during the forecast period. Adipose tissue provides a significantly higher concentration of MSCs compared to bone marrow, and harvesting it via liposuction is minimally invasive, with lower patient discomfort and risk.

b. Some of the prominent companies in the global mesenchymal stem cell therapy market include MEDIPOST Ltd., FCB-Pharmicell Co., Ltd., Anterogen, CORESTEMCHEMON Inc., Nipro Corporation, Stempeutics Research Pvt. Ltd., JCR Pharmaceuticals Co., Ltd., Mesoblast Limited, Cell Tech Pharmed, HOLOSTEM S.r.l, Takeda Pharmaceutical Company Limited.

b. The mesenchymal stem cell (MSC) therapy market is primarily driven by its wide-ranging therapeutic potential. MSCs possess anti-inflammatory, immunomodulatory, and tissue repair capabilities, making them highly versatile for treating a variety of conditions—including orthopedic disorders, cardiovascular diseases, autoimmune conditions, and wound healing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.