- Home

- »

- Medical Devices

- »

-

Mesotherapy Products Market Size, Industry Report, 2034GVR Report cover

![Mesotherapy Products Market Size, Share & Trends Report]()

Mesotherapy Products Market (2025 - 2034) Size, Share & Trends Analysis Report By Product (Hyaluronic Acid (Non-crosslinked) Revitalizers, Polynucleotides (PN)/PDRN Injectables, Vitamin), By Form Factors, By Indication, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-844-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2034

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mesotherapy Products Market Summary

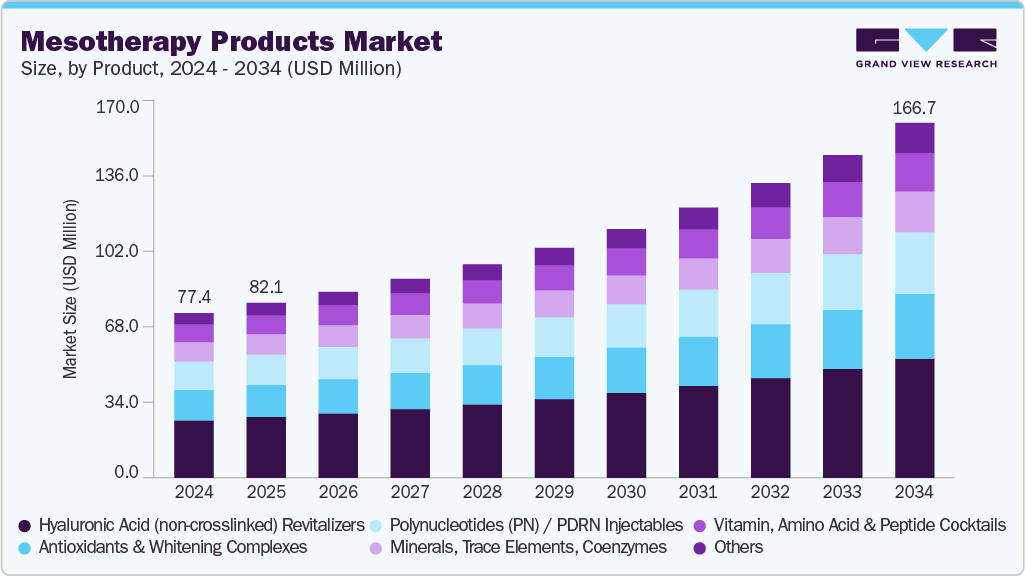

The global mesotherapy products market size was valued at USD 77.4 million in 2024 and is projected to reach USD 166.7 million by 2034, growing at a CAGR of 8.2% from 2025 to 2034. This growth is driven by the rising demand for minimally invasive aesthetic treatments, increasing focus on skin quality enhancement, and expanding consumer interest in preventive anti-aging solutions.

Key Market Trends & Insights

- Europe’s mesotherapy products market held the largest share of 44.4% of the global market in 2024.

- The Norway mesotherapy products industry is expected to grow significantly over the forecast period.

- By product, the hyaluronic acid (non-crosslinked) revitalizers segment held the largest market share of 34.9% in 2024.

- By form factors, the vials segment held a leading market share in 2024.

- By indication, the aging/revitalization (hydration, texture, glow, fine lines) segment held a leading market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 77.4 Million

- 2034 Projected Market Size: USD 166.7 Million

- CAGR (2025-2034): 8.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest-growing market

The growing prevalence of concerns such as dehydration, fine lines, pigmentation, and hair thinning has strengthened the adoption of injectable formulations that offer natural-looking improvements with minimal downtime. Advancements in hyaluronic acid revitalizers, polynucleotide injectables, and customized meso-cocktails have further improved treatment safety and efficacy, supporting wider clinical use.

People are increasingly opting for non-surgical cosmetic enhancements that provide visible results without the risks and recovery time associated with traditional surgery. The global demand for minimally invasive procedures surged in 2023; according to the American Society of Plastic Surgeons (ASPS), minimally invasive procedures grew by about 7% that year, outpacing surgical procedures. This shift reflects changing consumer preferences toward treatments that provide effective cosmetic results with fewer risks, shorter recovery periods, and lower overall costs. Patients are increasingly seeking procedures that can be performed quickly, often in outpatient settings, allowing them to return to their daily routines with minimal interruption. Growing awareness of these benefits, combined with advancements in technologies and products that enhance treatment outcomes, is encouraging more people to choose minimally invasive options over traditional surgical alternatives.

Rising hair loss and skin disorders among younger people are becoming clear drivers for growth in the mesotherapy products market. Young adults are experiencing hair thinning at an earlier age: approximately 25% of men begin losing hair by age 30, and hair-loss conditions also affect a substantial share of women. This early onset increases demand for cosmetic and restorative treatments that work quickly and with minimal downtime. At the same time, common skin problems remain highly prevalent in younger age groups. Acne affects roughly 85% of people aged 12–25 and continues to be one of the top skin complaints worldwide; persistent or scarring acne often pushes younger patients toward in-clinic treatments beyond topical drugs. These conditions heighten consumer willingness to try clinic-based, injectable, and minimally invasive solutions that promise visible results.

The rapid expansion of aesthetic clinics and the rising trend of medical tourism are becoming key drivers of the growing demand for mesotherapy products. In recent years, countries such as India have seen a significant increase in specialized clinics offering cosmetic and aesthetic treatments, ranging from laser and energy-based skin rejuvenation to injectables and mesotherapy. Medical tourism amplifies this trend further. Patients from abroad are increasingly traveling to countries like India, drawn by high‑quality treatments at costs often substantially lower than in Western nations. For example, a major aesthetic clinic chain in India recently reported that over 15% of its patients come from overseas, illustrating how global demand contributes significantly to the clinic's business volume.

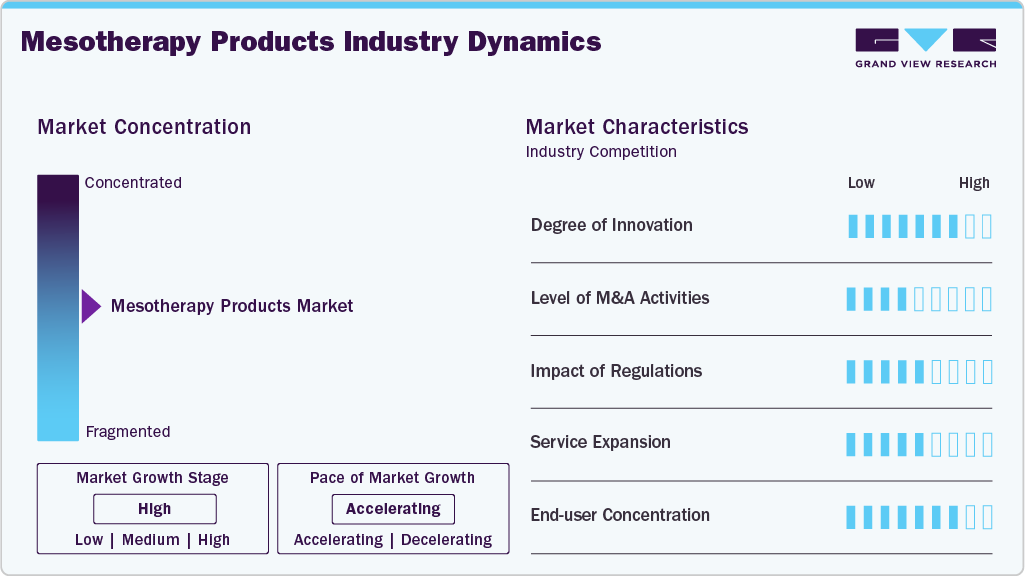

Market Concentration & Characteristics

The mesotherapy products industry is moderately concentrated, with key companies such as Laboratoires FILLMED, Revitacare, Mesoestetic, and Mastelli s.r.l. holding a notable share of the market. These players offer a wide range of injectable solutions containing vitamins, minerals, hyaluronic acid, peptides, and plant-based ingredients designed for skin rejuvenation, hair restoration, and body contouring. The market is evolving steadily due to ongoing product innovation, customized treatment formulations, and growing preference for minimally invasive aesthetic procedures. The rising demand for anti-aging, skin brightening, and hair-loss treatments across diverse age groups is supporting market growth and attracting new entrants with specialized and targeted mesotherapy solutions.

The market is undergoing major innovations and advancements. For instance, in January 2025, Maypharm launched its hybrid mesotherapy filler Hyalmass Aqua-Exosome, which blends hyaluronic acid with exosomes and PDRN to deliver improved skin hydration, elasticity, and regeneration. Such R&D efforts are important as they help expand the mesotherapy market, moving beyond basic hydration or wrinkle reduction to offer deeper skin rejuvenation, longer-lasting results, and even regenerative benefits.

Partnering and collaborating play a major role in learning how to get access to the new, different technological ways, and also being able to enhance the dermal fillers. For instance, in August 2025, PharmaResearch signed a strategic partnership with Laboratoires VIVACY to distribute its flagship skin‑booster brand Rejuran across 22 European countries, including major markets such as the UK, Germany, and France. The deal, worth approximately USD 63.64 (Euro 54.5) million over five years, is intended to leverage VIVACY’s extensive commercial network to introduce and expand Rejuran’s presence in Europe rapidly.

The industry is strictly regulated to ensure the safety, efficacy, and reliability of products. In January 2025, Thailand’s FDA issued the Guideline for Consideration of Notification of Cosmetics in Ampoule, Vial, or Syringe Forms (Revised September 2024) to ensure consumer safety and prevent misuse. The regulation clarifies that cosmetics packaged in vials must not be classified as medical devices or used with mesotherapy equipment such as MTS, iontophoresis devices, laser add-ons, or injection systems. Approved vial-based cosmetics must be strictly topical, with mandatory warnings: “Do not inject or use with medical devices. For external use only.”

Competition from more established aesthetic treatments limits the growth of the mesotherapy products industry. Clinics and patients prefer well-known options such as Botox, dermal fillers, lasers, and microneedling because these treatments are widely used, have strong clinical results, and are supported by trusted brands. Botox and fillers are performed in extremely high volumes globally, so clinics invest more in training, equipment, and marketing for these procedures rather than mesotherapy. As a result, mesotherapy is seen as a secondary option with lower awareness, less standardisation, and slower demand, making it harder for new products to grow in the market.

The market for mesotherapy products is expanding across all major regions. For instance, in November 2024, Vivacy signed a strategic distribution agreement with Shanghai Pharmaceuticals, China’s largest medicines importer, to bring Vivacy’s medical aesthetic solutions to China. As a result, Vivacy is expanding its high-quality aesthetic solutions into the rapidly growing Chinese medical aesthetics market. The partnership aims to leverage Shanghai Pharmaceuticals’ local presence to reach Chinese medical professionals and consumers and support Vivacy’s international expansion in Asia.

Product Insights

The hyaluronic acid (non-crosslinked) revitalizers segment dominated the market in 2024, accounting for the largest share of 34.9% of the overall revenue. Non-crosslinked hyaluronic acid (NCHA) revitalizers are emerging as high-value mesotherapy solutions designed to restore skin quality through deep hydration, enhanced radiance, and subtle micro-filling effects. Unlike crosslinked HA fillers, NCHA formulations are optimized for superficial intradermal delivery, making them ideal for global skin revitalization rather than volumization. These products play a growing role in the mesotherapy market due to their biocompatibility, natural integration into dermal tissues, and ability to improve multiple dimensions of skin aging.

The polynucleotides (PN)/PDRN injectables segment is expected to witness the fastest CAGR over the forecast period. Polynucleotides (PN) and Polydeoxyribonucleotide (PDRN) injectables have become among the most dynamic product segments in the global mesotherapy industry. Represented by leading brands such as Nucleofill, Crystal PDRN, PhilArt, and Plinest, these next-generation skin boosters rely on highly purified DNA fragments derived from salmon or trout. Unlike mechanical fillers, PN/PDRN therapies stimulate natural tissue repair, positioning them as biological rejuvenators favored by dermatologists for their regenerative potency.

Form Factor Insights

The vials segment dominated the market in 2024 and accounted for the largest share of the overall revenue. Vials represent one of the fastest-growing and most versatile product formats in the global market for mesotherapy products. Their popularity stems from their stability, sterile preservation capabilities, precise dosing, and compatibility with multi-ingredient formulations used for skin rejuvenation, hydration, pigmentation correction, and hair revitalization. As mesotherapy expands across dermatology, aesthetic medicine, and combination therapies, vials have become the preferred carrier for high-potency actives, regenerative complexes, peptides, vitamins, hyaluronic acid serums, and biostimulatory solutions. At the same time, regulatory developments are reshaping the vial landscape. In January 2025, Thailand’s FDA issued the Guideline for Consideration of Notification of Cosmetics in Ampoule, Vial, or Syringe Forms (Revised September 2024) to ensure consumer safety and prevent misuse. The regulation clarifies that cosmetics packaged in vials must not be classified as medical devices or used with mesotherapy equipment such as MTS, iontophoresis devices, laser add-ons, or injection systems.

The prefilled syringes (PFS) segment is expected to witness the fastest CAGR over the forecast period. The growth is driven by demand for precision dosing, enhanced safety, and improved treatment efficiency. Unlike vials or ampoules that require manual preparation, PFS come preloaded with a sterile, ready-to-use formulation, minimizing contamination risks while ensuring consistent ingredient concentration during mesotherapy sessions. In aesthetic medicine, PFS are increasingly used to deliver hyaluronic acid boosters, vitamin complexes, polynucleotides, peptides, antioxidants, and skin-repair blends directly into targeted dermal layers. Their single-use format lowers the risk of infection, reduces preparation time, and offers clinicians better control over depth and volume with each injection. This makes them particularly valuable for repetitive, multi-point mesotherapy procedures where dosing accuracy is essential.

Indication Insights

The aging/revitalization (hydration, texture, glow, fine lines) segment dominated the market in 2024. Skin aging is driven by moisture loss, reduced collagen synthesis, oxidative stress, and gradual weakening of dermal structure. Mesotherapy has become a leading minimally invasive rejuvenation option because it delivers bioactive ingredients directly into the superficial dermis, where hydration, firmness, and texture improvements begin at the cellular level. Unlike topical skincare, which struggles to penetrate beyond the epidermis, mesotherapy injectables provide targeted revitalization through cocktails containing hyaluronic acid, amino acids, vitamins, peptides, antioxidants, and polynucleotides. Polynucleotide-based injectables (e.g., Rejuran, PhilArt) also support revitalization through tissue repair and anti-inflammatory effects, making them suitable for thin or photo-damaged skin.

The anti-cellulite/lipolytic segment is expected to witness the fastest CAGR over the forecast period. The growth of the segment is driven by rising demand for minimally invasive body-contouring solutions. These injectable formulations are designed to target localized fat deposits, enhance microcirculation, and reduce the appearance of cellulite by addressing both adipocyte size and the structure of fibrous tissue. Unlike topical creams, lipolytic mesotherapy delivers active compounds directly into the subcutaneous fat layer, offering more precise and effective correction. A noteworthy trend is the social media-driven popularity of mesotherapy for cellulite, where treatments promising fat cell inhibition and enhanced lymphatic drainage have gained significant attention, increasing consumer awareness and clinical demand.

Application Insights

The face segment dominated the market, holding the largest revenue share in 2024 and it is expected to experience the fastest CAGR over the forecast period. Face mesotherapy is becoming one of the most rapidly expanding categories in aesthetic dermatology as consumers increasingly prefer non-surgical, minimally invasive rejuvenation solutions. The technique delivers micro-injections of hyaluronic acid, vitamins, minerals, peptides, antioxidants, and growth factors into the dermis to boost hydration, refine texture, and revitalize facial skin. It effectively targets dullness, dehydration, pigmentation, early signs of aging, acne scars, and fine lines, making it appealing to a broad audience seeking natural, progressive results.

The body segment is expected to witness significant growth during the forecast period. The global surge in obesity has become a defining health challenge of the modern era, with prevalence more than tripling between 1975 and 2022. Findings published by the NCD Risk Factor Collaboration in 2024 reveal that over one billion people worldwide are currently living with obesity, about 880 million adults and 159 million children and adolescents aged 5–19. Analysis by the World Obesity Federation further indicates that nearly 3 billion people fall into the overweight or obese category, showing that excess weight now poses a greater health risk than undernutrition in most regions. This creates rising demand for mesotherapy products for the fat-cutting treatments. With increasing use of ready-to-inject ampoules, tighter regulatory oversight, and growing consumer preference for natural-looking, low-downtime solutions, the body mesotherapy market is poised for strong global growth.

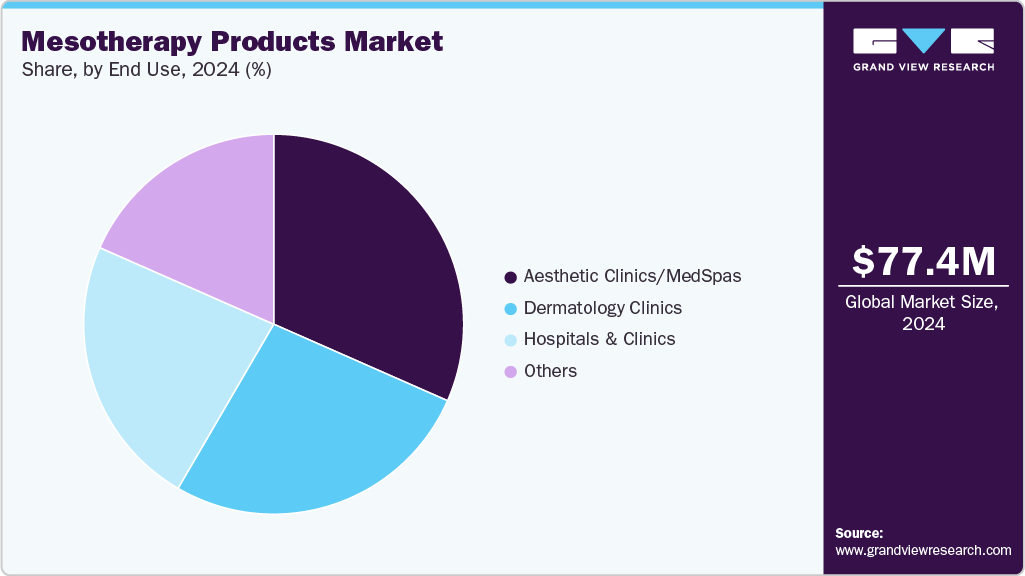

End Use Insights

The aesthetic clinics/medspas segment dominated the market for mesotherapy products in 2024. The growth is driven by the explosive growth of minimally invasive cosmetic procedures. With the number of U.S. med spas rising from 1,600 in 2010 to nearly 10,500 in 2023 and projected to reach 13,000 by 2026, the sector represents a massive commercial channel for mesotherapy injectables, serums, hyaluronic acid revitalizers, hair-growth formulations, and skin-brightening cocktails. Their convenience-based business model, shorter wait times, and relatively lower treatment costs compared to dermatology clinics have expanded access to treatments like skin rejuvenation, lipolysis, hair revitalization, anti-aging bio revitalization, and pigmentation correction, all of which rely heavily on mesotherapy.

The dermatology clinics segmentis anticipated to grow at the second-fastest CAGR over the forecast period. Dermatology clinics utilize mesotherapy to address a wide range of dermatological concerns, including skin rejuvenation, pigmentation, acne scars, cellulite, hair loss, and localized fat deposits. With rising patient preference for minimally invasive solutions, dermatology clinics are increasingly positioning mesotherapy as a safe, effective, and customizable treatment option that falls between basic skincare and surgical procedures. Dermatologists rely on high-quality mesotherapy formulations containing hyaluronic acid, vitamins, peptides, amino acids, antioxidants, growth factors, and lipolytic agents to deliver targeted benefits directly into the dermis. Their expertise ensures an accurate assessment of skin conditions, precise injection depth, and personalized treatment plans, all of which significantly enhance outcomes and patient satisfaction.

Regional Insights

The North America mesotherapy products industry accounted for the revenue share of 12.5% in 2024. Mesotherapy products in North America are primarily used within the broader scope of minimally invasive aesthetic medicine. Instead of being tracked as a separate procedure category, mesotherapy includes products such as skin boosters, hair restoration injectables, and injectable body contouring, among others. There is an underlying demand for these procedures. For instance, in 2024, plastic surgeons worldwide performed over 20 million non-surgical procedures, with the U.S. alone accounting for approximately 3.2 million of the total. The growing volume of injectable aesthetic treatments in the region, particularly in the U.S., has contributed to this trend. Injectable procedures have consistently been ranked among the most performed cosmetic interventions, creating a receptive environment for mesotherapy solutions based on non-crosslinked hyaluronic acid, vitamins, peptides, amino acids, and lipolytic agents.

U.S. Mesotherapy Products Market Trends

The U.S. mesotherapy products industry is experiencing steady growth, mainly driven by increasing preference for non-invasive cosmetic procedures. The American Society of Plastic Surgeons (ASPS) reported that approximately 25.4 million minimally invasive cosmetic procedures were performed in the U.S. in 2023, representing a 7% increase from 2022. Neuromodulator injections, soft-tissue fillers, skin resurfacing, and other skin treatments ranked among the most frequently performed non-surgical procedures. This high baseline of injectable volume creates the clinical and commercial infrastructure, trained injectors, treatment rooms, and follow-up systems, into which mesotherapy products are introduced. Many practices in dermatology and plastic surgery utilize mesotherapy-type formulations as add-on or maintenance services between major filler or neurotoxin sessions, particularly for patients seeking subtle improvements in skin hydration or tone, rather than structural changes.

Europe Mesotherapy Products Market Trends

The mesotherapy products industry in Europeis being reshaped by rising consumer demand for minimally invasive cosmetic interventions and a strong presence of experienced dermatologists and aesthetic practitioners across the region. Countries such as France, Italy, Spain, and Germany represent key hubs where mesotherapy has been commonly utilized for facial rejuvenation, hair restoration, and body contouring procedures. The method benefits from its flexibility, allowing practitioners to administer tailored formulations that may include hyaluronic acid, vitamins, amino acids, biomimetic peptides, and plant extracts depending on the indication. Growing interest in preventive aesthetics and natural-looking enhancements has further supported adoption, particularly among younger demographics seeking subtle, low-downtime treatments.

The UK mesotherapy products industry is expected to grow steadily over the forecast period. Aesthetic practitioners in the UK often position mesotherapy products as part of a multi-step treatment pathway rather than a standalone solution. Patients frequently undergo mesotherapy combined with or sequenced alongside dermal fillers, chemical peels, micro-needling, or botulinum toxin to enhance outcomes and prolong visible side effects. Hair-focused mesotherapy has also become more prominent, especially in early-stage androgenic alopecia and telogen effluvium cases, where injectables are used to improve follicular microcirculation and scalp vitality.

The mesotherapy products industry in Spain is experiencing significant growth in the regional landscape. The country has a fairly well-established tradition of injectable mesotherapy, used widely in aesthetic medicine for skin rejuvenation, hydration, localized fat reduction, cellulite treatment, and hair or scalp therapy. Many Spanish clinics describe “mesoterapia inyectada” (injected mesotherapy) as a minimally invasive technique involving micro-injections into the dermis. The injected cocktails may include hyaluronic acid, vitamins, amino acids, antioxidants, or lipolytic and bio-stimulatory substances.

The Germany mesotherapy products industry is steadily growing over the forecast period. The use of mesotherapy products in Germany has steadily increased, supported by a mature aesthetic medicine ecosystem and strong demand for non-surgical procedures focused on skin rejuvenation, hydration, and hair restoration. Dermatology and aesthetic clinics commonly integrate mesotherapy as part of individualized treatment plans for early signs of aging, pigmentation concerns, and localized fat reduction. The approach is particularly valued for its subtle outcomes, short recovery time, and compatibility with complementary procedures such as dermal fillers, botulinum toxin, and micro-needling. Growing interest in biostimulatory and regenerative approaches has further contributed to the adoption of formulations containing hyaluronic acid, vitamins, amino acids, and peptide-based complexes.

The mesotherapy products industry in France is growing significantly. French laboratories have played a prominent role in shaping the mesotherapy product market landscape. Laboratoires Filorga (now Fillmed) was among the first in France to develop polyrevitalizing mesotherapy solutions, and its NCTF 135HA formulation, containing non-crosslinked hyaluronic acid with a complex of vitamins, amino acids, coenzymes, minerals, and nucleic acids, is widely used for intradermal injections targeting facial, neck, décolleté, and hand rejuvenation. These injectables are positioned to improve skin hydration, tone, and fine lines without altering facial volumes, aligning with French patient preferences for gradual, natural-looking results. In clinical practice, NCTF-based mesotherapy protocols are typically delivered over multiple sessions, with cumulative effects on skin quality that complement, rather than replace, volumizing filler injections.

Asia Pacific Mesotherapy Products Market Trends

The mesotherapy products industry in the Asia Pacific region is witnessing growth due to consumer spending power in the aesthetics and wellness sector. As a result, minimally invasive treatments such as injectable mesotherapy have become more accessible and appealing to a broader patient base, particularly among younger consumers seeking early anti-aging or preventative skincare interventions. Growing awareness of aesthetic medicine, coupled with rising demand for natural-looking results with limited downtime, has contributed to wider acceptance of mesotherapy as an alternative or complement to traditional cosmetic procedures.

The Thailand mesotherapy products industry is experiencing significant growth. In Thailand, injectable mesotherapy is a common service offered by many private aesthetic and dermatology clinics, especially in major cities like Bangkok. Clinics such as Bangkok Aesthetic Clinic provide mesotherapy skin-revitalization programs where vitamins, amino acids, enzymes, and other nourishing substances are injected micro-intradermally to improve skin hydration, elasticity, and overall radiance, often promoted as a minimally invasive alternative to surgery for facial rejuvenation, contouring, and skin tone enhancement. This creates demand for mesotherapy products across the country.

The mesotherapy products industry in China benefits from increased traction for the non-surgical approach to hair loss management, particularly among individuals experiencing androgenetic alopecia, stress-related shedding, or post-partum hair thinning. The technique, often marketed alongside scalp “growth factor injections”, involves delivering targeted formulations, such as peptides, amino acids, vitamins, trace elements, and, in some protocols, platelet-rich bioactive components, directly into the scalp to improve microcirculation, nourish follicles, and stimulate cellular activity in the hair bulb. For instance, according to the National Council on Aging, in China, approximately 250 million people (1 in 6) suffer from hair loss.

The South Korea mesotherapy products industry has witnessed anincreased focus on new product development. A validated example includes the Rejuran (PDRN) injectable, developed by a South Korean company, PharmaResearch Bio, which has become well recognized across Asia since its introduction. The product is used in clinics to promote dermal repair, improve texture, and support skin regeneration through polynucleotide-based mesotherapy–style injection protocols. Multiple dermatology clinics, such as Oracle Clinic Korea, offer Rejuran as part of mesotherapy-type anti-aging programs aimed at stimulating collagen and improving long-term skin structure rather than providing temporary filling effects. This example demonstrates how Korea is not only a user of mesotherapy products but also a contributor to innovation within the category.

Latin America Mesotherapy Products Market Trends

The mesotherapy products industry in Latin America has observed a significant rise in medical tourism. Similarly, the growing middle-class population with higher disposable incomes in the region allows consumers to invest more in personal care and beauty products. Besides, with improved healthcare and longer life expectancy, more people are prioritizing skincare routines that help maintain a youthful appearance. Consumers are increasingly seeking products that offer hydration, collagen stimulation, and protection against environmental damage, particularly from UV exposure and pollution, which are common in many parts of the region.

The Brazil mesotherapy products industry is growing notably. Injectable mesotherapy is widely practiced in the country and is integrated into dermatology and aesthetic medicine clinics across major cities such as São Paulo, Rio de Janeiro, and Brasília. Treatments are commonly performed to address skin aging, hydration loss, uneven tone, and textural irregularities using intradermal injections of hyaluronic acid, vitamins, amino acids, and bioactive compounds. Many Brazilian clinics also promote mesotherapy as a “preventive aesthetic procedure,” reflecting the country’s strong cultural emphasis on maintaining skin quality and youthful appearance.

Middle East & Africa Mesotherapy Products Market Trends

The mesotherapy products industry in the Middle East is influenced by rising demand for minimally invasive aesthetic procedures, expanding medical tourism, and strong consumer focus on skin quality enhancement rather than surgical facial modification. The Gulf region, in particular, has seen rapid growth in cosmetic procedure uptake, with countries like the UAE and Saudi Arabia emerging among the most active aesthetic markets globally; for example, Dubai Health Authority has publicly reported increasing demand for cosmetic treatments, including injectables, driven by both residents and international patients seeking advanced aesthetic services.

The Saudi Arabia mesotherapy products industry growth isdriven by increasing consumer preference for non-surgical aesthetic procedures, with the rising popularity of mesotherapy products for their ability to enhance skin hydration and texture with minimal downtime. Key drivers of this demand include changing beauty standards that emphasize natural enhancement, rising awareness and education about skincare fueled by social media influencers, and technological advancements in formulation. These factors collectively drive the growth of the market.

Key Mesotherapy Products Company Insight

The market is highly competitive, with several key players. The major market players are focused on expanding their geographical presence, forming partnerships to enhance skin care products and patient care, leveraging key cooperation activities, and exploring mergers and acquisitions.

Key Mesotherapy Products Companies:

The following are the leading companies in the mesotherapy products market. These companies collectively hold the largest market share and dictate industry trends.

- Laboratoires FILLMED

- Revitacare

- Mesoestetic

- Mastelli s.r.l.

- PharmaResearch

- BRPHARM Co., Ltd.

- Teoxane

- Laboratoires VIVACY

- SKIN TECH PHARMA GROUP S.L.U.

- CAREGEN LTD

Recent Development

-

In April 2025, Caregen showcased its core technology-based 'Dr. CYJ Hair Filler, new inner beauty product 'Korglutide', and peptide-based injectable products, such as mesotherapy treatment, at the Dubai Derma 2025 exhibition. This product enhances blood flow and stimulates hair follicle regeneration, providing a minimally invasive alternative to traditional hair loss treatments. Through this exposure, Caregen reinforced its global competitiveness in aesthetic medicine, particularly in markets where demand for effective, non-surgical hair care solutions is high.

-

In December 2023, Teoxane received a CE certification under the Medical Device Regulation (MDR) for its entire injectable product portfolio, including TEOSYAL PureSense and TEOSYAL RHA, making it the first company in its sector to earn this approval. The MDR-CE certification confirms that Teoxane’s products meet rigorous standards of safety, efficacy, and quality, supported by 14 clinical studies across Europe and the U.S.

Mesotherapy Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.1 million

Revenue forecast in 2034

USD 166.7 million

Growth rate

CAGR of 8.2% from 2025 to 2034

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2034

Quantitative units

Revenue in USD million and CAGR from 2025 to 2034

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form factor, indication, application, end use,region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Portugal; Romania; Bulgaria; Czech Republic; Denmark; Sweden; Norway; Russia; Japan; China; Thailand; South Korea; Brazil; Argentina; Mexico; Peru; Colombia; South Africa; Saudi Arabia; UAE; Kuwait: Iran

Key companies profiled

Laboratoires FILLMED; Revitacare; Mesoestetic; Mastelli s.r.l.; PharmaResearch; BRPHARM Co., Ltd.; Teoxane; Laboratoires VIVACY; SKIN TECH PHARMA GROUP S.L.U.; CAREGEN LTD

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to the country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mesotherapy Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. Forthis study, Grand View Research has segmented the global mesotherapy products market report based on product, form factor, indication, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2034)

-

Hyaluronic Acid (non-crosslinked) Revitalizers

-

Polynucleotides (PN) / PDRN Injectables

-

Vitamin, Amino Acid & Peptide Cocktails

-

Antioxidants & Whitening Complexes

-

Minerals, Trace elements, Coenzymes

-

Others

-

-

Form Factors Outlook (Revenue, USD Million, 2021 - 2034)

-

Vials

-

Ampoules

-

Prefilled Syringes (PFS)

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2034)

-

Aging/Revitalization (hydration, texture, glow, fine lines)

-

Firming/Tightening (skin laxity, sagging, body firming)

-

Brightening/Anti-dark spots (pigmentation, photodamage)

-

Anti-cellulite/Lipolytic

-

Hair/Scalp revitalization (density, quality, hair loss support)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2034)

-

Face

-

Full Face (General Revitalization)

-

Periorbital Area

-

Perioral/Lip Zone

-

Cheeks/Mid-face

-

Forehead/Upper face

-

-

Body

-

Hair/Scalp

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2034)

-

Hospitals & Clinics

-

Dermatology Clinics

-

Aesthetic Clinics/MedSpas

-

Chain-based MedSpas

-

Standalone MedSpas

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2034)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Portugal

-

Romania

-

Bulgaria

-

Czech Republic

-

Denmark

-

Sweden

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Peru

-

Colombia

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global mesotherapy products market size was estimated at USD 77.4 million in 2024 and is expected to reach USD 82.1 million in 2025.

b. The global mesotherapy products market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2034 to reach USD 166.7 million by 2034.

b. Europe dominated the mesotherapy products market and accounted for the largest revenue share of 44.4% in 2025. This is owing to the rising consumer demand for minimally invasive cosmetic interventions and a strong presence of experienced dermatologists and aesthetic practitioners across the region.

b. Some key players operating in the mesotherapy products market include Laboratoires FILLMED; Revitacare; Mesoestetic; Mastelli s.r.l.; PharmaResearch; BRPHARM Co., Ltd.; Teoxane; Laboratoires VIVACY; SKIN TECH PHARMA GROUP S.L.U.; and CAREGEN LTD

b. Rising demand for minimally invasive aesthetic treatments, increasing focus on skin quality enhancement, and expanding consumer interest in are some of the major factors driving the growth of the mesotherapy products market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.