- Home

- »

- Advanced Interior Materials

- »

-

Metal Magnesium Market Size Report, 2022-2030GVR Report cover

![Metal Magnesium Market Size, Share & Trends Report]()

Metal Magnesium Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Iron & Steel Making, Die Casting, Aluminum Alloys, Titanium Reduction), By Region (APAC, EU, North America), And Segment Forecasts

- Report ID: GVR-4-68038-894-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Magnesium Market Summary

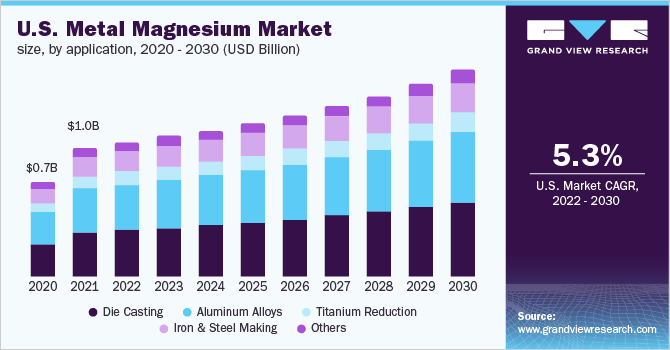

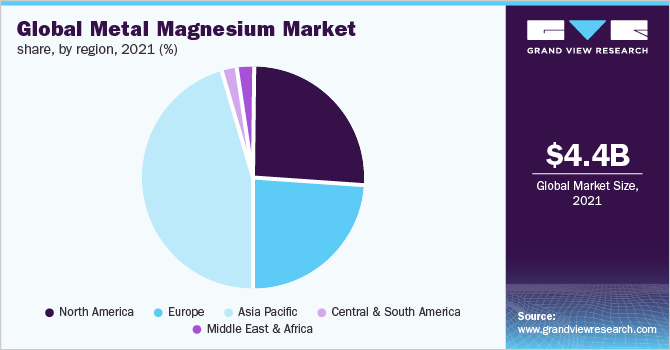

The global metal magnesium market size was valued at USD 4.39 billion in 2021 and is projected to reach USD 6.99 billion by 2030, growing at a CAGR of 5.3% from 2022 to 2030. The market growth is anticipated to be driven by the increasing product demand from die casting and aluminum alloy applications in various end-use industries. Magnesium is ideal for these applications due to its good electromagnetic screening property and heat conductivity.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share of more than 45.0% in 2021

- The market in the North America region is anticipated to witness steady growth over the coming years.

- Based on application, the die casting application segment accounted for the maximum revenue share of more than 37.5% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 4.39 billion

- 2030 Projected Market Size: USD 6.99 billion

- CAGR (2022-2030): 5.3%

- Asia Pacific: Largest market in 2021

It also adds strength to aluminum, which is widely used for these applications. Furthermore, the rising demand for lightweight components, mainly in the automotive and aerospace sectors, is anticipated to augment the market growth over the forecast period. The U.S. is one of the dominant aerospace manufacturers with established players, such as Boeing, Lockheed Martin, and United Technologies. As per the Bureau of Transportation Statistics, the U.S. recorded 1,551 aircraft deliveries in 2020 compared to 1,771 deliveries in 2019.

With the rising demand for aluminum alloys and titanium in aerospace parts production, metal magnesium is likely to witness growing demand over the forecast period. Magnesium and aluminum alloys are witnessing growing adoption in the aerospace and automotive industries owing to their high-strength-to-weight ratio, stiffness-to-weight ratio, machinability, and lightweight properties.

Also, with their ability to withstand extreme conditions, they are widely used in the construction of ballistic missiles and spacecraft as they require lightweight materials that can also resist short wave electromagnetic radiation. Increasing environmental concerns and the implementation of stringent pollution control norms across the world are further propelling the product demand. Furthermore, magnesium is used in the production process of metallic titanium. The usage of titanium alloys ranges from aerospace to the medical industry. Thus, the rapid growth of these industries is anticipated to propel the market growth over the forecast period.

Magnesium alloys are also seen as an alternative to fiber metal laminates or carbon fiber composites owing to their comparative strength and relatively lower cost. Also, with the recent changes to the aircraft seat design standards, these can be used in the production of seats in helicopters, transport aircraft, and general aviation aircraft, thereby further augmenting the product demand in the aerospace industry. Despite the rising demand for metal magnesium, certain limitations are restricting the market growth, such as concerns related to magnesia mining activities, which have adverse effects on the surrounding ecosystem. To counter this, several governments and regulatory bodies across the world have enacted various environmental laws to regulate such activities.

Application Insights

The die casting application segment accounted for the maximum revenue share of more than 37.5% in 2021. The trend is expected to continue with the segment registering the fastest CAGR over the forecast period. Magnesium is used as an ideal material in die casting applications owing to its good heat conductivity and electromagnetic screening property. Aluminum alloys are the second-most vital application segment of the market. Aluminum alloys are widely used in engineering components and structures where corrosion resistance and lightweight properties are required.

Increasing demand for lightweight materials in aircraft production for reducing the weight of commercial aircraft is expected to drive the segment growth. Titanium and its alloys are widely used in multiple applications due to their excellent strength, good chemical stability, and low density. Titanium is majorly used in spacecraft, aircraft, and missiles and is increasingly being used in the medical field as well. The rising demand for titanium from various industries is projected to increase its production and eventually propel the demand for magnesium.

Magnesium is an important reagent in the production of iron and steel making as it is used for removing excessive sulfur from hot metal, which is a necessary step for creating high-quality steel. In addition, magnesium alloys have several applications, such as in the production of aircraft, spacecraft, machinery, automobiles, portable tools, and household appliances, and these are also being used in steering columns, gearboxes, seat frames, steering wheels, and in other automotive machinery.

Regional Insights

Asia Pacific accounted for the largest revenue share of more than 45.0% in 2021 and is estimated to expand further at the fastest CAGR from 2022 to 2030. Increasing consumption of aluminum and steel from the end-use industries, such as electric vehicles (EVs) and construction, are the key factors driving the APAC regional market growth. In addition, the rising demand from the automotive and aerospace industries in China and India is expected to support the market growth in this region. Moreover, the demand from the steel industry in India and Japan will facilitate the overall market growth. North America accounted for the second-largest revenue share of the global market in 2021.

The market in the North America region is anticipated to witness steady growth over the coming years. This is mainly attributed to the rising demand for aluminum and titanium alloys from the automotive and aerospace & defense industries. In Europe, the demand for EVs has risen, which can be seen with a 137% increase in EV sales from 2019 to 2020. In addition, defense spending in Russia and Italy has expanded with an increase in demand for aircraft, missiles, etc. Thus, the positive outlook of the aerospace, transportation, and electrical & electronic industries in European countries is expected to drive the regional market over the projected period.

Key Companies & Market Share Insights

The market is competitive with the presence of several regional and global players. These players compete on the basis of product innovation and quality, brand reputation, market presence, and price to sell to various industries.The companies are focusing on various acquisition and expansion strategies to stay ahead of the competition. For instance, in January 2021, Nanjing Yunhai Special Metals Co., Ltd. expanded its presence from North China to South China by acquiring Tianjin Liuhe Magnesium, a magnesium parts producer for automobiles and bicycles with a production capacity of 8,000 tons per year. Some of the prominent players in the global metal magnesium market include:

-

Alliance Magnesium

-

Esan Eczacibasi

-

Latrobe Magnesium

-

Nippon Kinzoku Co. Ltd.

-

Regal Metal

-

Shanghai Sunglow Investment (Group) Co., Ltd.

-

SolikamskDesulphurizer Works (SZD)

-

U.S. Magnesium LLC

-

VSMPO-Avisma Corp.

-

Western Magnesium Corp.

Metal Magnesium Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.58 billion

Revenue forecast in 2030

USD 6.99 billion

Growth rate

CAGR of 5.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; APAC; CSA; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; China; Japan; India; Brazil; South Africa; Saudi Arabia

Key companies profiled

NipponKinzoku Co. Ltd.; VSMPO-Avisma Corp.; SolikamskDesulphurizer Works (SZD); Western Magnesium Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global metal magnesium market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Die Casting

-

Aluminum Alloys

-

Titanium Reduction

-

Iron & Steel Making

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global metal magnesium market size was estimated at USD 4.39 billion in 2021 and is expected to reach USD 4.58 billion in 2022.

b. The global metal magnesium market is expected to grow at a compound annual growth rate of 5.3% from 2022 to 2030 to reach USD 6.99 billion by 2030.

b. Based on the application segment, die casting held the largest revenue share of more than 37.0% in 2021, as magnesium is used in several industries as an ideal material in die casting applications, owing to its good heat conductivity and electromagnetic screening property of magnesium.

b. The key players operating in the metal magnesium market include Nippon Kinzoku Co. Ltd, VSMPO-avisma Corporation, Solikamsk Desulphurizer Works (SZD), Western Magnesium Corporation, among others.

b. Rising demand for lightweight parts in the automotive and aerospace industries and an increase in the demand for titanium are the key factors driving the growth of the metal magnesium market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.