- Home

- »

- Plastics, Polymers & Resins

- »

-

Metallized Films Market Size, Share, Industry Report, 2030GVR Report cover

![Metallized Films Market Size, Share & Trends Report]()

Metallized Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Metal (Aluminum, Others), By Material (Polypropylene (PP), Polyethylene Terephthalate (PET)), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-519-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metallized Films Market Size & Trends

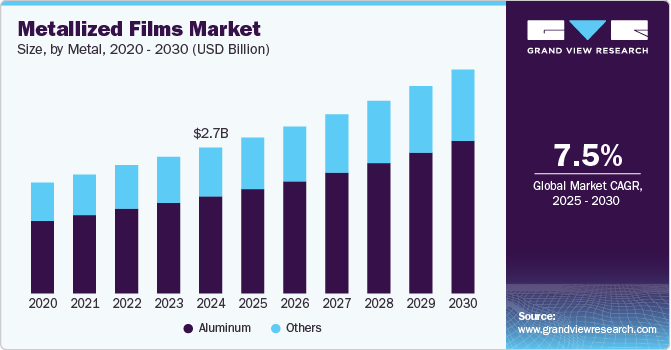

The global metallized films market size was estimated at USD 2.72 billion in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. The growing demand for sustainable and lightweight packaging solutions across various industries, particularly in food and beverage and electronics, is driving the demand for metallized films, thus accelerating market growth.

Metallized films, made primarily of plastic substrates such as PET, BOPP, and CPP with a thin layer of metal coating, provide excellent barrier properties against moisture, oxygen, and UV radiation. This enhances product shelf life while reducing material usage compared to traditional aluminum foils. Brands such as Nestlé and PepsiCo are incorporating metallized films into their flexible packaging to improve sustainability and meet eco-friendly packaging goals.

The food and beverage industry is one of the largest consumers of metallized films, driving the significant market growth. The increasing consumer preference for ready-to-eat meals, packaged snacks, and convenience foods has led to a surge in demand for packaging materials that maintain freshness, prevent spoilage, and enhance visual appeal. Metallized films provide superior aesthetics with a metallic shine, making them ideal for branding and premium product differentiation. Companies such as Mondelēz International use metallized films in snack packaging to improve visual appeal and extend product shelf life, reducing food waste.

Metallized films have widespread applications in the electronics and insulation industries, playing a crucial role in various high-performance components. In the electronics sector, these films are used in capacitors due to their high dielectric strength, lightweight properties, and resistance to moisture. With the increasing adoption of electric vehicles (EVs), smartphones, and renewable energy storage solutions, the demand for high-performance capacitors is rising, consequently driving metallized film consumption. In addition, metallized films serve as effective thermal insulation materials in construction, automotive, and aerospace applications, further expanding market opportunities.

Metal Insights

The aluminum segment recorded the largest market revenue share of over 66.0% in 2024 and is projected to grow at the fastest CAGR of 7.9% over the forecast period. Aluminum metallized films are the most widely used in the market due to their superior barrier properties, lightweight nature, and cost-effectiveness. These films are extensively used in the food and beverage industry for packaging applications such as snack pouches, confectionery wraps, and dairy product packaging. In addition, they find applications in insulation, electronics, and decorative uses due to their reflective and insulating properties.

The others segment includes metallized films produced using metals such as copper, silver, and other specialized coatings. While less common than aluminum, these metallized films are used in specific applications that require enhanced conductivity, antimicrobial properties, or superior barrier protection. Copper metallized films are utilized in electronic and EMI shielding applications due to their excellent electrical conductivity. Silver metallized films are sometimes used in premium packaging, medical applications, and high-end electronics due to their antimicrobial and high-reflective properties.

Material Insights

The polypropylene (PP) material segment held the largest market share of over 47.0% in 2024. PP metallized films are widely used in packaging applications due to their lightweight nature, excellent moisture barrier properties, and cost-effectiveness. The growing demand for flexible packaging, especially in the food and beverage sector, is a key driver for PP metallized films segment. Increasing consumer preference for lightweight and sustainable packaging solutions has further boosted their adoption.

Polyethylene Terephthalate (PET) is projected to grow at the fastest CAGR of 8.0% during the forecast period. The rising demand for high-performance packaging solutions, particularly in the food, electronics, and pharmaceutical industries, is fueling the growth of PET metallized films. Their recyclability and eco-friendly nature align with sustainability trends, further driving market adoption. In addition, the increasing use of PET films in high-barrier applications, including vacuum insulation panels and flexible electronics, has contributed to their expanding market presence.

End Use Insights

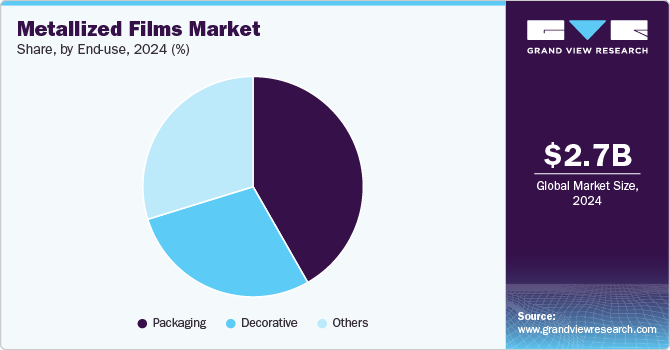

The packaging segment held the largest market share of over 41.0% in 2024 and is anticipated to grow at the fastest CAGR of 7.8% during the forecast period. Metallized films are widely used in packaging applications, primarily in the food and beverage, pharmaceutical, and personal care industries. These films offer excellent barrier properties against moisture, oxygen, and UV light, extending the shelf life of packaged products. They are commonly used in flexible packaging solutions such as pouches, wrappers, and laminated films for snacks, coffee, dairy products, and pet food.

Metallized films are extensively used in decorative applications, including gift wrapping, labels, banners, and interior design elements. These films provide a glossy, metallic appearance, making them ideal for enhancing product aesthetics. They are also used in the production of holographic films for branding and security applications, such as anti-counterfeiting labels and currency security features.

The others segment includes applications such as insulation, electronics, and industrial uses. In insulation, metallized films are used in reflective insulation materials for buildings and automotive applications due to their thermal resistance properties. In electronics, they are utilized in capacitors, printed circuit boards, and EMI shielding solutions. Other industrial applications include solar panels, textiles, and anti-static films for sensitive components.

Regional Insights

North America metallized films industry dominated globally and accounted for the largest revenue share of over 31.0% in 2024. The region's strong focus on sustainability has also been a key driver, with metallized films offering an environmentally friendly alternative to traditional aluminum foil. For example, major food manufacturers such as General Mills and Kraft Heinz have been transitioning to metallized films for their packaging needs. In addition, the region's established electronics and automotive industries contribute to demand, as metallized films are used in capacitors, insulation, and decorative applications in these sectors.

U.S. Metallized Films Market Trends

The U.S. metallized films industry is primarily driven by its strong packaging industry, especially in the food and beverage sector. Major companies such as PepsiCo, Kraft Heinz, and General Mills continuously require high-performance metallized films to enhance product life and appeal. In addition, the market benefits from advanced domestic manufacturing capabilities and ongoing technological innovation. Leading manufacturers such as Toray Plastics America and Flex Films USA has heavily invested in research and development, producing specialized metallized films tailored for various applications.

Europe Metallized Films Market Trends

The metallized films industry in Europe lays strong emphasis on circular economy principles and recycling infrastructure, which is driving the growth of the market. Countries such as Germany and the Netherlands have implemented advanced recycling systems that can effectively process metallized films, making them more attractive to environmentally conscious consumers and businesses. In addition, the European Union's regulations on plastic reduction have created a favorable market environment for metallized films. This regulatory framework, combined with consumer demand for sustainable packaging, has encouraged local converters and packaging companies to invest in metallized film production and processing capabilities, further strengthening Europe's position in the global market.

The metallized films market in the UK is primarily driven by its robust food and beverage packaging industry, coupled with increasing consumer demand for sustainable packaging solutions. Major UK retailers such as Tesco, Sainsbury's, and Marks & Spencer have been actively pushing for packaging that extends shelf life while reducing food waste. Moreover, the country's emphasis on sustainability and recycling regulations has boosted the metallized films industry in the country.

Asia Pacific Metallized Films Market Trends

The Asia Pacific metallized films industry’s growth is primarily driven by its robust packaging industry, particularly in countries such as China, India, Japan, and South Korea. The region's large population base, coupled with rising disposable incomes and changing consumer preferences toward packaged foods and beverages, has created substantial demand for metallized films. In addition, the region's electronics and solar panel manufacturing sectors are also significant contributors to metallized film demand. Countries such as South Korea, Taiwan, and Japan are global leaders in electronics production, where metallized films are extensively used in capacitors, circuit boards, and display technologies.

The metallized films industry in China is primarily driven by its massive manufacturing ecosystem and growing packaging industry. The country has established itself as a manufacturing powerhouse for flexible packaging materials, with numerous large-scale production facilities dedicated to metallized films. In addition, the explosive growth of China's e-commerce sector has created unprecedented demand for metallized films, particularly in food packaging and consumer goods.

Key Metallized Films Company Insights

The metallized films industry is highly competitive, with key players focusing on innovation, strategic partnerships, and capacity expansions to strengthen their market position. Companies such as Toray Industries, Cosmo Films, Uflex Limited, and Jindal Poly Films dominate the industry, leveraging advanced R&D and sustainable product offerings to gain a competitive edge. In addition, the rising demand for sustainable packaging solutions has led to increased investments in bio-based and recyclable metallized films, further intensifying competition. Regional players also play a significant role, particularly in emerging markets, by offering cost-effective solutions tailored to local industries.

-

In January 2025, Jindal Films completed the installation of a new metallizer at its Brindisi plant in Italy. This installation marks a significant milestone for Jindal Films Europe (JFE), increasing its metallization capacity. The company aims to support the growing demand for recyclable barrier BOPP (Biaxially Oriented Polypropylene) and BOPE (Biaxially Oriented Polyethylene) films with this new equipment.

-

In December 2023, Cosmo Films launched metalized electrical grade BOPP films for capacitor applications. These films are used in the manufacturing of AC and DC capacitors, which have various applications ranging from electronics appliances, industrial applications, power electronics, automobiles, electric vehicles, and renewable power systems. The films will be manufactured under clean room conditions with micro-slitting capability and a thickness ranging from 2.5 to 12 microns

Key Metallized Films Companies:

The following are the leading companies in the metallized films market. These companies collectively hold the largest market share and dictate industry trends.

- Toray Industries

- Cosmo Films

- Polibak

- DUNMORE

- Jindal Poly Films Limited

- Sumilon Group

- Flex Films

- SUKI CREATIONS PVT. LTD.

- Nahar PolyFilms Ltd.

- Zhejiang Changyu New Materials Co., Ltd.

- Paragon Poly Films Pvt Ltd.

- Qingdao Cloud film Packaging materials Co., Ltd.

- Emperial Films LLP

- FILIRIKO

Global Metallized Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,908.6 million

Revenue forecast in 2030

USD 4,175.6 million

Growth Rate

CAGR of 7.5% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Metal, material, end use, region

States scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Key companies profiled

Toray Industries; Cosmo Films; Polibak; DUNMORE; Jindal Poly Films Limited; Sumilon Group; Flex Films; SUKI CREATIONS PVT. LTD.; Nahar PolyFilms Ltd.; Zhejiang Changyu New Materials Co., Ltd.; Paragon Poly Films Pvt Ltd.; Qingdao Cloud film Packaging Materials Co., Ltd.; Emperial Films LLP; FILIRIKO

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metallized Films Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metallized films market report based on metal, material, end use, and region:

-

Metal Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Decorative

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global metallized films market was estimated at around USD 2.72 billion in the year 2024 and is expected to reach around USD 2,908.6 million in 2025.

b. The global metallized films market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach around USD 4,175.6 million by 2030.

b. Packaging emerged as a dominating end use segment with a value share of around 41.0% in the year 2024, owing to the increasing demand for lightweight, cost-effective, and high-barrier packaging solutions across various industries.

b. The key players in the metallized films market include Toray Industries; Cosmo Films; Polibak; DUNMORE; Jindal Poly Films Limited; Sumilon Group; Flex Films; SUKI CREATIONS PVT. LTD.; Nahar PolyFilms Ltd.; Zhejiang Changyu New Materials Co., Ltd.; paragon poly films pvt ltd.; Qingdao Cloud film Packaging materials Co., Ltd.; Emperial Films LLP; and FILIRIKO

b. The growing demand for sustainable and lightweight packaging solutions across various industries, particularly in food and beverage, and electronics is driving the demand for the metallized films, thus accelerating the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.