Methane Sulfonic Acid Market Size & Trends

The global Methane Sulfonic Acid Market was valued at USD 710.0 million in 2022 and is expected to grow at a CAGR of 4.40% over the forecast period. The expansion of industries such as pharmaceuticals, agrochemicals, and specialty chemicals is an essential driver for the methane sulfonic acid market.Methane Sulfonic Acid is commonly used as a catalyst and solvent in a variety of chemical processes such as esterification, alkylation, and polymerization.

The COVID-19 pandemic unleashed a profound and multifaceted impact on the Methane Sulfonic Acid Market. As the global economy grappled with lockdowns, travel restrictions, and economic contractions, the demand for raw materials and production of chemicals plummeted. Many manufacturers witnessed difficulties obtaining critical inputs, resulting in supply shortages and price increases. This has a direct impact on methane sulfonic acid demand, as it is employed in a variety of industrial operations. Moreover, the pandemic had a negative impact on the construction and automobile industries, which employ methane sulfonic acid in a variety of applications. Reduced building projects and a decline in vehicle manufacturing and sales resulted in a drop in methane sulfonic acid demand in these industries.

The market is expanding as the usage of methane sulfonic acid rises. Ongoing research & development operations are resulting in the identification of new applications for methane sulfonic acid, which is projected to fuel market expansion in the coming years.MSA is frequently used as a substitute for hazardous and corrosive acids in a variety of applications.

Furthermore, due to its efficiency as a catalyst and solvent, methane sulfonic acid is highly preferred in pharmaceutical formulations and medical applications. Growing healthcare demand is likely to boost market expansion in the future years. The global demand for methane sulfonic acid in the pharmaceutical and medical industries is increasing, creating considerable growth potential for market incumbents.

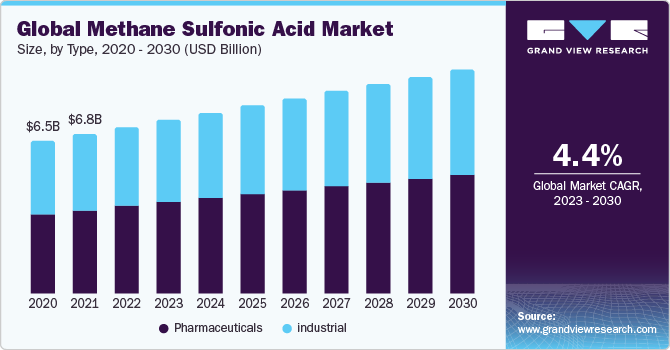

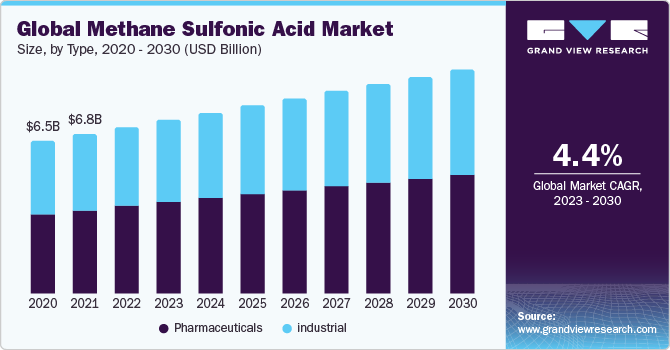

Type Insights

Based on the type, the Methane Sulfonic Acid Market is segmented into pharmaceuticals and industrial. The pharmaceutical type segment held the largest market share in 2022. Methane sulfonic acid is a significant organic acid which is utilized to make pharmaceutical ingredients such as Eprosartan, Telmisartan, and Angiotensin II receptor antagonists. The pharmaceutical sector is expanding globally, fueled by factors such as an aging population, rising healthcare costs, and the development of novel drugs and treatments. The expansion of the industry has a direct impact on Methane Sulfonic Acid demand as a major reagent in medication manufacture and synthesis. This factor is expected to fuel segment growth in the forecast period.

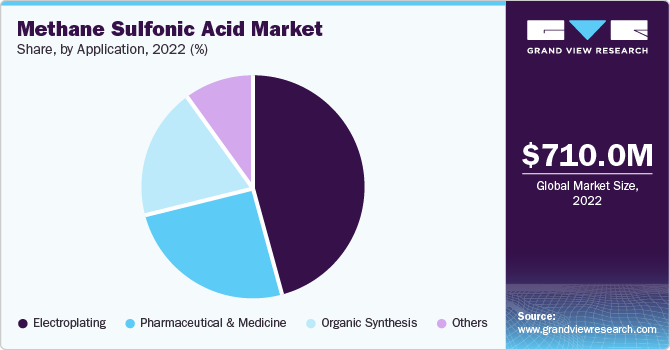

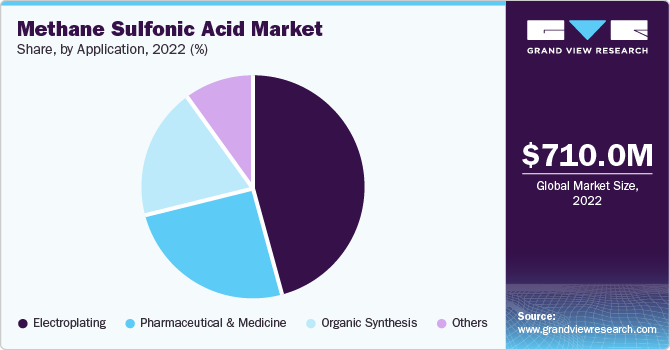

Application Insights

Based on application, the methane sulfonic acid market is segmented into electroplating, pharmaceuticals & medicine, organic synthesis, and others. Electroplating segment dominated the application segmentation in 2022. Methane sulfonic acid is used as a supportive electrolyte in electrochemical activities. Traditional commercial electrolytes can be replaced with methane sulfonic acid during the plating process, providing a more ecologically friendly alternatives. Electroplating is frequently used to protect fabricated metal components from corrosion. These factors fuels demand for methane sulfonic acid as a crucial component of the electroplating process.

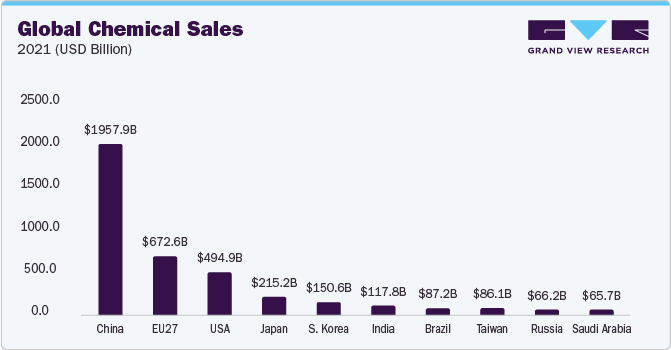

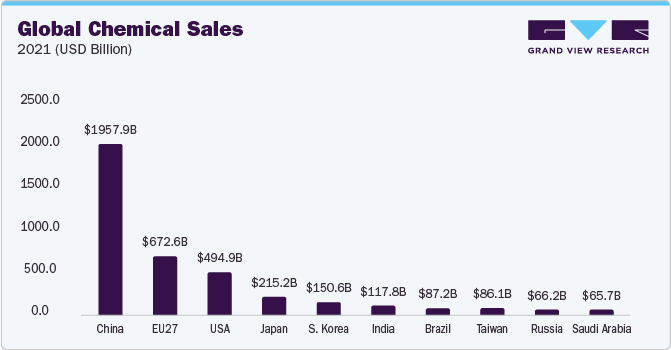

Regional Insights

North America dominated the largest market share in 2022. The Methane Sulfonic Acid Market in the North American region holds immense significance attributed to the fast increasing pharmaceutical sector. Methane sulfonic acid is widely utilized in the pharmaceutical sector due to its efficiency as a catalyst and solvent. The increased demand from the healthcare sector is likely to boost market expansion in North America. Moreover, the expansion of industries such as aerospace, automotive, and construction in North America is increasing demand for methane sulfonic acid, fueling the region's revenue growth.

U.S., in particular, has emerged as a dominant player in the North America Methane Sulfonic Acid Market. The country's booming economy, industrial production, and consumer spending have fueled a substantial increase in demand for the product across several industries. Consequently, the development of renewable energy and energy storage technologies is likely to boost the demand for methane sulfonic acid in the U.S. methane sulfonic acid is widely used in the pharmaceutical industry in the U.S. in order to be used in drug production procedures, API synthesis, and other pharmaceutical applications.

Key Companies & Market Share Insights

Key players operating in the market are Arkema Group, Shinya Chem, Yanuo Chemical, BASF SE, Xingchi Science and Technology, Langfang Jinshenghui Chemical Co., Ltd., Oxon Italia S.p.A., Key competitive factors in the Methane Sulfonic Acid Market is operational efficiency. Manufacturers aim to maximize their efficiency to reduce costs and enhance profitability. This often involves investments in advanced technologies, process optimization, and maintenance practices. Manufacturers that can consistently operate at high levels of efficiency tend to have a competitive advantage in terms of cost-effectiveness.

In June 2022, Avantor, Inc. announced the partnership with GeminiBio to supply cell culture media and custom hydrated solutions to the biopharma industry. This new capacity is expected to increase portfolio of proprietary services, demonstrating Avantor's commitment to supporting customer workflows in both upstream and downstream biopharma processing.

In May 2022, BASF announced its expansion of methane sulfonic acid manufacturing in Ludwigshafen. BASF has invested a high amount to boost production capacities at the Verbund location in Ludwigshafen in response to growing customer demand.The investment boosts capacity at the Ludwigshafen facility to 50,000 metric tons per year. BASF is retorting to the growing global demand for high-performance and sustainable formulations by increasing production quantities.