- Home

- »

- Organic Chemicals

- »

-

Methyl Ethyl Ketone Market Size, Industry Report, 2033GVR Report cover

![Methyl Ethyl Ketone Market Size, Share & Trends Report]()

Methyl Ethyl Ketone Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Paints & Coatings, Printing Inks, Others), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-209-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Methyl Ethyl Ketone Market Summary

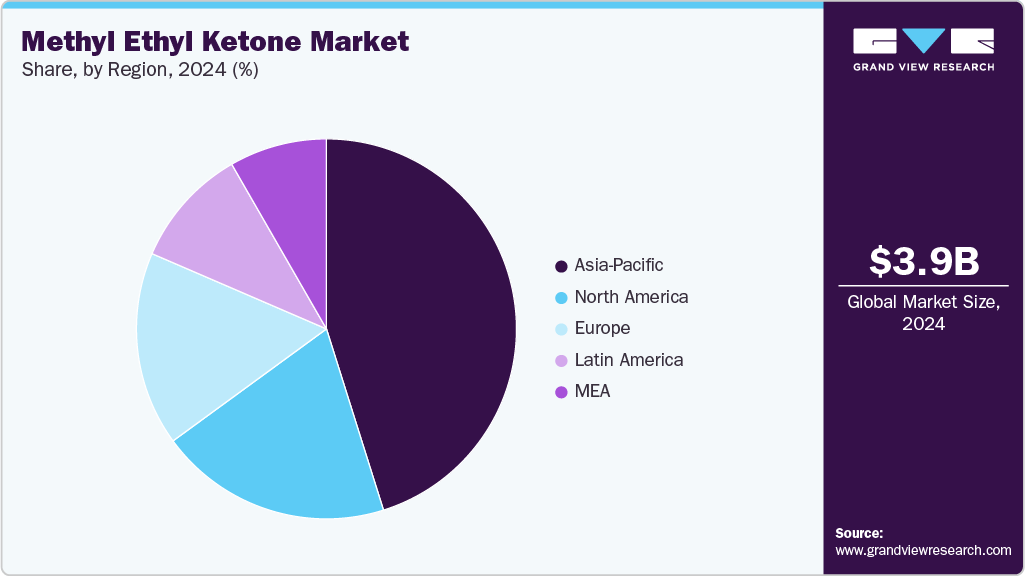

The global methyl ethyl ketone market size was estimated at USD 3,920.2 million in 2024 and is projected to reach USD 5,926.8 million by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The market is primarily driven by its extensive use as a high-performance solvent in paints, coatings, adhesives, and printing inks, particularly across the automotive, construction, and packaging industries.

Key Market Trends & Insights

- Asia Pacific dominated the Methyl Ethyl Ketone (MEK) market with the largest revenue share of 55.9% in 2024.

- The Asia Pacific Methyl Ethyl Ketone (MEK) market is projected to grow at a CAGR of 5.1% from 2025 to 2033.

- By application, paints & coatings dominated the Methyl Ethyl Ketone (MEK) market with a revenue share of 54.1% in 2024.

- By application, printing inks is expected to grow the fastest in Methyl Ethyl Ketone (MEK) market with a CAGR 5.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3,920.2 Million

- 2033 Projected Market Size: USD 5,926.8 Million

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

Its fast evaporation rate and excellent solvency make it ideal for surface coatings and resin processing. In addition, the growing industrialization and infrastructure development in emerging economies, especially in Asia-Pacific, are further accelerating methyl ethyl ketone (MEK) demand across end-use sectors. The market is primarily driven by growing demand in paints and coatings, adhesives, and printing ink sectors, fueled by expansion in automotive, construction, and packaging industries. Rising urbanization and infrastructure development in emerging economies are boosting consumption of coatings and adhesives, directly impacting MEK demand. In addition, MEK’s superior solvency, low boiling point, and compatibility with various resins make it a preferred choice for high-performance formulations. Environmental regulations promoting solvent recovery and efficient usage also influence market dynamics by encouraging adoption in controlled applications.

Methyl Ethyl Ketone (MEK), also known as butanone, is a highly effective, fast-evaporating solvent widely used in industrial and commercial applications. It plays a crucial role in the production of surface coatings, adhesives, synthetic resins, and printing inks. MEK’s ability to dissolve many substances makes it indispensable in manufacturing processes, especially for automotive refinishing, furniture coatings, and flexible packaging. It also serves as an intermediate in chemical synthesis and is used in dewaxing lubricating oils. The Asia-Pacific region dominates MEK consumption, driven by rapid industrial expansion and manufacturing activity.

Market Concentration & Characteristics

The methyl ethyl ketone (MEK) industry exhibits a moderately consolidated structure, dominated by a few large players that are vertically integrated across the value chain. Major companies such as ExxonMobil, Maruzen Petrochemical, Sasol, Shell Chemicals, and Arkema dominate the landscape due to their integrated operations, strong distribution networks, and consistent product quality. These players often control upstream feedstock availability and possess the technological capabilities for efficient MEK manufacturing, creating high entry barriers for smaller or new entrants. Regional production capacity is concentrated in Asia-Pacific, particularly China and Japan, while North America and Europe maintain a steady but smaller share. Strategic partnerships, capacity expansions, and product innovation remain central to maintaining competitiveness in this moderately concentrated market.

In addition to the dominance of key global producers, the MEK market is influenced by regional supply dynamics and trade flows, which further impact market concentration. For instance, Asia-Pacific not only leads in consumption but also in production capacity, often resulting in export-oriented supply chains that shape pricing and availability in other regions such as Europe, Latin America, and the Middle East. Moreover, fluctuations in feedstock availability (especially butylene) and compliance with environmental regulations, such as restrictions on volatile organic compounds (VOCs) have prompted some capacity rationalizations, reinforcing dependence on established players. As a result, while the market is not highly monopolistic, the limited number of large-scale producers ensures that pricing and supply decisions are concentrated among a handful of influential companies.

Application Insights

Paints & coatings segment by application dominated the market with a market share of 54.1% in 2024. The segment growth is due to its excellent solvency, fast evaporation rate, and compatibility with various resins. MEK is widely used in automotive, industrial, and protective coatings to enhance drying time and finish quality. Growing infrastructure development and vehicle production, especially in Asia-Pacific, continue to drive MEK demand in this segment. In addition, its role in high-performance and durable coating formulations strengthens its market relevance.

Printing inks segment is expected to grow fastest with a CAGR of 5.3% from 2025 to 2033 during the forecast period, due to its rapid drying properties, strong solvency, and ability to dissolve various resins and dyes. It is widely used in flexographic and gravure printing processes, especially for packaging materials such as plastic films and foils. The rising demand for flexible and high-speed packaging in food, pharmaceuticals, and consumer goods sectors is driving MEK consumption in this segment. Its performance in high-speed printing lines makes it a preferred solvent for consistent ink adhesion and clarity.

Regional Insights

The North America methyl ethyl ketone (MEK) industry is driven by strong demand from the automotive, aerospace, and construction industries, where MEK is used extensively as a solvent in coatings, adhesives, and sealants. The United States leads the region, supported by robust industrial production and infrastructure projects. Environmental regulations on VOC emissions also influence the market, prompting manufacturers to optimize solvent usage and invest in recovery technologies. Despite regulatory pressures, MEK maintains steady demand due to its efficiency and compatibility with various industrial applications.

U.S. Methyl Ethyl Ketone Market Trends

The U.S. methyl ethyl ketone industry is driven by strong demand from the automotive, construction, and packaging industries, where it is used as a key solvent in coatings, adhesives, and printing inks. Stringent environmental regulations on VOC emissions are encouraging manufacturers to adopt cleaner technologies and improve solvent recovery. Despite regulatory challenges, MEK remains essential due to its fast evaporation and excellent solvency, supporting steady market growth.

Asia Pacific Methyl Ethyl Ketone Market Trends

The methyl ethyl ketone industry in Asia Pacific dominated with a 45.1% revenue share in 2024, driven by the rapid industrialization, urbanization, and expansion in construction, automotive, and electronics manufacturing across key markets like China, India, Japan, South Korea, and Southeast Asia.

China methyl ethyl ketone (MEK) industry being the leading global manufacturer of MEK, the country enjoys cost and scale advantages while also supplying export markets. A key driver is rapid industrial growth, spurred by infrastructure investment and increasing automotive & electronics output, that continually boosts solvent demand. Government environmental policies targeting VOC emissions and carbon intensity impose stricter regulations, raising compliance costs and prompting industry consolidation among domestic producers.

Europe Methyl Ethyl Ketone Market Trends

The Europe methyl ethyl ketone (MEK) industry is relatively mature and stable, with moderate growth driven by demand in industrial coatings, adhesives, and printing inks. Countries such as Germany, France, and Italy lead consumption, primarily due to their well-established automotive, construction, and packaging sectors. MEK is widely used in surface coatings for vehicle components, machinery, and metal structures, where its fast-drying and strong solvency properties are essential.

Middle East & Africa Methyl Ethyl Ketone Market Trends

The methyl ethyl ketone industry in the Middle East & Africa is emerging, with growth largely driven by industrialization, construction, and packaging sectors in countries such as Saudi Arabia, the UAE, and South Africa. The region benefits from expanding petrochemical production, which supports local MEK availability. However, demand remains lower compared to other regions due to less diversified manufacturing bases. Environmental regulations are less stringent than in Europe or North America, but increasing focus on sustainability could shape future market trends.

Latin America Methyl Ethyl Ketone Market Trends

The methyl ethyl ketone industry In Latin America is growing steadily, supported by expanding automotive manufacturing, packaging, and construction activities in countries like Brazil and Mexico. Increasing urbanization and infrastructure development are fueling demand for paints, coatings, and adhesives that rely on MEK as a solvent. However, the market is somewhat constrained by economic fluctuations and regulatory uncertainties. Local production capacity remains limited, so imports play a significant role in meeting regional demand.

Key Methyl Ethyl Ketone Company Insights

Some of the key players operating in the methyl ethyl ketone (MEK) industry include ExxonMobil Corporation and Shell Plc.

-

ExxonMobil Corp. is a global manufacturer & supplier of synthetic lubricants. The company mainly deals in three business segments that include upstream (oil & gas, E&P, shipping and wholesale operations), downstream (refining, marketing and retail operations) and chemicals. The product portfolio of the company includes consumer, commercial, industrial, aviation, marine lubricants, base stocks & specialty products. ExxonMobil owns 37 oil refineries in 21 countries with refining capacity of 6.3 million barrels per day.

Arkema SA and Sasol Limited are emerging market participants in the Methyl Ethyl Ketone (MEK) industry.

-

Arkema is engaged in the manufacturing of specialty chemicals and advanced materials. It operates through three segments: high-performance materials, coating solutions, and industrial specialties. The company caters its products to end-use industries including construction, electrical & electronics, food & agrochemicals, health, hygiene & beauty, oil & gas, paper & packaging, renewable energies, sports, and transportation. The company has 151 production plants in 55 countries.

Key Methyl Ethyl Ketone Companies:

The following are the leading companies in the methyl ethyl ketone market. These companies collectively hold the largest market share and dictate industry trends.

- Shell Plc

- ExxonMobil Corporation

- Arkema S.A.

- Sasol Limited

- INEOS Group

- Maruzen Petrochemical Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Nouryon

- ENEOS Corporation

- Nova Molecular Technologies

- Cetex Petrochemicals

- Kishida Chemical Co.,

- Vivochem

- Arpadis

- Muby Chemicals

Recent Developments

-

In October 2022, Arkema announced a reorganization of the distribution of its organic peroxides in Europe, focusing on improving customer service, efficiency, and proximity. The company is partnering with new distributors for specific countries and products, aiming to streamline its supply chain and strengthen its regional presence. This change is part of Arkema’s strategy to support its customers more closely and enhance its functional additives business.

Methyl Ethyl Ketone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,104.4 million

Revenue forecast in 2033

USD 5,926.8 million

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Report updated

August 2025

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Shell Plc; ExxonMobil Corporation; Arkema S.A.; Sasol Limited; INEOS Group; Maruzen Petrochemical Co., Ltd.; Idemitsu Kosan Co., Ltd.; Nouryon; ENEOS Corporation; Nova Molecular Technologies; Cetex Petrochemicals; Kishida Chemical Co.; Vivochem; Arpadis; Muby Chemicals

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Methyl Ethyl Ketone Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global Methyl Ethyl Ketone (MEK) market report based on application and region

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Paints & Coatings

-

Printing Inks

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global methyl ethyl ketone market size was estimated at USD 3920.2 million in 2024 and is expected to reach USD 4,104.4 million in 2025.

b. The global methyl ethyl ketone market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 5,926.8 million by 2033.

b. The MEK market in Asia Pacific dominated with a 45.1% revenue share in 2024, driven by the rapid industrialization, urbanization, and expansion in construction, automotive, and electronics manufacturing across key markets like China, India, Japan, South Korea, and Southeast Asia.

b. Some key players operating in the methyl ethyl ketone market include Shell Plc, ExxonMobil Corporation, Arkema S.A., Sasol Limited, INEOS Group, Maruzen Petrochemical Co., Ltd., Idemitsu Kosan Co., Ltd., Nouryon, ENEOS Corporation, Nova Molecular Technologies, Cetex Petrochemicals, Kishida Chemical Co., Vivochem, Arpadis, and Muby Chemicals

b. Key factors that are driving the market growth include positive demand outlook for adhesives, printing inks, paints, and coatings, on account of increasing construction spending, particularly in Asia Pacific and Middle East regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.