- Home

- »

- Advanced Interior Materials

- »

-

Metrology Equipment Market Size And Share Report, 2030GVR Report cover

![Metrology Equipment Market Size, Share & Trends Report]()

Metrology Equipment Market Size, Share & Trends Analysis Report By Type (Coordinate Measuring Machine, Optical Digitizer & Scanner) By End-use (Manufacturing, Automotive, Aerospace, Electronics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-439-4

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Metrology Equipment Market Size & Trends

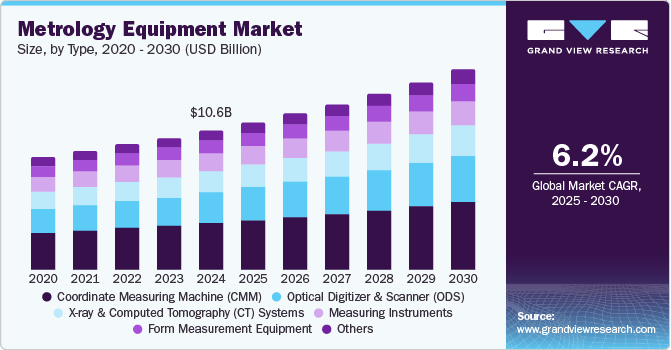

The global metrology equipment market size was estimated at USD 10.0 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. The growth of the global market is driven by several key factors. Increasing industrial automation and the need for precision in manufacturing processes are major contributors, as industries seek to ensure high quality and accuracy in their products.

The expanding aerospace and automotive sectors drive demand, requiring precise measurements and quality control to meet stringent standards and improve performance. Furthermore, advancements in technology, such as the integration of IoT and smart sensors in metrology equipment, enhance measurement capabilities and data analysis, fueling market expansion.

Drivers, Opportunities & Restraints

The growing emphasis on regulatory compliance and quality assurance across various industries plays a significant role, as companies adopt advanced metrology solutions to meet stringent standards and avoid costly errors. Additionally, the rise in research and development activities and the increasing complexity of modern products necessitate advanced metrology equipment for precise measurements and quality control.Top of FormBottom of Form

Restraints include high initial costs and maintenance expenses, which can be prohibitive for smaller companies and limit the widespread adoption of advanced metrology systems. Moreover, the complexity of integrating new metrology equipment with existing systems can pose challenges, requiring significant time and resources for effective implementation and training. Technological advancements also contribute to rapid obsolescence of equipment, leading to frequent upgrades and associated costs.

On the other hand, opportunities for market growth are substantial. The increasing demand for precision and quality in manufacturing across various sectors, such as aerospace, automotive, and electronics, drives the need for advanced metrology solutions. Innovations in technology, such as the integration of IoT, AI, and smart sensors, offer enhanced measurement capabilities and new functionalities, presenting growth prospects

Type Insights

“The Optical Digitizer and Scanner (ODS) segment is expected to grow at a significant CAGR of 7.0% from 2024 to 2030 in terms of revenue”

The growth of Optical Digitizer and Scanner (ODS) systems segment is primarily driven by their ability to capture precise, detailed 3D measurements and digital representations of complex objects. This technology's application across various industries, including manufacturing and engineering, enhances the accuracy of product design and quality control. The demand for ODS systems is further fueled by advancements in scanning technology and increasing adoption in reverse engineering and digital inspection processes.

The Coordinate Measuring Machine (CMM) segment dominated the market in 2023 accounting for a 33.9% market share. CMM is expected to experience growth due to their essential role in quality control and precision measurement in manufacturing environments. Furthermore, CMMs are crucial for ensuring the accuracy of complex components and assemblies, which is vital as manufacturing processes become increasingly sophisticated. The rise in automated and high-precision manufacturing techniques drives the demand for CMMs, as these machines help maintain strict tolerances and improve overall product quality.

End-use Insights

“The demand for the water segment is expected to grow at a rapid CAGR of 7.1% from 2024 to 2030 in terms of revenue”

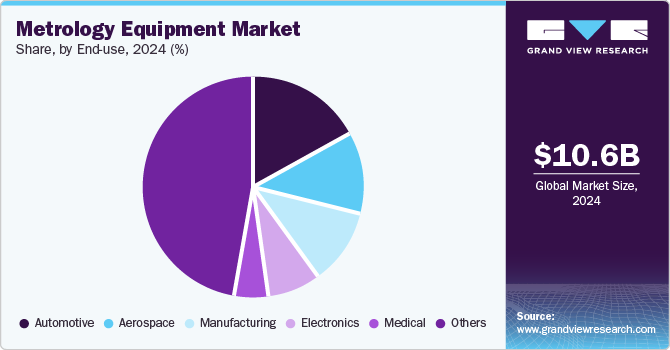

In the electronics sector, the growth of the demand for metrology equipment is driven by the increasing complexity and miniaturization of electronic components. As electronic devices become more advanced, the need for precise measurement and quality control in the manufacturing process intensifies. Metrology equipment helps ensure that electronic components meet stringent performance and reliability standards, driving demand for advanced measurement solutions.

The automotive segment held a 29.9% market share in 2023. The automotive industry is expanding the use of metrology equipment due to the need for high precision in manufacturing and quality assurance. As vehicles incorporate more advanced technologies and safety features, precise measurement and verification of components become critical. The push for enhanced vehicle performance, safety, and compliance with regulatory standards fuels the demand for metrology equipment in automotive manufacturing and design processes.

Regional Insights

“U.S. to witness fastest market growth at 5.3% CAGR”

In North America, the growth of the metrology equipment market is driven by a strong emphasis on technological innovation and high-precision manufacturing. The region’s advanced aerospace, automotive, and electronics industries require sophisticated metrology solutions to meet rigorous quality standards and ensure the performance of complex components. Additionally, significant investments in research and development further drive the demand for cutting-edge measurement technologies.

U.S. Metrology Equipment Market Trends

The metrology equipment market in U.S. is estimated to grow at 5.3% over the forecast period.In the U.S., the market growth is driven by several factors. The country's strong focus on technological innovation and high-precision manufacturing across key sectors, including aerospace, automotive, and electronics, necessitates advanced metrology solutions. The U.S. is home to leading technology companies and research institutions that require precise measurement tools to ensure the quality and performance of their products.

Asia Pacific Metrology Equipment Market Trends

In Asia Pacific, rapid industrialization and technological advancement are key factors driving the market. The region’s booming manufacturing sector, including electronics and automotive industries, demands high-precision metrology solutions to support the production of complex and miniaturized components. Additionally, government initiatives to boost domestic manufacturing capabilities and investments in infrastructure and technology further stimulate the market growth.

Europe Metrology Equipment Market Trends

In Europe, the market growth is fueled by stringent regulatory standards and a focus on maintaining high-quality manufacturing processes. The automotive, aerospace, and industrial manufacturing sectors in Europe are under continuous pressure to adhere to strict quality and safety regulations, which drives the adoption of advanced metrology equipment. The region’s commitment to technological advancements and sustainability also contributes to the increasing use of precise measurement tools.

Key Metrology Equipment Company Insights

Some of the key players operating in the market include ENTACT and WSP among others.

-

Nikon Metrology NV is a manufacturer of metrology solutions, part of the Nikon Corporation based in Belgium. The company specializes in offering a comprehensive range of measurement and inspection products designed for quality control across various industries, including automotive, aerospace, electronics, medical, and consumer goods

-

Keyence Corporation is a prominent Japanese direct sales organization that specializes in developing and manufacturing advanced equipment and solutions for factory automation. In the area of failure analysis test equipment, the company offers solutions designed to enhance quality control and inspection processes. Their measuring instruments, such as high-precision microscopes and machine vision systems, are used for identifying defects and ensuring the reliability of components.

Key Metrology Equipment Companies:

The following are the leading companies in the metrology equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Hexagon AB

- Nikon Metrology NV (Nikon Corporation)

- ZEISS

- KEYENCE CORPORATION

- KLA Corporation.

- Mitutoyo America Corporation

- Jenoptik

- Renishaw plc.

- CREAFORM.

- Metro

- AMETEK.Inc.

- InspecVision Ltd.

Recent Developments

-

In April 2024, Nikon Metrology NV (Nikon Corporation) in collaboration with Applied Automation Technologies announced its successful integration of Nikon's LC15Dx wireless non-contact laser scanner with AAT3D's CAPPSNC on machine metrology software. This advanced integration allows for seamless non-contact inspection within the machine tool environment and facilitates wireless data transfer, marking a significant advancement in manufacturing efficiency and quality assurance.

-

In December 2022, KLA Corporation introduced the AxionT2000 X-ray metrology system, designed for advanced memory chip production. As the fabrication of 3D NAND and DRAM chips involves creating intricate structures with high aspect ratios and nanoscale precision, the Axion T2000 utilizes patented technologies to measure these complex features with exceptional resolution, accuracy, precision, and speed. By identifying minute shape anomalies that could affect chip performance, the Axion T2000 ensures the reliable production of memory chips for applications like 5G, artificial intelligence (AI), data centers, and edge computing.

Metrology Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.6 billion

Revenue forecast in 2030

USD 15.1 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Hexagon AB; Nikon Metrology NV (Nikon Corporation); ZEISS; KEYENCE CORPORATION; KLA Corporation.; Mitutoyo America Corporation; Jenoptik; Renishaw plc.; CREAFORM; Metro; AMETEK.Inc.; InspecVision Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metrology Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global metrology equipment market on the type, end use, and region:

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Coordinate Measuring Machine (CMM)

-

Optical Digitizer and Scanner (ODS)

-

X-ray and Computed Tomography (CT) Systems

-

Measuring Instruments

-

Form Measurement Equipment

-

Others

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Manufacturing

-

Automotive

-

Aerospace

-

Electronics

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global metrology equipment market size was estimated at USD 10.0 billion in 2023 and is expected to reach USD 15.1 billion in 2024.

b. The Metrology Equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 15.1 billion by 2030.

b. The automotive segment dominated the market in 2023 accounting for 29.9% of the market share in 2023. The automotive industry is increasingly adopting metrology equipment to meet the demands for high precision in manufacturing and quality control. As vehicles integrate advanced technologies and safety features, the accurate measurement and verification of components become essential.

b. Some of the key players operating in the Metrology Equipment market are Hexagon AB, Nikon Metrology NV (Nikon Corporation), ZEISS, KEYENCE CORPORATION, KLA Corporation., Mitutoyo America Corporation, Jenoptik, Renishaw plc., CREAFORM, Metro, AMETEK.Inc., and InspecVision Ltd.

b. The Metrology Equipment market is driven by the increased industrial automation, the growing need for precision in manufacturing, and advancements in technology. The demand is further driven by the aerospace and automotive sectors, regulatory compliance, and the rising complexity of modern products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."