Mexico Flavors Market Summary

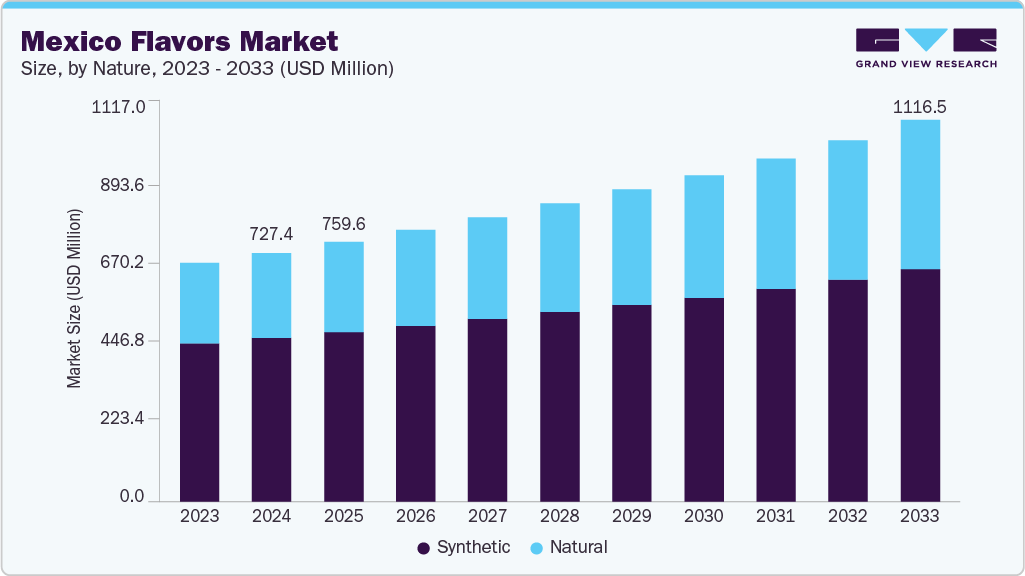

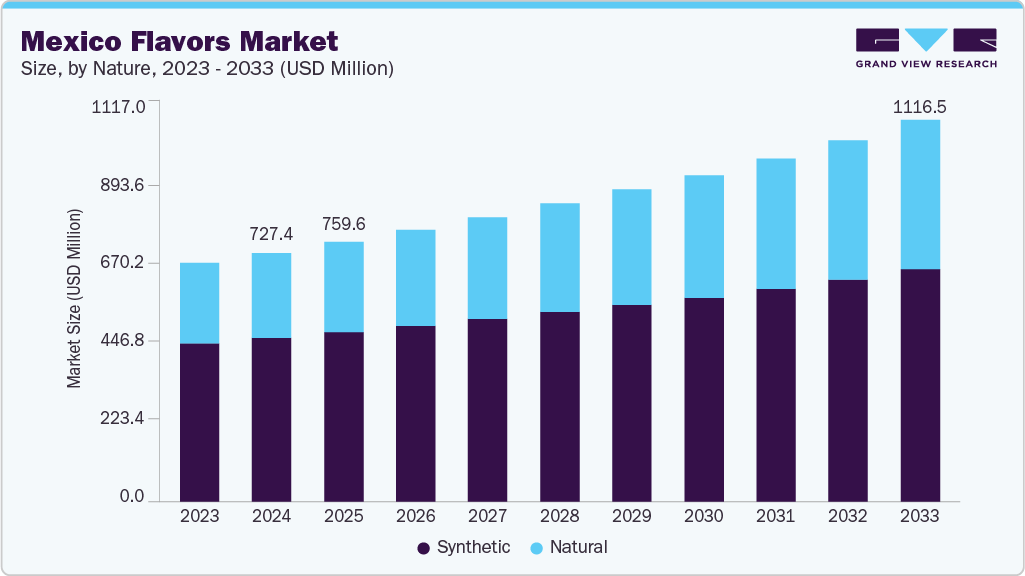

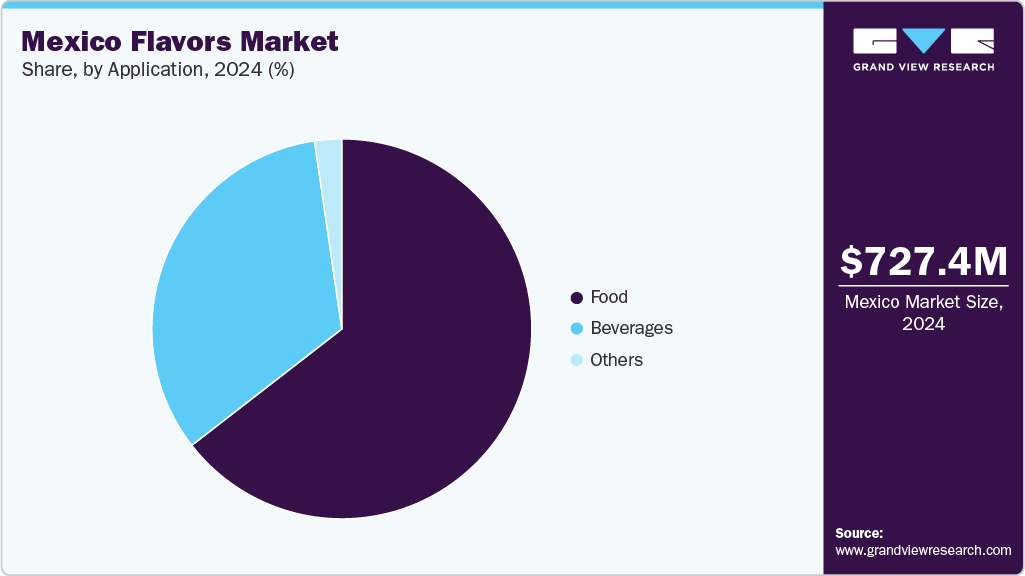

The Mexico flavors market size was estimated at USD 727.4 million in 2024 and is projected to reach USD 1,116.5 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The market is primarily driven by rising demand for natural and fruit-flavored products.

Key Market Trends & Insights

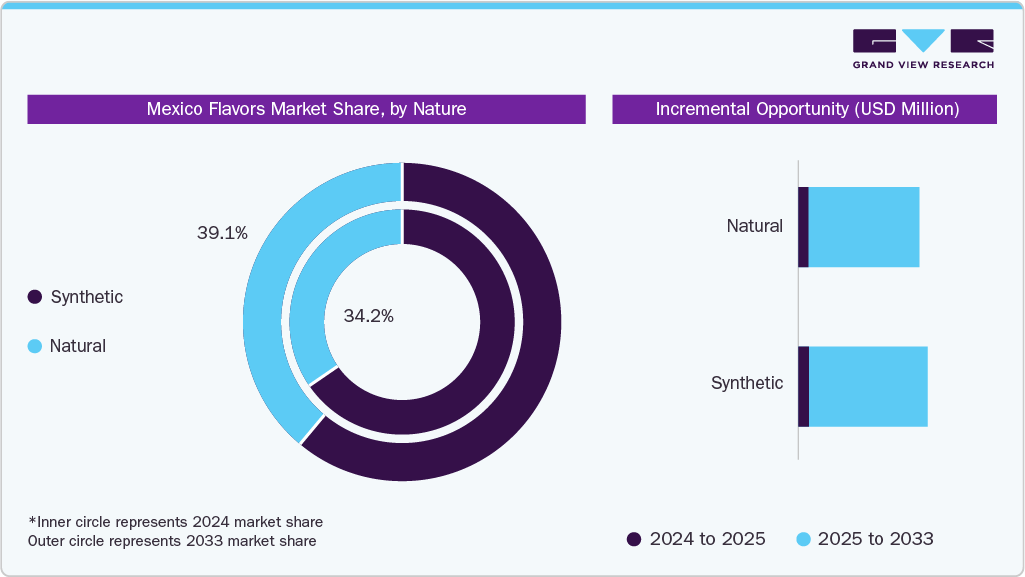

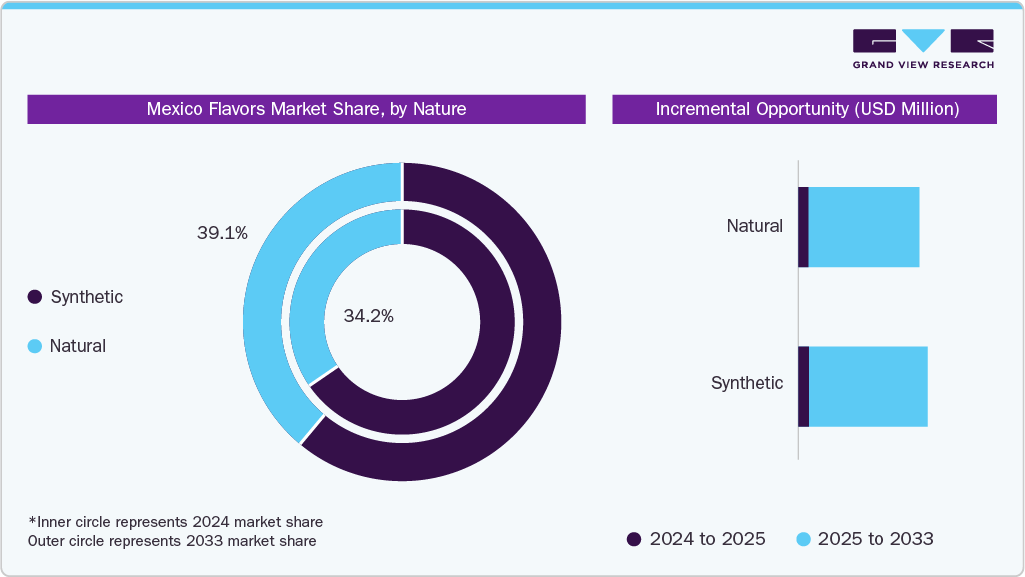

- By nature, the synthetic segment held the largest market share of 65.8% in 2024.

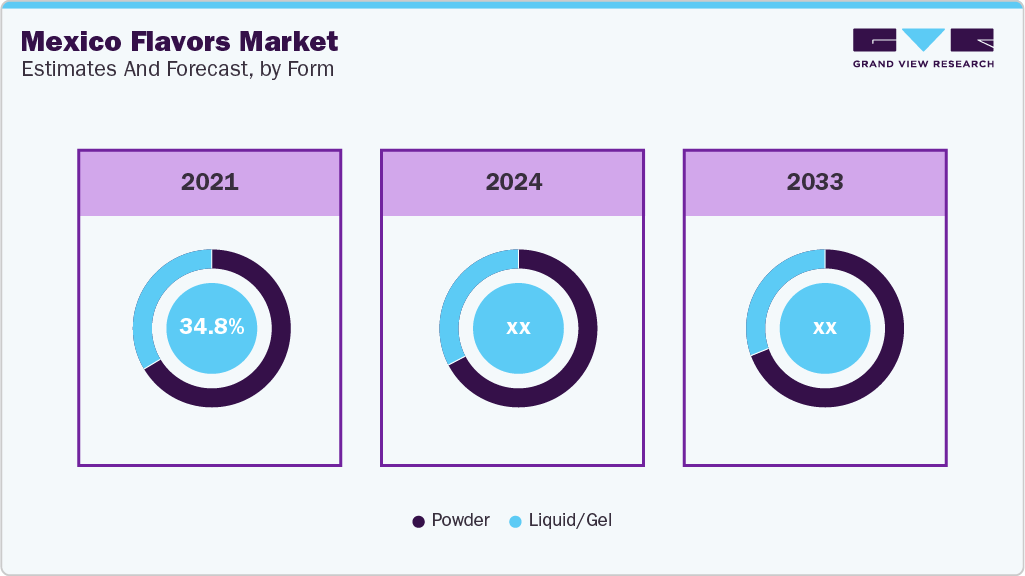

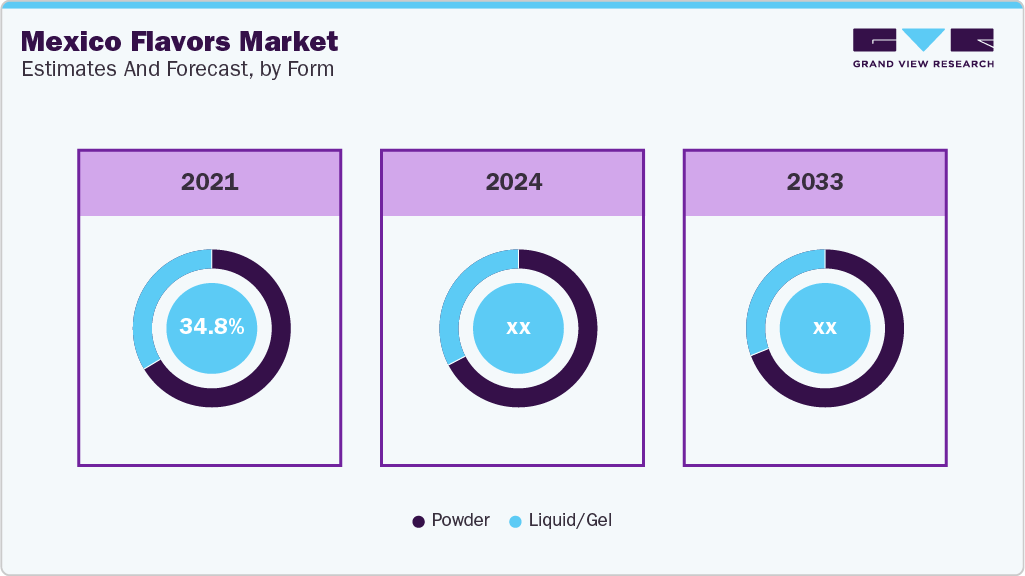

- By form, the powder segment held the largest market share of 65.9% in 2024.

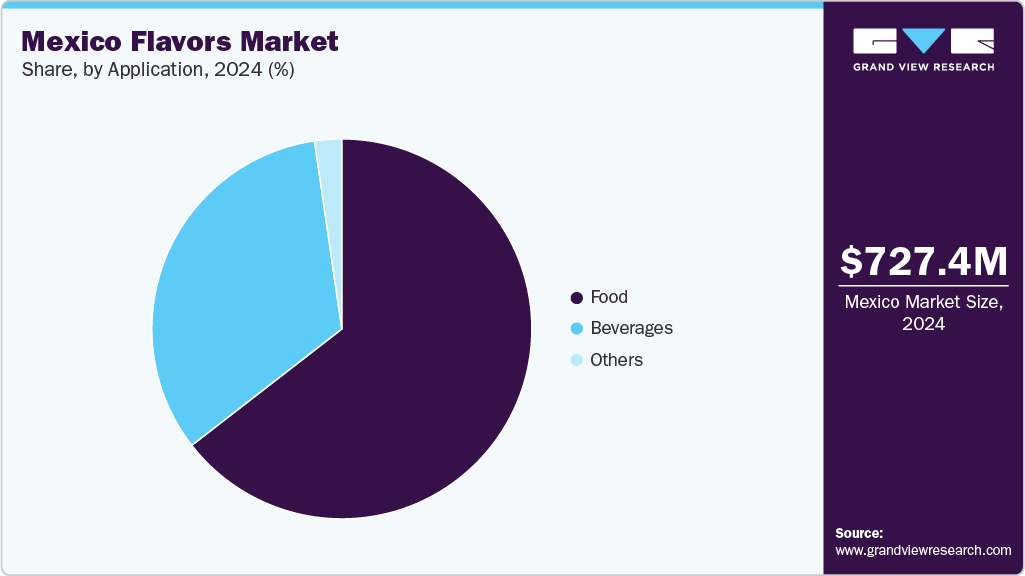

- By application, the food segment accounted for the largest market share of 64.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 727.4 Million

- 2033 Projected Market Size: USD 1,116.5 Million

- CAGR (2025-2033): 4.9%

Innovations in packaged and processed foods are leading to the formulation of new flavor combinations to capture consumer interest. Flavors such as spicy, sweet, smoky, fruity, and premium flavors are increasingly introduced in snacks, sauces, and ready-to-eat meals to offer an enhanced and unique experience to consumers. Growing demand for natural and clean-label products is expected to drive the growth of the Mexican flavors industry. Consumers are increasingly prioritizing transparency and clean-label ingredients, driving demand for natural and minimally processed flavors. Flavors derived from fruits, herbs, and spices are gaining popularity, especially in health-conscious and organic product lines. In addition, younger, urban consumers are driving demand for bold, unique, and globally inspired flavor experiences. This demographic is more open to trying experimental combinations and fusion flavors, fueling innovation in foodservice and retail sectors.

Furthermore, innovation in packaged and processed foods is expected to drive market growth. Brands constantly introduce new and creative flavor combinations to keep consumers engaged in a competitive market.

Nature Insights

The synthetic segment accounted for a revenue share of 65.8% in 2024. Cost-effectiveness and wider availability of flavors are key factors contributing to the surge in demand for synthetic flavors. Synthetic flavors are significantly cheaper than natural ones, making them attractive to manufacturers. Their demand is higher, especially in price-sensitive segments such as snacks, candies, and beverages. High demand for synthetic flavors in mass-produced and processed foods is also driving the growth of the Mexican flavors industry.

The natural segment is projected to experience the fastest CAGR of 6.5% from 2025 to 2033. Increasing health consciousness among consumers and changing lifestyles are expected to favor the demand for convenience foods with clean labels.

Form Insight

The powder segment accounted for the largest revenue share of the market in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. Factors such as convenience, portability, longer shelf life, and versatility across applications are driving the growth of this segment. Powdered flavor products such as instant drink mixes and spice blends fit well in fast-paced urban lifestyles as they are extremely easy to store, transport, and prepare. These powders are widely used in beverages, snacks, and cooking kits, enabling consistent flavor delivery across diverse categories.

The liquid/gel segment is expected to grow at a significant CAGR over the forecast period. Instant application and the high solubility of the products are expected to drive the growth of this segment. Liquid and gel formats also offer benefits such as easy integration and uniformity. These flavor formats dissolve quickly and blend well into beverages, sauces, and dressings, making them ideal for instant beverage mixes, RTDs, and culinary sauces.

Application Insights

The food segment accounted for the largest revenue share of the market in 2024. Rising demand for authentic and regional flavors and expansion of processed and packaged food formats are driving the growth of the food segment. The increasing popularity of fusion cuisines and global flavor influence also contributes to the demand for Mexican sauces.

The beverages segment is anticipated to record the fastest CAGR from 2025 to 2033. The growth of this segment is driven by a significant surge in the popularity of ready‑to‑drink cocktails and beverage mixes, health and functional beverage trends, and the expansion of retail and foodservice channels.

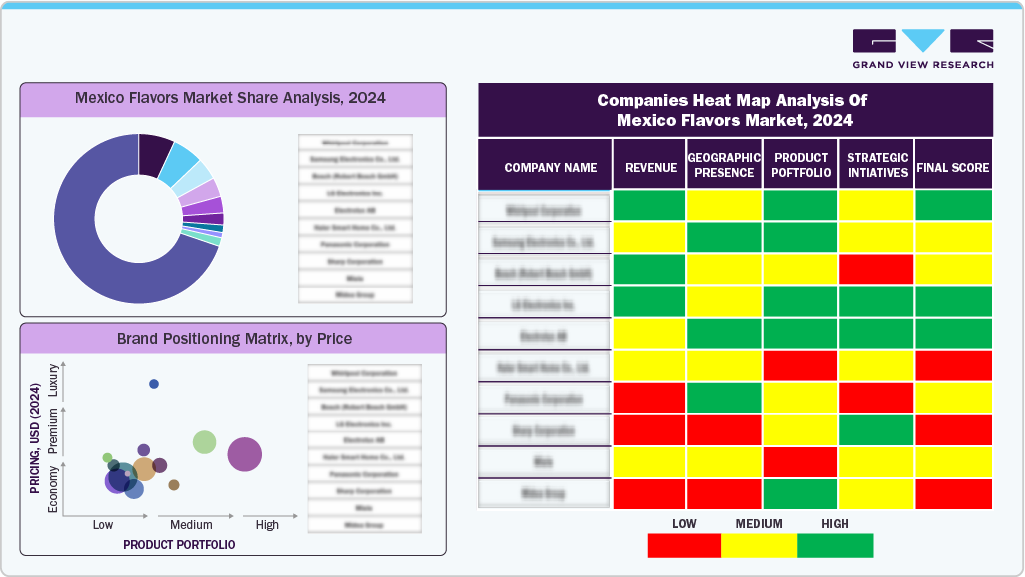

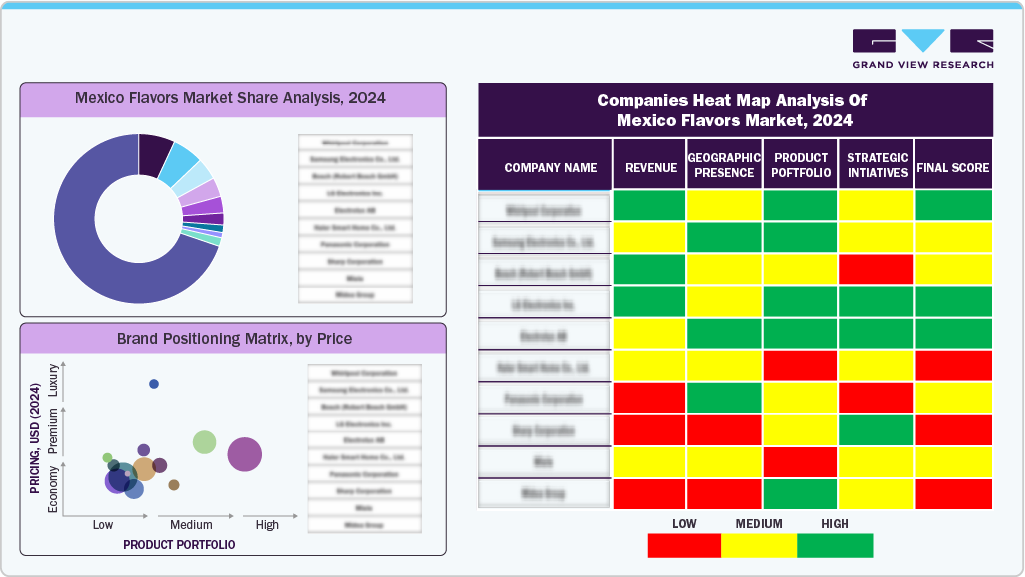

Key Mexico Flavors Company Insights

Some key players in the Mexican flavors industry are Givaudan, DSM-Firmenich, and others.

-

Givaudan offers flavors, fragrances, and beauty ingredients to the food, beverage, and personal care industries. The company focuses on innovation and sustainability to help brands create unique consumer experiences.

Key Mexico flavors Companies:

- PROBAMEX SA DE CV

- Mexicana de Aditivos Alimenticios S.A. De C.V.

- Givaudan

- dsm-firmenich

- Tulip Aromatics de México SA de CV

Mexico Flavors Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 759.6 million

|

|

Revenue forecast in 2033

|

USD 1,116.5 million

|

|

Growth rate

|

CAGR of 4.9% from 2025 to 2033

|

|

Actuals

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Nature, form, application

|

|

Key companies profiled

|

Givaudan; dsm-firmenich; PROBAMEX SA DE CV, Mexicana de Aditivos Alimenticios S.A. De C.V. Tulip Aromatics de México SA de CV

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Mexico Flavors Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Mexico flavors market report based on nature, form, and application:

-

Nature Outlook (Revenue, USD Million, 2021 - 2033)

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Application Outlook (Revenue, USD Million, 2021 - 2033)