- Home

- »

- Beauty & Personal Care

- »

-

Micellar Water Market Size, Share & Growth Report, 2030GVR Report cover

![Micellar Water Market Size, Share & Trends Report]()

Micellar Water Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (Men, Women), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-399-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Micellar Water Market Summary

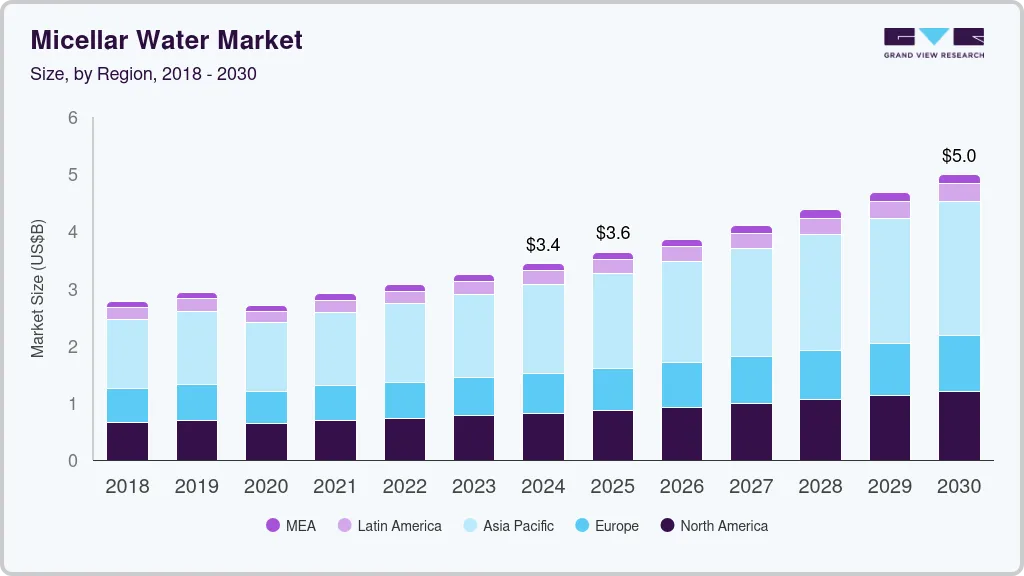

The global micellar water market size was estimated at USD 3.43 billion in 2024 and is projected to reach USD 4.99 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. Micellar water is a skincare product consisting of purified water, humectants like glycerin, and mild surfactants.

Key Market Trends & Insights

- North America accounted for a global market share of around 23.80% in 2023.

- The U.S. accounted for a market share of around 85% in 2023 in the North American market.

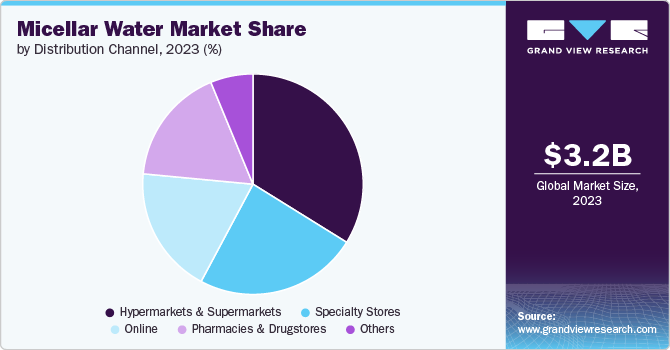

- By distribution channel, the hypermarkets & supermarkets segment accounted for a market share of 33.84% in 2023.

- By end-use, women users accounted for a share of 62.92% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 3.43 Billion

- 2030 Projected Market Size: USD 4.99 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2023

It takes its name from micelles, which are round clusters of surfactant molecules. These micelles trap and remove oil, makeup, and dirt from the skin. The surfactants in micellar water have dual ends: one that attracts water and one that attracts oil, allowing them to cleanse effectively without drying the skin.Micellar water offers numerous benefits for the skin, making it a versatile and essential addition to skincare routines. It serves as a gentle and effective cleanser, capable of removing makeup, dirt, and oil without compromising the skin barrier. The tiny micelles in the solution trap and lift away impurities, ensuring a thorough cleanse. In addition, micellar water includes hydrating compounds like glycerin, which attract moisture to the skin, helping to maintain optimal hydration levels and support the skin's natural barrier function.

Bioderma Sensibio H2O Micellar Water is a popular French pharmacy staple suitable for sensitive and easily irritated skin. Priced at about USD 19 for a 3.38 oz bottle, it effectively cleanses and removes eye and face makeup in one step without causing stinging or discomfort. The formula includes fatty acid esters similar to skin lipids, aiding in repairing the skin's protective layer and treating irritation. Moreover, it contains cucumber extract for soothing benefits, leaving the skin soft, smooth, and free of flakiness or redness.

Another advantage of micellar water is its suitability for all skin types, including sensitive and rosacea-prone skin. It typically contains non-irritating ingredients and avoids harsh additives such as alcohol, fragrance, and essential oils, which can irritate. Including soothing components like glycerin further reduces potential irritation and inflammation, making micellar water a gentle option for those with delicate skin. Its ability to cleanse without rinsing makes it a convenient and travel-friendly choice, perfect for quick touch-ups and on-the-go skincare.

A 2023 poll by YouGov found that makeup products such as mascara, lipstick, lipgloss, eyeliner, eyeshadow, and blush are some of the most used makeup products among American women.As the popularity of makeup continues to rise, the demand for effective makeup removers also increases. This trend highlights the growing need for products like micellar water, which offers a gentle yet effective solution for removing makeup while catering to a variety of skin types. As more women incorporate makeup into their daily routines, the convenience and efficacy of micellar water make it a preferred choice for maintaining healthy skin and ensuring thorough cleansing.

End Use Insights

Women users accounted for a share of 62.92% in 2023. According to CivicScience's 2023 data, women are more likely than men to use three to four skincare products, suggesting that full skincare regimens are becoming more widely adopted. Micellar waters perfectly fit these routines since they remove makeup and pollutants softly and effectively without irritating the skin. The calming effects of micellar water are especially appreciated by women whose skin is delicate or prone to acne.

Demand among men is expected to rise at a CAGR of 6.9% from 2024 to 2030. As more men embrace cosmetics, driven by a younger generation's openness to products like BB creams and concealers, the demand for effective makeup removal solutions, such as micellar water, is set to rise. With its ability to gently and efficiently cleanse without harsh chemicals, micellar water will likely become a staple in men's grooming routines, aligning with the evolving norms of masculinity and the need for convenient, high-quality skincare products.

Distribution Channel Insights

The hypermarkets & supermarkets segment accounted for a market share of 33.84% in 2023.Supermarkets and hypermarkets, which provide a wide selection of skincare and cosmetics, are turning into dependable places to buy beauty items. These merchants create a memorable shopping experience with well-organized product displays and clever visual merchandising. Sainsbury's, Garnier, and L'Oréal Paris collaborated to introduce AR and AI-powered skincare consultations at multiple UK locations in 2022. This technology highlights the importance of skin health and the appeal of goods like micellar water by analyzing clients' facial traits and providing customized skincare suggestions.

Online sales of micellar water are expected to grow at a CAGR of 8.1% from 2024 to 2030.This is due to the convenience of online shopping, which allows consumers to easily access a wide range of micellar water products and compare prices. The availability of detailed product information, user reviews, and personalized recommendations online helps shoppers make informed decisions. In addition, online retailers frequently offer exclusive discounts and promotions, making it cost-effective for customers to purchase their favorite micellar water brands.

Regional Insights

The micellar water market in North America accounted for a global market share of around 23.80% in 2023. The market here thrives due to a growing consumer preference for versatile and gentle skincare products. Micellar water's ease of use, effective cleansing properties, and suitability for various skin types make it highly appealing. Moreover, the increasing popularity of skincare routines and the rise of beauty e-commerce platforms contribute to its widespread availability and consumer accessibility. The emphasis on convenience, coupled with the trend towards minimalist and multifunctional beauty products, drives the region's high demand for micellar water.

U.S. Micellar Water Market Trends

The micellar water market in the U.S. accounted for a market share of around 85% in 2023 in the North American market. The demand for micellar water in the U.S. is high due to its convenience and effectiveness in a streamlined skincare routine. Consumers increasingly prioritize simplicity and multi-functionality in their beauty products; micellar water's ability to cleanse, remove makeup, and hydrate with minimal effort makes it highly appealing. Furthermore, the rising interest in skincare routines and self-care drives the popularity of products that offer both efficiency and ease of use.

Asia Pacific Micellar Water Market Trends

The micellar water market in Asia Pacific is anticipated to rise at a CAGR of about 7.0% from 2024 to 2030. This is due to its alignment with the region's growing trend toward multifunctional and efficient skincare solutions. As consumers increasingly seek products that simplify their beauty routines, micellar water's ability to cleanse, remove makeup, and hydrate in one step becomes highly attractive. In addition, the region's heightened awareness of skincare efficacy and the influence of digital beauty trends drive interest in innovative and convenient products like micellar water.

Key Micellar Water Company Insights

The market is fragmented. Many brands have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new products and expanding or making strategic acquisitions to better meet consumer needs and preferences. In September 2023, Shiseido Company, Limited expanded its presence in the thriving consumer market by introducing NARS Cosmetics to local beauty stores. The company collaborated with Indian retailer Shoppers Stop’s Global SS Beauty Brands to open 14 new locations across major cities.

Key Micellar Water Companies:

The following are the leading companies in the micellar water market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oréal S.A.

- NAOS

- Shiseido Company, Limited

- Unilever

- Byphasse

- Kao Corporation

- Kenvue

- Clarins

- Caudalie

- Pierre Fabre

Recent Developments

-

In May 2023, COSRXlaunched its Low pH Niacinamide Micellar Cleansing Water, designed specifically for sensitive and acne-prone skin. Enriched with Allantoin, Niacinamide, and Hyaluronic Acid, this gentle cleanser removes makeup, unclogs pores, and balances sebum production without disrupting the skin's natural pH. Its lightweight formula hydrates and soothes the skin, making it ideal for daily use and suitable for all skin types.

-

In April 2023, L'Oréal S.A.’s brand Garnier launched its first Micellar Cleansing Water in a bottle made entirely from upcycled PET plastic in collaboration with Loop Industries. This innovative initiative transforms low-value plastic waste into high-quality, 100% recycled PET through Loop's advanced technology. Available from April 2023, this limited-edition product underscores Garnier's commitment to sustainability and circular economy practices.

-

In November 2022, S'Able Lab launched its Rooibos Micellar Water.This purifying micellar water enhances skin strength and hydration, featuring Rooibos Tea Extract for a calming effect and Babassu Oil for deep cleansing. It joins the brand’s lineup, which includes a Qasil Cleanser, Black Seed Toner, Baobab Moisturizer, and Qasil Exfoliating Mask.

Micellar Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.64 billion

Revenue forecast in 2030

USD 4.99 billion

Growth rate (Revenue)

CAGR of 6.5% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

L'Oréal S.A.; NAOS; Shiseido Company, Limited; Unilever; Byphasse; Kao Corporation; Kenvue; Clarins; Caudalie; Pierre Fabre

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micellar Water Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global micellar water market report based on end use, distribution channel, and region.

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global micellar water market was estimated at USD 3.24 billion in 2023 and is expected to reach USD 3.43 billion in 2024.

b. The global micellar water market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 4.99 billion by 2030.

b. Asia Pacific dominated the micellar water market with a share of around 45% in 2023. This is due to its strong skincare culture, high consumer demand for effective cleansing solutions, and the presence of leading beauty brands in the region.

b. Key players in the micellar water market are L'Oréal S.A., NAOS, Shiseido Company, Limited, Unilever, Byphasse, Kao Corporation, Kenvue, Clarins, Caudalie, and Pierre Fabre.

b. Key factors that are driving the micellar water market growth include its effective makeup removal properties, skin-nourishing ingredients, and the increasing trend towards multi-step skincare routines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.