- Home

- »

- Plastics, Polymers & Resins

- »

-

Micro-perforated Food Packaging Market Size Report, 2033GVR Report cover

![Micro-perforated Food Packaging Market Size, Share & Trends Report]()

Micro-perforated Food Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (PE, PP, PET), By Application (Fruits & Vegetables, Bakery & Confectionery, Ready-to-Eat), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-703-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro-perforated Food Packaging Market Summary

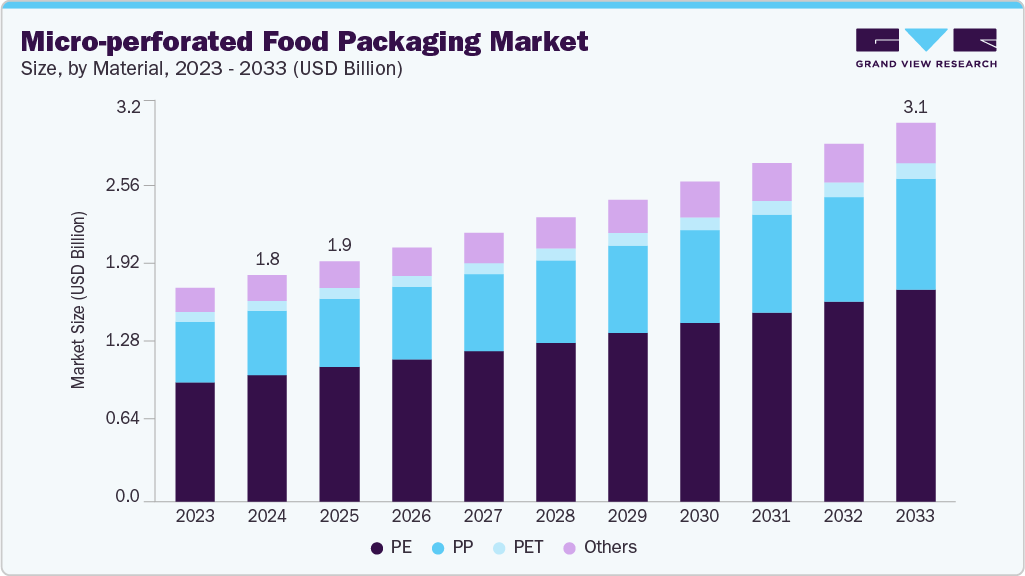

The global micro-perforated food packaging market size was estimated at USD 1.85 billion in 2024 and is projected to reach USD 3.09 billion by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The growth is driven by rising demand for extended shelf life and freshness in packaged foods, particularly fresh produce, bakery, and ready-to-eat meals.

Key Market Trends & Insights

- North America dominated the micro-perforated food packaging market with the largest revenue share of over 31.0% in 2024.

- The micro-perforated food packaging industry in China is expected to grow at a substantial CAGR of 6.2% from 2025 to 2033.

- By material, the polypropylene (PP) segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By application, the ready-to-eat segment is expected to grow at a considerable CAGR of 6.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.85 Billion

- 2033 Projected Market Size: USD 3.09 Billion

- CAGR (2025-2033): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing consumer preference for convenient, breathable, and sustainable packaging solutions further boosts the growth of the micro-perforated food packaging industry. Consumers are increasingly seeking packaging solutions that extend shelf life while maintaining the freshness, texture, and nutritional value of fruits, vegetables, and bakery products. Micro-perforated films enable controlled gas exchange, reducing moisture build-up and slowing down the ripening process, which directly helps in minimizing food spoilage. For example, companies such as Amcor plc and Sealed Air have developed advanced micro-perforated solutions for fresh produce packaging, which supermarkets widely adopt to reduce waste and improve product presentation. This trend aligns with the global shift toward reducing food wastage, further accelerating market growth.

The expansion of the packaged fresh food and ready-to-eat (RTE) segments is also contributing to market growth. With the busy lifestyles of urban populations, demand for convenience foods such as sandwiches, salads, and bakery items is rising, especially in developed and emerging economies. Micro-perforated packaging offers the advantage of maintaining product integrity without compromising taste or texture. For instance, Tesco in the UK uses micro-perforated film for its pre-packed bakery products, ensuring they stay fresh while preventing sogginess. This capability meets consumer expectations for quality and convenience while supporting the retail sector’s efforts to maintain consistent product quality across supply chains.

Sustainability and the growing preference for eco-friendly packaging solutions also play a crucial role in driving the market. Manufacturers are focusing on developing recyclable or compostable micro-perforated films to meet regulatory requirements and consumer demand for sustainable materials. This shift is supported by stringent packaging waste regulations in regions like the European Union, where single-use plastics are being phased out, prompting food brands to adopt greener packaging solutions.

Moreover, technological advancements in laser and mechanical perforation processes are enhancing product performance and broadening application areas. Precision laser perforation allows for consistent hole size and placement, which optimizes gas transmission rates for specific food types, extending shelf life and improving visual appeal. This technological edge is especially relevant in global supply chains where fresh products are transported over long distances.

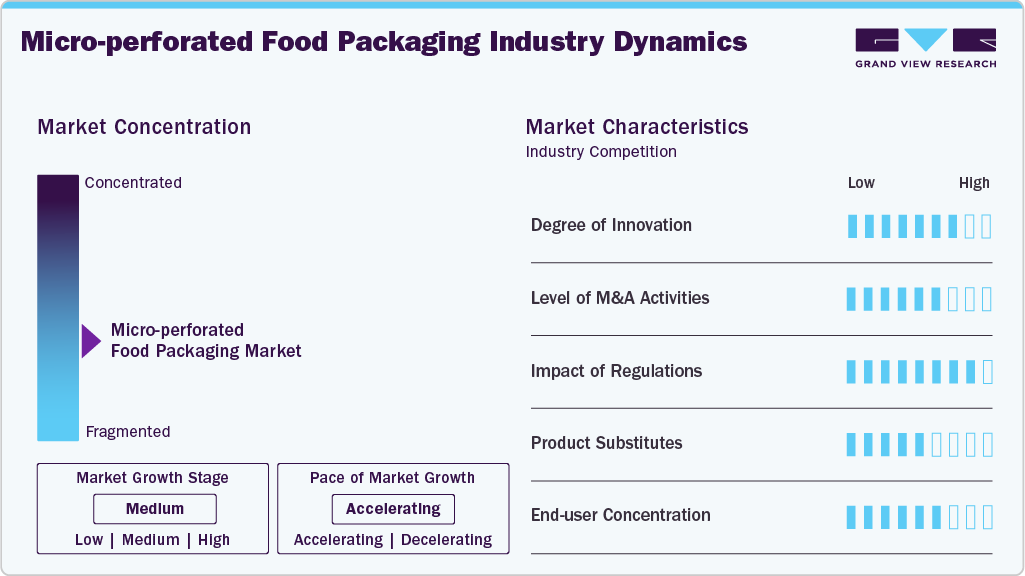

Market Concentration & Characteristics

The global micro-perforated food packaging industry is characterized by its strong focus on food preservation and quality enhancement, with a primary role in extending the shelf life of perishable products. The industry operates at the intersection of food science, materials engineering, and supply chain logistics, catering to sectors such as fresh produce, bakery, dairy, meat, and ready-to-eat meals. Its value proposition lies in controlled gas exchange through precisely engineered perforations, enabling optimal moisture and oxygen levels for different food types. This highly specialized functionality makes micro-perforated packaging a critical enabler in reducing food wastage and supporting the growing fresh food retail sector worldwide.

The micro-perforated food packaging market is closely linked to global supply chain dynamics and consumer behavior trends. Growth in online grocery delivery, cross-border fresh produce trade, and the expanding retail presence in emerging markets have amplified demand for micro-perforated packaging that can handle longer transit times without compromising freshness. The industry’s growth trajectory is thus shaped by macro factors like urbanization, increasing disposable incomes, shifting dietary habits toward fresh and healthy foods, and governmental initiatives to curb food waste. This creates an ecosystem where packaging innovation directly influences market competitiveness and end user satisfaction.

Material Insights

The PE segment recorded the largest revenue share of over 55.0% in 2024. PE is one of the most widely used materials in micro-perforated food packaging due to its excellent flexibility, moisture resistance, and cost-effectiveness. PE films, including LDPE and HDPE, are commonly used for packaging fresh produce, bakery items, and frozen foods. PE’s compatibility with a variety of printing techniques also makes it a preferred choice for brand visibility in retail environments. The demand for PE-based micro-perforated packaging is driven by its affordability, lightweight nature, and adaptability to both food and non-food applications.

The PP segment is expected to grow at the fastest CAGR of 6.2% during the forecast period. PP offers superior transparency, rigidity, and heat resistance compared to PE, making it an ideal choice for fresh food packaging where product visibility and shelf appeal are crucial. PP micro-perforated films are commonly used for salads, herbs, fresh-cut fruits, and snacks, where controlled moisture and oxygen levels help maintain texture and prevent spoilage. PP films are also valued for their ability to withstand higher sealing temperatures, enabling faster packaging line speeds in industrial operations. The growth of PP in micro-perforated packaging is supported by the increasing demand for high-clarity films that enhance product presentation, especially in premium retail food segments.

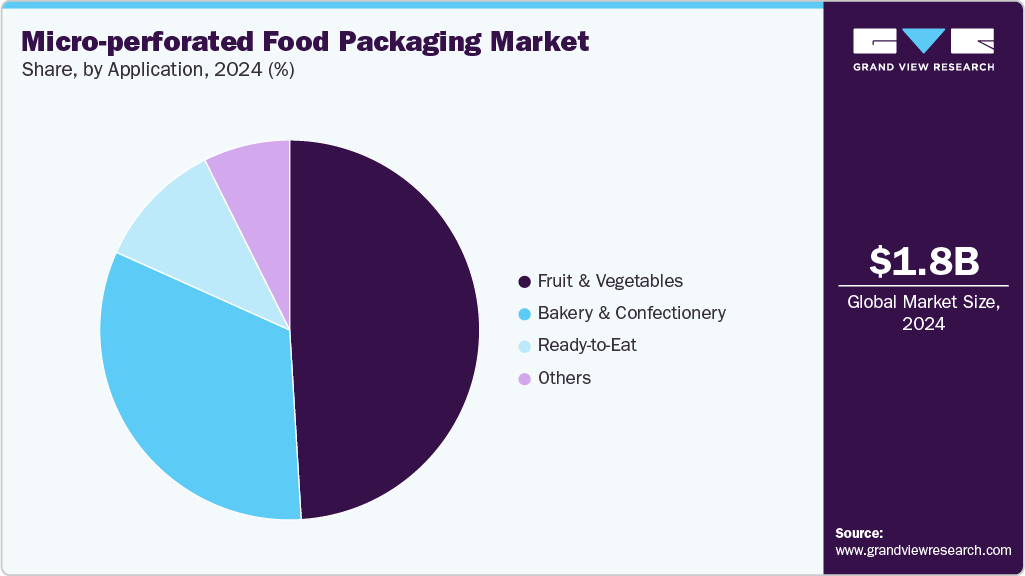

Application Insights

The fruits & vegetables segment led the micro-perforated food packaging industry and recorded the largest revenue share of over 49.0% in 2024. The fruits & vegetables segment is a major consumer of micro-perforated food packaging due to its ability to extend shelf life while maintaining product freshness. Rising demand for fresh and minimally processed produce, coupled with the growth of organized retail and cross-border fruit & vegetable exports, is driving adoption. Increasing consumer awareness about food waste reduction and the role of packaging in maintaining quality also contributes to growth.

The ready-to-eat segment is expected to grow at the fastest CAGR of 6.7% during the forecast period. Ready-to-eat meals, salads, and fresh-cut fruits heavily rely on micro-perforated packaging to maintain freshness while accommodating specific respiration rates of food items. Micro-perforation also supports modified atmosphere packaging (MAP) for RTE products. The growing urban workforce, busy lifestyles, and preference for convenience foods are accelerating the demand for RTE meals, driving the need for efficient micro-perforated packaging. The rapid expansion of online food delivery services and meal kit subscriptions also fuels market growth.

Regional Insights

North America dominated the micro-perforated food packaging market with the largest revenue share of over 31.0% in 2024. This positive outlook is due to high consumer demand for convenience foods, stringent food safety standards, and advanced packaging technologies. The U.S. and Canada have a well-established retail sector where brands such as Sealed Air (Cryovac) and Amcor plc offer micro-perforated films for meat, poultry, and bakery products to maintain freshness. The rise of organic and fresh food trends, particularly in the U.S., has increased the need for breathable packaging that prevents spoilage. For instance, Whole Foods and Walmart use micro-perforated packs for pre-cut fruits and salads. Additionally, sustainability concerns are pushing manufacturers toward eco-friendly perforated films, further accelerating market growth.

U.S. Micro-perforated Food Packaging Market Trends

The U.S.micro-perforated food packaging industry dominates North America due to the high demand for convenience foods, technological advancements, and strong retail infrastructure. The growth of meal kit delivery services (e.g., HelloFresh, Blue Apron) has also increased the need for breathable packaging to maintain food freshness during transit. Furthermore, sustainability trends are pushing companies to develop compostable micro-perforated films, aligning with consumer preferences for eco-friendly packaging.

Europe Micro-perforated Food Packaging Market Trends

Europe is a major market for micro-perforated food packaging, driven by strict EU regulations on food waste reduction and sustainable packaging. Countries such as Germany, France, and the UK are at the forefront, with retailers such as Tesco and Lidl adopting micro-perforated solutions for fresh produce and dairy products. The European market emphasizes biodegradable and recyclable films, with companies such as Coveris and Constantia Flexibles developing eco-friendly perforated packaging. For example, modified atmosphere packaging (MAP) with micro-perforations is widely used for berries and leafy greens to extend shelf life. The region’s focus on reducing food waste and carbon footprints makes it a key player in advancing micro-perforation technology.

Asia Pacific Micro-perforated Food Packaging Market Trends

The Asia Pacific micro-perforated food packaging industry is expected to grow at the fastest CAGR of 6.3% during the forecast period. This outlook is due to rapid urbanization, increasing disposable incomes, and growing demand for fresh and packaged food. Countries such as China, India, and Japan are witnessing a surge in supermarket and e-commerce grocery sales, where micro-perforated packaging extends the shelf life of perishables such as fruits, vegetables, and ready-to-eat meals. Additionally, government initiatives promoting sustainable packaging and food safety regulations further boost adoption. The region’s large population and expanding middle class make it a high-growth market for innovative packaging solutions.

Key Micro-perforated Food Packaging Company Insights

The competitive environment of the micro-perforated food packaging industry is characterized by moderate to high rivalry, driven by the presence of both global packaging giants and regional players focusing on niche applications. Companies compete on factors such as innovation in perforation technology, customization capabilities for specific food categories, sustainability credentials, and cost efficiency. Technological advancements, like laser micro-perforation for precise gas exchange control, are key differentiators, while strategic partnerships with food producers and retailers strengthen market positions. The industry also sees frequent product innovation to meet the rising demand for extended shelf life, reduced food waste, and eco-friendly materials, creating an environment where continuous R&D investment is essential to maintain competitiveness.

-

In January 2024, Sev-Rend expanded its macro- and micropreforating product offerings as part of its broader strategy to enhance packaging solutions, including the acquisition of Wolarmann Enterprises, which strengthens its market presence in North America and broadens its product portfolio. This expansion is aimed at delivering more flexible, high-performance packaging options that meet evolving retailer requirements and sustainability goals, supporting customers with innovative and customizable solutions across various packaging needs.

-

In January 2023, PerfoTec developed laser micro-perforated bags that extend fresh produce shelf life by precisely regulating air exchange to slow respiration, keeping items like spinach fresh for up to 21 days and bananas for three weeks. Integrated with packing machines and using a feedback camera for accuracy, the system reduces food waste, costs, and carbon emissions.

Key Micro-perforated Food Packaging Companies:

The following are the leading companies in the micro-perforated food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sealed Air

- Constatia Flexibles

- Uflex Limited

- Huhtamaki

- A·ROO Company

- Specialty Polyfilms

- Prism Pak, Inc.

- Greendot Biopak Pvt. Ltd.

- Crystal Vision Packaging

- Sev-Rend

- Perfo Tec

- KM Packaging Services Ltd.

Micro-perforated Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.96 billion

Revenue forecast in 2033

USD 3.09 billion

Growth rate

CAGR of 5.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; the Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor plc; Sealed Air; Constantia Flexibles; Uflex Limited; Huhtamaki; A·ROO Company; Specialty Polyfilms; Prism Pak, Inc.; Greendot Biopak Pvt. Ltd.; Crystal Vision Packaging; Sev-Rend; PerfoTec; KM Packaging Services Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

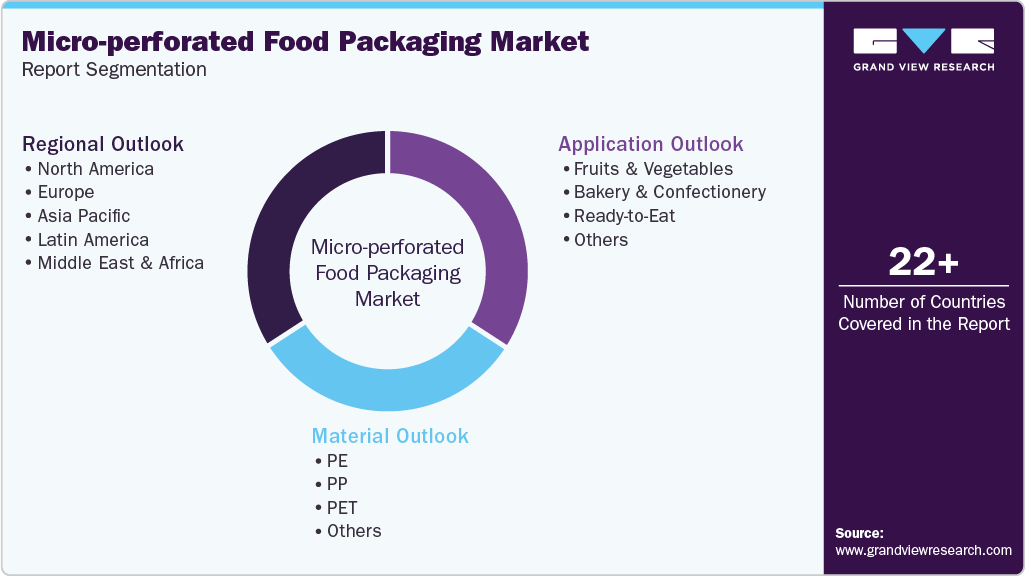

Global Micro-perforated Food Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global micro-perforated food packaging market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

PE

-

PP

-

PET

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Fruits & Vegetables

-

Bakery & Confectionery

-

Ready-to-Eat

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global micro-perforated food packaging market size was estimated at USD 1.85 billion in 2024 and is expected to reach USD 1.96 billion in 2025.

b. The global micro-perforated food packaging market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 3.09 billion by 2033.

b. North America dominated the micro-perforated food packaging market with a share of over 31.0% in 2024. This is attributable to the confluence of increased consumer incomes and year-round demand for fresh produce have encouraged manufacturers across the globe to develop innovative packaging solutions and offerings.

b. Some key players operating in the micro-perforated food packaging market include Amcor plc; Sealed Air; Constantia Flexibles; Uflex Limited; Huhtamaki; A·ROO Company; Specialty Polyfilms; Prism Pak, Inc.; Greendot Biopak Pvt. Ltd.; Crystal Vision Packaging; Sev-Rend; PerfoTec; and KM Packaging Services Ltd.

b. The market is driven by rising demand for extended shelf life and freshness in packaged foods, particularly fresh produce, bakery, and ready-to-eat meals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.