- Home

- »

- Biotechnology

- »

-

Microbiology & Bacterial Culture For Industrial Testing Market Report 2030GVR Report cover

![Microbiology & Bacterial Culture For Industrial Testing Market Size, Share & Trends Report]()

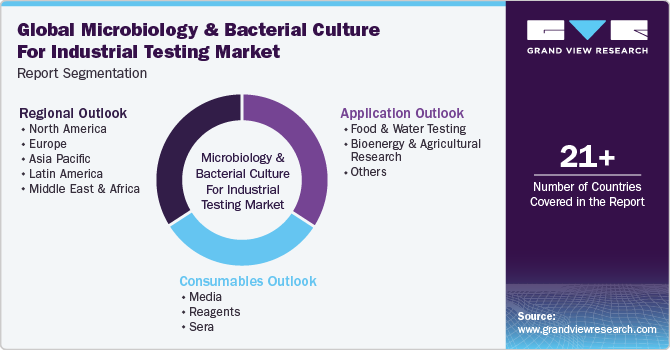

Microbiology & Bacterial Culture For Industrial Testing Market Size, Share & Trends Analysis Report By Consumables (Media, Reagents, Sera), By Application (Food & Water Testing, Bioenergy & Agricultural Research), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-936-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

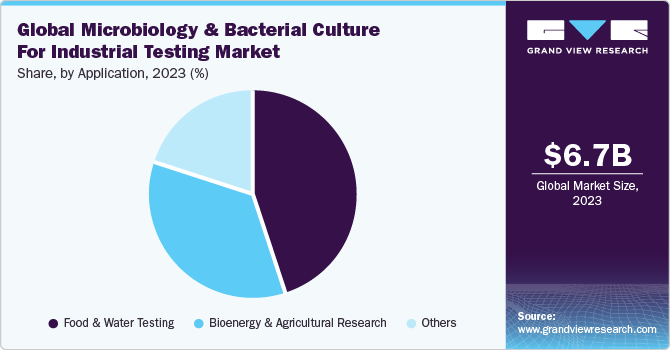

The global microbiology & bacterial culture for industrial testing market size was estimated to be USD 6.74 billion in 2023 and is expected to grow at a CAGR of 7.09% from 2024 to 2030. Growth of the market can be attributed to the growing developments in the microbiology industry due to the advancements in biotechnology for research purposes, specifically focused on identifying & detecting microbes to understand the role of microorganisms in disease pathogenesis. Moreover, the rising prevalence of food-borne diseases is another factor expected to contribute to market growth over the forecast period. Scientists and industry experts are engaged in developing new and rapid microbial culture systems to enhance testing efficiency and offer instant results. For instance, in April 2022, Merck KGaA launched the ReadyStream system that prepares and instantly dispenses culture media for use in microbiological food testing.

Moreover, in recent years, there have been significant advancements in microbiology culture media tailored for bioenergy applications. These developments aim to support the growth and metabolic activities of bioenergy-relevant microbes to enhance the production of next-generation biofuels & bioproducts. The optimization of culture media is crucial in maximizing microbial productivity and efficiency in biofuel production. Researchers have been focusing on designing customized culture media formulations that provide the necessary nutrients, growth factors, and substrates required by specific microbial strains involved in bioenergy production.

The rising burden of foodborne infections has emerged as a key factor propelling the microbiology and bacterial culture for industrial testing market growth. This phenomenon is marked by a surge in the incidence of foodborne illnesses caused by pathogens such as Salmonella, E. coli, and Listeria, which pose significant public health concerns worldwide. According to the World Health Organization (WHO), every year, unsafe food causes about 600 million cases of foodborne illnesses and results in up to 500,000 deaths worldwide, with 30% of these deaths affecting children under five. Consequently, governments and regulatory bodies have enforced increasingly stringent food safety regulations, which has resulted in mandatory rigorous quality & safety standards and regular testing for contaminants & pathogens. This has, in turn, increased the demand for advanced microbiological testing methods, including bacterial culture, to ensure compliance and safeguard public health.

In addition, the growth in food microbiology testing can primarily be attributed to the rising awareness about food safety and quality among consumers & regulatory bodies. As a result, the market is witnessing a surge in the adoption of microbiological testing methods to ensure the safety and quality of food products. Growing demand for various applications in products such as soy products, meat products, and fruit & vegetables testing is fueling the growth of the microbiology & bacterial culture for industrial testing market.

Furthermore, AMR is a global health concern that affects various sectors, including food and water safety. The overuse and misuse of antimicrobial agents in agriculture, aquaculture, and healthcare have contributed to the emergence of resistant strains of bacteria, viruses, parasites, and fungi, posing a significant risk to human health. Resistant pathogens in food can cause large-scale outbreaks of foodborne illnesses that are difficult to control due to limited treatment options. This further necessitates the need for food and water testing to detect AMR pathogens and avoid future infections, thus propelling market growth.

Market Concentration & Characteristics

The degree of innovation in the market can be considered high. This advancement allows for more efficient and accurate analysis, leading to improved processes and products. For instance, MSL Solution Providers announced the launch of VeganSure, a dehydrated culture media. The solution is expected to enable microbial testing and assure quality safety in cosmetic products.

The level of collaboration and partnership in innovation for microbiology and bacterial culture in the industrial testing sector is growing. Researchers, industries, and academic institutions are working together to share knowledge, resources, and expertise, fostering a more dynamic and effective approach to innovation. For instance, in February 2023, Hardy Diagnostics announced its agreement with Premier, Inc. for manual microbiology.

The impact of regulation in the microbiology and bacterial culture for the industrial testing market can be considered moderate. Regulations ensure safety, quality, and reliability in the industry. While they may pose some constraints, they also create a stable environment that encourages innovation and growth. Balanced regulation is crucial for maintaining trust in the sector and promoting continuous improvement.

Product expansion in the microbiology and bacterial culture sector for the industrial testing market is considered high. Innovative products and services are continuously being developed to cater to the growing demand for efficient and accurate testing methods. This high expansion drives competition and encourages further innovation, benefiting the overall industry. For instance, in February 2023, Hardy Diagnostics announced the launch of a ready-to-use dehydrated culture medium plate, CompactDry TCR, for the detection and enumeration of microorganisms within 24 hours.

The regional expansion in microbiology and bacterial culture for the industrial testing market is considered moderate. For instance, in June 2023, Merck KGaA announced an investment of USD 74.53 million for the expansion of the reagents manufacturing facility in China. This expansion was anticipated to add production capacity and provide purified reagents used for quality control & testing. While there is growing interest and adoption in various regions, the pace of expansion may differ due to factors such as infrastructure, regulatory environments, and local industry needs.

Consumable Insights

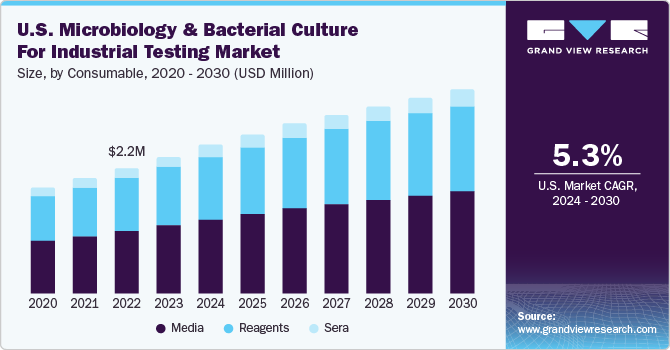

Based on the consumables, the market is segmented into media, reagents, and sera. The media segment dominated the market with a share of 50.33% in 2023 andis expected to register the highest CAGR over the forecast period, which can be attributed to the substantial demand for media, which is crucial for cell culture composition. As bacterial cell cultivation experiences significant growth, this development is anticipated to directly contribute to the increased adoption of media, fostering segment growth. For instance, in October 2022, MSL Solution Providers, a company offering lab and regulatory testing services to the cleansing, personal care, & cosmetics sectors, introduced VeganSure. This vegan testing solution, a Dehydrated Culture Media (DCM), was added to its existing portfolio. MSL Solution Providers can cater to global clients, having in-house labs or collaborating with subcontracted microbiological testing facilities, and now provide vegan-specific DCM. This offering empowers its users to conduct regular microbiological testing and uphold the safety standards of their cosmetic products.

The reagents segment is witnessing a significant expansion, driven by rapid growth across pharmaceuticals, chemicals, food & beverage, and other industries, boosting the need for accurate & reliable testing solutions to ensure product quality, safety, & regulatory compliance. Reagents play a critical role in various testing processes, including chemical analysis, environmental monitoring, material testing, and quality control. This increasing demand for testing services is fueling the reagent market as companies invest in developing and manufacturing high-quality reagents optimized for specific industrial applications.Furthermore, investments in R&D and infrastructure are driving innovation in the reagent market, leading to the development of advanced reagents with improved sensitivity, specificity, and efficiency. Companies are allocating significant resources to research initiatives aimed at enhancing reagent performance, developing novel formulations, and expanding the range of analytes that can be detected.

Application Insights

Based on application, the market is segmented into food & water testing, bioenergy & agricultural research, and others. The food & water testing segment dominated the market with a share of 47.39% in 2023. Parenteral food and water are the easiest & most frequent ways of transfer of pathogens. The growing concern for food safety, driven by increased food poisoning cases, is fueling the demand for microbiological testing solutions. To ensure pathogen-free products, global supply chains are focusing on maintaining microbial quality control. This heightened awareness among food manufacturing and processing entities is anticipated to significantly contribute to the market's prosperous growth in the foreseeable future.

The bioenergy & agricultural research segment is expected to register the highest CAGR over the forecast period. In the bioenergy sector, microbial culture testing plays a crucial role in biofuel production processes. Microorganisms are utilized in fermentation processes to convert biomass, such as agricultural residues & organic waste, into biofuels like ethanol and biodiesel. As the demand for renewable energy sources grows and governments implement policies to reduce reliance on fossil fuels, there is a rising emphasis on R&D in bioenergy technologies, driving the demand for microbial culture testing services. For instance, in November 2022, the Ministry of New & Renewable Energy (MNRE), under the Government of India, announced the initiation of the National Bioenergy Programme. MNRE extended the National Bioenergy Programme for the duration spanning from fiscal year 2021-22 to 2025-26. The optimization of microbial cultures through industrial testing methods enhances fermentation efficiency, increases biofuel yields, and reduces production costs.

Regional Insights

North America accounted for the largest market share of 39.53% in 2023. The North American market owing to the local presence of a large number of biotechnology companies that operate in various fields of bioprocessing, including the production of biofuels, nutritional supplements, and agricultural advancements by cell culture. Furthermore, North America has a significant market presence in terms of innovation and use of technology, particularly in microbial cell cultures. Several multinational companies have manufacturing or processing plants in North America, which is expected to boost the country’s market in the forecast period. For instance, in October 2022, MSL Solution Providers, which offers integrated laboratory and regulatory testing services for household cleaning, personal care, and cosmetics industries, announced the launch of VeganSure, a DCM, as an expansion of its vegan testing solution portfolio. MSL Solution Providers is capable of providing companies globally with in-house laboratory services.

U.S. Microbiology & Bacterial Culture For Industrial Testing Market Trends

The microbiology & bacterial culture for industrial testing market in the U.S. is witnessing robust growth, driven by several factors shaping the healthcare landscape. The increasing prevalence of infectious diseases, including ongoing challenges posed by emerging pathogens, highlights the critical role of microbiology in disease diagnosis, surveillance, & management. In addition, it is engaged in subcontracted microbiological testing with vegan DCM. Such offerings empower it to conduct regular microbiological testing and uphold the safety standards of its cosmetic products.

Europe Microbiology & Bacterial Culture For Industrial Testing Market Trends

The microbiology & bacterial culture for industrial testing market in Europe is anticipated to grow significantly due to increasing demand for quality control in various industries such as pharmaceuticals, food, and water treatment. Key drivers include advancements in molecular diagnostics, rising awareness about microbial contamination, and stringent regulatory norms. This market expansion fosters innovation and collaboration among researchers and businesses, contributing to a safer and healthier society.

The microbiology & bacterial culture for industrial testing market in the UK held a significant share in 2023. With a growing focus on health and wellness, consumers in the UK are increasingly seeking products free from harmful bacteria and contaminants. This has prompted food and beverage companies to invest in robust microbiological testing protocols to uphold quality standards and meet consumer expectations. Moreover, advancements in microbiological testing technologies have enabled faster and more accurate detection of bacterial contaminants. Recent instances include the adoption of rapid molecular methods such as PCR and next-generation sequencing by testing laboratories in the UK to enhance testing efficiency & accuracy.

The Germany microbiology & bacterial culture for industrial testing market is witnessing considerable growth in the forecast period. Germany faces public health challenges related to foodborne illnesses, healthcare-associated infections, and environmental contamination. Concerns about emerging infectious diseases, antibiotic resistance, and food fraud drive the demand for microbiological testing to protect public health and prevent outbreaks. Recent outbreaks of foodborne illnesses and contamination incidents have highlighted the importance of robust testing protocols.

Asia Pacific Microbiology & Bacterial Culture For Industrial Testing Market Trends

The Asia Pacific microbiology & bacterial culture for industrial testing market is witnessing remarkable growth, due to rising demand for quality control in various industries, increasing research activities, and advancements in microbiological techniques. This market expansion is driven by factors such as environmental monitoring, food safety, and pharmaceutical production. Moreover, The interdisciplinary approach to microbiology in Asia Pacific has also led to collaborations between microbiologists, geneticists, biochemists, and engineers, resulting in innovative solutions for addressing microbial challenges.

The microbiology & bacterial culture for industrial testing market in China is witnessing remarkable growth. has a huge demand for better food, cosmetics, and sustainable fuel. Studies show that there has been a significant increase in the volume of fermented food consumed in the last 5 years due to the advantages of fermented food over normal food, as probiotics are known for improving health in many ways. Other significantly growing industries are cosmetics and biofuel. This growth is mainly due to the increasing investments made by various multinational and local companies, as well as government agencies. These industries are using natural supplements to create sustainable fuel.

The Japan microbiology & bacterial culture for industrial testing market experiences growth driven by several factors. One of the factors is the increasing demand for safe and quality food products. Consumers are becoming more aware of food safety issues and are demanding products that have undergone rigorous testing for microbiological contaminants. Recent instances of food safety incidents in Japan, such as outbreaks of foodborne illnesses, have further highlighted the need for robust testing protocols. Another factor is the globalization of food trade. As Japan's food exports increase, there is a growing need for reliable testing methods to ensure that these products meet international safety standards.

Middle East & Africa Microbiology & Bacterial Culture For Industrial Testing Market Trends

The Middle East & Africa microbiology & bacterial culture for industrial testing market is steadily growing, driven by the presence of key players and universities, which are actively engaged in partnerships, collaborations, & research studies. For instance, in November 2023, the University of Johannesburg announced that its researchers discovered a new bacterium in medicinal plants in South Africa. Hence, clinical microbiology-based products and instruments are expected to be used to conduct advanced research.

The microbiology & bacterial culture for industrial testing market in Saudi Arabia is growing significantly and its growth can be attributed to the significant investments in R&D and the presence of leading institutions focused on science & technology. For instance, since 2021, Saudi Arabia witnessed a substantial investment of USD 3.9 billion in R&D.

Key Microbiology & Bacterial Culture For Industrial Testing Company Insights

The market players operating in the microbiology & bacterial culture for the industrial testing market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Microbiology & Bacterial Culture For Industrial Testing Companies:

The following are the leading companies in the microbiology & bacterial culture for industrial testing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Neogen Corporation

- HiMedia Laboratories

- Eiken Chemical Co., Ltd

- ATCC

- Titan Biotech

- Hardy Diagnostics

Recent Development

-

In June 2023, Gold Standard Diagnostics launched BACGro Culture Media, an innovative product for identifying pathogenic microorganisms across various industries, including food, environmental, and pharmaceutical sectors.

-

In February 2023, Hardy Diagnostics introduced the CompactDry TCR, a preprepared dehydrated culture medium plate designed for promptly detecting and quantifying microorganisms. This product offers total aerobic plate counts within 24 hours.

-

In July 2023, Merck invested around USD 75.16 million to enhance its reagent manufacturing capabilities in China. This expansion aimed to increase production capacity and better cater to customers' needs, offering them highly purified reagents for quality control & testing.

-

In May 2023, HiMedia Laboratories announced the launch of Anoxomat III Anaerobic Culture System. Thereby propelling the market growth over the forecast period.

Microbiology & Bacterial Culture For Industrial Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.38 billion

Revenue forecast in 2030

USD 11.13 billion

Growth rate

CAGR of 7.09% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Consumables, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India;;South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Bio-Rad Laboratories, Inc.; bioMérieux SA; Neogen Corporation; HiMedia Laboratories; Eiken Chemical Co., Ltd; ATCC; Titan Biotech; Hardy Diagnostics

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microbiology & Bacterial Culture For Industrial Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global microbiology & bacterial culture for industrial testing market report based on consumables, application, and region.

-

Consumables Outlook (Revenue, USD Million, 2018 - 2030)

-

Media

-

Bacterial

-

Fungi & Algae

-

Others

-

-

Reagents

-

Bacterial

-

Others

-

-

Sera

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Water Testing

-

Food

-

Animal Feed

-

Water Testing

-

-

Bioenergy & Agricultural Research

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microbiology & bacterial culture for industrial testing market size was estimated at USD 6.74 billion in 2023 and is expected to reach USD 7.38 billion in 2024.

b. The global microbiology & bacterial culture for industrial testing market is expected to grow at a compound annual growth rate of 7.09% from 2024 to 2030 to reach USD 11.13 billion by 2030.

b. Media dominated the microbiology & bacterial culture for industrial testing market with a share of 50.33% in 2023. This is attributable to the high requirement for media due to the different compositions of cell cultures.

b. Some key players operating in the microbiology & bacterial culture for industrial testing market include Thermo Fisher Scientific, Inc.; Merck KGaA; Bio-Rad Laboratories, Inc.; bioMérieux SA; Neogen Corporation; HiMedia Laboratories; Eiken Chemical Co., Ltd; ATCC; Titan Biotech; Hardy Diagnostics

b. Key factors that are driving the market growth include the growing developments in the microbiology industry due to the advancements in biotechnology for research purposes, specifically focused on identifying & detecting microbes to understand the role of microorganisms in disease pathogenesis. Moreover, the rising prevalence of food-borne diseases is another factor expected to contribute to market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."