- Home

- »

- Pharmaceuticals

- »

-

Microbiome Therapeutics Market Size & Share Report, 2030GVR Report cover

![Microbiome Therapeutics Market Size, Share & Trends Report]()

Microbiome Therapeutics Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (FMT, Microbiome Drugs), By Application (C. difficile, Crohn's Disease, Inflammatory Bowel Disease, Diabetes), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-311-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microbiome Therapeutics Market Summary

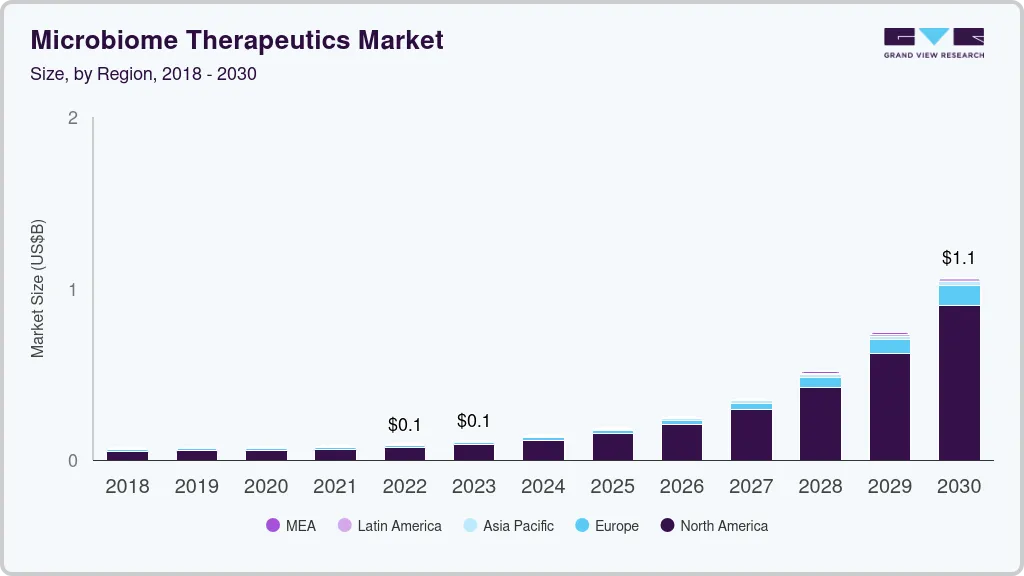

The global microbiome therapeutics market size was estimated at USD 94.9 million in 2022 and is projected to reach USD 1,066.8 million by 2030, growing at a CAGR of 35.3% from 2023 to 2030. The market is witnessing growth due to the factors such as the increasing number of strategic collaborations for microbiome therapeutics for R&D, product development, the projected launch of novel drugs, and portfolio enhancement.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, c. difficile accounted for a revenue of USD 79.2 million in 2022.

- C. difficile is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 94.9 Million

- 2030 Projected Market Size: USD 1,066.8 Million

- CAGR (2023-2030): 35.3%

- North America: Largest market in 2022

For instance, in January 2022, Hudson Institute and BiomeBank entered into a 4-year collaboration for the development and discovery of microbial therapies. Furthermore, a significant increase in the prevalence of target diseases is boosting the demand for microbiome therapeutics.

The COVID-19 pandemic had a significant negative impact on the market for microbiome therapeutics. Clinical trial research was severely disrupted globally. This is especially true considering that trials frequently include weaker populations who are most at risk of being exposed to COVID-19. The COVID-19 pandemic and the suspension of non-essential medical procedures, such as endoscopies, at numerous clinical sites had a negative effect on Seres Therapeutics' SER-287 development activity.

The majority of therapeutic agents in the pipeline are in the early stages of development, roughly in Phase I and Phase II. For GI indications, over 13 drugs are being investigated out of 23, with the majority targeting ulcerative colitis. For instance, in 2021, Seres Therapeutics, Inc. announced data of SER-109, released from its Phase 3 ECOSPOR III study. The pipeline drug is under investigation as an oral therapy for recurring C. difficile infection with an anticipated launch in the first half of 2023. In contrast to placebo, SER-109 is linked to a decline in antimicrobial resistance genes.

The advancements in microbiome research are expected to aid the discovery of better treatments for infections and other diseases, which will enhance the outcomes of medical care. To aid the adoption of microbiome-based treatments, companies are lowering the cost of their products and making cutting-edge medical care more accessible to a larger portion of the population, and a few nations governing bodies are restructuring their approaches. Resultantly, this provides market vendors with profitable growth prospects to improve their market share.

Stringent regulatory guidelines owing to the complex nature of the product and the high cost of microbiome therapeutics are major factors restraining the growth of the market. High cost of development, production, and stringent & lengthy regulation processes increase the overall cost of the product and, thereby, impact the treatment cost. For instance, the out-of-pocket cost of screening one’s donor can exceed USD 3500, while FMT capsules are available at USD 2050 per dose.

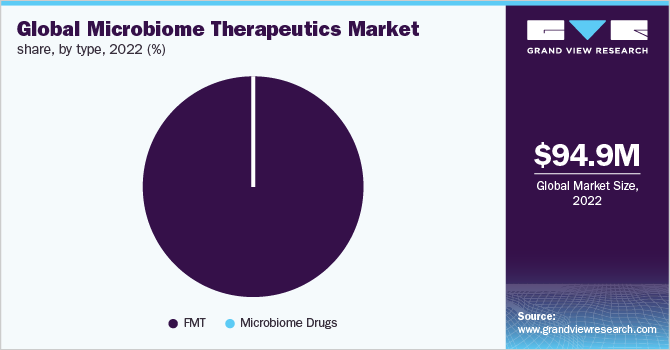

Type Insights

Fecal microbiota therapy (FMT) dominated the microbiome therapeutics market in 2021 with a share of 91.6%. The dominance of the segment is attributed to its wide usage in the treatment of C. difficile infection. Moreover, increasing R&D focusing on developments to discover other therapeutic applications of FMT and the introduction of capsules in the market is expected to drive the growth. For instance, in February 2021, new direct testing for SARS-COV-2 was announced by OpenBiome in fecal microbiota therapy preparation which is aimed at increasing the availability of FMT to any scheduled patient for emergency use without infection transmission risk.

Microbiome drugs are expected to expand at the fastest rate of 49.1% over the forecast period attributable to the presence of a robust pipeline and the development of advanced and novel drugs. The majority of drugs are still in the developmental stages. For instance, 4D Pharma plc’s drug, Blautix is under Phase II stage of clinical trials which is a single strain biotherapeutic product, under investigation for the treatment of both IBS-C and IBS-D.

Application Insights

Clostridium difficileinfection (CDI or C. difficile) application segment is projected to expand at the fastest growth rate with a CAGR of 37.34% from 2023 to 2030. The growth of this segment is attributed to the increasing use of Fecal microbiota transplants (FMT) in the treatment of C. difficile. According to a study published in 2020, by the University of Birmingham, FMT is highly accepted for the treatment of patients suffering from Clostridium difficile infections. Further, FMT is more efficient in the treatment of C difficile than an antibiotic, especially in recurrent cases.

Crohn’s disease application segment is expected to show lucrative growth during the forecast period owing to enhanced focus on gut microbial changes in patients with the condition. For instance, as per the Microbiome Journal in 2020, remission of Crohn’s disease can be maintained in patients with the use of fecal microbiota transplantation.

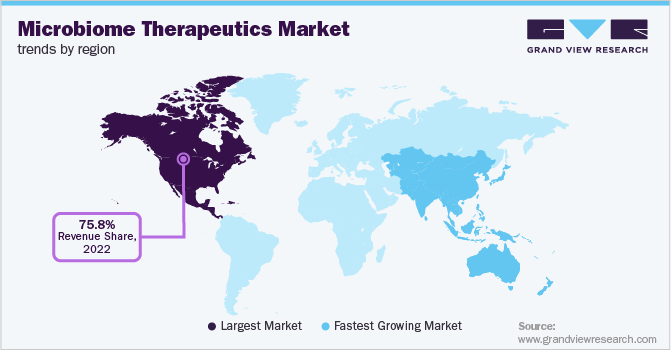

Regional Insights

North America dominated the market with the largest market share of 75.8% in 2022. Highly established research facilities for the development of novel therapeutics and increasing target population are the major factors for the dominance of the region. Further, the prevalence of programs such as the Canadian Microbiome Initiative (CMI) in Canada facilitates collaboration with stakeholders and partners. This allows the focusing of research efforts on microbiome therapeutics development. For instance, in July 2021, Biocodex Microbiota Foundation announced a call for proposals for microbiome studies in Canada for over USD 26,000 in research grants. These grants are expected to fuel new developments in the market.

Europe is estimated to demonstrate significant growth of 35.4% during the forecast period. Germany is an emerging market in Europe for microbiome therapeutics. Despite the high cost of microbiome therapeutics, supportive reimbursement policies are expected to facilitate treatment adoption in upcoming years. Furthermore, startups are receiving funding to research and introduce microbiome-based products.

Key Companies & Market Share Insights

The increasing number of collaborations is becoming a key strategy being adopted by the players. For instance, in December 2021, Kaleido Biosciences announced a collaboration to investigate the potential of microbiome metabolic therapies with Janssen for the prevention of childhood-onset of immune, atopic, and metabolic conditions. Some of the key players in the global microbiome therapeutics market include:

-

OpenBiome

-

Seres Therapeutics Inc.

-

4D Pharma plc.

-

Locus Biosciences, Inc.

-

Enterome SA

-

Finch Therapeutics Group, Inc.

-

Intralytix, Inc.

-

Microbiotica

-

Second Genome

-

Rebiotix Inc.

-

Vedanta Bioscience, Inc.

Microbiome Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 114.16 million

Revenue forecast in 2030

USD 1,066.8 million

Growth rate

CAGR of 35.32% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

OpenBiome; Seres Therapeutics Inc.; 4D Pharma plc.; Locus Biosciences, Inc.; Enterome SA; Finch Therapeutics Group, Inc.; Intralytix, Inc.; Microbiotica; Second Genome; Rebiotix Inc.; Vedanta Bioscience, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microbiome Therapeutics Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microbiome therapeutics market based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

FMT

-

Microbiome Drugs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

C. difficile

-

Crohn’s disease

-

Inflammatory Bowel Disease

-

Diabetes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global microbiome therapeutics market size was estimated at USD 94.86 million in 2022 and is expected to reach USD 114.16 million in 2023.

b. The global microbiome therapeutics market is expected to grow at a compound annual growth rate of 35.32% from 2023 to 2030 to reach USD 1,066.8 million by 2030.

b. C. difficile dominated the microbiome therapeutics market with a share of 81.88% in 2022 owing to the presence of a wide target population and the projected launch of promising products over the forecast period

b. Some key players operating in the microbiome therapeutics market include OpenBiome, Seres Therapeutics Inc., 4D pharma plc., Locus Biosciences, Inc., and Enterome SA.

b. Key factors that are driving the microbiome therapeutics market include an increasing number of strategic collaborations for microbiome therapeutics for R&D, product development, the projected launch of novel drugs, and portfolio enhancement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.