- Home

- »

- Medical Devices

- »

-

Microcatheter Market Size & Share, Industry Report, 2030GVR Report cover

![Microcatheter Market Size, Share & Trends Report]()

Microcatheter Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Design (Single Lumen), By Product (Delivery Microcatheters), By Application (Cardiology, Neurology, Oncology), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-566-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microcatheter Market Size & Trends

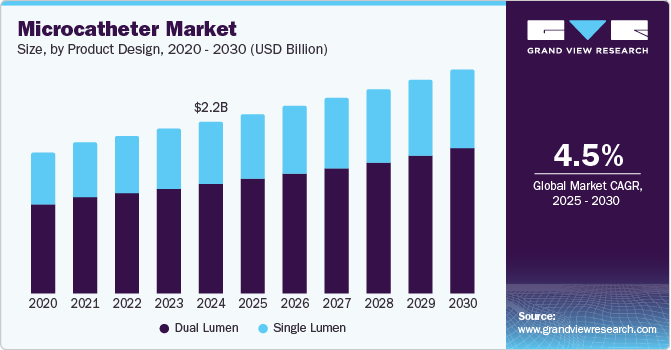

The global microcatheter market size was valued at USD 2.18 billion in 2024 and is anticipated to grow at a CAGR of 4.5% from 2025 to 2030. The microcatheter market is growing due to the rising prevalence of chronic diseases, such as cardiovascular and neurological disorders, which require advanced treatment options. In addition, the aging population is increasing the demand for minimally invasive procedures. A supportive healthcare ecosystem, including improved access to healthcare services and advancements in medical technology, further contributes to this market expansion.

The rising prevalence of chronic diseases, such as cardiovascular and neurological disorders, is a major driver of the microcatheter market, as these conditions often require advanced treatment methods. Microcatheters, which allow for precise delivery of therapies in minimally invasive procedures, are increasingly used for conditions such as aneurysms and arterial blockages. According to the WORLD HEART REPORT 2023, over half a billion people worldwide were affected by cardiovascular diseases, which caused 20.5 million deaths in 2021, accounting for nearly a third of all global deaths. This marked an increase from the previous estimate of 121 million CVD-related deaths, emphasizing the growing global health crisis.

The aging population is driving the demand for minimally invasive procedures, as older adults are more likely to suffer from chronic conditions that require such treatments. Microcatheters, which enable precise and less invasive interventions, are increasingly sought after for cardiovascular and neurological care procedures. According to the World Population Prospects 2022, the global population of people aged 65 and above grew faster than those below that age. It was projected that by 2050, the proportion of people aged 65 and older would rise from 10% in 2022 to 16%. In addition, by 2050, the number of individuals aged 65 and above was expected to be double that of children under 5 years and nearly equal to those under 12.

Product Type Insights

Dual lumen accounted for the largest share of 64.5% in 2024 and is expected to grow at the fastest CAGR of 4.7% over the forecast period. A key driving factor for the dual-lumen microcatheter market is the demand for advanced biomaterial-based devices that reduce complications such as thrombosis and infections, improving patient outcomes and healthcare efficiency. For instance, in May 2022, Access Vascular, Inc. received FDA clearance for its HydroPICC Dual-Lumen catheter, designed with a biomaterial that significantly reduces complications like thrombosis and infections compared to standard catheters. This innovation improves patient outcomes and hospital economics by minimizing vascular access issues. The new catheter is part of AVI’s expanding portfolio of advanced medical devices.

The single lume segment is expected to grow significantly over the forecast period, owing to the need for precise and minimally invasive procedures, cost-effectiveness compared to multi-lumen designs, and versatility for various diagnostic and interventional applications. In addition, advancements in material technologies and increasing adoption in fields such as neurovascular and cardiovascular interventions further support the demand.

Product Insights

The aspiration microcatheters segment held the largest market share of 32.2% in 2024. This is attributable to demand for devices that ensure rapid and effective recanalization, enhance functional recovery rates, and demonstrate proven clinical safety and efficacy in treating acute ischemic strokes. For instance, in July 2024, MicroVention, Inc. announced the clinical publication of the SOFAST study, highlighting the efficacy and safety of the SOFIA Flow Plus Aspiration Catheter for treating acute ischemic stroke. The study reported impressive metrics, including a median time of 17 minutes to recanalization and 66.7% of patients achieving good functional outcomes at 90 days. This research reinforces SOFIA's long-standing clinical performance and innovation in neurovascular treatments.

The steerable microcatheters segment is expected to grow at the fastest CAGR of 5.5% over the forecast period. This growth is attributed to the growing demand for precise navigation in minimally invasive procedures, especially in challenging vascular and neurovascular applications. These microcatheters offer enhanced control and flexibility, enabling access to complex anatomical sites while reducing procedural risks. The rising prevalence of chronic diseases and advancements in catheter technology further drive their adoption.

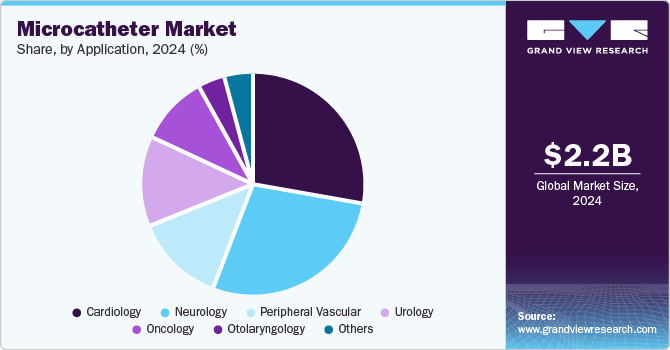

Application Insights

The cardiology segment dominated the market with share of 28.0% in 2024. This dominance is attributed to the increasing global prevalence of cardiovascular diseases, advancements in minimally invasive techniques, and the growing need for precise, targeted therapies contribute to the rising demand for microcatheters. These devices offer enhanced navigation and access to intricate coronary and vascular areas, improving treatment outcomes and reducing recovery times. In addition, technological innovations and better patient outcomes further drive the adoption of microcatheters in cardiology.

The neurology segment is projected to grow at the fastest CAGR of 5.4% over the forecast period. This growth is attributed to the rising global prevalence of neurological disorders, which has led to an increasing demand for advanced medical devices capable of treating conditions such as stroke, Alzheimer's, and Parkinson's disease, as these are major causes of illness and disability. A study published in The Lancet Neurology revealed that over one-third of the global population had been affected by neurological conditions, making them the leading cause of illness and disability. According to the Global Burden of Disease Study 2021, the total disability-adjusted life years (DALYs) due to neurological disorders had risen by 18% since 1990. This highlighted the increasing global burden of brain diseases and their significant societal impact.

Regional Insights

North America microcatheter market held the largest share of 31.7% in 2024, which can be attributed to the increasing demand for advanced catheters, which is driven by ongoing innovation in catheter manufacturing and improved patient outcomes. For instance, in May 2024, Scientia Vascular, Inc. received FDA clearance for two advanced catheters: the Plato 17 microcatheter, compatible with DMSO, and the Socrates 38 aspiration catheter for ischemic stroke. Scientia is revolutionizing catheter manufacturing for improved patient care by applying cutting-edge microfabrication and design principles.

U.S. Microcatheter Market Trends

The U.S. microcatheter market held a dominant position in 2024 due to the increasing demand for advanced, high-flow microcatheters that offer improved drug delivery, higher flow rates, and precise placement while maintaining compact sizes, enhancing vascular intervention procedures. For instance, in March 2024, Embolx, Inc.'s Soldier High Flow Microcatheter received FDA clearance. It was designed to enhance localized drug delivery during vascular interventions. Utilizing Ultra-Thin Wall (UTW) technology, the catheter offers higher flow rates while maintaining a compact size. It is available in 2Fr and 2.5Fr sizes and provides improved usability, trackability, and precise placement, enabling effective embolization with smaller devices.

Europe Microcatheter Market Trends

The Europe microcatheter market was identified as a lucrative region in 2024. The increasing prevalence of cardiovascular diseases, such as coronary artery and peripheral artery disease, is driving the demand for microcatheters used in diagnostic and therapeutic procedures. In addition, the shift towards minimally invasive procedures, which offer quicker recovery and reduced risk, is boosting microcatheter usage in treatments like angioplasty and neurovascular interventions.

Asia Pacific Microcatheter Market Trends

The Asia Pacific microcatheter market is anticipated to grow at a CAGR of 5.5% during the forecast period. The rising prevalence of cardiovascular diseases, particularly ischemic heart disease, and stroke, driven by high systolic blood pressure and high fasting plasma glucose in certain regions, is a key driver for the growth of the microcatheter market in Asia Pacific. According to The Lancet, from 2025 to 2050 high systolic blood pressure will be the top contributor to ASMR in Asia, except Central Asia, where high fasting plasma glucose will be the dominant factor. Ischaemic heart disease and stroke will remain the leading causes of ASMR, with Central Asia having the highest ASMR, more than three times that of the overall Asia region. Crude cardiovascular mortality is projected to rise by 91.2% despite a 23% drop in the age-standardized cardiovascular mortality rate (ASMR).

The China microcatheter market held a substantial market share in 2024 and is expected to grow at the fastest CAGR over the forecast period. China's aging population drives demand for advanced medical devices such as microcatheters. Elderly individuals are more prone to chronic conditions requiring minimally invasive procedures, boosting the adoption of microcatheters in healthcare settings. For instance, by the end of 2022, China's elderly population aged 60 and above totaled 280.04 million, making up 19.8% of the total population. The population aged 65 and above reached 209.78 million, accounting for 14.9%, with a dependency ratio of 21.8%. This highlights the growing proportion of elderly individuals in China.

Japan microcatheter market is expected to grow significantly over the forecast period owing to the advancements in healthcare technology, with innovations enhancing precision and safety in minimally invasive procedures. The country's high healthcare spending and robust infrastructure facilitate the adoption of advanced medical devices. In addition, the rising prevalence of vascular disorders linked to lifestyle diseases such as diabetes and hypertension increases the demand for microcatheters. These factors collectively strengthen the market in Japan's advanced medical landscape.

Key Microcatheter Company Insights

Some of the key companies in the microcatheter market include Medtronic, Terumo Corporation, Merit Medical Systems, Stryker and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Medtronic is a global medical technology company that designs, develops, and manufactures various medical devices for treating heart valve disorders, heart failure, vascular diseases, neurological disorders, and musculoskeletal issues. The company also provides biologic solutions for orthopedics and dental markets.

-

Merit Medical Systems develop single-use medical devices for interventional and diagnostic procedures, including catheters, embolotherapy products, and fluid dispensing systems. Their products are widely used across fields such as cardiology, radiology, oncology, vascular surgery, and pain management.

Key Microcatheter Companies:

The following are the leading companies in the microcatheter market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Terumo Corporation

- Merit Medical Systems

- Stryker

- Penumbra, Inc.

- Boston Scientific Corporation

- Teleflex Incorporated

- ASAHI INTECC USA, INC.

- Surmodics, Inc.

- BIOCARDIA, INC.

Recent Developments

-

In June 2024, MicroVention, Inc. (Terumo Corporation) launched the LVIS EVO, a next-generation coil-assist intracranial stent, in the U.S. It treats wide-neck intracranial aneurysms. It offers enhanced precision and flexibility for neurovascular procedures.

-

In February 2024, BIOTRONIK and IMDS introduced the Micro RX catheter, a highly flexible microcatheter designed for complex coronary interventions. The catheter enhances precision during procedures, offering greater navigation capabilities in challenging anatomies. Its improved design facilitates optimal performance for clinicians performing intricate vascular procedures.

-

In May 2023, Stryker acquired Cerus Endovascular, a company specializing in innovative technologies for treating intracranial aneurysms. This acquisition expands Stryker's portfolio in neurovascular care, enhancing its offerings in minimally invasive endovascular solutions.

Microcatheter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.28 billion

Revenue forecast in 2030

USD 2.85 billion

Growth Rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product Design, Product, Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Medtronic; Terumo Corporation; Merit Medical Systems; Stryker; Penumbra, Inc.; Boston Scientific Corporation; Teleflex Incorporated; ASAHI INTECC USA, INC.; Surmodics, Inc.; BIOCARDIA, INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microcatheter Market Report Segmentation

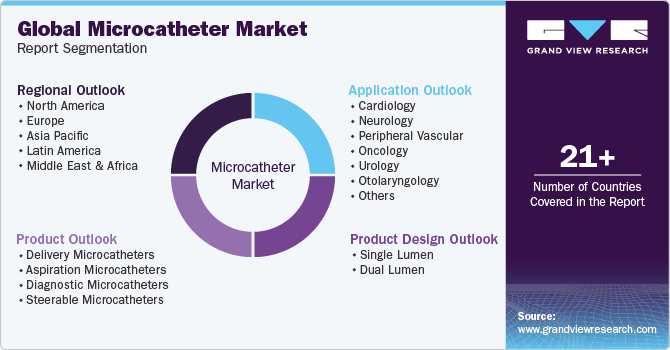

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microcatheter market report based on product design, product, application, and region.

-

Product Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Lumen

-

Dual Lumen

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Delivery Microcatheters

-

Aspiration Microcatheters

-

Diagnostic microcatheters

-

Steerable Microcatheters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Neurology

-

Peripheral Vascular

-

Oncology

-

Urology

-

Otolaryngology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.