- Home

- »

- Display Technologies

- »

-

Microdisplays Market Size, Share And Growth Report, 2030GVR Report cover

![Microdisplays Market Size, Share & Trends Report]()

Microdisplays Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Near-To-Eye, Projection, Others), By Technology (LCD, LCoS, OLED, DLP), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-645-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microdisplays Market Size & Trends

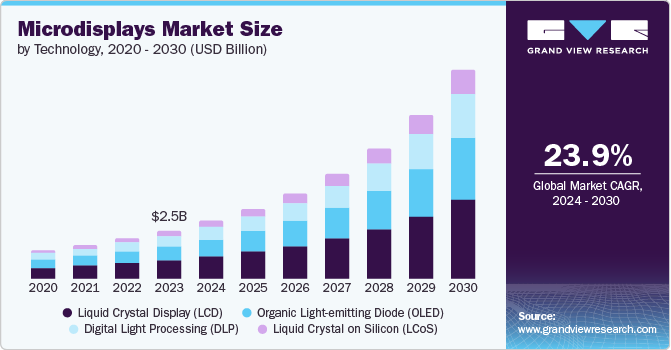

The global microdisplays market size was valued at USD 2.46 billion in 2023 and is projected to grow at a CAGR of 23.9% from 2024 to 2030. Increasing innovations in microdisplay technology and the growing adoption of next-generation emissive display technologies in various devices are key growth drivers for this market. Additionally, the rising use of Head-Mounted Displays (HMDs), Advanced Diver-Assistance Systems (ADAS), and Head-Up Displays (HUDs) in numerous industries and the growth in demand for compact-size microdisplays are attributable to the market's growth in the forecast period.

With a rising inclination towards portable, compact, and convenient modern devices, the demand for simple and compact high-resolution displays is increasing. Increasing demand for projectors, medical equipment, and thermal imaging glasses in numerous industries, including aerospace, automotive, medical, defense, electronics, and others, is expected to develop significant growth for this market in the approaching years. The growing demand for smartwatches and fitness trackers for health monitoring, lifestyle support, entertainment, and fitness tracking has also been a key growth driving factor.

Latest technology innovations such as OLED microdisplays, the growing adoption of multiple products and services related to Augmented Reality (AR) and Virtual Reality (VR) delivering immersive experiences, inclusion of head-up displays in vehicle manufacturing, and advancements in healthcare infrastructure are projected to generate an upsurge in demand for the microdisplays market during the forecast period.

Product Insights

The near-to-eye segment dominated the market and accounted for a market revenue share of 54.2% in 2023. This growth is attributable to the increasing adoption of near-to-eye displays and AR devices such as head-up displays (HUDs), electronic viewfinders (EVFs), and head-mounted displays (HMDs). Near-to-eye displays have the capacity to generate a large image from a compact, lightweight source display unit, allowing its integration into compact technology such as wearables. It has high pixel density, leading to excellent resolution and clarity, due to which it is increasingly used in medical and military industries.

The projection segment is expected to experience a significant CAGR during the forecast period. The increasing evolution of technologies such as Liquid Crystal on Silicon (LCOS) has an advantage in high-end projection applications. The capacity to deliver larger size images characterized by higher quality with smaller size display units, power efficiency, and growing demand for associated products such as television devices is expected to develop growth for this market during the forecast period. Some noteworthy technologies in projection microdisplays are liquid crystal on silicon (LCoS) and digital micromirror devices (DMD).

Technology Insights

The Liquid Crystal Display (LCD) segment accounted for the largest revenue share in 2023. The growth is attributed to factors such as low costs, less energy consumption, and growing use in head-up displays (HUDs), head-mounted display (HMDs), electronic viewfinders (EVFs), and wearables. Moreover, LCDs provide excellent contrast solution and brightness, ensuring precise image accuracy. Wide application of LCDs in consumer electronics such as mobile devices, smartphones, gaming systems, computers, televisions, and laptops is expected to drive growth for this segment.

The Liquid Crystal on Silicon (LCoS) segment is anticipated to experience a significant CAGR over the forecast period. The segment is primarily driven by the use of LCoS in laser projections. Cost-effectiveness and growing inclusion of LCoS microdisplays in multiple products such as embedded projectors, pico-projectors and head-mounted displays is projected to generate greater demand for this segment in approaching years.

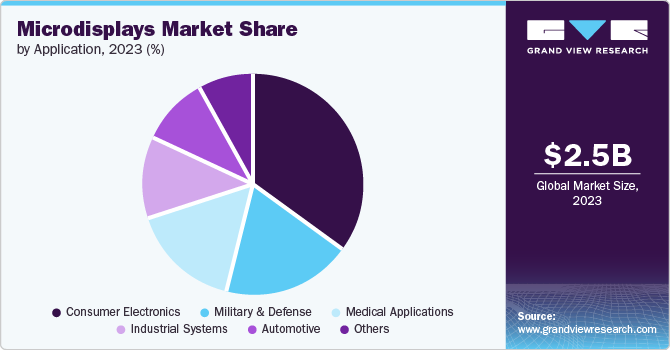

Application Insights

Consumer electronics segment accounted for the largest revenue share in 2023. Microdisplays play a crucial role in the functional ability of products such as VR headsets, wearable devices, and AR glasses within the consumer electronics industry. These screens offer engaging visual experiences in digital content consumption, gaming, and entertainment with high pixel density and minimal delay. Moreover, the rising preference for portable and convenient devices and the growing adoption of smartphones, smart glasses, and smartwatches are contributing to the growth of the market during the forecast period.

The automotive application segment is anticipated to register the fastest CAGR over the forecast period. Microdisplays are utilized in automotive technologies such as heads-up displays (HUDs), augmented reality dashboards, and rear-seat entertainment systems. Microdisplays allow drivers to view important information such as navigation directions and vehicle diagnostics without diverting their attention from the road, enhancing safety and overall driving experience. Rising innovation in microdisplays and integration of innovative features by key companies allow car drivers to control music and respond to calls and texts without diverting attention. These factors are expected to fuel growth in this industry in the coming years.

Regional Insights

North America microdisplays market was identified as a lucrative region in 2023. Rising technological advancements and innovations in microdisplays technology, the presence of multiple manufacturing companies that use microdisplays in their product development, and growing availability & accessibility are some of the key growth driving factors for this market. Moreover, the increasing adoption of AR/VR and rising demand for high-resolution displays fuel demand for this regional industry.

U.S. Microdisplays Market Trends

U.S. microdisplays market dominated the regional industry and accounted for 72.8% in 2023. This market is primarily driven by the rising inclusion of microdisplays in products manufactured in the country, such as consumer electronics, cameras, projectors, and automotive products. Microdisplays are widely utilized in these industries due to their high resolution, excellent picture quality, low power consumption, and compact size. The rapid advancements in display technology are another factor propelling the market growth.

Asia Pacific Microdisplays Market Trends

The Asia Pacific microdisplays market dominated the global industry and accounted for a revenue share of 35.5% in 2023. This market is primarily driven by factors such as growing demand for consumer electronics in countries such as China and India, the large number of enterprises operating in the electronic and automotive manufacturing industry, technological advancements adopted by multiple organizations, and ease of availability.

Japan microdisplays market is expected to grow rapidly in the upcoming years. The projected growth is attributed to the increasing use of high-resolution display devices and the rising need for advanced consumer electronics such as digital camera viewfinders, smart glasses, head-mounted displays, and smartphones. Moreover, the presence of major market participants in Japan's digital camera market is expected to increase demand for the microdisplays market during the forecast period.

Latin America Microdisplays Market Trends

Latin America microdisplays market is anticipated to witness the fastest growth during the forecast period. The adoption of advanced technology, availability of consumer electronics products in the region, expansion of multiple large enterprises in parts of Latin America, and the emergence of numerous technology-driven industries are expected to deliver more significant growth in the coming years.

Brazil microdisplays market held a substantial market share in 2023. Growing demand for industries such as automotive, consumer electronics, augmented reality technology, and others is expected to drive demand for this market. Entry of multiple large corporations and expanding consumption of consumer electronics such as smartphones and cameras are also contributing to the growth of this industry in Brazil.

Key Microdisplays Company Insights

Some of the key companies in the microdisplays market include LG DISPLAY CO., LTD., eMagin. (SAMSUNG DISPLAY), Sony Corporation, KOPIN, AUO Corporation, and others. Key organizations in this industry are concentrating on expanding their customer base to secure a competitive advantage by adopting strategies such as enhanced research & development, innovation, collaborations, and geographical advancements.

-

LG DISPLAY CO., LTD, one of the prominent companies in microdisplays industry, offers advanced consumer electronics such as television displays, OLED(Organic Light Emitting Diode) technology based products, variety of monitors, IPS-based IT products, mobile displays, automotive displays, and other commercial displays.

-

Sony Corporation, a global technology company that focuses on developing, designing, producing, manufacturing, and selling electronic equipment, instruments, and related components. Sony Semiconductor Solutions Corporation, a subsidiary of Sony corporation that offers OLED microdisplays which utilizes combination of OLED technology and backplane technology for image sensors.

Key Microdisplays Companies:

The following are the leading companies in the microdisplays market. These companies collectively hold the largest market share and dictate industry trends.

- LG DISPLAY CO., LTD.

- eMagin. (SAMSUNG DISPLAY)

- Sony Corporation

- KOPIN

- AUO Corporation

- Micron Technology, Inc.

- Himax Technologies, Inc.

- Syndiant

- UNIVERSAL DISPLAY

- MicroVision

Recent Developments

-

In June 2024, LG Display, an innovation-based organization operating in display technologies, announced the beginning of mass production for the world's first 13-inch Tandem OLED panel of laptops. The company is focusing on the OLED market by utilizing the superior performance and reduced power consumption of Tandem OLED technology.

-

In January 2024, Kopin Corporation and MICLEDI Microdisplays announced a collaboration initiative to develop advanced micro-LED displays for an immersive AR experience in high-brightness light conditions. This collaboration combines MICLEDI's CMOS manufacturing process and Kopin's advanced backplane control and driving abilities to develop high-performance microLED displays.

Microdisplays Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.95 billion

Revenue forecast in 2030

USD 10.64 billion

Growth rate

CAGR of 23.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Arabia; UAE; South Africa

Key companies profiled

LG DISPLAY CO., LTD. ; eMagin. (SAMSUNG DISPLAY); Sony Corporation; KOPIN; AUO Corporation,; Micron Technology, Inc.; Himax Technologies, Inc.; Syndiant; UNIVERSAL DISPLAY; MicroVision

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microdisplays Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microdisplays market report based on product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Near-To-Eye

-

Projection

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Crystal Display (LCD)

-

Organic Light-emitting Diode (OLED)

-

Digital Light Processing (DLP)

-

Liquid Crystal on Silicon (LCoS)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Military & Defense

-

Medical Applications

-

Industrial Systems

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.