- Home

- »

- Display Technologies

- »

-

Head Mounted Display Market Size And Share Report, 2030GVR Report cover

![Head Mounted Display Market Size, Share & Trends Report]()

Head Mounted Display Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Integrated HMD, Slide On HMD), By Technology (VR, MR), By Product, By Connectivity, By Component, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-251-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Head Mounted Display Market Summary

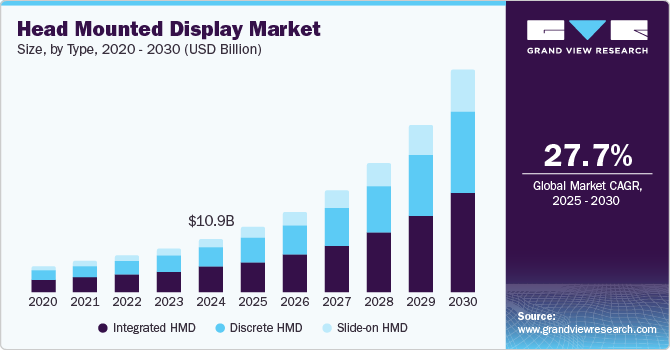

The global head mounted display market size was valued at USD 10.94 billion in 2024 and is projected to reach USD 45.41 billion by 2030, growing at a CAGR of 27.7% from 2025 to 2030. The market growth can be attributed to the increasing investments of major players in developing head mounted display (HMD) technology.

Key Market Trends & Insights

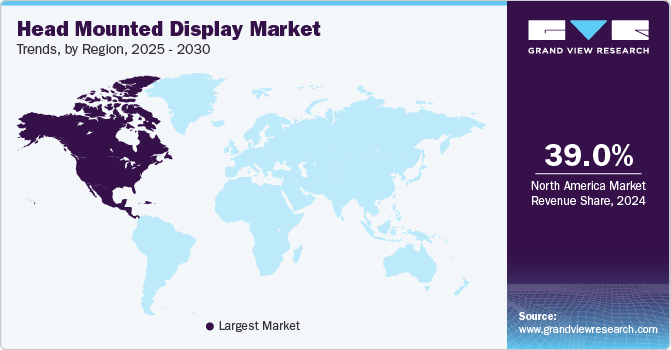

- The North America head mounted display market led with a 39.0% share in 2024.

- The U.S. HMD market is expected to boost owing to the increasing enterprise applications over the forecast period.

- By type, integrated HMDs dominated the market with 47.5% share in 2024

- By technology, virtual reality (VR) held a lucrative share in 2024.

- By product, head mounted products dominated with a 78.0% share in 2024

Market Size & Forecast

- 2024 Market Size: USD 10.94 Billion

- 2030 Projected Market Size: USD 45.41 Billion

- CAGR (2025-2030): 27.7%

- North America: Largest market in 2024

Companies have significantly poured resources into research and development to create more advanced, user-friendly, and cost-effective HMDs. This has led to the availability of low-cost HMDs, making them more accessible to a broader audience. Moreover, the increasing use of Augmented Reality (AR) and Virtual Reality (VR) technologies, accelerated during pandemic, across industries such as gaming, entertainment, healthcare, and education has propelled the market forward.

The gaming and entertainment sectors have particularly fueled demand for immersive experiences. In addition, businesses have adopted HMDs for training, simulation, and remote collaboration owing to expanding digitalization. For instance, these head-mounted displays have enhanced productivity and reduced operational costs in defense, aerospace, manufacturing, and healthcare fields.

Furthermore, technological advancements in micro display technology, sensors, and processors have led to the development of more sophisticated and high-performing HMDs. These advancements have improved the overall user experience, making HMDs more appealing to consumers and enterprises.

Type Insights

Integrated HMDs dominated the market with 47.5% share in 2024, primarily due to their standalone functionality. Unlike tethered or mobile HMDs, these do not rely on external devices, including PCs or smartphones. Such independence enhances user convenience and mobility, which makes them more appealing to a wide range of applications, particularly in gaming, industrial use, and training. Moreover, these HMDs have considerably benefitted from improved processors, graphics, and display technology. With enhanced computing capabilities and better displays such as OLED, 4K resolution, these devices provide more realistic and engaging experiences.

Slide on HMDs are expected to emerge at the fastest CAGR over the forecast period. These are significantly more affordable than integrated or tethered HMDs, making them more accessible to a broader range of consumers. In addition, with the continued advancement of smartphone technology, slide-on HMDs benefit from the high-resolution displays and powerful processors of modern smartphones. Many consumers prefer the convenience of using their existing smartphones to experience AR/VR, driving demand for these types of HMDs. Furthermore, slide-on HMDs have been increasingly used in education and training for immersive learning, experiences, and simulations.

Technology Insights

Virtual Reality (VR) held a lucrative share in 2024. The gaming industry has continued to be the largest market contributor, with HMDs offering immersive experiences that have been in continuous demand. VR headsets have become increasingly sophisticated with better graphics, higher refresh rates, and more engaging content. Additionally, the ongoing development of the metaverse has driven the market. As companies build virtual environments for social interaction, entertainment, shopping, and work, VR HMDs have become the primary interface for users to interact with immersive experiences.

Mixed Reality (MR) is expected to grow at a CAGR of 28.6% during the forecast period, with businesses considerably leveraging this technology for collaboration, remote assistance, and real-time data visualization. MR headsets enable workers to interact with 3D holograms while staying connected to their physical environment, making them valuable tools in industries such as engineering, design, architecture, and manufacturing. Moreover, this display technology is widely used in aerospace, automotive, and manufacturing industries for hands-on training and remote maintenance. By overlaying virtual instructions or data on real-world machinery, MR HMDs enable workers to perform tasks more efficiently, reducing downtime, and improving safety.

Product Insights

Head mounted products dominated with a 78.0% share in 2024 owing to the rising adoption of AR, VR, and MR technologies for immersive experiences. These products have increasingly gained traction in manufacturing, defense, aerospace, and healthcare industries, which are used for training, simulation, and visualization. For instance, in healthcare applications such as surgery planning, remote consultations, and medical training, surgeons use VR and AR HMDs to visualize complex procedures, while medical students benefit from interactive, simulated environments for hands-on learning.

Eyewear products are expected to grow considerably over the forecast period. Retail, healthcare, manufacturing, and logistics industries have adopted AR smart glasses to provide real-time data, guidance, and contextual information, enhancing productivity and decision-making. In addition, enterprises have increasingly adopted eyewear products for hands-free operations, including remote assistance, field services, maintenance, and warehouse management. AR smart glasses allow workers to access digital instructions and real-time data, boosting efficiency and safety in industrial environments.

Connectivity Insights

Wireless connectivity held a dominant market share in 2024 due to the increasing demand for untethered and flexible HMD solutions. Users have increasingly sought devices that offer freedom of movement without the constraints of cables, which is particularly important in applications such as AR, VR, and MR. Wireless connectivity enables seamless integration of HMDs with other devices, enhancing user experience and productivity. Moreover, the growing adoption of the Internet of Things (IoT) and edge computing has contributed to the rise of wireless HMDs. These technologies enable HMDs to connect and communicate with various devices and sensors, providing users with real-time data and insights. This connectivity is particularly valuable in industrial and professional settings, where HMDs are used for tasks such as equipment monitoring and hands-free operation.

Wired connectivity is expected to grow at a CAGR of 25.3% over the forecast period due to the growing need for stable and high-bandwidth connections. Wired connectivity provides reliable, uninterrupted data transmission, which is crucial for delivering high-quality, immersive experiences. The absence of latency issues in wired connections makes them ideal for applications requiring real-time feedback and interaction, such as gaming, simulations, and professional training. Additionally, cable design and materials innovations have resulted in more durable and flexible connections, making them more user-friendly and less cumbersome.

Component Insights

Displays dominated the market with a 20.5% share in 2024 with the continuous advancements in display technology. Innovations such as OLED and micro-LED displays have enhanced the visual quality of HMDs, providing higher resolutions, better color accuracy, and improved contrast ratios. In addition, the increasing demand for compact and lightweight displays has driven the market. As HMDs are designed to be worn for extended periods, the need for lightweight components that do not compromise performance is rising. Advances in miniaturization and integration of display components have led to the development of slimmer, more comfortable HMDs, making them more appealing to consumers.

Cases and connectors are expected to emerge as the fastest-growing segment with the increasing demand for durable and ergonomic designs over the forecast period. HMDs are often used for extended periods, which has led to the need for robust cases that can protect the device while ensuring comfort. Manufacturers have focused on developing lightweight yet strong materials that can withstand daily wear and tear, enhancing the longevity and usability of HMDs. Additionally, with the rise of wireless connectivity, the market witnessed a growing need for efficient and reliable wired connections for charging and data transfer. Innovations in connector design, such as magnetic and quick-snap connectors, provide a seamless user experience.

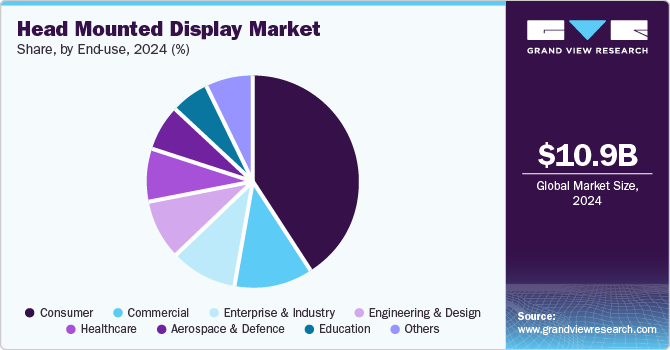

End Use Insights

Consumers dominated the market with a 41.3% share in 2024. The market dominance can be attributed to the rising demand for immersive entertainment experiences. Consumers have increasingly sought out VR and AR headsets for gaming and streaming interactive content. The enhanced visual and sensory experiences provided by these HMDs have transformed user experience with digital content, driving significant market growth. Furthermore, technological advancements in display quality, comfort, and usability have stimulated considerable market growth. Innovations such as lightweight materials, ergonomic designs, and advanced optics have made HMDs more comfortable and user-friendly, encouraging longer use and broader adoption.

Education is projected to grow at the fastest CAGR over the forecast period due to the increasing shift towards immersive and interactive learning experiences. Traditional educational methods have been complemented and transformed by AR and VR technologies.

Regional Insights

The North America head mounted display market led with a 39.0% share in 2024. Market growth is attributable to the expanding growth in the gaming and entertainment sectors. Regional consumers have been increasingly drawn to immersive gaming experiences, with high-end and affordable HMDs, particularly AR headsets.

U.S. Head Mounted Display Market Trends

The U.S. HMD market is expected to boost owing to the increasing enterprise applications over the forecast period. Businesses in the country have adopted HMDs for various enterprise applications, including training, remote assistance, and design visualization for healthcare, manufacturing, and logistics sectors. The U.S. military is a significant user of HMDs for training and simulation purposes. VR and AR technologies enable realistic combat training scenarios and mission planning, providing soldiers with valuable experience without the risks associated with live training.

Europe Head Mounted Display Market Trends

The HMD market in Europe held a 23.0% share in 2024. The market was primarily driven by the region’s progressive healthcare sector that increasingly adopted HMDs for surgical training, patient rehabilitation, and medical education.

Asia Pacific Head Mounted Display Market Trends

The head mounted display market in the Asia Pacific (APAC) region held 26.0% of the global revenue share in 2024 and is expected to grow significantly over the forecast period. The increasing popularity of VR and AR games has driven demand for HMDs as consumers seek more immersive gaming experiences. In addition, the rise of immersive entertainment experiences, including VR films, concerts, and events, has fueled demand for HMDs in the APAC region. Content creators have increasingly developed engaging VR experiences, attracting consumers to invest in HMD devices.

Key Head Mounted Display Company Insights

The global HMD market is moderately concentrated and marked by intense competition among top players. Key players include NATIONAL INSTRUMENTS CORP., Siemens, HEAD acoustics GmbH, and others.

-

National Instruments Corporation (NI) is a leading provider of software-connected automated tests and measurement systems that has grown to offer a wide range of products, including LabVIEW, PXI hardware, and test execution software.

Key Head Mounted Display Companies:

The following are the leading companies in the head mounted display market. These companies collectively hold the largest market share and dictate industry trends.

- NATIONAL INSTRUMENTS CORP.

- Siemens

- HEAD acoustics GmbH

- Brüel & Kjær

- Meta

- Sony Corporation

- Microsoft

- SAMSUNG

- BAE Systems

- HTC Corporation

Recent Developments

-

In May 2024, Siemens and Sony Corporation collaborated to launch a new solution integrating Siemens’ Xcelerator suite of industry software with suite of industry software with Sony's latest XR HMD, the SRH-S1. The SRH-S1 is designed using Siemens’ NX software, a key tool employed by Sony for creating its leading products.

-

In January 2024, Sony Corporation launched an immersive content creation system with XR HMD, high-quality video see-through function, 4K OLED Microdisplays, and controllers designed for intuitive interaction with 3D objects and precise pointing.

Head Mounted Display Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.39 billion

Revenue forecast in 2030

USD 45.41 billion

Growth rate

CAGR of 27.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, product, connectivity, component, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

NATIONAL INSTRUMENTS CORP.; Siemens; HEAD acoustics GmbH; Brüel & Kjær; Meta; Sony Corporation; Microsoft; SAMSUNG; BAE Systems; HTC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Head Mounted Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global head mounted display market report based on type, technology, product, connectivity, component, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Slide-on HMD

-

Integrated HMD

-

Discrete HMD

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

AR

-

VR

-

MR

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Processors and Memory

-

Displays

-

Lenses

-

Sensors

-

Controllers

-

Cameras

-

Cases and Connectors

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Head-Mounted

-

Eyewear

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Commercial

-

Enterprise & Industry

-

Engineering & Design

-

Healthcare

-

Aerospace & Defence

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.