- Home

- »

- Advanced Interior Materials

- »

-

Microencapsulation Market Size, Industry Report, 2030GVR Report cover

![Microencapsulation Market Size, Share & Trends Report]()

Microencapsulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Coating, Emulsion), By Coating Material, By Application (Pharmaceutical & Healthcare Products, Agrochemicals), By Region, And Segment Forecasts

- Report ID: 978-1-68038-339-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microencapsulation Market Summary

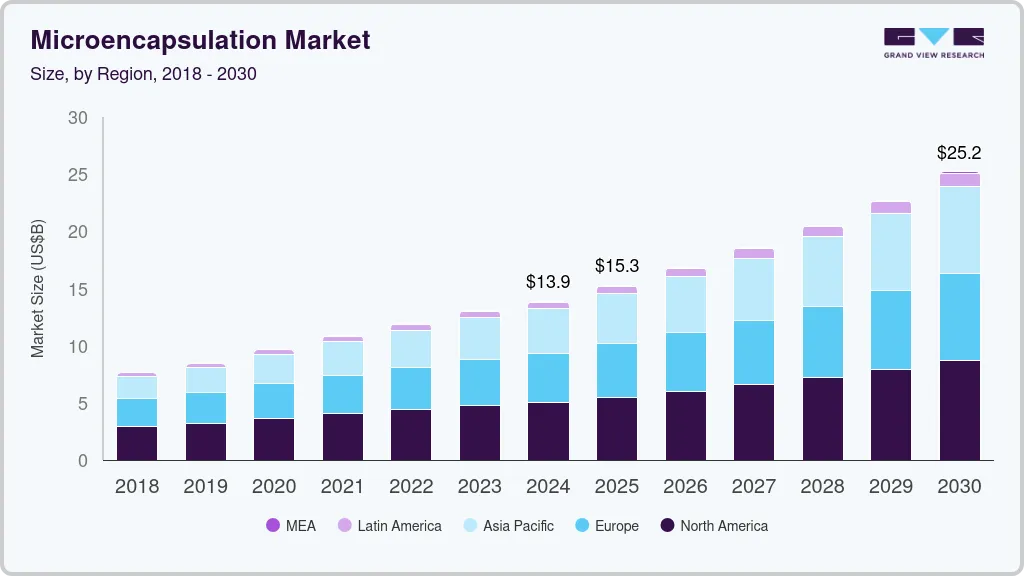

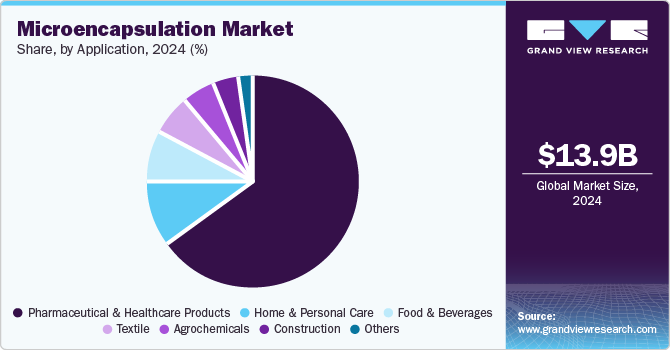

The global microencapsulation market size was valued at USD 13.90 billion in 2024 and is projected to reach USD 25.19 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The surge in interest around microencapsulation technology is anticipated to fuel market growth, particularly in safeguarding active drugs such as cisplatin, lidocaine, naltrexone, progesterone, insulin, proteins, peptides, and vaccines.

Key Market Trends & Insights

- North America microencapsulation market dominated the global market and accounted for the highest revenue share of 36.3% in 2024.

- The microencapsulation market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024.

- Based on technology, the spray segment led the market and accounted for the largest revenue share of 33.9% in 2024.

- By coating material, the polymer coating material dominated the global microencapsulation industry and accounted for the largest revenue share of 28.3% in 2024.

- By application, The pharmaceutical and healthcare application segment held the dominant position in the market, with the highest revenue share of 65.4% in 2024

Market Size & Forecast

- 2024 Market Size: USD 13.90 Billion

- 2030 Projected Market Size: USD 25.19 Billion

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

Furthermore, this heightened interest is driven by the technology's ability to protect these sensitive compounds adequately. The market is also poised for growth due to the various advantages of microencapsulation, including controlled release of core materials, protection of encapsulated substances, and improved handling of ingredients. Furthermore, the technology's application in masking the odor, taste, and activity of encapsulated materials is projected to positively influence market growth, indicating a growing recognition of its versatile benefits across diverse industries.

Microencapsulation technology offers value-added structures that act as functional ingredients for a wide range of industries, including pharmaceuticals, food and beverages, home and personal care, construction materials, and textiles. The technology's high penetration in the pharmaceutical industry in the U.S. is likely to drive the microencapsulation industry's growth over the forecast period.

The growing trend of employing natural substances to improve face attractiveness has increased the market for oral supplements made with microencapsulation technology. Furthermore, the need for microencapsulation for masking applications is anticipated to grow as n-3 fatty acid consumption rises owing to its advantageous health qualities.

Moreover, due to the quick advancement of novel sciences and technologies, textile materials are now used in the cosmetic industry. As consumer awareness is expanding and disposable income is rising, including in industrialized economies, growing demand for cosmetic textiles is predicted to expand prospective markets and new target audiences for microencapsulation technology.

Technology Insights

The spray technology segment led the market and accounted for the largest revenue share of 33.9% in 2024. The spray technologies offer high encapsulation efficiency along with good stability of finished products. The process is used in the large-scale commercial production of microcapsules on account of low process cost, simple equipment, and reduced storage and transportation costs. Furthermore, they provide uniform coating and easy integration with industrial processes, making them ideal for encapsulating a wide range of ingredients, thereby driving the growth of the market.

The emulsion technology is expected to grow at a CAGR of 10.7% over the forecast period. Microcapsules produced from an emulsion of two or more immiscible liquids are known as the emulsion solidification technique of microencapsulation. In addition, the increasing penetration of techniques in the food and pharmaceutical industries is expected to drive the market for emulsion technology over the forecast period. Furthermore, its high stability, controlled release properties, and eco-friendly processes also drives its growth in diverse sectors seeking sustainable solutions.

Coating Material Insights

The polymer coating material dominated the global microencapsulation industry and accounted for the largest revenue share of 28.3% in 2024, primarily driven by the premium quality of this coating material. Polylactic acid (PLA) and polylactic-co-glycolic acid (PLGA) have been the most preferred polymers owing to their extensive use in products, such as surgical sutures and depot formulations, approved by the U.S. Food and Drug Administration (FDA). Furthermore, polymers offer stability, customization, and eco-friendly solutions, making them increasingly popular in pharmaceuticals, food, and agriculture.

The carbohydrates are expected to grow at a CAGR of 10.8% over the forecast period, owing to coating materials in microencapsulation being driven by several factors that contribute to their popularity and effectiveness in diverse applications. One significant factor is the natural and biodegradable nature of carbohydrates, aligning with the increasing consumer preference for eco-friendly and sustainable products. Carbohydrates, such as polysaccharides (e.g., starch, cellulose, and alginate), offer a safe and non-toxic option for encapsulating various active ingredients, making them suitable for applications in pharmaceuticals, food, and nutraceuticals.

Application Insights

The pharmaceutical and healthcare application segment held the dominant position in the market, with the highest revenue share of 65.4% in 2024, owing to the technique’s several advantages, which include taste and odor masking, environmental protection for pharmaceuticals, particle size reduction to improve the solubility of the less soluble drugs, prolonged drug administration, and cell encapsulation. In addition, the demand for controlled drug release and targeted delivery systems is driving the growth of microencapsulation.

The food and beverage application segment is expected to grow at a CAGR of 12.4% over the forecast period. The growing trend towards a healthier way of life, preventing illness by diet, also known as functional foods, and improving the nutritional value of food products along with taste, color, texture, and aroma has a major impact on driving the demand for microencapsulation in the food and beverage industry.

Regional Insights

North America microencapsulation market dominated the global market and accounted for the highest revenue share of 36.3% in 2024. The region is the largest producer of pharmaceutical products with the presence of major players, including Johnson & Johnson, Pfizer, and Merck &Co. and is involved in the development of novel drug delivery systems, which has a major impact on driving the demand for microencapsulation. The regional demand is driven by its increasing use in the food & beverage industry for flavors, fragrances, colorants, and manufacturing of functional foods.

U.S. Microencapsulation Market Trends

The microencapsulation market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, driven by advanced processing capabilities, high tech development, and availability of skilled workforce and extensive R&D initiatives of domestic companies. In addition, the growing focus on health and wellness, along with stringent regulations, encourages the use of microencapsulation for enhanced efficacy and safety.

Asia Pacific Microencapsulation Market Trends

The Asia Pacific microencapsulation market is expected to grow at a CAGR of 11.8%, over the forecast period. Favorable government policies to promote FDI in the pharmaceutical industry in China and India have played a crucial role in promoting the healthcare industry in Asia Pacific over the past few years. In addition, the increasing R&D expenditure for new drug development and increasing innovation in novel drug delivery systems in Japan and South Korea is expected to play an important role in driving the pharmaceutical industry growth thereby driving the market for microencapsulation.

China microencapsulation market led the Asia Pacific market and held a significant share in 2024, driven by the rapid growth of the pharmaceutical and food processing sector in the region is expected to have a positive impact on the industry growth over the forecast period. Furthermore, the country’s strong manufacturing base, coupled with growing healthcare awareness, is boosting the adoption of microencapsulation technology in agriculture, food, and pharmaceuticals for improved product performance and cost-effectiveness.

Europe Microencapsulation Market Trends

The Europe microencapsulation market is expected to grow significantly over the forecast period. The region is the second largest and one of the most developed globally in terms of the availability of raw materials, coating technologies, and application areas. In addition, developed economies in the region, including Germany, the UK, France, and Italy, contributed to the major revenue share of the region, owing to the high penetration of the technology in the pharmaceutical industry in this region of Europe.

The microencapsulation market in Germany is expected to be driven by innovation in pharmaceuticals, food & beverage, and agrochemicals. With a focus on sustainability and precision, Germany’s advanced research capabilities and strong regulatory environment promote the adoption of microencapsulation for controlled release and enhanced functionality in various applications, particularly in the healthcare sector.

Key Microencapsulation Company Insights

Key players in the global microencapsulation industry include AVEKA Group, LycoRed Group, and BASF SE. These players are adopting strategies such as technological innovation, strategic partnerships, and mergers & acquisitions. In addition, they focus on expanding product portfolios, enhancing research and development, and improving manufacturing capabilities to offer sustainable, efficient, and cost-effective microencapsulation solutions across various industries.

-

Balchem manufactures nutrient and flavor delivery systems, encapsulated active ingredients, and specialty ingredients that enhance product stability, release control, and bioavailability. The company operates in the food, health, and nutrition segments, offering innovative solutions that address challenges in ingredient protection and controlled release, helping to improve product performance and consumer experience.

-

Encapsys LLC manufactures various encapsulated products, including controlled release formulations and active ingredients. The company operates within the healthcare and consumer products sectors, providing advanced delivery mechanisms that ensure stability, targeted release, and optimal performance of ingredients, catering to the increasing demand for precision and efficiency in the formulation of products.

Key Microencapsulation Companies:

The following are the leading companies in the microencapsulation market. These companies collectively hold the largest market share and dictate industry trends.

- LycoRed Group

- BASF SE

- Balchem

- Encapsys LLC

- AVEKA Group

- Reed Pacific Pty Ltd.

- Microtek Laboratories, Inc.

- TasteTech Ltd.

- GAT Microencapsulation GmbH

- Ronald T. Dodge Co.

- Evonik Industries AG

- Inno Bio Limited

- Bayer AG

- Dow

Recent Developments

-

In November 2024, Milliken launched a microplastic-free polymer technology in Brazil, designed to improve agricultural efficiency. The technology enhances the delivery and release of crop protection products, a significant step forward in sustainability. It employs microencapsulation to protect active ingredients, reducing environmental impact. The polymer technology ensures controlled and targeted release, optimizing the efficacy of agrochemicals. Milliken’s innovative approach aligns with growing demands for environmentally friendly solutions in the agricultural sector.

Microencapsulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.29 billion

Revenue forecast in 2030

USD 25.19 billion

Growth Rate

CAGR of 10.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, coating material, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, India, Japan, Australia, South Korea, Malaysia, Brazil, Argentina, Chile, and South Africa.

Key companies profiled

LycoRed Group; BASF SE; Balchem; Encapsys LLC; AVEKA Group; Reed Pacific Pty Ltd.; Microtek Laboratories, Inc.; TasteTech Ltd.; GAT Microencapsulation GmbH; Ronald T. Dodge Co.; Evonik Industries AG; Inno Bio Limited; Bayer AG; Dow

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

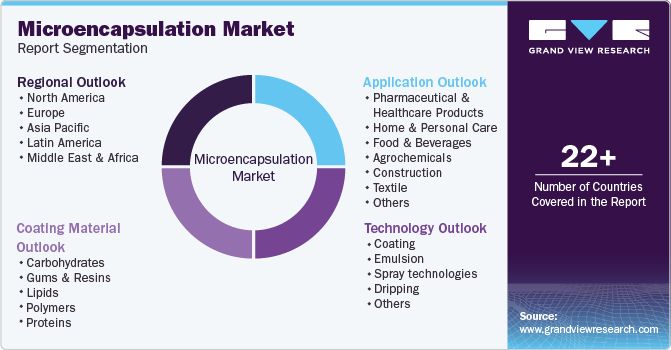

Global Microencapsulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global microencapsulation market report based on technology, coating material, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Coating

-

Emulsion

-

Spray technologies

-

Dripping

-

Others

-

-

Coating Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrates

-

Gums & Resins

-

Lipids

-

Polymers

-

Proteins

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Healthcare products

-

Home & Personal Care

-

Food & Beverages

-

Agrochemicals

-

Construction

-

Textile

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East and Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.