- Home

- »

- Advanced Interior Materials

- »

-

Microencapsulation Market Size And Share Report, 2030GVR Report cover

![Microencapsulation Market Size, Share & Trends Report]()

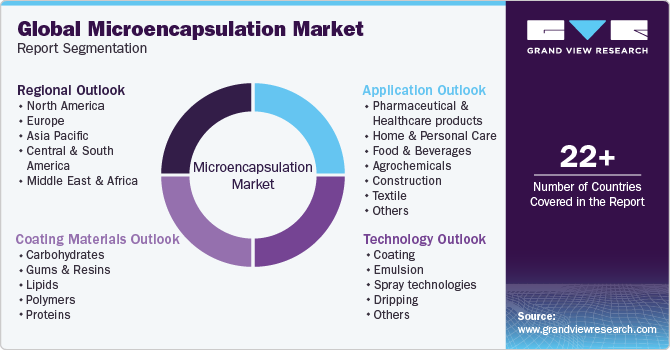

Microencapsulation Market Size, Share & Trends Analysis Report By Application (Pharmaceutical & Healthcare Products, Home & Personal Care), By Technology (Coating, Emulsion), By Coating Material, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-339-3

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Microencapsulation Market Size & Trends

The global microencapsulation market size was estimated at USD 13.05 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. The surge in interest around microencapsulation technology is anticipated to fuel market growth, particularly in safeguarding active drugs such as cisplatin, lidocaine, naltrexone, progesterone, insulin, proteins, peptides, and vaccines. This heightened interest is driven by the technology's ability to provide adequate protection to these sensitive compounds.

The market also is poised for growth due to the various advantages associated with microencapsulation, including controlled release of core materials, protection of encapsulated substances, and improved handling of ingredients. Furthermore, the technology's application in masking the odor, taste, and activity of encapsulated materials is projected to positively influence market growth, indicating a growing recognition of its versatile benefits across diverse industries.

Microencapsulation technology offers value-added structures that act as functional ingredients for a wide range of industries including pharmaceuticals, food & beverages, home & personal care, construction materials, textiles, etc. High penetration of the technology in the pharmaceutical industry in the U.S. is likely to drive the microencapsulation industry growth over the forecast period.

The industry players often engage in strategic partnerships with microencapsulation technology users from the end-user industries. High investment in R&D to improve technology efficiency and the rising adoption of the technology by small and medium-scale end-users is expected to further expected to drive the market growth. For instance, in March 2022, a new "Potenza Argan Oil" microcapsule for cosmetic usage was introduced by Reed Pacific. Potenza Argan Oil can be used to water-based recipes without impacting the stability of the finished product, even at high quantities. Encapsulation significantly improves the effectiveness and shelf life of argan oil and prevents fatty acids from oxidizing by limiting exposure to light and air.

The main purpose of the microencapsulation technology is to conceal the taste, odor, and activity of the encapsulated structures, which serve as functional ingredients for application sectors including the pharmaceutical and healthcare. Due to the existence of numerous pharmaceutical firms, spray technology is predicted to experience significant expansion in the U.S. thereby fueling the market demand over the forecast period.

The growing trend of employing natural substances to improve face attractiveness has increased the market for oral supplements made with microencapsulation technology. Additionally, the need for microencapsulation for masking applications is anticipated to increase as n-3 fatty acid consumption rises owing to its advantageous health qualities.

Owing to the quick advancement of novel sciences and technologies, textile materials are now being used in the cosmetic industry. Because of the expanding consumer awareness and rising disposable income, industrialized economies growing demand for cosmetic textiles is predicted to expand prospective markets and new target audiences for microencapsulation technology.

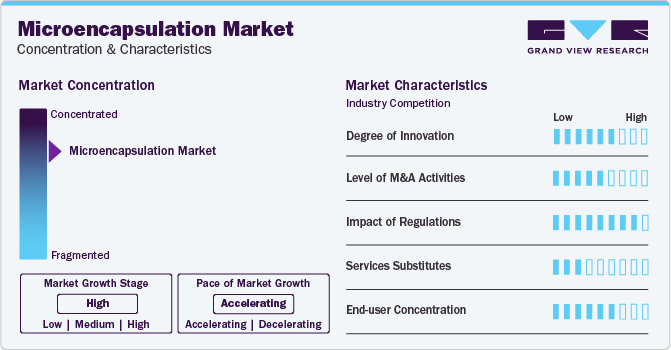

Market Concentration & Characteristics

Market growth stage is high and the pace of the market growth is accelerating. The microencapsulation market is characterized by a high degree of innovation owing to the rapid technological advancements driven by advancements in encapsulation techniques, such as spray drying, coacervation, and fluidized bed coating, refined to enhance the efficiency and precision of microencapsulation processes. Subsequently, the market is also governed by various standards and regulations from the governments of the U.S., India, and European countries.

The market for microencapsulation is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including increasing the reach of their products in the market and enhancing the availability of their products & services in diverse geographical areas. Key market players adopting this inorganic growth strategy include Capsulae, LycoRed Group, BASF SE, and Balchem.

Regulations play a crucial role in shaping the landscape of the microencapsulation market, influencing product development, safety standards, and market access. Stringent regulatory frameworks imposed by health and safety agencies have led to increased scrutiny of microencapsulation processes and materials, ensuring compliance with established quality and safety parameters. While these regulations may pose challenges for market players, they also create opportunities by fostering consumer confidence in microencapsulated products.

Compliance with regulatory requirements can serve as a competitive advantage, particularly in sectors such as pharmaceuticals and food, where adherence to safety and quality standards is paramount. As the regulatory landscape evolves, with a growing emphasis on sustainability and environmental impact, market participants are increasingly focusing on eco-friendly and biodegradable encapsulation materials to align with emerging standards and ensure long-term market sustainability.

End-user concentration significantly influences the dynamics of the microencapsulation market. Industries such as pharmaceuticals, food and beverages, and cosmetics, each with distinct end-user requirements, drive demand for specialized encapsulation solutions. Regulatory compliance, product safety, and quality standards become paramount considerations for suppliers catering to concentrated end-user markets.

For instance, pharmaceutical applications often demand precise and controlled release mechanisms, necessitating advanced encapsulation technologies. In the food industry, end-users seek solutions for flavor enhancement, ingredient protection, and prolonged shelf life. As concentration in specific sectors intensifies, manufacturers of microencapsulation technologies must tailor their products to meet the unique needs and compliance standards of these key end-user segments, thereby influencing innovation and market strategies within the microencapsulation industry.

The degree of innovation in the microencapsulation market is profoundly influenced by the evolving needs of end-users and regulatory requirements. As industries such as pharmaceuticals, food, and cosmetics continue to seek novel applications and improved performance from microencapsulation, the market responds with a heightened focus on innovation. Advancements in encapsulation techniques, materials, and delivery systems are driven by the imperative to meet stringent regulatory standards while addressing the specific demands of concentrated end-user markets.

Integration of nanotechnology, development of intelligent and responsive encapsulation systems, and exploration of eco-friendly materials showcase the commitment to innovation within the microencapsulation sector. As the market continues to mature, the degree of innovation is expected to remain a critical factor in sustaining competitiveness, meeting diverse industry needs, and unlocking new growth opportunities.

Application Insights

The pharmaceutical & healthcare products application segment led the market and accounted for 65.6% of the global revenue share in 2023. Owing to the technique’s several advantages, which include taste and odor masking, environmental protection for the pharmaceuticals, particle size reduction to improve the solubility of the less soluble drugs, prolonged drug administration, and cell encapsulation.

The food & beverage application segment is likely to grow at a significant pace over the forecast period. The growing trend towards healthier way of living, preventing illness by diet also known as functional foods and improving nutritional value of the food products along with taste, color, texture and aroma has major impact on driving the demand for microencapsulation from food & beverage industry.

Technology Insights

The spray technology segment accounted for largest revenue share in 2023. The spray technologies offer high encapsulation efficiency along with good stability of finished products. The process is used in the large-scale commercial production of microcapsules on account of low process cost, simple equipment, reduced storage and transportation cost.

The emulsion technology segment is likely to grow at the fastest CAGR over the forecast period. Microcapsules produced from emulsion of two or more immiscible liquids is known as emulsion solidification technique of microencapsulation. The increasing penetration of technique in food and pharmaceutical industries is expected to drive the market for emulsion technology over the forecast period.

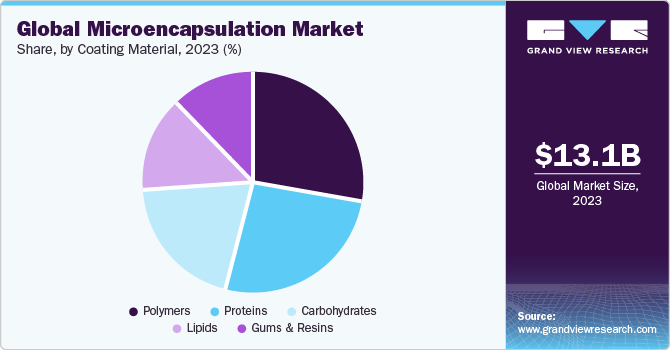

Coating Material Insights

The polymer coating material segment accounted for largest revenue share in 2023 due to the premium quality of this coating material. Polylactic acid (PLA) and polylactic-co-glycolic acid (PLGA) have been the most preferred polymers owing to their extensive use in products, such as surgical sutures and depot formulations, approved by the U.S. Food and Drug Administration (FDA).

The use of carbohydrates as coating materials in microencapsulation has been driven by several factors that contribute to their popularity and effectiveness in diverse applications. One significant factor is the natural and biodegradable nature of carbohydrates, aligning with the increasing consumer preference for eco-friendly and sustainable products. Carbohydrates, such as polysaccharides (e.g., starch, cellulose, and alginate), offer a safe and non-toxic option for encapsulating a variety of active ingredients, making them suitable for applications in pharmaceuticals, food, and nutraceuticals.

Regional Insights

North America dominated the market and accounted for a 36.6% share in 2023. The region is the largest producer of pharmaceutical products with the presence of major players including Johnson & Johnson, Pfizer, and Merck &Co. and is involved in the development of novel drug delivery systems which has a major impact on driving the demand for microencapsulation. The regional demand is driven by its increasing use in the food & beverage industry for flavors, fragrances, colorants, and manufacturing of functional foods. The major players are actively involved in R&D to develop new coating materials in compliance with government regulations in North America, which is likely to complement the demand for microencapsulation over the forecast period.

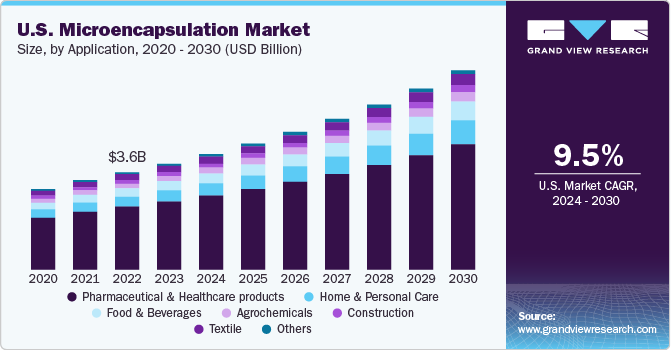

U.S. Microencapsulation Market Trends

Microencapsulation market in the U.S. projected to grow at a CAGR of 9.5% from 2024 to 2030. The U.S. leads microencapsulation market in North America, characterized by advanced processing capabilities, high tech development, and availability of skilled workforce and extensive R&D initiatives of domestic companies.

Europe Microencapsulation Market Trends

The microencapsulation market in Europe is the second largest and one of the most developed globally in terms of availability of raw materials, coating technologies and application areas. Developed economies in the region, including Germany, UK, France, and Italy, accounted for the major revenue share in the region in 2023, owing to high penetration of the technology in the pharmaceutical industry in this region of Europe.

The microencapsulation market in Germany is accounted more than 21% of revenue share in the European market in 2023. The market highly influenced by high production capacity of the pharmaceutical industry owing to the presence of major pharmaceutical companies like Pfizer, Merck KGaA, Evonik, and many more.

The UK microencapsulation market is driven by the rising demand from the pharmaceutical & health care, food & beverage industries, primarily due to surging instances of infectious diseases like COVID, in the country

Asia Pacific Microencapsulation Market Trends

The Asia Pacific microencapsulation market is anticipated to grow at a significant CAGR over the forecast period. Favorable government policies to promote FDI in the pharmaceutical industry in China and India have played a crucial role in promoting the healthcare industry in Asia Pacific over the past few years. In addition, the increasing R&D expenditure for new drug development and increasing innovation in novel drug delivery systems in Japan and South Korea is expected to play an important role in driving the pharmaceutical industry growth thereby driving the market for microencapsulation.

China microencapsulation market accounted over 35% within Asia Pacific region. Rapid growth of the pharmaceutical and food processing sector in the region is expected to have a positive impact on the industry growth over the forecast period.

Microencapsulation market in India is projected to grow substantially driven by development of pharmaceutical industries along with rising R&D activities to identify novel drug delivery systems

Central & South America Microencapsulation Market Trends

The Central & South America is one of the prominent markets for pharmaceuticals, soap & detergent and has witnessed rapid growth over the past few years. Fragrances and flavors used in perfume, soap, lotion, cream, shampoo, and washing liquids are susceptible to loss by evaporation, oxidation, and ingredient interactions, uses microencapsulation technique to alter quality of the products thereby driving the market growth over the forecast period.

Brazil microencapsulation market is projected to grow at a CAGR of 11.6% from 2024 to 2030 driven by large number of initiatives aimed at developing biotechnology projects and novel drug delivery systems.

Middle East & Africa Microencapsulation Market Trends

Development of healthcare industries with increasing government healthcare coverage in countries such as South Africa, UAE, and Saudi Arabia is expected to rise penetration of microencapsulation technique for the development of novel drug delivery systems in the region over the forecast period.

Microencapsulation market in South Africa is projected to grow at a CAGR of 10.6% over the forecast period driven by expansion of nutritional food products and health supplements in the country.

Key Microencapsulation Company Insights

Some of the key players operating in the market include Capsulae, LycoRed Group, BASF SE, and Balchem

-

Capsulae lays high emphasis on the research & development to produce superior microencapsulation technologies. In addition, the company lays high emphasis on the development of innovative technologies in a bid to strengthen its product portfolio and expand its market presence across multiple industries. The company provides personalized solutions to their customers’ needs to ensure optimum performance of the composition via microencapsulation. It caters to three major sectors including Nutri (human and animal nutrition), Bio (microencapsulation for biotechnologies), and Chem (microencapsulation for chemical industries).

-

LycoRed provides solutions for blending/premixes, microencapsulation, and advanced research & development. It uses microencapsulation technology to provide resistance against oxidation and heat, thereby enabling improved stability and shelf-life of products. In addition, the company invests significantly in research and development activities for the development of advanced products and technologies.

Encapsys LLC, AVEKA Group, Reed Pacific Pty Ltd., Microtek Laboratories, Inc. are some of the emerging market participants.

-

Encapsys LLC is a microencapsulation service provider which is a business unit of Appvion, Inc. The company caters to a wide range of markets including agriculture, paints & coatings, oil & gas, adhesives & sealants, personal & household care, paper, food, and pharmaceuticals. The company encapsulates a wide range of liquid core materials including perfumes, vegetable oils, and solvents; oil soluble materials such as dyes, pesticides, and catalysts; oil suspension materials including salts, sugar, acids, and water suspension materials comprising pigments, fungicides, and nutrients.

-

AVEKA Group offers microencapsulation solutions through AVEKA Manufacturing, Inc. and Cresco Food Technologies, LLC. The company provides microencapsulation solutions for products across the food & beverage and healthcare industries. It offers encapsulation and microencapsulation solutions using alginate encapsulation, polyoxymethylene urea, and complex coacervation (gelatin) microencapsulation depending on the client’s requirements.

Key Microencapsulation Companies:

The following are the leading companies in the microencapsulation market. These companies collectively hold the largest market share and dictate industry trends.

- Capsulae

- LycoRed Group

- BASF SE

- Balchem

- Encapsys LLC

- AVEKA Group

- Reed Pacific Pty Ltd.

- Microtek Laboratories, Inc.

- TasteTech Ltd.

- GAT Microencapsulation GmbH

- Ronald T. Dodge Co.

- Evonik Industries AG

- Inno Bio Limited

- Bayer AG

- Dow

- 3M

Recent Developments

-

In March 2022, Reed Pacific introduced a novel cosmetic-grade microcapsule named "Potenza Argan Oil." This microcapsule, designed for cosmetic applications, allows for easy incorporation of high concentrations of argan oil into water-based formulations without compromising the stability of the end product. Through encapsulation, Potenza Argan Oil significantly enhances the efficiency and shelf life of the oil while preventing oxidation of its fatty acids by minimizing exposure to light and air.

-

In October 2021, Milliken & Company acquired Encapsys, LLC, a prominent player in the global microencapsulation market. This strategic move underscores Milliken's commitment to advancing microencapsulation technologies and signifies its intent to broaden the application of these innovations to new segments. With the integration of Encapsys, Milliken aims to leverage its expertise and capabilities to explore and enhance microencapsulation across diverse industries, marking a significant step in the expansion of their portfolio and market influence.

Microencapsulation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.32 billion

Revenue forecast in 2030

USD 25.97 billion

Growth rate

CAGR of 10.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, coating materials, region

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Russia; China; India; Japan; South Korea; Australia; Malaysia; Brazil; Argentina; South Africa

Key companies profiled

Capsulae; LycoRed Group; BASF SE; Balchem; Encapsys LLC; AVEKA Group; Reed Pacific Pty Ltd.; Microtek Laboratories, Inc.; TasteTech Ltd.; GAT Microencapsulation GmbH; Ronald T. Dodge Co.; Evonik Industries AG; Inno Bio Limited; Bayer AG; Dow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microencapsulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the microencapsulation market report based on application, technology, coating material, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Healthcare products

-

Home & Personal Care

-

Food & Beverages

-

Agrochemicals

-

Construction

-

Textile

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Coating

-

Emulsion

-

Spray technologies

-

Dripping

-

Others

-

-

Coating Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Carbohydrates

-

Gums & Resins

-

Lipids

-

Polymers

-

Proteins

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global microencapsulation market size was estimated at USD 13.05 billion in 2023 and is expected to be USD 14.32 billion in 2024.

b. The global microencapsulation market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.4% from 2024 to 2030 to reach USD 25.97 billion by 2030.

b. North America region dominated the market in 2023 by accounting for a share of 36.6% of the market. The demand for the microencapsulation technique in the region is driven by its increasing use in food & beverage industry for flavors, fragrances, colorants, and manufacturing of functional foods.

b. Some of the key players operating in the microencapsulation market include Capsulae, LycoRed Group, BASF SE, Balchem, Encapsys LLC, AVEKA Group, Reed Pacific Pty Ltd., Microtek Laboratories, Inc., TasteTech Ltd., GAT Microencapsulation GmbH, Ronald T. Dodge Co., Evonik Industries AG, Inno Bio Limited, Bayer AG, Dow, among others

b. The market is anticipated to be driven by growing demand for flavors, fragrances, essential oils, minerals, vitamins, enzymes and bioactive compounds in food and beverage products specifically in emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."