- Home

- »

- Advanced Interior Materials

- »

-

Micromachining Market Size & Share Report, 2020-2027GVR Report cover

![Micromachining Market Size, Share & Trends Report]()

Micromachining Market (2020 - 2027) Size, Share & Trends Analysis Report By Type (Traditional, Non-traditional, Hybrid), By Process (Additive, Subtractive), By Axis, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-737-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micromachining Market Summary

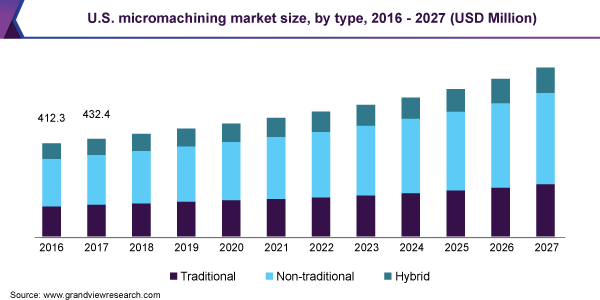

The global micromachining market size was valued at USD 2.51 billion in 2019 and is expected to reach USD 4.35 billion by 2027, expanding at a compound annual growth rate (CAGR) of 7.3% from 2020 to 2027. The growth is driven by the increasing adoption of these systems for the fabrication of micro-components in industries such as automotive, healthcare, consumer electronics, healthcare, and aerospace.

Key Market Trends & Insights

- The Asia Pacific dominated the market with a share of over 30% in 2019.

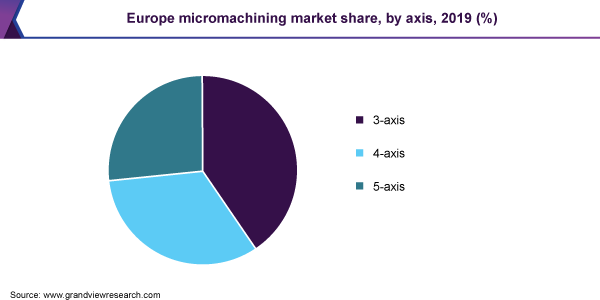

- By axis, the 3-axis segment dominated the market with a share of more than 40% in 2019.

- By type, the non-traditional segment dominated the market with a share of about 50% in 2019.

- By process, the subtractive segment dominated the market with a share of more than 40% in 2019.

- By end-use, the automotive segment dominated the market with a share of over 20% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 2.51 Billion

- 2027 Projected Market Size: USD 4.35 Billion

- CAGR (2020-2027): 7.3%

- Asia Pacific: Largest market in 2019

- Europe: Fastest growing market

The increasing advancements in the production technologies have resulted in a reduction in the time required for the manufacturing of components, which has further boosted the market growth. Besides, various companies in the manufacturing sector such as Johnson Matthey and Tekniker have shown a preference for laser-based material over traditional micromachining which bodes well for market growth.

The increasing applications of micro components in highly complex structures are creating opportunities for manufacturers. The integration of these systems with Computer-Aided Manufacturing (CAM) has been instrumental in reducing the time required for the manufacturing of workpieces and enabling hassle-free production of micro components. The evolution of machine learning and Internet of Things (IoT) technology has resulted in the introduction of new features, such as an application that sends the status of a system to the operators/ supervisors on their smartphones or PCs. This has impacted the market growth positively. These features enable proactive decision-making by the managers and improve the productivity of the unit.

The funding provided by government agencies such as the U.S. National Science Foundation (NSF) and the European Commission (EC) for the development of micromachining systems has driven the market growth significantly. For instance, in July 2017, under the Small Business Innovation Research (SBIR) grant, Omax Corporation received funding from the U.S. National Science Foundation (NSF) for the development of a micromachining abrasive waterjet-MicroMAX JetMachining center-that is capable of positioning accuracy of fewer than 15 microns. Moreover, some educational institutes such as the Indian Institute of Technology (Mumbai) and Bannari Amman Institute of Technology are organizing workshops that focus on research and development activities for these systems that drive the market growth further.

In recent years, there has been an increase in the number of events such as the International Conference on Micromachining that has raised consumer awareness. The increased adoption of micromachining for the fabrication of precision instruments is accelerating market growth. For instance, in July 2016, MITSUBISHI HEAVY INDUSTRIES, LTD. completed the delivery of its ABLASER” laser micromachining system to a Japanese manufacturer of precision instruments. Furthermore, manufacturers of lasers are focusing on the development of ultrafast lasers for micromachining applications that have boosted the market growth. For instance, in June 2019, NKT Photonics A/S and Oxide Corporation established a partnership under which they will combine their technologies for developing and manufacturing a range of ultraviolet and deep ultraviolet ultrafast lasers.

Although there has been an increased demand for these systems from various industries, the high cost of these systems is expected to negatively impact market growth. The high cost can be attributed to the complex process of repetitive deposition of thin films on the wafer and higher fabrication steps. However, the usage of fiber laser markers for micromachining has significantly reduced the costs of micromachining. The primary benefit provided by this approach is that fiber laser markers are less expensive than standard equipment.

COVID-19 Impact Insights

COVID-19 has forced various governments globally to adopt strict policies to restrict the movement of people. One of these policies was the activation of “Circuit Breaker“ by the Singapore Government in April 2020 which resulted in the shutdown of workplaces and schools. These government policies have had an impact on the production capacities of some of the major players operating in the market, such as Makino and Georg Fischer, Ltd. However, these players had put exemption applications to avoid the impact of lockdowns on their supply chain. For instance, Makino Asia has put up an exemption application from the suspension of business activities for approval. This has enabled the company to resume its manufacturing.

The pandemic has impacted the revenues of other players, such as IPG Photonics Corporation and Electro Scientific Industries operating in the micromachining market. For instance, IPG Photonics Corporation’s sales for the March quarter fell by more than 20% year-on-year to USD 249 million. However, the company’s production capacity was not hampered much in some countries, including Germany and Russia. For instance, the company’s operations were not at all impacted in Germany. Whereas in Russia, the production was only stopped for one week. As micromachining is used in the fabrication of respiratory assistance devices such as ventilators, some manufacturers have reported a surge in demand for their products. For instance, in May 2020, TORNOS SA’s machinery have been extensively used by Hamilton Medical which manufactures respiratory assistance devices. Hamilton Medical is focusing on increasing its production capacity by 50% using TORNOS SA’s machinery.

Axis Insights

The 3-axis segment dominated the market with a share of more than 40% in 2019. The increased adoption of 3-axis systems in fabricating lens arrays and other non-rotationally symmetric free-form optics are instrumental in driving the segment demand. Furthermore, the growing focus on key market players on the development of 3-axis micro-milling machines has boosted the segment growth further. The cost advantages provided by 3-axis machines over 4-axis and 5-axis machines have propelled the segment growth. For instance, in November 2017, YASDA PRECISION TOOLS K.K. introduced their Yasda YMC 430 micro milling machine that is used in mold making and injection molding for automotive and healthcare industries.

The 5-axis segment is anticipated to expand at the highest CAGR over the forecast period on account of the higher cutting speed. Moreover, 5-axis micromachining provides the ability to fabricate extremely complex parts from solid that are required to be cast. Furthermore, there has been increased adoption of these machines in the production of artificial bones, titanium creations for artistic purposes, and architectural door frames, among others which bodes well for the growth of the segment. Various market players are emphasizing the development of 5-axis systems that are expected to impact the segment growth positively. For instance, in April 2018, Georg Fischer, Ltd. introduced new 5-axis laser micromachining system-ML-5-that provides precise part handling, motion control, and high acceleration to deliver ultraprecise machining.

Type Insights

The non-traditional segment dominated the market with a share of about 50% in 2019. This can be attributed to the extensive use of technologies such as Electro Discharge Machining (EDM), Electrochemical Machining (ECM), and laser. EDM micromachining provides advantages such as superior consistency, simultaneous cutting, material compatibility, and elimination of finishing. Some applications of non-traditional systems include spray hole drilling in diesel and gasoline injection nozzles and micro-drilling of valve plates. Moreover, the increasing usage of non-traditional methods in the fabrication of healthcare components, micro molds, electronic tooling, MEMS sensors, and submarine actuators and motors are driving the segment growth.

The traditional segment is projected to expand at a significantly high CAGR over the forecast period on account of the increasing usage of micro-milling as it has emerged as a versatile and rapid method for the removal of material and creation of microstructures. Furthermore, the growing demand for mass production in the aerospace and defense sector, as well as industrial verticals, is encouraging the adoption of traditional systems. Besides, there has been increased adoption of traditional methods for the fabrication of miniaturized electronic components such as micro-step antennas, among others, which bodes well for segment growth. Moreover, the increased adoption of these systems in the fabrication of printed circuit boards used in consumer electronics is expected to further drive the growth.

Process Insights

The subtractive segment dominated the market with a share of more than 40% in 2019. This can be attributed to the cost and time advantage and extensive usage in mass production. Furthermore, it possesses advantages such as the ability to process a wide variety of materials and fabricate large-sized objects. Moreover, the rising usage of the process for fabrication of hard metals, wood, and thermoplastics has propelled the segment growth. The design of new tools offers improved ability and flexibility to perform multiple operations with the same tool and has helped the end-use companies reduce their floor space requirements.

In recent years, additive micromachining has been widely adopted in the fabrication of components used in aircraft, medical implants, dental restorations, automotive, and fashion products. Furthermore, this process is also used in the deposition of thin-film layers on semiconductor wafers for the development of Microelectromechanical Systems (MEMS) sensors. Besides, various companies, such as 3D-Micromac AG, IPG Photonics Corporation, and Makino, among others, are launching additive micromachining systems that are expected to fuel the segment growth over the forecast period. For instance, in November 2019, 3D-Micromac AG introduced its new DMP 74 additive micromachining system for the manufacturing of micro metal parts. The systems machine the workpiece by selectively fusing a powder material layer-by-layer.

End-use Insights

The automotive segment dominated the market with a share of over 20% in 2019. This can be attributed to the increasing demand for technology in the machining of fuel injector nozzles used in automobiles. Furthermore, the increased production of electric vehicles in which, micromachining is extensively used in for the development of electro voltaic cells has significantly boosted the growth of the automotive segment. In addition, the rising demand for laser micromachining in remote welding of seat structures and door panels has fueled the growth. Furthermore, there has been increased adoption of these systems in the fabrication of various sensors in automobiles such as ultrasonic sensors, position sensors, and parking sensors.

In recent years, there has been an increased adoption in the aerospace & defense sector for the fabrication of electronic assemblies, sensors, actuators, and optical MEMS, among others. As a result, the aerospace and defense segment is anticipated to grow at a significantly high CAGR over the forecast period. In addition, these systems are used in the aerospace and defense sector to machine components used in various systems such as control panels for cockpits, flight control & actuation systems, missile detection & tracking systems, Light Detection and Ranging (LIDAR) systems, and military robotics, among others. They are also used in the fabrication of various sensors used in tactical grade inertial applications, platform stabilization, structural modeling, and structure health monitoring.

Regional Insights

The Asia Pacific dominated the market with a share of over 30% in 2019. The presence of some of the largest automotive component manufacturing countries such as China, India, and South Korea is driving regional growth. Major automotive components fabricated using micromachining include fuel injectors, automotive sensors, and electrical assemblies, among others. Various companies such as Synova SA and Okuma Corporation are focusing on the establishment of new micromachining centers in the region that has driven the segment growth. For instance, in April 2018, Synova SA-a leading manufacturer of laser-based micromachining equipment opened a center in Mumbai (India). Furthermore, there exists an increased awareness of the technology owing to the presence of key manufacturers such as AMADA WELD TECH Co., Ltd.; Han’s Laser Process Industry Group Co., Ltd.; Makino; and MITSUBISHI HEAVY INDUSTRIES, LTD.

European countries such as Germany, Italy, and France, are some of the largest automotive manufacturers, as a result, the region is expected to expand at the highest CAGR over the forecast period. For instance, in FY2018, Germany produced nearly 6 million cars and accounted for more than 22.7% of exports of cars in the same year. Furthermore, there has been an increased demand for micromachined components in the railway and energy sectors that are expected to further drive the growth of the regional market. In addition, manufacturing companies in the region are making a quick shift to new machining technologies and new materials in healthcare, automotive, aerospace, and die and mold industries.

Key Companies & Market Share Insights

Companies operating in the market such as Coherent, Inc.; Georg Fischer Ltd.; and Makino are emphasizing their R&D activities to explore long-term growth opportunities. Georg Fischer Ltd.’s R&D expenses were USD 130 million, USD 129 million, and USD 115 million in FY2019, FY2018, and FY2017, respectively, which enabled the company to launch new products. For instance, in July 2018, the company launched its new Microlution advanced Laser micromachining system ML-5 which offers features such as positional feedback for high precision laser cutting and drilling applications.

Some of the other players such as Georg Fischer Ltd.; IPG Photonics Corporation; and AMADA WELD TECH Co., Ltd. are focusing on strategies such as mergers, acquisitions, and partnerships. For instance, in May 2016, Georg Fischer Ltd. announced that it acquired Microlution, Inc.; which was a U.S.-based developer of micromachining systems for milling and laser cutting applications for the aerospace and defense industry. The acquisition enabled Georg Fischer Ltd. to enlarge its technology portfolio to meet the demand for manufacturers in aerospace and defense. Some of the prominent players in the micromachining market include:

-

AMADA WELD TECH Co., Ltd.

-

Coherent, Inc.

-

Electro Scientific Industries

-

Georg Fischer Ltd.

-

Han’s Laser Process Industry Group Co., Ltd.

-

IPG Photonics Corporation

-

Makino

-

MITSUBISHI HEAVY INDUSTRIES, LTD.

-

OpTek Ltd.

-

Oxford Lasers

Micromachining Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.65 Billion

Revenue forecast in 2027

USD 4.35 Billion

Market size volume in 2020

95,711 Units

Volume forecast in 2027

167,152 Units

Growth Rate

CAGR of 7.3% (revenue-based) from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2020 to 2027

Report coverage

Revenue, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, process, axis, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

AMADA WELD TECH Co., Ltd.; Coherent, Inc.; Electro Scientific Industries; Georg Fischer Ltd.; Makino; Han’s Laser Process Industry Group Co., Ltd.; IPG Photonics Corporation; Makino; MITSUBISHI HEAVY INDUSTRIES, LTD.; OpTek Ltd.; Oxford Lasers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global micromachining market report based on type, process, axis, end use, and region:

-

Type Outlook (Volume, Units; Revenue, USD Million; 2016 - 2027)

-

Traditional

-

Non-traditional

-

Electro Discharge Machining (EDM)

-

Electrochemical Machining (ECM)

-

Laser

-

-

Hybrid

-

-

Process Outlook (Volume, Units; Revenue, USD Million; 2016 - 2027)

-

Additive

-

Subtractive

-

Others

-

-

Axis Outlook (Volume, Units; Revenue, USD Million; 2016 - 2027)

-

3-axis

-

4-axis

-

5-axis

-

-

End-use Outlook (Volume, Units; Revenue, USD Million; 2016 - 2027)

-

Automotive

-

Semiconductors & Electronics

-

Aerospace & Defense

-

Healthcare

-

Telecommunications

-

Power & Energy

-

Plastics & Polymers

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Million; 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global micromachining market size was estimated at USD 2.5 billion in 2019 and is expected to reach USD 2.7 billion in 2020.

b. The global micromachining market is expected to grow at a compound annual growth rate of 7.3% from 2020 to 2027 to reach USD 4.3 billion by 2027.

b. The Asia Pacific dominated the micromachining market with a share of 35.6% in 2019. This is attributable to the presence of some of largest automotive component manufacturing countries such as China, India, and South Korea, among others.

b. Some key players operating in the micromachining market include AMADA WELD TECH Co., Ltd.; Coherent, Inc.; Electro Scientific Industries; Georg Fischer Ltd.; Han’s Laser Technology Industry Group Co., Ltd.; IPG Photonics Corporation; Makino; MITSUBISHI HEAVY INDUSTRIES, LTD.; OpTek Ltd.; and Oxford Lasers.

b. Key factors that are driving the micromachining market growth include increasing demand for the miniaturization of microelectronic devices and increasing demand for laser-based micromachining.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.