- Home

- »

- Medical Devices

- »

-

Middle East & Africa Diabetes Care Devices Market, Industry Report, 2030GVR Report cover

![Middle East & Africa Diabetes Care Devices Market Size, Share & Trends Report]()

Middle East & Africa Diabetes Care Devices Market Size, Share & Trends Analysis Report By Type (BGM Devices, Insulin Delivery Devices), By Distribution Channel, By End-use (Hospitals, Homecare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-301-7

- Number of Report Pages: 158

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

MEA Diabetes Care Devices Market Trends

The Middle East & Africa diabetes care devices market size was estimated at USD 1.03 billion in 2023 and is projected to grow at a CAGR of 8.20% from 2024 to 2030. The prevalence of diabetes has increased in the Middle East and Africa in recent years, resulting in a high primary record due to lifestyle changes. Several health issues are related to diabetes. To maintain minimal blood glucose levels, diabetic patients need to make several modifications throughout the day. These adjustments involve providing more insulin or eating more carbs by closely monitoring their blood glucose levels. Diabetes is becoming a more significant healthcare issue in the area. All these factors are expected to support the MEA market.

For instance, in 2021, according to the International Diabetes Federation (IDF) MENA Region, 73 million individuals aged 20 to 79 are currently affected by diabetes, with projections indicating a surge to 95 million by 2030. Within the IDF MENA Region, 48 million individuals exhibit impaired glucose tolerance, heightening their susceptibility to type 2 diabetes. Diabetes accounted for 796,000 fatalities based on available data. Expenditure on diabetes-related healthcare reached USD 33 billion in 2021. These factors are poised to significantly influence the demand for diabetes devices in the MEA region.

Furthermore, leading manufacturers focus on technological advancements and develop advanced products to gain a substantial market share. For instance, in May 2021, F. Hoffmann-La Roche Ltd and Lilly collaborated to incorporate Lilly's connected insulin pen solution into the mySugr app across numerous countries. Both companies are dedicated to seeking innovative ways to streamline daily decision-making for individuals with diabetes who rely on insulin pen therapy and their healthcare providers. Through its partnership with Lilly, Roche is accelerating the broadening of its open ecosystem, bolstering its integrated Personalised Diabetes Management (iPDM) strategy.

In addition, the market is growing due to the rising prevalence of diabetes and the increasing utilization of insulin-delivery devices. For instance, in November 2020, Medtronic plc introduced InPen, a product related to real-time Guardian Connect CGM data. During the projected period, the market for diabetes care devices is expected to rise due to ongoing research on insulin pens.

The increasing prevalence of chronic diseases and growing awareness of illness care drive demand and expand the market. The world's diabetes patient population is on the rise due in part to fast-changing lifestyle choices, including smoking and alcohol use. One of the leading causes of diabetes is obesity as well. Moreover, the industry is growing due to the growing elderly population. According to the World Health Organization (WHO), it was projected that the global population aged 60 years or above was likely to increase from 1 billion in 2020 to approximately 2 billion individuals by the year 2050.

Iran, the second-largest country in the Middle East, has a high prevalence rate, a growing incidence rate, and an economic impact from diabetes, making it a severe public health concern. It was projected that 9.2 million Iranian people would have diabetes by 2030. In Iran, the age-standardized death rate from diabetes has increased, contributing to the country's rising diabetes-related mortality rate. Diabetes has an immense effect on the nation's economy. Diabetes poses a severe risk factor for chronic conditions, including cardiovascular disease, due to its high direct healthcare expenses.

Egypthas an aging population, and the prevalence of diabetes increases with age. As the population continues to age, the demand for diabetes care devices is expected to rise, contributing to the growth of the market. According to IDF, 18.4% of Egyptian adults currently have diabetes.

Regions in the MEA, such as South Africa, Saudi Arabia, UAE, Kuwait, Iran, & Oman, dominate the MEA diabetes care devices market.

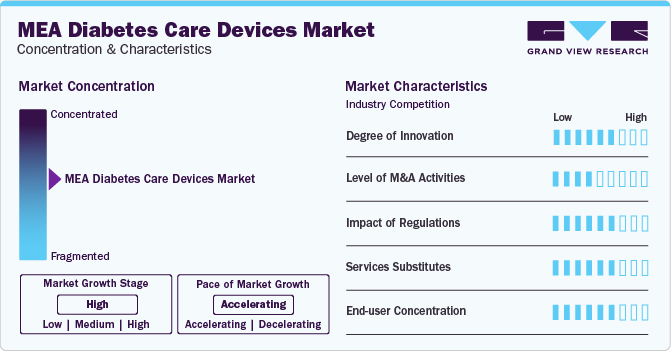

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The MEA diabetes care devices market is characterized by a high degree of innovation. For instance, in October 2022, Dexcom launched the Dexcom G7, an advanced continuous glucose monitor (CGM) tailored for individuals with diabetes aged two years and above. This innovative device boasts new features, such as a 60% smaller, inconspicuous, all-in-one wearable and the quickest 30-minute sensor activation among all CGMs available. The Dexcom G7 significantly improves the Dexcom CGM experience.

The market is fragmented, featuring several regional players. Manufacturers have been pushing ongoing innovation to be competitive in the industry. Prominent companies like Abbott and Medtronic have shown their commitment to market dominance through substantial R&D investments and a combination of organic growth strategies and strategic moves such as mergers, acquisitions, and partnerships.

The market is also subject to increasing regulatory scrutiny. The Middle Eastern governments have recognized the risk posed by diabetes and have begun to address it through various policies, campaigns, and initiatives. Six out of fifteen countries in this region still have no national operational action policy for diabetes. Obesity and physical inactivity are two major risk factors for diabetes, remain a challenge for many nations. Many countries have fully incorporated the federal recommendations for treating diabetes. Nonetheless, ongoing efforts are being made to reduce the difficulties associated with diabetes, as a result the Middle East and Africa are expected to witness the market's expansion.

Several substitutes offer similar services to help manage diabetes. These substitutes can be categorized into various types of devices and services. In addition to CGM devices, these alternatives include insulin pumps, blood glucose meters, telemedicine services, smartphone apps, and others. These services-based apps are used for therapy, identification, and monitoring, among other functions.

End-user concentration is a significant factor in the market since several end-user industries drive demand for digital health. The market is characterized by the growing presence of telemedicine, the development of novel digital health solutions, the influence of regulations, the growing adoption of digital health applications, and the empowerment of patients. The rising demand for diabetes care devices is also attributed to preventing more extended hospital stays and higher mortality rates in diabetes patients.

Type Insights

Insulin delivery devices dominated the market and accounted for a share of 54.2% in 2023. It is expected to grow at the fastest CAGR of 8.65% from 2024 to 2030. These medical devices are used to deliver insulin, a hormone that helps prevent diabetes. The most common insulin delivery devices are insulin pens, pumps, needles, and syringes. In MEA, insulin delivery devices are experiencing significant advancements aimed at improving the quality of life for people with diabetes. These innovative technologies offer enhanced precision, convenience, and user control in managing blood glucose levels. For instance, in July 2021, Medtronic received FDA approval for its new enhanced-wear infusion sets, designed to last up to three times longer than traditional tubed infusion sets that attach the pump to the patient's skin for insulin delivery.

The MEA region has witnessed the launch of several innovative insulin delivery devices from leading diabetes care companies, such as Novo Nordisk, Sanofi, Medtronic, and Tandem Diabetes Care. These devices offer improved diabetes management, better patient outcomes, and increased user convenience. Novo Nordisk, a leading diabetes care company, has launched several insulin delivery devices in the MEA region, including the NovoPen Echo, NovoPen 5, and Novo Nordisk Mobile App.

Distribution Channel Insights

Hospital pharmacies accounted for the largest market revenue share in 2023. The number of diabetes patients in the region is increasing rapidly due to factors such as urbanization, sedentary lifestyles, and unhealthy diets. This growing prevalence of diabetes leads to a higher demand for diabetes care devices in hospital pharmacies, as they cater to both inpatients and outpatients. Hospital pharmacies in the region are increasingly stocking advanced diabetes care devices, such as insulin pumps, continuous glucose monitoring systems, and connected insulin pens. These devices offer better diabetes management, improved patient outcomes, and increased convenience, making them popular among healthcare professionals and patients. According to the data compiled by Our World in Data, utilizing statistics from the International Diabetes Federation (IDF), countries within the MENA region prominently feature in the top 20 nations with the highest diabetes rates. The study evaluated diabetes prevalence among populations aged 20 to 79 across 211 countries. While Pakistan, a South Asian country, claimed the top spot with 31 percent of its population affected by the condition, followed by French Polynesia, Gulf state Kuwait secured the third position with a diabetes prevalence of 24.9 percent.

The retail pharmacies segment is anticipated to register the fastest CAGR from 2024 to 2030. This is crucial in providing patients with easy access to essential diabetes care products and services. These pharmacies offer various diabetes care devices and supplies, professional advice, and support from trained pharmacists.

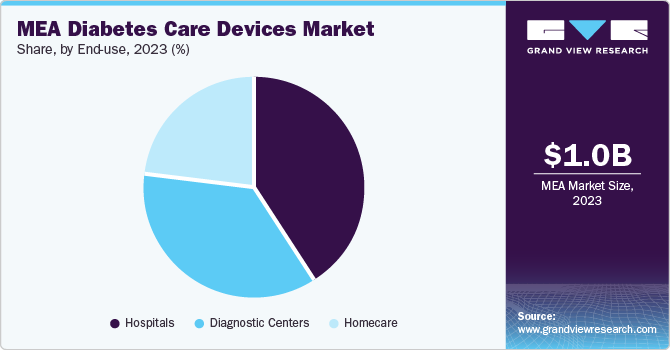

End-use Insights

The hospitals segment held the largest market revenue share in 2023. The increasing number of hospital admissions of diabetes patients is boosting the demand for the segment. Patients who have diabetes have a threefold chance of hospitalization compared with those without diabetes. Diabetes technology has evolved rapidly in the past few years. Most of these technologies aim to improve diabetes care in hospitals and clinics. These advancements in technology have increased the usage of insulin pumps in hospitals and clinics.

The diagnostics center segment is anticipated to register the fastest CAGR from 2024 to 2030. With the increasing adoption of digital health solutions, telemedicine services have emerged as an essential component of this segment in the market. These services enable patients to consult with healthcare professionals remotely, receive advice on diabetes management, and even undergo remote monitoring of their blood glucose levels. In MEA, some diagnostic centers have introduced mobile units to provide diabetes testing services in remote or underserved areas. These portable units are equipped with essential diagnostic equipment. They are staffed by trained professionals, making it easier for people in rural or hard-to-reach locations to access diabetes testing services.

Country Insights

MEA diabetes care devices held a revenue share of around 3% of the global market in 2023. This is attributed to the increasing prevalence of type-2 diabetes and is influenced by a multifaceted combination of social, demographic, ecological, and genetic aspects. Significant factors contributing to this increase include regional life, an older population, reduced physical activity, and higher rates of overweight and obesity. According to the IDF, the Africa region is anticipated to witness a substantial 129% surge in diabetes cases by 2045, marking the highest projected growth rate among all regions, which highlights the escalating diabetes concern in Africa.

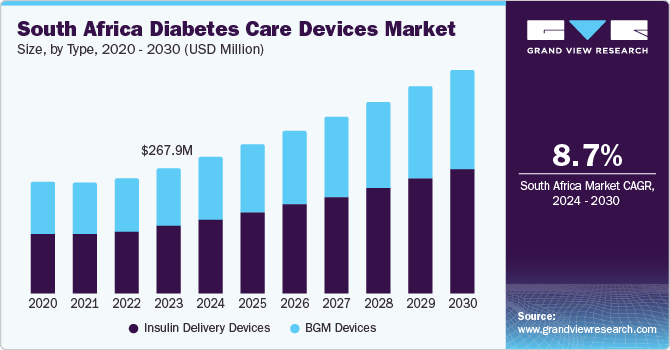

South Africa Diabetes Care Devices Market Trends

South Africa Diabetes Care Devices Market held a revenue share of 26.0% in the 2023. This growth owes to rapid urbanization, marked by the emergence of unhealthy, energy-dense diets and reduced physical activity, which has substantially contributed to the rapid rise in obesity rates. In this country, women are particularly affected, with a majority being overweight or obese. Obesity is a significant contributor to the escalating type-2 diabetes (T2DM) epidemic, as excess body weight is estimated to account for around 87% of T2DM cases in the country. Moreover, studies reveal high occurrences of newly diagnosed diabetes and glucose intolerance, which are linked to a heightened annual risk of developing T2DM.

Furthermore, as innovative technologies, such as cell phone integration, are being developed, these advanced continuous glucose monitoring devices are becoming more cost-effective, which is expected to enhance market growth. For instance, in December 2022, IND and the Leona M. and Harry B. Helmsley Charitable Trust announced a joint initiative where Helmsley has granted FIND USD 3.5 million over three years. This funding aims to improve access to continuous glucose monitoring devices (CGMs) in Kenya and South Africa, enhancing diabetes care through the ACCEDE initiative, which includes interventions to make CGMs more affordable, strengthen diabetes management capacity, and generate evidence supporting their use in LMICs, potentially fostering market growth.

Key Middle East & Africa Diabetes Care Devices Company Insights

Some key players operating in the market include Abbott, Dexcom, Inc., Medtronic, F. Hoffmann-La Roche Ltd, and Novo Nordisk A/S.

-

Abbott produces and distributes adult and pediatric nutritional items, diabetic and cardiovascular devices, testing kits, diagnostic equipment, and branded generic pharmaceuticals. Products include continuous glucose monitors, catheters, infant formula, adult dietary supplements, implanted cardioverter defibrillators, neuromodulation devices, coronary stents, immunoassays, and point-of-care diagnostic tools.

-

Dexcom, Inc. produces and distributes continuous glucose monitoring devices for people with diabetes. As an alternative to a typical blood glucose meter, CGM systems are becoming more advanced. The business integrates its CGM systems with insulin pumps from Tandem and Insulet to enable automatic insulin delivery.

Ascensia Diabetes Care Holdings AG, Bionime Corporation & Agamatrix, Inc. are some other market participants in the market.

-

Ascensia Diabetes Care Holdings AG is a company that develops and produces medical equipment for those with diabetes. The business offers a variety of blood glucose monitoring devices, enhancing the quality of life and enabling people with diabetes to take control of their well-being.

-

Bionime Corp is engaged in the biotechnology and medical testing business in Taiwan. Products from the company used to test and monitor blood glucose density include chips, lancing devices, testing strips, and blood glucose monitoring systems.

Key Middle East & Africa Diabetes Care Devices Companies:

- Abbott

- Dexcom, Inc.

- Medtronic

- F. Hoffmann-La Roche Ltd

- Novo Nordisk A/S

- Ascensia Diabetes Care Holdings AG

- Bionime Corporation

- Agamatrix, Inc.

- Lifescan IP Holdings, LLC

- Insulet Corporation

- Lilly

- Sanofi

- Rossmax International Ltd.

Recent Developments

-

In December 2023, Tandem Diabetes Care introduced its Slim X2 insulin pump, which is compatible with the Dexcom G6 Continuous Glucose Monitoring (CGM) system. Similarly, Ypsomed Holdings has developed a CGM system called Mylife Unio Neva, which integrates their insulin pump technology. Both companies are expanding their product offerings to provide advanced diabetes management solutions for patients.

-

In October 2022, Biocorp (Novo Nordisk A/S) and Becton, Dickinson, and Company (BD) announced a partnership to oversee compliance with self-administered medication schedules, encompassing biologics, through connected technology. This collaboration merges Biocorp's Injay technology, a system tailored to record and transmit injection events via Near Field Communication, with BD UltraSafe Plus Passive Needle Guard, a companion product for pre-filled syringes. The integration aims to aid biopharmaceutical companies in improving adherence to and outcomes of injectable treatments.

-

In June 2022, Abbott announced it was constructing a new bio-wearable device to monitor ketone and glucose levels continuously through a single sensor. This glucose-ketone sensor would integrate with Abbott's digital platform, which comprises mobile applications for individuals and caregivers and cloud-based software for medical professionals to monitor remotely. The device was expected to be the same size as FreeStyle Libre 3 by Abbott, the world's thinnest and smallest continuous glucose monitoring sensor.

-

In February 2020, Abbott and Insulet Corporation partnered to coordinate next-generation glucose-detecting and computerized affront conveyance advances for consistent diabetes care. This collaboration can combine Abbott's driving nonstop glucose observing (CGM) innovation with Insulet's omnipod horizon robotized affront conveyance framework to offer an exact, easy-to-use, coordinates advanced well-being stage & coordinates innovation that can give individuals living with diabetes around the world a reasonable, transformational encounter for moved forward glucose control.

Middle East & Africa Diabetes Care Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.12 billion

Revenue forecast in 2030

USD 1.79 billion

Growth rate

CAGR of 8.20% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, end-use

Regional scope

MEA

Country scope

South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Dexcom, Inc; Medtronic; F. Hoffmann-La Roche Ltd; Novo Nordisk A/S; Ascensia Diabetes Care; Bionime Corporation; Agamatrix, Inc;

Lifescan; Insulet Corporation; Lilly; Sanofi and Rossmax International Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Diabetes Care Devices Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Middle East & Africa diabetes care devices market report based on type, distribution channel, end-use, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

BGM Devices

-

Self-Monitoring Devices

-

Blood Glucose Meters

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitters

-

Receiver

-

-

-

Insulin Delivery Devices

-

Pumps

-

Pens

-

Syringes

-

Jet Injectors

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/Centers

-

Online Pharmacies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East & Africa diabetes care devices market size was valued at USD 1.03 billion in 2023 and is expected to reach USD 1.12 billion in 2024.

b. The Middle East & Africa diabetes care devices market is projected to grow at a compound annual growth rate (CAGR) of 8.20% from 2024 to 2030 to reach USD 1.79 billion in 2030.

b. Insulin delivery devices dominated the market and accounted for a share of 54.2% in 2023. These medical devices are used to deliver insulin, a hormone that helps prevent diabetes. The most common insulin delivery devices are insulin pens, pumps, needles, and syringes. In MEA, insulin delivery devices are experiencing significant advancements aimed at improving the quality of life for people with diabetes.

b. Some of the key players operating in the market include Abbott, Dexcom, Inc., Medtronic, F. Hoffmann-La Roche Ltd, and Novo Nordisk A/S.

b. The prevalence of diabetes has increased in the Middle East and Africa in recent years, resulting in a high primary record due to lifestyle changes. Several health issues are related to diabetes. Diabetes is becoming a more significant healthcare issue in the area. All these factors are expected to support the MEA market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."