- Home

- »

- Network Security

- »

-

Middle East And Africa Private Higher Education Market Report, 2030GVR Report cover

![Middle East And Africa Private Higher Education Market Size, Share & Trends Report]()

Middle East And Africa Private Higher Education Market Size, Share & Trends Analysis Report By Learning Mode (Online (Distance Learning), Offline (Traditional Learning)), By Course (Undergraduate, PH.D.), By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-152-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

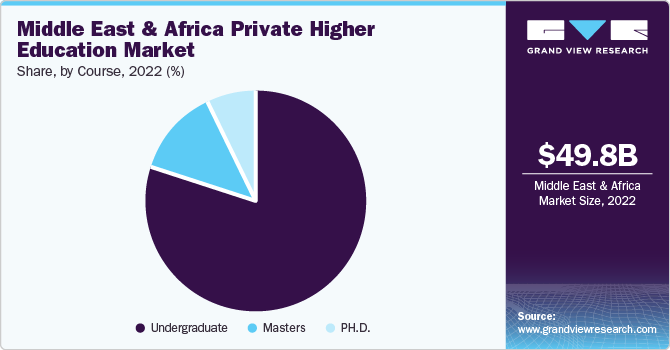

The Middle East and Africa private higher education market size was estimated at USD 49.76 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The growing youth population in the MEA region and rising middle-class affluence have paved the way for more private colleges and universities. Furthermore, a shift to more interactive teaching styles from pedagogical learning methods, shifting demographics towards the youth population, growing enrollments in higher education universities, political challenges, economic diversification, and access to higher education are the current top priorities of MEA governments. In addition, the increasing popularity of the international curriculum among the students in the region is anticipated to boost the enrollment of private universities in the region. Thus, driving the market growth of the MEA private higher education market.

Private colleges and universities in the region are expected to increase as students consider it a future investment and are willing to pay high fees. There has been an increase in demand for private colleges and universities since they cater to the curriculum needs of students by providing higher qualifications and specialized Courses. In addition, many local nationals across the countries prefer the private higher education system because it exposes them to the global community. This is expected to translate into robust growth rates for the private higher education sector.

The significant role played by governments through appropriate legislation and policies remains a crucial component of advancing the growth of the higher education market. For instance, in Ghana, the government announced that all private universities would be exempt from the 25% corporate tax. Moreover, GCC nations’ governments are engaged in developing dedicated educational zones to attract foreign players and meet the growing demand for quality higher education. Moreover, Dubai International Academic City, which hosts 22 foreign universities, and Qatar Education City, which hosts eight foreign universities, have been developed to attract international players and students. Increasing enrollment at tertiary levels in the GCC provides an excellent opportunity for higher education providers (both local and foreign) to establish new campuses.

Education is deeply connected to national and economic development. Providing high-quality teaching in schools, mainly to the younger generation, helps in building human skills and capabilities at an early stage that supports the growth of the economy. The cooperative release by the UN Development Programme (UNDP), the UN Labor Agency (ILO), the UN Children’s Fund (UNICEF), and the UN Population Fund (UNFPA) in Amman, Jordan, in May 2022, aimed at addressing the transition of youth from learning to work as a key priority for the young people across the Middle East and North Africa. It focuses on enhancing education systems, strengthening the network between learning and the labor market, exploring opportunities to create more jobs in private sectors, enhancing policies, and supporting youth entrepreneurship. As such, the efforts of several organizations toward developing the socio-economic status of the Middle East & African countries are driving the growth of the higher education market.

The preference and technology in the higher education market are growing increasingly competitive. The country’s government across the region has called on investors to assist in improving the quality of education in order to create an educated and well-informed society. The government across the region has placed education on top priority and has been undertaking various initiatives in line with its Tanzania Development Vision 2025. Moreover, the World Bank has extended its support to Tanzania by allocating USD 425 million for the development and expansion of higher education across the country in 2022. The allocation has been made as a part of the World Bank’s Education for Economic Transformation Project. As mentioned by a senior education specialist at the World Bank, the funding will be used to improve the quality of teaching and boost enrollments at Tanzanian Universities. With the gross enrollment ratio in secondary education going up to 7%, it is expected to create pressure on the higher education system with the increasing number of enrollments in the future. As such, the World Bank mentioned that there is an urgent need to expand university education in Tanzania to accommodate future enrollments. Thus, driving the market growth in the region.

Learning Mode Insights

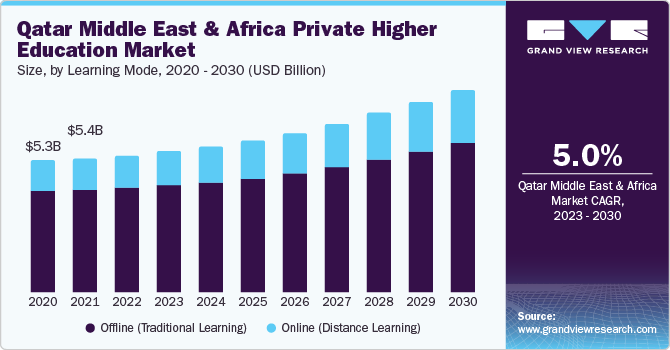

Based on learning mode, the offline (traditional learning) segment accounted for the largest revenue share of over 77.0% in 2022. The increasing expatriate population, coupled with a significant amount of the population over the age of 14 years, is expected to drive the demand for the traditional learning segment. In addition, increasing government initiatives and expenditures are some of the factors that have influenced segmental growth. The collaboration between the governments is expected to support the implementation of the initiative through three important aspects, including making education more inclusive, sector-wide education planning and policy, and promoting education in order to facilitate sustainable development.

The online (distance learning) segment is expected to grow with a CAGR of more than 6.0% over the forecast period. The COVID-19 outbreak compelled several educational institutions to shift to distance learning, resulting in increased technology adoption in the sector. The rapidly expanding EdTech market and growing investment in developing technology infrastructure by governments worldwide are anticipated to drive digital transformation in the distance learning segment. Although EdTech has been on the rise even before the pandemic, reliance on distance classes and other technology-based options has visibly increased the importance of EdTech during the pandemic. Thus, driving the market growth of the segment.

Vertical Insights

Based on vertical, the private colleges segment accounted for a significant revenue share of more than 37.0% in 2022. Private universities are increasingly integrating their educational offerings with the demands of the industry. This includes working with employers, conducting regular skill gap evaluations, and revising curricula to ensure graduates have skills relevant to the changing employment market. Private educational institutions are leveraging technology to provide personalized learning routes. Adaptive learning systems, data analytics, and artificial intelligence are being utilized to personalize educational experiences for individual students, increasing engagement and success rates. The scenario is likely to drive the adoption of higher education by private institutions over the forecast period.

The community segment is expected to grow with a CAGR of more than 6% over the forecast period. For decision-making, community segments are increasingly relying on data analytics. This includes analyzing student performance statistics, enrollment trends, and other metrics to guide strategic decisions about resource allocation, student support, and academic programs. To promote entrepreneurship and the commercialization of research, public institutions are constructing innovation hubs, incubators, and technology transfer offices. This fosters collaboration between academia and industry, hence boosting economic progress.

Course Insights

Based on course, the undergraduate segment accounted for the largest revenue share of over 72.0% in 2022. Academic study conducted after high school but prior to postgraduate studies is known as undergraduate higher education. A student obtaining a degree at a university or college's first level of higher education is known as an undergraduate.Academic study conducted after high school but prior to postgraduate studies is known as undergraduate higher education. A student obtaining a degree at a university or college's first level of higher education is known as an undergraduate.The governments across the region are engaged in making heavy financial investments to develop a first-rate undergraduate education system, which is eventually expected to create more investment opportunities for the segment.

The master's segment is expected to grow with a CAGR of around 5.0% during the forecast period. With the increasing adoption of online learning trends, the government also highlighted the importance of the development of technical infrastructure to facilitate e-learning in the segment. The increasing popularity of the e-learning trend in the master’s has contributed to the rise of the blended learning method. Blended learning provides an opportunity for private higher education institutes to increase graduate employability. Private universities are making changes to teaching methods and adopting various strategies to make hybrid learning a part of their curricula.

Regional Insights

The Middle East segment held the highest revenue share of more than 70.0% in 2022. The government is focused on developing a knowledge-based economy in the region to reduce the dependency on oil and increase the non-oil GDP by 5% every year. Further, favorable government initiatives are driving the launch of several international branch campuses (IBCs) in the region’s free zones, which bodes well for market growth. This has contributed to the establishment of globally reputed private institutions, subsequently contributing to higher expatriate enrolment, diversity in student nationality, increased employment prospects, relaxed visa regulations, and quality of life in the region. Therefore, driving the market demand in the region.

The Africa segment is anticipated to expand at a CAGR of around 4.3% during the forecast period. The government in the region is planning on raising the capacity of higher education to reduce student congestion and raise the quality of education. It also focuses on providing additional study spaces to the students and diversifying university specialties to accommodate the needs of the labor market. Thus, several government initiatives to support higher education in the region are expected to drive market growth in the region.

Key Companies & Market Share Insights

The key market players in the global MEA private higher education market in 2022 include Abu Dhabi University; Ajman University; Al Ain University in Dubai; and others. National Universities are focusing on expanding the private higher education sector in the region. For instance, in May 2021, the National Universities Commission (NUC) granted provisional licenses to twenty new private universities, which increased private universities’ overall number in Nigeria to ninety-nine. The secretary of the Association of Nigerian University Professional Administrators (ANUPA) is keen on adding more private higher education universities in order to cater to the increasing population of the country growing at the rate of 2.9% in 2019.

Key Middle East And Africa Private Higher Education Companies:

- Abu Dhabi University

- Ajman University

- Al Ain University in Dubai

- Alfaisal University

- American University of Sharjah

- Amity University

- BITS, Dubai

- Effat University

- King Abdullah University of Science and Technology

- Middle East University

- Middlesex University Dubai

- Prince Mohammad Bin Fahd University

- Prince Sultan University

- The University of Wollongong in Dubai

- University of Sharjah

Middle East and Africa Private Higher Education Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 51.09 billion

Revenue forecast in 2030

USD 72.10 billion

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Regional scope

Middle East and Africa

Segments covered

Learning mode, course, vertical, region

Key companies profiled

Abu Dhabi University; Ajman University; Al Ain University in Dubai; Alfaisal University; American University of Sharjah; Amity University; BITS, Dubai; Effat University; King Abdullah University of Science and Technology; Middle East University; Middlesex University Dubai; Prince Mohammad Bin Fahd University; Prince Sultan University; The University of Wollongong in Dubai; University of Sharjah

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East and Africa Private Higher Education Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018-2030. For this study, Grand View Research has segmented the Middle East and Africa private higher education market report based on learning mode, course, vertical, and region:

-

Learning Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online (Distance Learning)

-

Offline (Traditional Learning)

-

-

Course Outlook (Revenue, USD Billion, 2018 - 2030)

-

Undergraduate

-

Masters

-

PH.D.

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Colleges

-

Community Colleges

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Middle East

-

Saudi Arabia

-

United Arab Emirates

-

Oman

-

Qatar

-

Egypt

-

Kuwait

-

-

Africa

-

Nigeria

-

Tanzania

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The Middle East and Africa private higher education market size was estimated at USD 49.76 billion in 2022 and is expected to reach USD 51.09 billion in 2023.

b. The Middle East and Africa private higher education market is expected to witness a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 20.66 billion by 2030.

b. The offline (Traditional Learning) segment accounted for the largest revenue share in 2022, contributing over 77.0% of the overall revenue. The increasing expatriate population, coupled with a significant amount of the population over the age of 14 years, is expected to drive the demand for the traditional learning segment. Additionally, increasing government initiatives and expenditures are some of the factors that have influenced segmental growth. The collaboration between the government is expected to support the implementation of the initiative through three important aspects, including making education more inclusive, sector-wide education planning and policy, and promoting education in order to facilitate sustainable development.

b. Abu Dhabi University, Ajman University, Al Ain University in Dubai, Alfaisal University, American University of Sharjah, Amity University, BITS, Dubai, Effat University, King Abdullah University of Science and Technology, Middle East University, Middlesex University Dubai, Prince Mohammad Bin Fahd University, Prince Sultan University, The University of Wollongong in Dubai, and University of Sharjah are the key players in the MEA private higher education market

b. The increasing popularity of the international curriculum among the students in the region is anticipated to boost the enrollment of private universities in the region. Thus, driving the market growth of the MEA private higher education market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."