- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Biodegradable Plastic Market Size Report, 2033GVR Report cover

![Middle East Biodegradable Plastic Market Size, Share & Trends Report]()

Middle East Biodegradable Plastic Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Material (Starch Based, PLA, PBAT, PBS, PHA), By End Use (Packaging, Agriculture, Textiles, Consumer Goods), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-729-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Biodegradable Plastic Market Summary

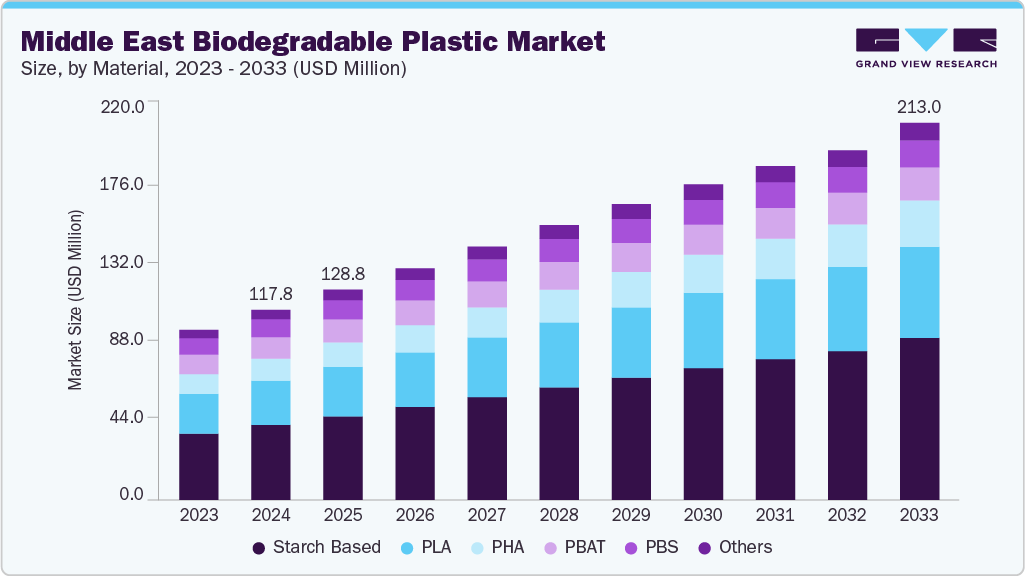

The Middle East biodegradable plastic market size was estimated at USD 117.8 million in 2024 and is projected to reach USD 213.0 million by 2033, growing at a CAGR of 6.5% from 2025 to 2033. Rising consumer demand for eco-friendly products is pushing retailers and brands to source biodegradable packaging.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East biodegradable plastic market with the largest revenue share of 51.46% in 2024.

- The biodegradable plastic market in Saudi Arabia is expected to grow at a substantial CAGR of 7.1% from 2025 to 2033.

- By material, the starch-based segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By application, the gynecological examination segment is anticipated to grow with the highest CAGR from 2025 to 2033.

- By end use, the packaging segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 117.8 Million

- 2033 Projected Market Size: USD 213.0 Million

- CAGR (2025 - 2033): 6.5%

- Saudi Arabia: Largest market in 2024

This preference creates shelf share opportunities and allows suppliers with certified solutions to command price premiums. Regulation-led changes and visible corporate sustainability commitments are coalescing into the dominant trend shaping biodegradable plastic demand across the Middle East. Governments are moving from voluntary guidelines to enforceable restrictions on single-use plastics, while major retailers and food brands are actively retooling packaging specifications to meet customer expectations. This dual pressure is driving procurement teams to pilot biodegradable resin blends for retail-ready and foodservice applications. The net effect is a steady shift from niche trials to broader commercial adoption in selected product categories.Drivers, Opportunities & Restraints

Public policy and reputational economics are the primary commercial drivers. When authorities restrict conventional single-use items or set circular economy targets, procurement risk rises for noncompliance and brand damage. That makes biodegradable alternatives an acceptable, and sometimes necessary, line item in supplier contracts for consumer goods companies and hospitality chains. In turn, this regulatory clarity lowers procurement uncertainty and accelerates supplier investments in regional distribution and certification.

There is a sizable commercial opportunity in building regional value chains that convert agricultural residues and food waste into compostable polymers and additives. Middle Eastern logistics hubs and free zones can host compounding and conversion facilities that shorten lead times and reduce landed cost premiums for biodegradable formats. Brands can also monetize sustainability through premium positioning and B2B service offerings such as takeback or industrial composting partnerships, turning packaging into a source of differentiation rather than just cost. Evidence of rising consumer interest in sustainable packaging supports this value play.

High raw material and processing costs remain the most immediate restraint, keeping biodegradable formulations at a price premium versus commodity plastics. That economic friction is compounded by fragmented standards across governments and unclear end-of-life infrastructure for industrial composting and organic waste collection. Without interoperable certification regimes and scalable composting capacity, commercial buyers face execution risk and potential reputational exposure if claimed biodegradability cannot be demonstrated in market conditions. These combined constraints slow large-scale conversion despite strong policy signals.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The industry exhibits slight consolidation, with key players dominating the industry landscape. Major companies like Avani Eco Middle East, Al Bayader International, BASF SE, Cargill Incorporated, Eastman Chemical Company, Ecoway Biopolymers LLC, EuP Egypt, Novamont S.p.A., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Buyers and brand owners routinely treat biodegradable polymers as one option within a wider substitution set that includes recyclable polyethylene and polypropylene, paper and molded fiber, glass for refillable formats, and reuse systems such as deposit return or refill stations. Each substitute brings a distinct commercial trade-off: paper and molded fiber reduce fossil feedstock dependence but can raise logistics and contamination costs for food contact use.

Similarly, glass and refill systems cut single-use waste but require capital investment in reverse logistics; high-quality recyclable plastics remain the lowest cost route where collection systems exist. Strategic procurement, therefore, evaluates lifecycle costs, available collection and sorting infrastructure, and brand positioning before preferring biodegradable grades over these other substitutes.

Regulation is simultaneously the strongest enabler and a source of commercial complexity for the market: bans and phase-outs on single-use items create predictable, near-term demand for alternative materials, while mandates and certification requirements force buyers to requalify suppliers and absorb compliance costs.

In the Middle East, this dynamic is visible through national measures such as the UAE and Oman restrictions and broader national sustainability strategies that steer procurement toward certified compostable or bio-based formats. At the same time, inconsistent standards between jurisdictions and the need for verifiable end-of-life evidence raise execution risk for regional rollouts, pushing brands to favor suppliers that can provide clear certification and end-of-life solutions.

Material Insights

The starch-based segment dominated the industry, accounting for a revenue share of 40.16% in 2024 and is expected to grow at a 7.5% CAGR from 2025 to 2033. Starch-based formulations are gaining traction because they can be blended and processed on existing extrusion and thermoforming lines with only minor adjustments, which lowers conversion risk for regional converters and brand owners.

This operational compatibility makes starch solutions the near-term commercial choice where procurement teams want visible sustainability but also need predictable supply and stable unit economics. Local compounders are therefore prioritizing starch blends that match existing film and rigid packaging specifications to speed adoption.

The PHA segment is anticipated to grow at a CAGR of 7.1% through the forecast period. Polyhydroxyalkanoate (PHA) is attracting strategic interest because its microbially produced chemistry delivers strong end-of-life credentials and performance for sensitive applications, from compostable food-contact films to specialty consumer packaging.

The unique technical profile of PHA justifies investment by regional players and public-private partnerships into fermentation scale-up, since successful localization would cut import exposure and create higher margin pathways for domestic producers. As a result, PHA is moving from an R&D story to targeted commercial pilots.

End Use Insights

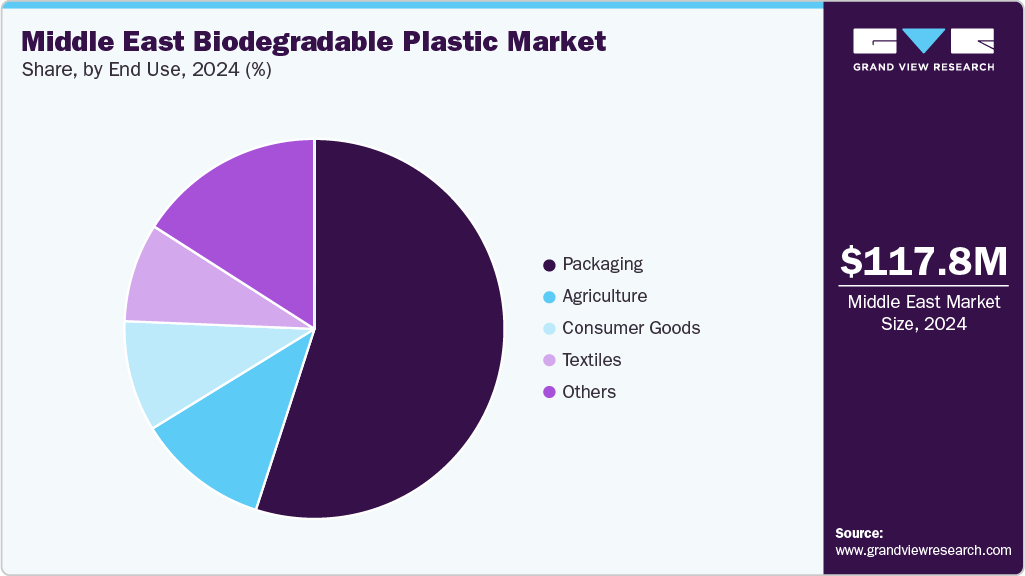

Packaging dominated the market across the end use segment, accounting for a revenue share of 55.0% in 2024, and is anticipated to grow at a 6.9% CAGR over the forecast period. Packaging is the primary commercial battleground because retailers and food service chains face direct regulatory scrutiny and visible reputational risk, so they are formalizing procurement mandates for certified biodegradable formats.

This creates predictable annual volumes that compel converters and resin suppliers to secure longer-term supply agreements and localized warehousing. The effect is faster qualification cycles for new materials and a clearer channel economics that supports premium pricing for verified compostable and biodegradable options.

The consumer goods segment is expected to grow at a substantial CAGR of 6.6% through the forecast period. In fast-moving consumer categories, especially personal care and packaged foods, sustainability has become a premium attribute that supports higher price points and stronger shelf presence, encouraging brand owners to co-invest in biodegradable packaging trials.

The Gulf consumer base, which places value on product provenance and premium experiences, gives early movers measurable marketing leverage. Consequently, consumer goods firms are treating biodegradable packaging as a brand investment rather than a pure cost center, enabling scalable rollouts when the economics align.

Country Insights

Saudi Arabia Biodegradable Plastic Market Trends

Saudi Arabia biodegradable plastic market held the largest share of 51.46% in 2024 and is expected to grow at the fastest CAGR of 7.1% over the forecast period. Vision 2030 and the Saudi Green Initiative are unlocking capital and regulatory programs to build circular waste systems and divert organic waste away from landfills, which directly raises the business case for industrial compostable and biodegradable formats.

State-backed projects and entities are funding regional recycling and waste conversion infrastructure, lowering execution risk for brand owners and converters and making local compounding economically viable. National materials players and research centers are also aligning R&D and product roadmaps to supply bio-based feedstocks and certified solutions, shortening qualification cycles for large retailers and food service chains. The combined policy, public investment and industry alignment create predictable demand signals that accelerate supplier entry and local scale-up.

Turkey Biodegradable Plastic Market Trends

Turkey biodegradable plastic market’s primary driver is alignment with European buyers and tightening domestic packaging rules that make certified biodegradable formats a practical compliance tool for exporters and large domestic brands. Recent updates to Turkey’s packaging and waste framework increase Extended Producer Responsibility obligations and recyclability scoring, which raises the cost of non-compliant packaging and encourages purchase of verified alternatives. At the same time,

Turkey’s circular economy transition and closer integration with EU value chains pressure manufacturers to redesign packaging for end of life, creating steady demand signals for compostable resins and local compounding capacity. Limited industrial composting and high landfill rates mean buyers prefer materials with clear certification to reduce regulatory and reputational risk.

UAE Biodegradable Plastic Market Trends

UAE biodegradable plastic market is projected to gain significant momentum over the forecast period. The growth in consumer demand, driven by aggressive government regulations banning single-use plastics, and the UAE’s shift toward a circular economy, are fueling the adoption of starch blends, PLA, PHA, and other biopolymer-based alternatives. Despite infrastructure and cost challenges, regulatory pressure and rising eco-conscious brands are driving sustained expansion of biodegradable plastic across packaging, food service, and retail sectors.

Oman Biodegradable Plastic Market Trends

Oman biodegradable plastic marketis driven by broader compostable packaging trends and market groundwork. Oman is gradually phasing out single-use plastics, prompting businesses and consumers to explore compostable options, especially in foodservice and retail environments. Additionally, government-backed initiatives, awareness campaigns, and emerging local startups are beginning to build the foundation for a circular plastics economy.

Qatar Biodegradable Plastic Market Trends

Qatar biodegradable plastic marketis projected to grow at a substantial rate over the forecast period. Government initiatives, including the distribution of biodegradable bags and targeted support for local production, are actively promoting product adoption. Moreover, packaging is projected to be one of the largest segments, due to the country’s push toward sustainable consumption and alignment with National Vision 2031.

Kuwait Biodegradable Plastic Market Trends

Kuwait biodegradable plastic marketis positioned for gradual growth from 2025 to 2033. Consumer interest in sustainable packaging, alongside nascent government measures to curb single-use plastics, is fostering product adoption, particularly in foodservice and retail sectors. Additionally, market maturation may hinge on enhanced awareness, infrastructure investment, and scaled production capabilities.

Key Middle East Biodegradable Plastic Companies Insights

Key players operating in the Middle East biodegradable plastic market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Biodegradable Plastic Companies:

- Avani Eco Middle East

- Al Bayader International

- BASF SE

- Cargill Incorporated

- Eastman Chemical Company

- Ecoway Biopolymers LLC

- EuP Egypt

- Novamont S.p.A.

- Emirates Biotech

Recent Developments

-

In June 2025, the UAE announced a phased ban on single-use plastics culminating in a full ban by January 2026 on plastic cutlery, food containers, cups, lids, straws, and stirrers. This move aligned with the country's environmental goals, including Net Zero by 2050 and the Green Agenda 2030, aiming to significantly reduce plastic waste, which made up 11% of municipal waste.

-

In September 2024, Emirates Biotech and Sulzer joined forces to build the world's largest polylactic acid (PLA) production facility in the UAE, located in Abu Dhabi’s KEZAD Free Zone. The plant is designed to produce 75,000 metric tons annually in its first phase, with the capacity to scale up to 160,000 tons per year in two phases.

Middle East Biodegradable Plastic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 128.8 million

Revenue forecast in 2033

USD 213.0 million

Growth rate

CAGR of 6.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

Avani Eco Middle East; Al Bayader International; BASF SE; Cargill Incorporated; Eastman Chemical Company; Ecoway Biopolymers LLC; EuP Egypt; Emirates Biotech; Novamont S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Biodegradable Plastic Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East biodegradable plastic market report based on material, end use, and country:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Starch Based

-

PLA

-

PBAT

-

PBS

-

PHA

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Food Packaging

-

Non-Food Packaging

-

-

Agriculture

-

Textiles

-

Consumer Goods

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The Middle East biodegradable plastic market size was estimated at USD 117.8 million in 2024 and is expected to reach USD 128.8 million in 2025.

b. The Middle East biodegradable plastic market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2033 to reach USD 213.0 million by 2033.

b. Packaging dominated the Middle East biodegradable plastics market across the end use segmentation in terms of revenue, accounting for a market share of 55.00% in 2024 and is anticipated to grow at 6.9% CAGR over the forecast period. Packaging is the primary commercial battleground because retailers and food service chains face direct regulatory scrutiny and visible reputational risk, so they are formalising procurement mandates for certified biodegradable formats.

b. Some key players operating in the Middle East biodegradable plastic market include Avani Eco Middle East, Al Bayader International, BASF SE, Cargill Incorporated, Eastman Chemical Company, Ecoway Biopolymers LLC, EuP Egypt, Emirates Biotech, and Novamont S.p.A.

b. Rising consumer demand for eco friendly products is pushing retailers and brands to source biodegradable packaging. This preference creates shelf share opportunities and allows suppliers with certified solutions to command price premiums.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.