- Home

- »

- Consumer F&B

- »

-

Middle East Consumer Packaged Goods Market Report, 2033GVR Report cover

![Middle East Consumer Packaged Goods Market Size, Share & Trends Report]()

Middle East Consumer Packaged Goods Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Personal Care, Home Care, Food & Beverages), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-760-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Consumer Packaged Goods Market Summary

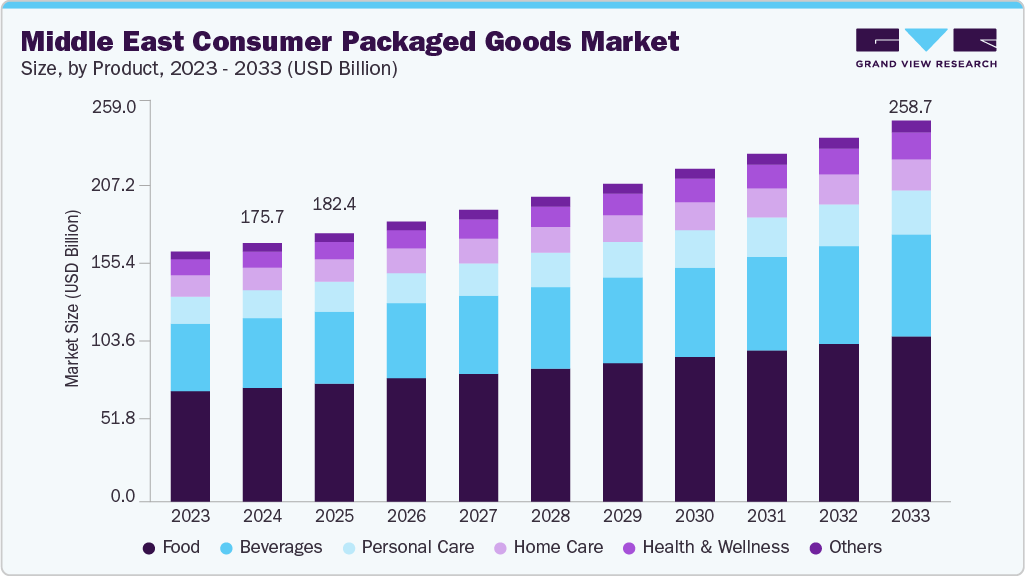

The Middle East consumer packaged goods market size was estimated at USD 175.72 billion in 2024 and is projected to reach USD 258.68 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. Rapid urbanization, a young population, and the growing adoption of modern retail and e-commerce are boosting demand for packaged food, beverages, and personal care products.

Key Market Trends & Insights

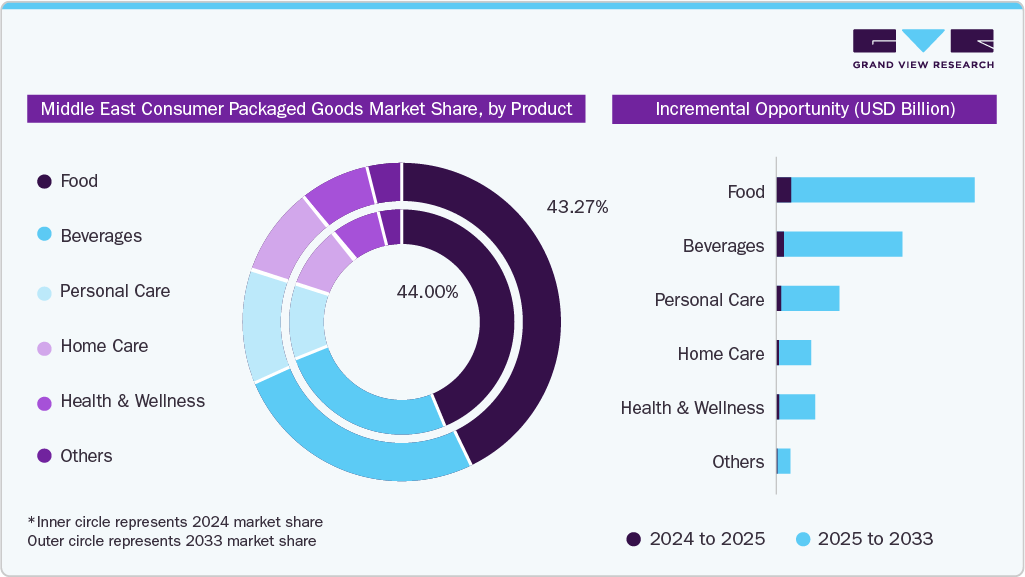

- By product, consumer packaged food led the market and accounted for a share of 44.00% in 2024.

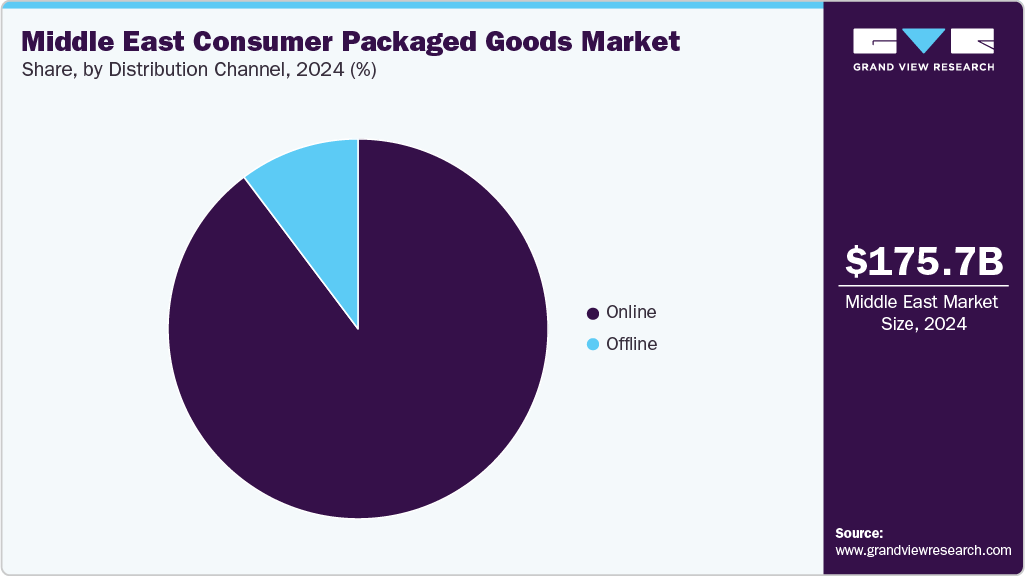

- By distribution channel, the offline sales held the highest market share in 2024.

- By Country, Saudi Arabia held a market share of 37.97% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 175.72 Billion

- 2033 Projected Market Size: USD 258.68 Billion

- CAGR (2025-2033): 4.5%

Value-conscious behavior is shaping purchases in the Middle East CPG market. Rising prices and shrinkflation are prompting shoppers to look for deals, promotions, private labels, and pack sizes that fit their budgets. Brands are responding by offering more affordable formats without compromising quality, while retailers that manage promotions well and provide transparent everyday pricing are winning loyal customers in this price-sensitive environment.The growth of modern retail is reshaping the CPG landscape in MEA. Supermarkets and hypermarkets rapidly expand across countries like Saudi Arabia, the UAE, Egypt, and Morocco, bringing shoppers wider product choices, consistent pricing, and more private-label options. In 2023 alone, Egypt saw 211 new store openings, the UAE 147, and Morocco 131, giving packaged food, beverages, and personal care brands stronger visibility and helping formal retail gain ground.

Urbanization, higher incomes, and demographic trends are also driving demand. Young, urban populations and a rising middle class are shopping more frequently and filling larger baskets, especially in big cities such as Cairo, Riyadh, Jeddah, Casablanca, Lagos, and Nairobi. Growing consumer spending and better infrastructure are creating new opportunities for FMCG brands across the Gulf region.

Digital and omnichannel shopping is picking up as well. E-commerce and quick-delivery services are expanding thanks to widespread smartphone use and improved last-mile delivery. Markets in the GCC are seeing the fastest growth in online grocery, with consumers increasingly comfortable buying staples through apps. In response, brands and retailers are investing in digital platforms, expanding online assortments, and improving fulfillment to meet these changing shopping habits.

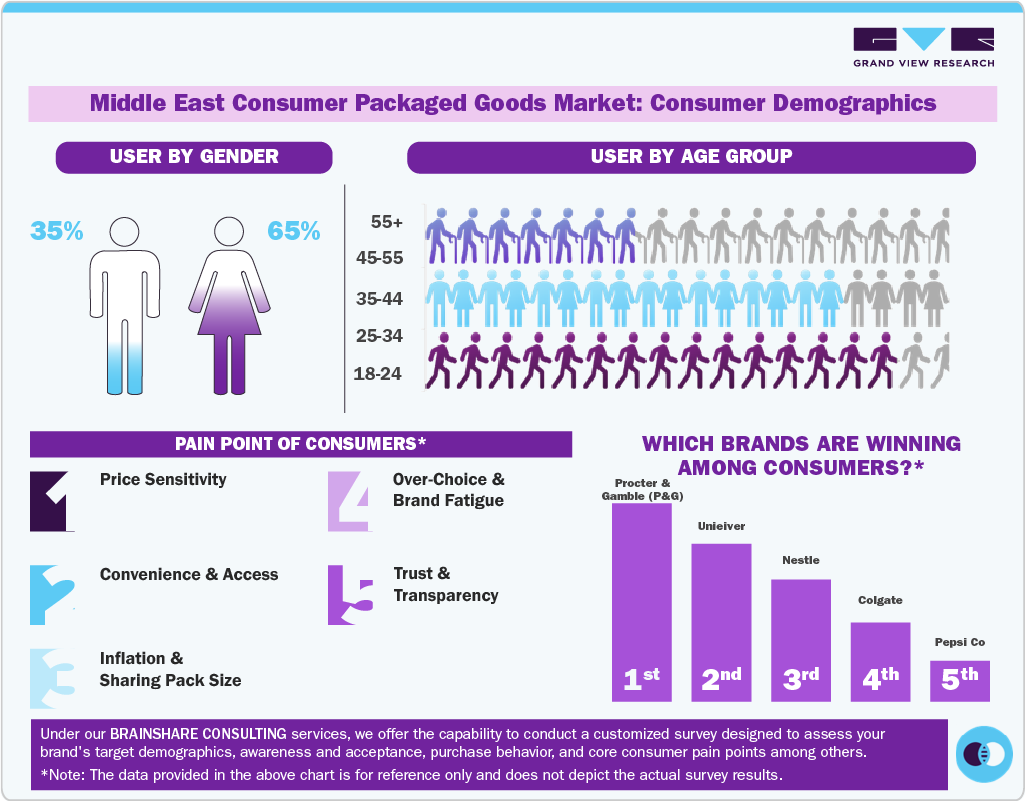

Consumer Insights

Consumer demographics in the Middle East CPG market are strongly influenced by both gender and age. Women comprise around 65% of buyers, reflecting their role as the primary decision-makers for groceries, household items, and personal care. Men, who account for approximately 35%, are becoming more active in areas such as grooming, fitness-focused nutrition, and convenient packaged products.

Age is an important factor in how people shop for CPG products. Young adults between 18 and 34 are the most likely to experiment with online shopping, direct-to-consumer brands, eco-friendly packaging, and functional or health-focused foods, thanks to their comfort with digital platforms and willingness to try new products. The 35-54 age group drives most household spending, purchasing essentials like groceries, cleaning supplies, and over-the-counter health items, while balancing cost with occasional premium choices. Those aged 55 and above generally stick to well-known, trusted brands, particularly in oral care, nutrition, and OTC medicines, valuing consistency and reliability in their purchases.

Consumers also face prominent pain points that shape market dynamics. Rising prices and shrinkflation-where packaging sizes decrease but costs stay the same-are common sources of frustration. Convenience can also be an issue, with out-of-stock items or delayed deliveries creating additional hurdles. The sheer number of product options, such as dozens of toothpaste or shampoo variants, can overwhelm shoppers, leading to a preference for simpler choices and clear guidance. Most importantly, trust and transparency remain essential, as claims like “all natural” or “organic” are often met with skepticism, requiring brands to back up their messaging with credible labels and authentic information.

Despite these hurdles, a few global leaders continue to dominate. Unilever leads in personal care, home care, and food; P&G dominates household and personal care; Nestlé drives packaged food and beverages; PepsiCo and Coca-Cola lead snacks and drinks; Colgate-Palmolive tops oral and personal care.

Product Insights

Consumer packaged food accounted for 44.00% of the market in 2024, underscoring the dominance of convenient, long-lasting, and accessible food products in everyday consumption. This shows that packaged food continues to be a staple purchase, especially in regions where busy lifestyles and urban migration drive reliance on ready-to-eat or processed food options.

Consumer packaged goods for health and wellness is anticipated to grow at a CAGR of 5.6% from 2025 to 2033, supported by increasing health consciousness, lifestyle-related diseases, and preferences for natural and functional products. This growth indicates a strong consumer shift toward preventive healthcare, dietary supplements, and personal well-being solutions.

Distribution Channel Insights

Sales of consumer packaged goods (CPG) through offline channels held a market share of 89.75%. The dominance of offline retail underscores traditional shopping habits, consumers’ preference for in-person product inspection, and the strong presence of physical distribution networks across the region, despite the gradual rise of e-commerce.

Sale of consumer packaged goods (CPG) through online channel is expected to grow at a CAGR of 7.3% from 2025 to 2033, as broader e-commerce adoption, improved digital payments, and increasingly reliable last‑mile logistics make it easier for consumers to buy everyday essentials such as groceries, home care items, and personal care products via apps and marketplaces; this steady expansion is further supported by high smartphone usage in major urban centers, growing investment in fulfillment capacity and quick‑commerce services

Country Insights

South Arabia Consumer Packaged Goods Market Trends

The South Arabia consumer packaged goods market accounted for a share of 37.97 % of the market in 2024, highlighting its role as the Middle East’s key hub for modern retail and urban consumption. Strong demand in cities like Riyadh and Jeddah, and well‑developed supermarket and hypermarket networks support robust sales across food, beverages, and personal/home care products. Local manufacturing and regional exports further strengthen the market, allowing Saudi Arabia to maintain a prominent position in the broader GCC and Middle East CPG landscape.

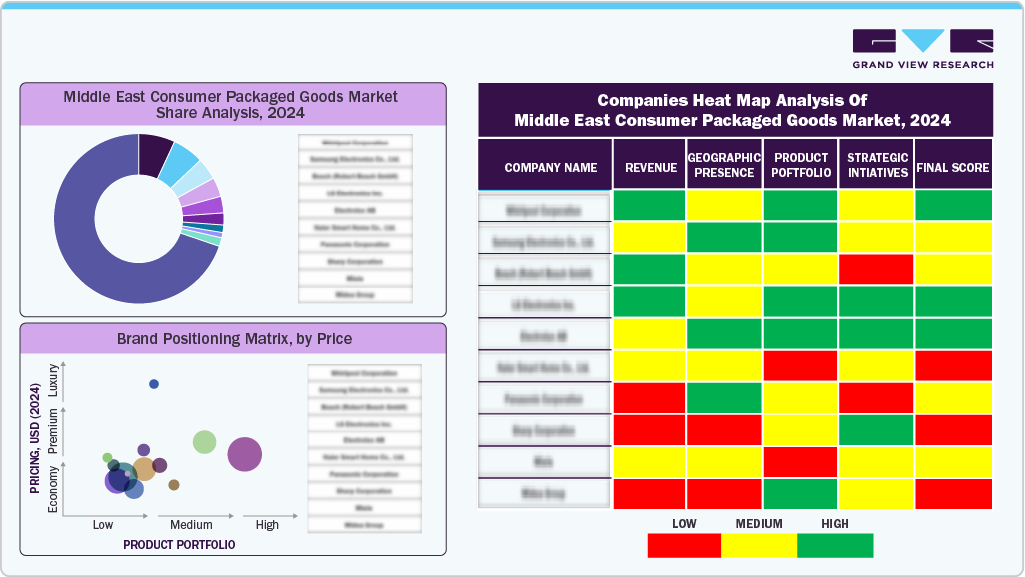

Key Middle East Consumer Packaged Goods Company Insights

A mix of global leaders and strong regional companies drives the Middle East CPG market. Key players include Unilever, Procter & Gamble (P&G), Nestlé, PepsiCo, Coca-Cola, Colgate-Palmolive, Danone, Savola Group, Arla Foods, and Almarai, which dominate categories like food, beverages, personal care, and household products. These companies rely on wide-ranging portfolios and established distribution networks to meet the needs of diverse consumers across different countries, while maintaining quality and brand loyalty through regular product innovations.

At the same time, smaller and local brands are making a mark by offering specialized items such as organic foods, plant-based alternatives, functional drinks, and eco-friendly household or personal care products. Savola and Almarai leverage local tastes and cultural preferences to appeal to younger and health-conscious consumers.

Key Middle East Consumer Packaged Goods Companies:

- Unilever

- Procter & Gamble (P&G)

- Nestlé

- PepsiCo

- Coca-Cola Company

- Colgate-Palmolive

- Danone

- Savola Group

- Arla Foods

- Almarai

Recent Developments

-

In July 2025, Tasteology & Co. is expanding into the Middle East and Africa, selectively onboarding clean‑label CPG partners for launches in late 2025 and early 2026, and offering science‑led formulation for shelf‑stable functional beverages, fermented proteins, and low/no‑sugar products under strict NDAs

-

In August 2025, Keychain raised USD 30 million in Series B funding and unveiled KeychainOS, an AI operating system built to help CPG manufacturers run plants faster by replacing or augmenting legacy ERPs

-

In February 2025, Reliance Consumer Products Limited launched Campa Cola in the UAE at Gulfood 2025, marking its first entry into the country and signaling a long‑term regional commitment alongside distribution partner Agthia Group.

Middle East Consumer Packaged Goods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 182.38 billion

Revenue forecast in 2033

USD 258.68 billion

Growth rate (revenue)

CAGR of 4.5% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Country scope

Saudi Arabia; UAE; Egypt; Kuwait; Oman

Key companies profiled

Unilever; Procter & Gamble (P&G); Nestlé; PepsiCo; Coca-Cola Company; Colgate-Palmolive; Danone; Savola Group; Arla Foods, Almarai

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Consumer Packaged Goods Market Report Segmentation

This report forecasts revenue growth at the country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East Consumer Packaged Goods (CPG) market report by product and country.

-

Product Outlook (Revenue, USD Billion; 2021 - 2033)

-

Personal Care

-

Skincare

-

Haircare

-

Cosmetics & Beauty

-

Oral Care and Personal Hygiene

-

-

Home Care

-

Laundry

-

Surface Cleaning

-

Dish Care

-

Air Care

-

-

Health & Wellness

-

OTC Medicines

-

Vitamins & Supplements

-

Functional Nutrition

-

-

Food

-

Staples & Pantry

-

Snacks & Confectionery

-

Bakery & Breakfast

-

Frozen & Convenience Foods

-

Dairy & Alternatives

-

Meat, Poultry & Seafood

-

-

Beverage

-

Non-alcoholic

-

Bottled water

-

Soft Drinks & Juices

-

Others

-

-

Alcoholic

-

-

Others

-

-

Distribution Channel (Revenue, USD Billion; 2021 - 2033)

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Traditional Trade

-

-

Online

-

E-Commerce Platforms

-

D2C / Brand-Owned Websites

-

Social Commerce

-

-

-

Regional Outlook (Revenue, USD Billion; 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Egypt

-

Kuwait

-

Oman

-

Frequently Asked Questions About This Report

b. The Middle East consumer packaged goods market size was estimated at USD 175.72 billion in 2024 and is expected to reach USD 182.38 billion in 2025.

b. The Middle East consumer packaged goods market is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033 to reach USD 258.68 billion by 2033.

b. Consumer packaged food accounted for 42.31% of the market in 2024, due to its consistent demand and essential role in daily life. Staples like snacks, dairy, and packaged meals are purchased frequently, creating high repeat consumption.

b. Some key players in the Middle East consumer packaged goods market include Unilever; Procter & Gamble (P&G); Nestlé; PepsiCo; Coca-Cola Company; Colgate-Palmolive; Danone; Savola Group; Arla Foods and Almarai

b. The Middle East consumer packaged goods market growth can be attributed to the rapid urbanization, a young population, and growing adoption of modern retail and e-commerce, which are boosting demand for packaged food, beverages, and personal care products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.