- Home

- »

- Advanced Interior Materials

- »

-

Middle East Copper Flat Rolled Products Market Report, 2033GVR Report cover

![Middle East Copper Flat Rolled Products Market Size, Share & Trends Report]()

Middle East Copper Flat Rolled Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Copper Sheets, Copper Strips), By End Use (Construction, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-709-9

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Copper Flat Rolled Products Market Summary

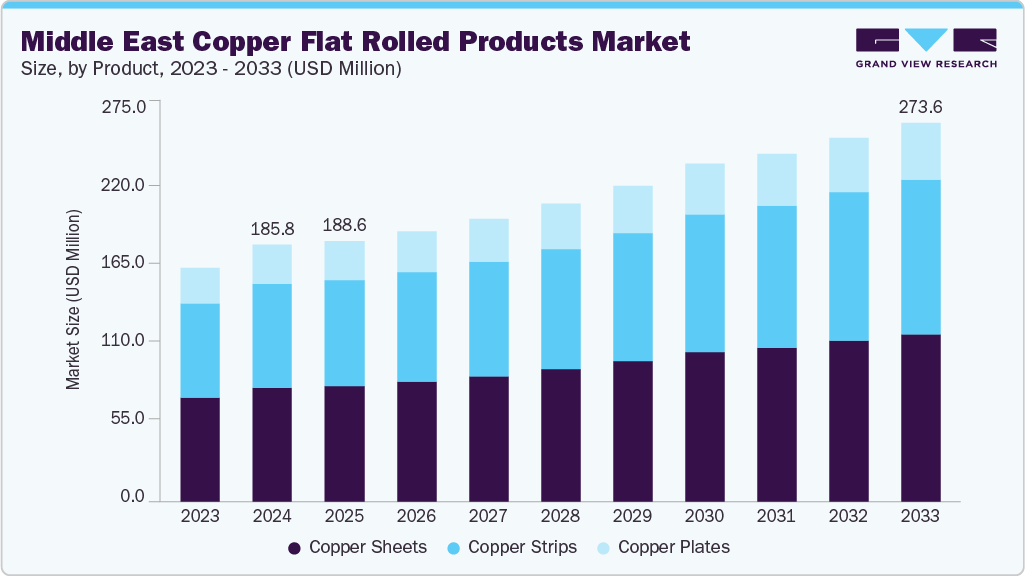

The Middle East copper flat rolled products market size was estimated at USD 185.8 million in 2024 and is expected to reach USD 273.6 million in 2033, and is expected to grow at a CAGR of 4.8% from 2025 to 2033. The market is experiencing robust growth, driven primarily by increasing demand in the electrical and electronics sector, rapid expansion of infrastructure development, and the accelerating transition toward electric mobility.

Key Market Trends & Insights

- The copper flat rolled products market in the Middle East is expected to grow at a substantial CAGR of 4.8% from 2025 to 2033.

- By product, copper sheets dominated the market with a revenue share of over 44.0% in 2024.

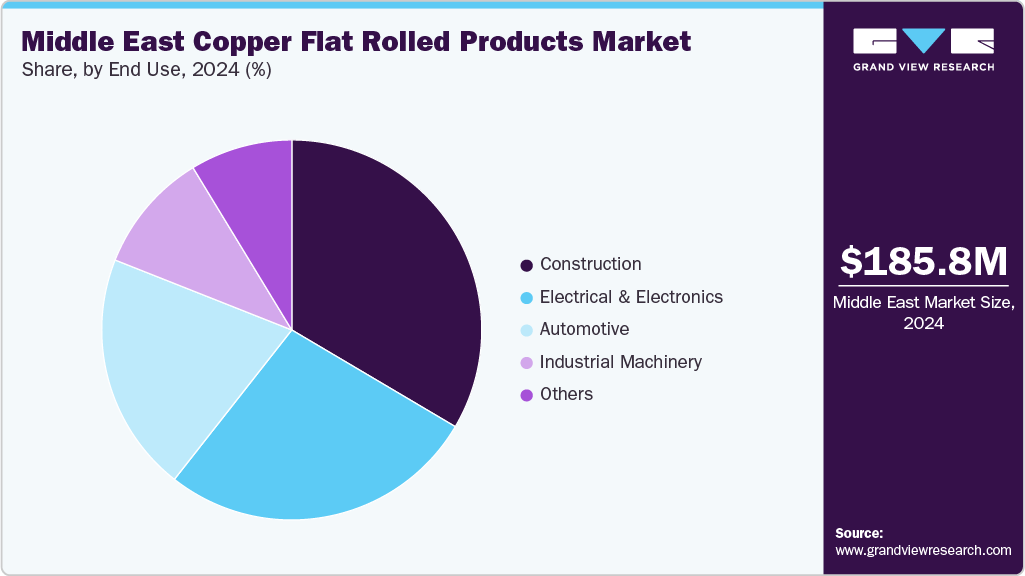

- The construction segment held the largest share of over 33.0% of copper flat rolled products revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 185.8 Million

- 2033 Projected Market Size: USD 273.6 Million

- CAGR (2025-2033): 4.8%

Copper flat-rolled products are increasingly favored in the Middle East for their high-performance, miniaturized, and energy-efficient characteristics. Copper's exceptional electrical conductivity makes it a critical material in manufacturing printed circuit boards (PCBs), connectors, busbars, and transformer windings. The rapid deployment of 5G infrastructure and the proliferation of smart home and IoT devices have further accelerated the demand for copper foils and strips, particularly in compact, high-frequency components where performance and reliability are paramount.

Technological innovations in electric vehicles (EVs) and energy infrastructure design amplify the region's demand for flat-rolled copper products. Advancements in high-efficiency electric drivetrains, battery management systems, and next-generation charging infrastructure necessitate materials with exceptional electrical conductivity, thermal performance, and durability-key characteristics of copper. As solid-state batteries and high-voltage EV architectures gain traction, precision-engineered copper foils and sheets are becoming increasingly critical to meet performance and safety standards.

Moreover, the Middle East's transition toward renewable energy sources such as solar and wind has intensified the need for reliable power transmission and storage solutions. Copper's role in solar panel connectors, wind turbine generators, and innovative grid components continues to expand, positioning flat-rolled copper products at the core of future-ready energy and mobility ecosystems.

Drivers, Opportunities & Restraints

The Middle East market for copper flat rolled products industry is strongly propelled by extensive infrastructure development initiatives, including the construction of smart cities, advanced telecommunications networks, and large-scale renewable energy projects. The region’s strategic investments in deploying 5G technology have significantly increased demand for high-performance copper foils and strips used in miniaturized, high-frequency electronic components. Moreover, the rapid growth of electric vehicle adoption, supported by government incentives and growing environmental awareness, creates strong demand for copper in electric drivetrains, battery systems, and charging infrastructure. Copper’s superior electrical and thermal conductivity, durability, and recyclability make it the material of choice across these sectors, ensuring sustained market growth.

The Middle East’s ambitious energy transition roadmap, emphasizing solar and wind power, offers vast opportunities for the copper flat rolled products industry. These renewable energy installations require efficient power transmission and storage components, which heavily rely on copper due to its reliability and conductivity. There is also a growing governmental push towards localizing manufacturing to reduce import dependence and enhance supply chain resilience, presenting opportunities for establishing regional copper fabrication and processing plants. In addition, the expanding adoption of smart homes, IoT devices, and next-generation electric vehicles creates avenues for developing specialized copper products tailored for compact, high-frequency applications, driving innovation and value addition in the market.

Despite the promising outlook, the market faces several challenges that could hinder growth. Fluctuations in global copper prices, influenced by geopolitical tensions and supply-demand imbalances, create cost uncertainty for manufacturers and end-users, potentially limiting investment in new projects. The competition from alternative materials such as aluminum, which offers lighter weight and lower costs in some applications, can constrain copper demand. Moreover, geopolitical instability and regional conflicts in parts of the Middle East may disrupt supply chains, affect raw material availability, and delay infrastructure projects. Furthermore, regulatory complexities and the need for stringent quality standards in emerging applications like EVs and renewable energy can increase operational costs and slow market penetration.

Product Insights

In the Middle East, copper sheets are increasingly recognized for their outstanding electrical and thermal conductivity, corrosion resistance, malleability, and durability, aligning well with the region’s growing industrial and infrastructural needs. The booming construction sector across GCC countries extensively uses copper sheets for roofing, cladding, and architectural detailing due to their superior weather resistance and appealing finish, which withstands harsh desert climates. Their critical role in electrical systems, including busbars, printed circuit boards, and grounding equipment, is vital to support the region’s rapid urbanization and expanding smart infrastructure projects. Moreover, the growing focus on renewable energy, particularly solar power in countries like the UAE and Saudi Arabia, leverages copper sheets in panel components and battery systems.

Copper strips are highly valued in the Middle East for their excellent electrical and thermal conductivity, flexibility, corrosion resistance, and mechanical strength, which suit the precision demands of key regional industries. The electrical and electronics sector utilizes copper strips extensively in switchgear, transformers, and power distribution systems, ensuring efficient energy transmission to support the region’s industrial growth and urban development. The automotive sector, especially with the rising push towards electric vehicles, increasingly depends on copper strips for EV battery connectors, busbars, and wiring harnesses, where compact design and reliability are crucial.

End Use Insights

In 2024, the construction segment accounted for the largest share of over 33.0%, driven by copper’s unique combination of durability, corrosion resistance, and excellent electrical conductivity. These products are extensively used in architectural applications such as roofing, cladding, wall panels, and flashing, where long-term weather resistance and aesthetic appeal are critical. Copper’s excellent formability enables intricate detailing in facades and decorative elements, while its natural patina adds significant value to modern and heritage structures. Moreover, copper’s inherent antimicrobial properties make it an ideal choice for high-touch surfaces in public and commercial buildings, contributing to enhanced hygiene standards.

Copper flat rolled products also play a vital role in the electrical and electronics sector, thanks to their outstanding electrical conductivity, superior thermal properties, and corrosion resistance. Copper sheets, strips, and foils are fundamental components in manufacturing printed circuit boards (PCBs), connectors, busbars, and transformers. Their high efficiency in conducting electricity with minimal energy loss makes them particularly suitable for high-frequency and high-current applications. Moreover, copper’s excellent thermal conductivity facilitates effective heat dissipation from electronic devices, improving their performance and longevity.

Copper strips and foils' flexibility and ease of fabrication allow for precise shaping, essential for compact and sophisticated electronics such as smartphones, computers, and industrial control systems. As technological advancements continue and devices become increasingly miniaturized, demand for copper flat-rolled products in this industry remains robust and steadily growing.

Regional Insights

The Middle East copper flat rolled products market is evolving amid a dynamic global environment marked by shifting trade flows and regional industrial growth. One notable external influence is the current strain on the European market, where supply constraints and changing trade dynamics are causing copper shipments to divert towards the U.S. in anticipation of tariffs. This diversion has led to shortages and increased demand in European spot markets, especially in hubs like Germany, Livorno, and Rotterdam, highlighting the sensitivity of global copper supply chains to geopolitical developments and trade policies.

Saudi Arabia Copper Flat Rolled Products Market Trends

The copper flat rolled products market in Saudi Arabia remains a critical market player in the Middle East, driven by its massive infrastructure development and ambitious diversification strategies under Vision 2030. The ongoing expansion of smart cities, renewable energy projects (especially solar and wind), and industrial zones is fueling robust demand for copper sheets and strips used in construction, electrical systems, and energy infrastructure. Moreover, the government’s focus on electric vehicle adoption and sustainable transportation is expected to further boost demand for copper components in automotive applications.

UAE Copper Flat Rolled Products Market Trends

The copper flat rolled products market in the UAE stands out as a regional hub due to its advanced manufacturing capabilities and status as a logistics and trade gateway. The country’s rapid urbanization, continuous development of large-scale commercial and residential projects, and increasing investment in 5G telecommunications infrastructure are key drivers for copper demand. Moreover, the UAE’s proactive approach toward renewable energy integration and smart grid modernization significantly elevates the need for high-quality copper products, strengthening the market’s growth trajectory.

Key Middle East Copper Flat Rolled Products Company Insights

Some key players operating in the market include Dubai Copper Company LLC, Emirates Copper & Aluminium Industry, and National Copper Industries.

-

Dubai Copper Company LLC is a prominent manufacturer of copper flat rolled products, specializing in sheets, strips, and foils for industrial, electrical, and construction applications. Established to serve the rapidly growing Middle East market, the company focuses on high-quality production standards and innovation. Dubai Copper Company operates modern manufacturing facilities and employs a skilled workforce to meet regional demand for durable and efficient copper products.

-

Emirates Copper & Aluminium Industry is a key manufacturer in the copper and aluminium sector, producing a wide range of copper sheets, strips, and related products for construction, automotive, and electrical industries. Founded to support the infrastructure boom in the Middle East, the company combines advanced manufacturing technology with a strong emphasis on sustainability and quality control. Emirates Copper & Aluminium Industry employs experienced professionals and operates strategically located production units.

-

National Copper Industries is a leading manufacturer of copper flat rolled products, including sheets and strips, catering primarily to industrial, energy, and construction sectors. The company is recognized for its commitment to quality and innovation, supporting the Middle East’s economic diversification goals. National Copper Industries runs state-of-the-art production facilities and employs a dedicated team to deliver high-performance copper products tailored to regional market needs.

Key Middle East Copper Flat Rolled Products Companies:

- Dubai Copper Company LLC

- Emirates Copper & Aluminium Industry

- National Copper Industries

- Al Zamil Group

- Union Metals Manufacturing

- Hadeed Metal Industries

Recent Developments

-

On May 13, 2025, Emirates Global Aluminium (EGA) announced that construction on the UAE’s largest aluminium recycling plant in Al Taweelah had been completed 50%-42 days ahead of schedule. The plant will process approximately 170,000 tons per year of scrap into low-carbon, high-quality billets under the ‘RevivAL’ brand, with the first hot metal expected in the first half of 2026.

-

On May 20, 2025, ADNOC Refining and Emirates Global Aluminium (EGA) signed a USD 500 million five-year supply agreement for up to 1.5 million tons of calcined petroleum coke from Ruwais Refinery. This strategic deal secures essential raw material for aluminium production, bolstering local supply chains and supporting domestic industrial capacity.

-

On May 16, 2025, Emirates Global Aluminium (EGA) unveiled plans for a USD 4 billion primary aluminium smelter at the Tulsa Port of Inola in Oklahoma-the first new U.S. primary aluminium plant since 1980. The facility is expected to produce 600,000 tons per year, create 1,000 direct and 1,800 indirect jobs, and nearly double the current U.S. aluminium capacity.

Middle East Copper Flat Rolled Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 188.6 million

Revenue forecast in 2033

USD 273.6 million

Growth rate

CAGR of 4.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar; Oman

Key companies profiled

Dubai Copper Company LLC; Emirates Copper & Aluminium Industry; National Copper Industries; Al Zamil Group; Union Metals Manufacturing; Hadeed Metal Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Copper Flat Rolled Products Market Report Segmentation

This report forecasts volume and revenue growth at the regional and country level and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East copper flat rolled products market report based on product and end use:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Copper Sheets

-

Copper Strips

-

Copper Plates

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Construction

-

Electrical & Electronics

-

Automotive

-

Industrial Machinery

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

Frequently Asked Questions About This Report

b. The Middle East copper flat rolled products market size was estimated at USD 185.8 million in 2024 and is expected to reach USD 188.6 million in 2025.

b. The Middle East copper flat rolled products market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033, reaching USD 273.6 million by 2033.

b. By product, copper sheets dominated the market with a revenue share of over 44.0% in 2024.

b. Some of the key vendors in the Middle East copper flat rolled products market are Dubai Copper Company LLC, Emirates Copper & Aluminium Industry, National Copper Industries, Al Zamil Group, Union Metals Manufacturing, and Hadeed Metal Industries.

b. In the Middle East, demand for copper flat-rolled products in construction is driven by rapid urbanization, smart city projects, and stricter green building standards such as the UAE’s Estidama and Qatar’s QSAS. Copper’s high electrical and thermal conductivity supports energy-efficient systems, while its recyclability aligns with sustainability goals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.