- Home

- »

- Advanced Interior Materials

- »

-

Middle East Copper Market Size, Industry Report, 2033GVR Report cover

![Middle East Copper Market Size, Share & Trends Report]()

Middle East Copper Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Primary Copper, Secondary Copper), By Product (Wire, Rods, Bars & Sections, Flat Rolled Products, Tube, Foil), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-705-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Copper Market Summary

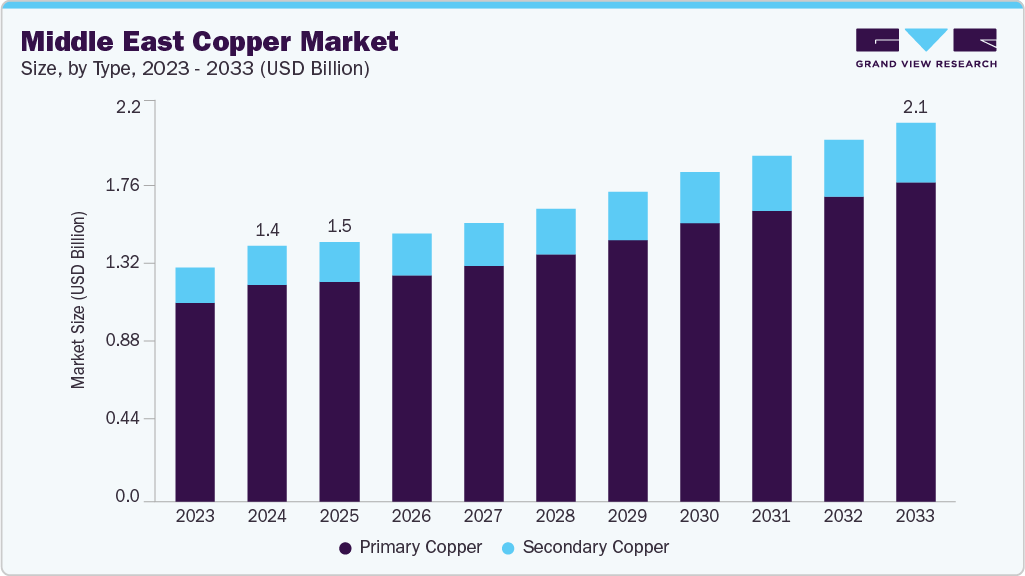

The Middle East copper market size was estimated at USD 1,446.2 million in 2024 and is expected to reach USD 2,140.1 million by 2033, at a CAGR of 4.9% from 2025 to 2033. Copper is critical in solar panels, wind turbines, and associated grid infrastructure.

Key Market Trends & Insights

- The copper market in the Middle East is expected to grow at a substantial CAGR of 4.9% from 2025 to 2033.

- By product, primary copper held the revenue share of 84.8% in 2024.

- Building & construction segment held a revenue share of 26.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,446.2 Million

- 2033 Projected Market Size: USD 2,140.1 Million

- CAGR (2025-2033): 4.9%

According to the International Energy Agency (IEA), expanding solar PV and wind capacity globally has sharply increased copper demand, especially for cabling, power conductors, and transformers. The market is witnessing steady growth, driven by the region’s extensive infrastructure development and diversification efforts under national transformation agendas such as Saudi Vision 2030 and the UAE’s Economic Vision 2031. Copper’s superior conductivity and corrosion resistance make it indispensable in building wiring, plumbing, roofing, and other construction applications. Rapid urbanization, coupled with large-scale investments in residential, commercial, and public infrastructure projects-including smart cities, transportation networks, and industrial zones is fuelling copper consumption across the Gulf and wider region.

The shift toward renewable energy is emerging as a key growth driver, as copper plays a critical role in solar photovoltaic installations, wind turbines, electric grids, and energy storage systems. Middle Eastern nations are ramping up renewable capacity to meet clean energy targets, with the UAE’s Mohammed bin Rashid Al Maktoum Solar Park and Saudi Arabia’s NEOM Green Hydrogen Project being notable examples. These initiatives, alongside regional efforts to modernize and expand electricity transmission and distribution networks, significantly increase the demand for copper-intensive infrastructure.

The automotive sector, particularly the growing interest in electric vehicles (EVs), is adding another dimension to copper demand in the region. EVs require more copper than traditional vehicles for batteries, wiring harnesses, and electric motors. Regional governments are introducing incentives and infrastructure for EV adoption, while luxury and performance EV brands are expanding into Middle Eastern markets. This trend, paired with ongoing investments in EV charging stations, is set to boost copper usage in transportation applications.

In addition, advancements in manufacturing, industrial automation, and electronics reinforce copper’s role in the Middle East’s industrial transformation. Copper is essential for semiconductors, circuit boards, and high-performance wiring in consumer electronics, industrial machinery, and smart technologies. The role of 5G networks, expansion of data centers, and proliferation of IoT-enabled devices further enhance its demand profile.

Sustainability and resource efficiency are also gaining traction, making copper recycling a strategic priority for regional industries. Given copper’s ability to retain its properties indefinitely, investments in scrap collection, recovery technologies, and secondary smelting are growing. These efforts support environmental goals and provide a stable supplementary supply to meet the region’s long-term demand, reducing reliance on imported primary copper amid global market fluctuations.

Drivers, Opportunities & Restraints

The Middle East copper industry is primarily driven by growing infrastructure development, rapid urbanization, and expandingregional power transmission networks. Large-scale projects under national development plans, such as Saudi Arabia’s Vision 2030, the UAE’s infrastructure upgrades, and Qatar’s industrial expansion, boost copper demand for wiring, cabling, and plumbing. The increasing adoption of renewable energy systems, including solar and wind power projects in the Gulf, further accelerates copper consumption due to its critical role in power generation, grid connectivity, and energy storage. In addition, the rising demand from construction, industrial manufacturing, and electronics assembly reinforces copper’s strategic importance in the regional economy.

The Middle East copper industry opportunities are expanding with government-backed investments in renewable energy, electric mobility, and smart city projects. The region’s shift toward energy diversification and electrification is expected to drive demand for copper-intensive technologies such as EV charging infrastructure, smart grids, and energy-efficient building systems. Growing interest in copper recycling and secondary production-supported by circular economy initiatives in the GCC-also offers scope for sustainable growth while reducing import dependence. Furthermore, copper’s use in emerging sectors such as data centers, AI-enabled infrastructure, and advanced manufacturing presents untapped potential for market expansion.

However, the market faces challenges including a heavy reliance on copper imports due to limited regional mining activity, which exposes the market to global supply fluctuations and price volatility. Geopolitical tensions in nearby mining and shipping routes, rising freight costs, and currency fluctuations can further impact supply stability. Environmental regulations, particularly those aimed at reducing carbon footprints and improving waste management, may increase operational costs for processors and recyclers. Moreover, competition from alternative materials like aluminum in certain applications could constrain copper demand in cost-sensitive projects.

Type Insights

Primary copper production offers superior electrical conductivity, making it ideal for power transmission, renewable energy systems, and automotive components applications. As the global rollout of renewable energy projects and smart grids accelerates, especially in countries like China, the U.S., and Germany, the requirement for high-quality copper extracted from ores is surging. In addition, new mining investments in regions like Latin America and Africa, combined with large-scale industrialization in the Asia Pacific, are strengthening the supply and utilization of primary copper in various downstream industries.

Secondary copper production i.e. refined copper produced after recycling, requires significantly less energy, up to 85% less, than primary methods, making it an environmentally friendly alternative. As governments and industries push toward carbon neutrality, recycling is recognized as a strategic solution to reduce emissions and conserve resources. Furthermore, regulatory frameworks in Europe, North America, and parts of Asia encourage the development of scrap recovery infrastructure, thereby boosting the volume and efficiency of secondary copper production.

End Use Insights

In the Middle East, the building and construction segment represents one of the largest end-use markets for copper, supported by the region’s rapid urbanization, large-scale real estate projects, and robust infrastructure investments. Copper’s essential role in electrical wiring, plumbing, roofing, and HVAC systems makes it indispensable for safe and efficient power distribution in residential, commercial, and industrial developments. Its superior conductivity, durability, and corrosion resistance align well with the region’s focus on delivering high-quality, long-lasting infrastructure. Moreover, the Middle East’s growing emphasis on sustainable and energy-efficient building practices-driven by green building certifications and government-led sustainability initiatives-has increased copper usage in solar panel installations, smart building automation systems, and advanced heating and cooling solutions. Ongoing renovation and retrofitting projects, particularly in the Gulf Cooperation Council (GCC) countries, drive demand as outdated systems are replaced with modern copper-based components to improve performance and energy efficiency.

The infrastructure segment in the Middle East is anticipated to witness strong growth over the coming years, propelled by massive investments in national development strategies and economic diversification plans. Copper’s unmatched electrical and thermal conductivity makes it essential for applications such as power transmission lines, substations, rail electrification systems, and telecommunications networks. Mega infrastructure projects-from smart city developments like NEOM in Saudi Arabia to new airports, metro systems, and industrial zones across the UAE, Qatar, and Oman-are expected to boost copper demand significantly. Moreover, the region’s commitment to expanding renewable energy capacity, upgrading electricity grids, and enhancing transportation networks will further strengthen copper’s role as a critical material for modernization and long-term infrastructure resilience.

Product Insights

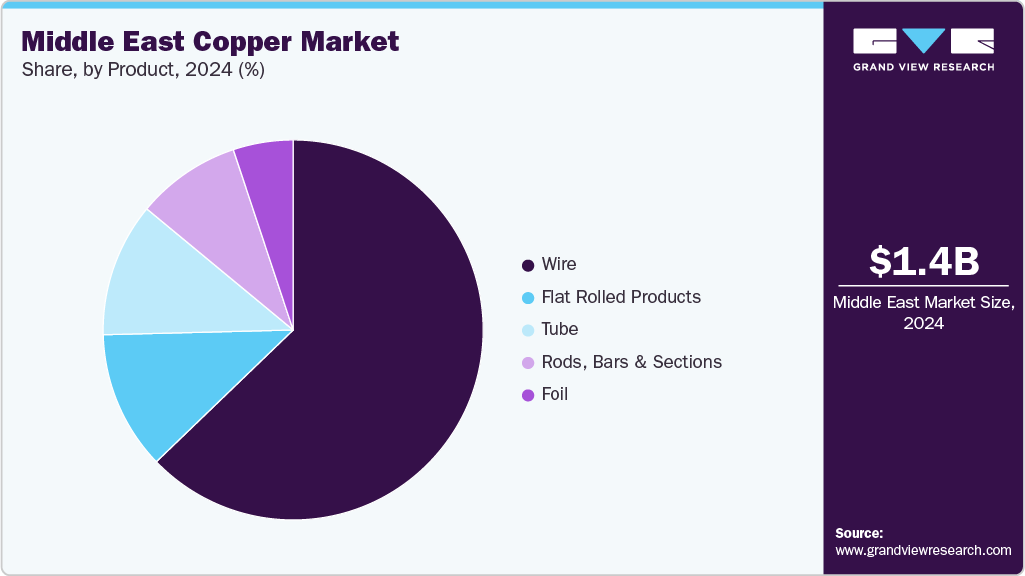

In the Middle East, copper wires play a pivotal role in residential, commercial, and industrial infrastructure, serving critical functions in power distribution, telecommunications, and grounding systems. Their exceptional conductivity, flexibility, and corrosion resistance make them indispensable in high-temperature and harsh environmental conditions common to the region. Renewable energy projects-such as large-scale solar farms in the UAE and Saudi Arabia’s wind energy initiatives-depend heavily on copper wiring for efficient energy transmission. The rapid development of electric vehicle charging networks, battery storage facilities, and modernized power grids further drives demand. Technological upgrades in smart cities, hyperscale data centers, and 5G infrastructure across the Gulf Cooperation Council (GCC) nations amplify copper wire consumption, as these applications require high-performance wiring to ensure speed, reliability, and efficiency. With the region’s strong push toward clean energy and digital transformation, the wire segment is poised to remain a cornerstone of copper product demand in the Middle East over the coming years.

Flat-rolled copper products, including sheets, strips, and plates, are anticipated to register the fastest CAGR over the forecast period. These products find extensive applications in architectural elements such as roofing and cladding, as well as in heat exchangers, printed circuit boards (PCBs), and precision engineering components. Their superior thermal and electrical conductivity, excellent formability, and strong corrosion resistance make them ideal for applications that demand reliable performance and aesthetic appeal. The growing adoption of modern building designs and the expanding consumer electronics sector are expected to drive demand for flat-rolled copper products in the coming years.

Regional Insights

In the Middle East, countries like Saudi Arabia, the UAE, and Oman are investing in copper-intensive projects to diversify their economies beyond oil. Saudi Arabia's Vision 2030 emphasizes mining, including copper, as a key sector. The UAE and Oman are developing metal trading hubs to capitalize on the growing demand for copper and other critical minerals.

UAE Copper Market Trends

The copper market in the UAE is witnessing steady growth, driven by infrastructure development, renewable energy projects, and its emergence as a regional metals trading hub. Dubai’s strategic location and advanced logistics infrastructure have positioned it as a major re-export center for copper products across the Middle East, Africa, and Asia. Demand is further supported by investments in construction, power transmission, and manufacturing sectors, and initiatives to expand domestic copper processing capabilities to meet rising regional needs.

Saudi Arabia Copper Market Trends

The copper market in Saudi Arabia is gaining momentum under the Kingdom’s Vision 2030 strategy, prioritizing mining as a pillar of economic diversification. Significant investments are channeled into copper exploration and mining projects, supported by favorable regulations and partnerships with global mining companies. The country’s growing industrial base, including power infrastructure, desalination plants, and manufacturing, is driving strong domestic demand for copper. In addition, Saudi Arabia aims to become a key supplier of refined copper and copper products within the GCC and global markets.

Key Middle East Copper Company Insights

Some key players operating in the market include Alara Resources Limited and Mawarid Mining LLC.

-

Alara Resources Limited is an Australia-based mining and exploration company focusing on the Middle East. Its flagship asset is the Al Wash-hi - Majaza Copper-Gold Project in Oman, where it holds a 51% stake through a joint venture. This project includes a 1 Mtpa copper concentrate plant and supports ongoing exploration across Oman to expand regional copper production capacity.

-

Mawarid Mining LLC, part of the Omani conglomerate MB Holding, has played a pivotal role in Oman’s copper sector since its inception in 2000. The company has conducted multiple successful open-pit operations and currently leads the Al Ghuzayn underground copper project, targeting the extraction of 6.4 million tonnes of ore at an average grade of 2.04% copper, in alignment with Oman Vision 2040 ambitions for economic diversification

-

Minerals Development Oman (MDO) is a state-owned enterprise spearheading the revival of Oman’s copper exports. It recently resumed shipments from the Lasail Mine-marking the end of a three-decade pause-and is advancing the Mazoon Copper Project, an integrated initiative with multiple open-pit sites and a processing plant capable of producing 115,000 tonnes of copper concentrate annually by 2027

-

Saudi Arabian Mining Company (Ma’aden) is the Middle East’s largest multi-commodity mining and metals firm and a key driver of Saudi Vision 2030. The company operates across 17 mining sites and is pursuing substantial copper development both domestically-through integrated operations-and internationally, including advanced acquisition talks for a stake in a Zambian copper mine to enhance resource security.

Key Middle East Copper Companies:

- Al-Masane Al Kobra Mining Company (AMAK)

- Alara Resources Limited

- Mawarid Mining LLC

- Minerals Development Oman (MDO)

- National Iranian Copper Industries Company (NICICO)

- Saudi Arabian Mining Company (Ma’aden)

Recent Development

-

In March 2025, Saudi Arabia issued mining exploration licenses to both local and international firms, including Vedanta and a consortium of Ajlan & Bros with China's Zijin Mining, for key regions such as Jabal Sayid and Al Hajar in Madinah and Aseer. These zones are rich in base and precious metals, including copper, and the initiative forms part of Saudi Arabia’s Vision 2030 economic diversification drive, with around 366 million riyals (~USD 97.6 million) committed to exploration over three years.

-

In late 2024, the UAE’s International Resources Holding (IRH), an arm of IHC, announced plans to establish a major copper trading hub in Abu Dhabi. The hub aims to trade over 500,000 metric tons of copper annually, marking a strategic push to integrate the UAE into global critical minerals supply chains after acquiring a 51% stake in Zambia’s Mopani Copper Mines.

-

In June 2025, Oman inaugurated the country’s first industrial plant to recycle legacy copper mining waste into high-purity copper cathodes using sustainable, closed-loop hydrometallurgical processes. Phase 1 of the facility, developed by Green Tech Mining and Services with state support, will produce approximately 60 tonnes of "green copper cathodes" annually, with plans to scale up to 12,000 tonnes by December 2026-advancing circular economy goals under Oman Vision 2040.

Middle East Copper Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,463.0 million

Revenue forecast in 2033

USD 2,140.1 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, product, end use, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Omar; Qatar

Key companies profiled

Al-Masane Al Kobra Mining Company (AMAK); Alara Resources Limited; Mawarid Mining LLC; Minerals Development Oman (MDO); National Iranian Copper Industries Company (NICICO); Saudi Arabian Mining Company (Ma’aden)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Copper Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East copper market report based on type, product, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Primary Copper

-

Secondary Copper

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wire

-

Rods, Bars & Sections

-

Flat Rolled Products

-

Tube

-

Foil

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Industrial Equipment

-

Transport

-

Infrastructure

-

Building & Construction

-

Consumer & General Products

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East copper market size was estimated at USD 1,446.2 million in 2024 and is expected to reach USD 1,463.0 million in 2025.

b. The Middle East copper market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 2,140.1 million by 2033.

b. The primary copper segment dominated the market with a revenue share of 84.8% in 2024.

b. Some of the key players in the Middle East copper market are Al-Masane Al Kobra Mining Company (AMAK), Alara Resources Limited, Mawarid Mining LLC, Minerals Development Oman (MDO), National Iranian Copper Industries Company (NICICO), Saudi Arabian Mining Company (Ma’aden), and others.

b. The key factor driving the growth of the copper market is the increasing demand from renewable energy systems, electric vehicles, and infrastructure development, all of which require significant amounts of copper for electrical conductivity, thermal efficiency, and durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.