- Home

- »

- Advanced Interior Materials

- »

-

Middle East Decks Market Size, Share, Industry Report, 2033GVR Report cover

![Middle East Decks Market Size, Share & Trends Report]()

Middle East Decks Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Wood, Metal, Plastics & Composites), By Application (Railing, Walls, Floors), By End Use (Residential, Non-residential), By Fastening Method, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-750-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Decks Market Summary

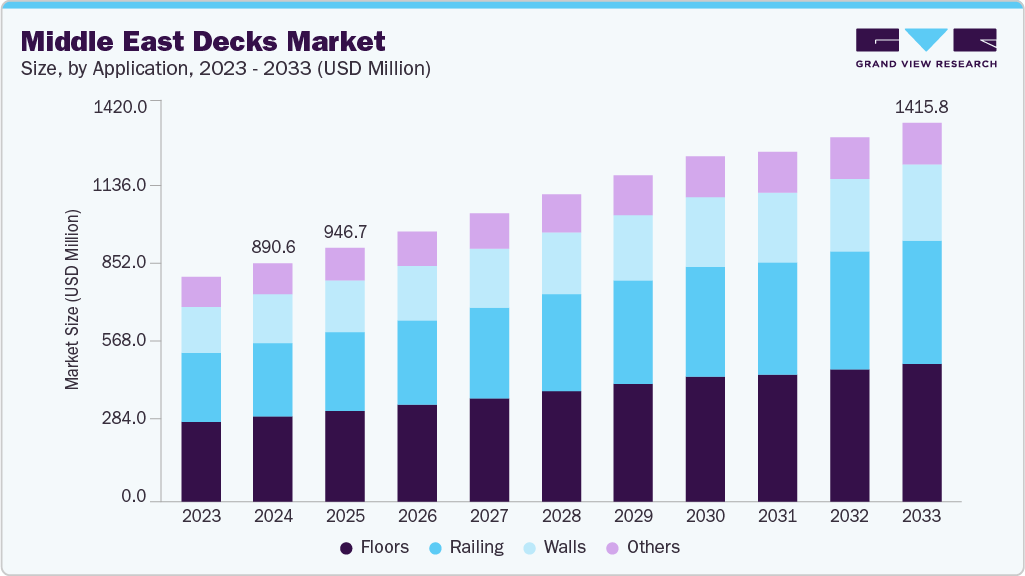

The Middle East decks market size was estimated at USD 890.6 million in 2024 and is projected to reach USD 1415.8 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The demand for decks in the Middle East is steadily increasing due to rapid urbanization, a surge in luxury housing projects, and the growing preference for outdoor living spaces.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East decks market with the largest revenue share of 17.1% in 2024.

- By material, the plastics & composites segment is expected to grow at the fastest CAGR of 5.8% over the forecast period.

- By application, the floors segment is expected to grow at the fastest CAGR of 5.4% over the forecast period.

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 3.8% over the forecast period.

- By fastening method, the deck board hidden fastening segment is expected to grow at the fastest CAGR of 5.4% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 890.6 Million

- 2033 Projected Market Size: USD 1415.8 Million

- CAGR (2025-2033): 5.2%

- Saudi Arabia: Largest market in 2024

- Egypt: Fastest market in 2024

Consumers are shifting towards modern architectural styles that incorporate wooden, composite, and PVC decking to enhance aesthetics and functionality. The tourism and hospitality industry is also driving demand, as resorts, hotels, and recreational facilities increasingly adopt premium decks for poolside, terraces, and leisure zones. Rising disposable incomes and lifestyle changes are encouraging homeowners to invest in deck installations, particularly in villas and high-end residential complexes.

Key drivers of demand in the Middle East decks industry include government-backed real estate development programs, population growth, and an expanding tourism sector. Mega construction projects such as Saudi Vision 2030, Expo City Dubai, and Qatar’s infrastructure development are integrating advanced decking solutions. The rising adoption of eco-friendly and low-maintenance materials like composite decking is another strong driver, given the region’s climatic challenges. Moreover, increasing investments in luxury outdoor furniture and landscaping are complementing deck usage. Growing demand for modular and customizable deck solutions allows customers to align outdoor spaces with modern design preferences.

The Middle East decks industry is witnessing innovations in material design, sustainability, and modular construction. Composite decks that mimic the natural look of wood while resisting heat and moisture are gaining significant traction. Modular decking systems are being introduced, enabling easier installation and customization for residential and commercial customers. Innovations in shading structures, such as integrated pergola-deck solutions with smart lighting and cooling features, are trending. Companies are also introducing anti-slip and fire-resistant decking materials to comply with safety standards.

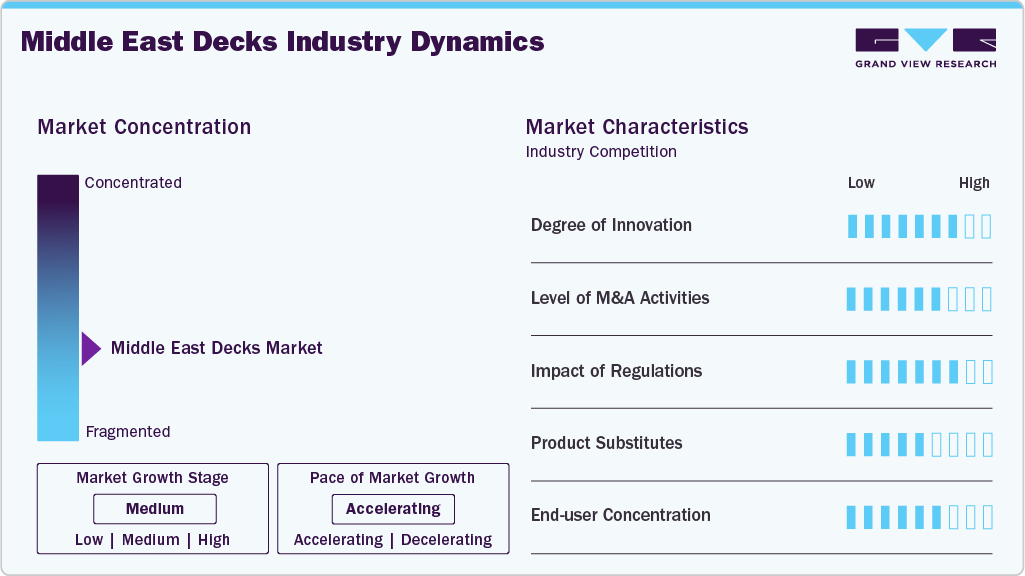

Market Concentration & Characteristics

The Middle East decks industry is moderately fragmented, with a mix of regional manufacturers and global players competing in the space. While established companies dominate large-scale projects in luxury housing and hospitality, smaller local firms cater to residential and commercial outdoor landscaping. Competitive pricing and product differentiation strategies are commonly used by players to expand their footprint. Global decking material suppliers are entering the region through partnerships with construction firms, further intensifying competition.

The primary substitutes for decking in the Middle East are tiled patios, marble flooring, and artificial turf, all of which serve as alternatives for outdoor living areas. However, decking remains preferred for its versatility, modularity, and aesthetic appeal, particularly in luxury and resort projects. The threat of substitutes is moderate, as consumer preference for customizable and eco-friendly solutions continues to grow.

Material Insights

The wood segment led the market with the largest revenue share of 38.47% in 2024, largely because of its timeless aesthetic appeal and the traditional architectural preferences in the region. High-end residential villas, resorts, and cultural spaces frequently adopt hardwood decking for terraces, pergolas, and outdoor lounges. Despite the climatic challenges of heat, humidity, and exposure to sand, premium treated wood and imported timber remain in high demand. Local consumers often perceive wood as a luxury material that adds natural beauty and warmth to outdoor areas. Contractors also favor wood due to its availability and versatility in custom designs.

The plastics & composites segment is expected to grow at the fastest CAGR of 5.8% over the forecast period, primarily due to their durability, long lifespan, and minimal maintenance requirements. Composite decking, which combines recycled wood fibers and plastics, has become a preferred choice for urban consumers who prioritize sustainability. Its ability to withstand extreme heat and resist moisture makes it ideal for poolside installations, resort decks, and residential terraces. With the region’s growing eco-consciousness, demand for recycled and environmentally friendly materials is rising steadily. Developers are increasingly using composites in mega projects such as NEOM and waterfront complexes

Application Insights

The railings segment led the market with the largest revenue share of 30.82% in 2024, as safety and aesthetics are critical in both residential and commercial outdoor spaces. High-rise apartments, villas with balconies, and resorts overlooking waterfronts all rely on strong railing systems for protection. Stainless steel, aluminum, glass, and composite railings are widely used to enhance durability while aligning with modern design trends. The combination of functionality and style makes railings an indispensable component of deck installations. Developers in luxury markets often incorporate designer railings that complement flooring and architectural finishes. Customizable railings are also gaining traction, allowing architects to create unique outdoor environments.

The floors segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. Middle Eastern consumers increasingly invest in outdoor spaces designed for leisure, dining, and recreation. With the expansion of luxury villas, poolside lounges, and hotel resorts, flooring solutions are becoming central to decking installations. Advanced materials with anti-slip coatings, UV resistance, and heat-dissipating features are now widely adopted. Composite and PVC floors, in particular, are seeing higher demand due to their ability to withstand the harsh regional climate. Developers are also opting for modular flooring systems that reduce installation time and maintenance. Lifestyle changes post-pandemic have reinforced the importance of private outdoor leisure, accelerating residential flooring adoption.

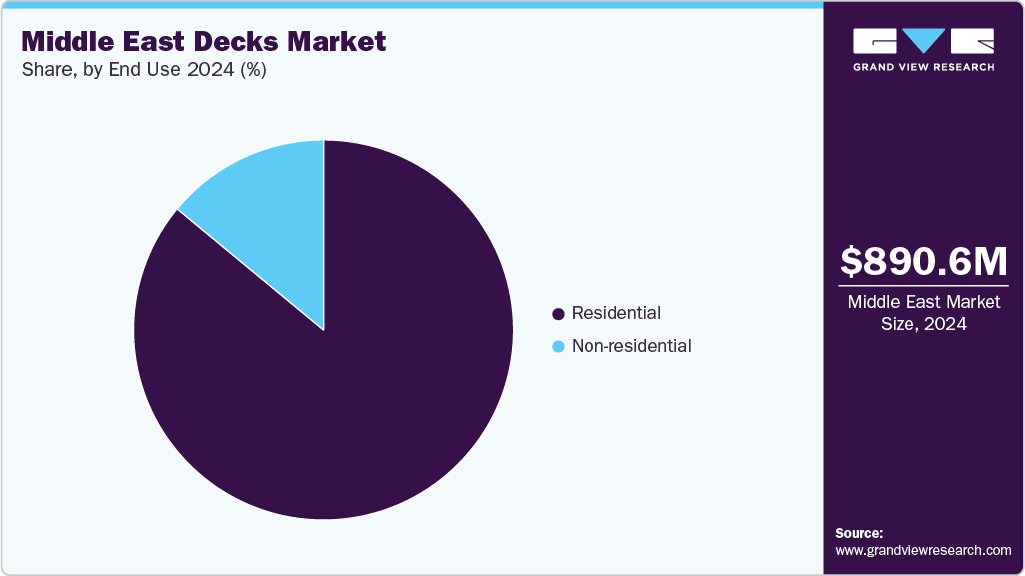

End Use Insights

The residential segment led the market with the largest revenue share of 86.0% in 2024, supported by the rapid growth of luxury housing and villa projects. Outdoor living spaces, including terraces, balconies, pergolas, and gardens, are central to modern residential architecture. Wealthy consumers increasingly invest in premium decking materials to create private leisure spaces. Government initiatives promoting affordable housing also contribute to decking demand in mid-range homes. Composite and wooden decks remain the most preferred materials for enhancing outdoor aesthetics. Rising disposable incomes and changing lifestyles are reinforcing this dominance. With urbanization and mega housing projects across Saudi Arabia, the UAE, and Egypt, the residential sector will continue to be the leading contributor to decking demand.

The non-residential segment is expected to grow at the fastest CAGR of 3.8% over the forecast period, due to large-scale investments in tourism, hospitality, and commercial complexes. Governments in Saudi Arabia, Qatar, and UAE are developing luxury hotels, resorts, and waterfront entertainment hubs, which all require modern decking solutions. Public spaces such as parks, boardwalks, and shopping centers are integrating outdoor decks for recreational appeal. Businesses are adopting composite and PVC decks due to their durability and ability to withstand heavy foot traffic. Mixed-use complexes and retail hubs increasingly include outdoor dining and relaxation areas, adding to demand. Post-World Cup infrastructure in Qatar has also fueled non-residential growth. This segment is set to become a key growth driver alongside residential adoption.

Fastening Method Insights

The deck board face fastening segment led the market with the largest revenue share of 55.1% in 2024, due to its cost-effectiveness, simplicity, and reliability. Builders and contractors favor this method for its straightforward installation process, which reduces construction timelines. Visible fasteners remain widely accepted, especially in large-scale projects where functionality is prioritized over seamless finishes. The technique is also more economical, making it popular in mid-range residential housing projects. Its durability ensures structural integrity even in extreme climates. Though newer hidden fastening methods are emerging, face fastening continues to dominate mainstream usage.

The deck board hidden fastening segment is expected to grow at the fastest CAGR of 5.4% over the forecast period, driven by consumer preference for seamless aesthetics and modern design. Luxury residential projects, resorts, and premium villas increasingly demand hidden fastening for sleek, uninterrupted finishes. These systems also protect decking boards from surface damage, extending product lifespan. Although installation costs are higher, the long-term benefits of reduced wear appeal to high-income consumers. Hidden fastening is especially popular in projects emphasizing architectural elegance and high-end finishes.

Country Insights

The Middle East decking market is experiencing strong momentum due to large-scale urban development projects, growth in luxury housing, and expanding hospitality investments. Increasing demand for shaded leisure zones, outdoor dining areas, and poolside decks is shaping market growth. Composite decking, in particular, is gaining adoption because of its resilience to extreme heat and low maintenance. Government-backed real estate initiatives in Saudi Arabia, UAE, and Qatar are driving premium outdoor construction.

Saudi Arabia Decks Market Trends

Saudi Arabia dominated the Middle East market with the largest revenue share of 17.1% in 2024, driven by ambitious megaprojects under Vision 2030. Developments such as NEOM, The Line, and Red Sea Global are integrating sustainable outdoor designs that rely on modern decking materials. Luxury villas and gated communities are increasingly adopting wood-plastic composite (WPC) and PVC decking to enhance durability. The hospitality industry, particularly resorts along the Red Sea, is creating consistent demand for large-scale deck installations. Rising disposable income and a cultural shift toward modern outdoor living are accelerating residential adoption.

UAE Decks Market Trends

The decks market in the UAE is rapidly expanding with demand centered in Dubai and Abu Dhabi. Luxury real estate projects, waterfront villas, and tourism-centric infrastructure heavily influence decking adoption. Expo City Dubai and smart city initiatives are creating demand for sustainable, modular decking systems. Hotels and resorts are continuously investing in innovative outdoor designs, often integrating decks with pergolas, shaded lounges, and poolside areas. The growing expatriate population and preference for Western-style outdoor living fuel further adoption. Composite decking is highly popular due to its resistance to heat and minimal upkeep.

Egypt Decks Market Trends

The Egypt decks market is emerging as a growth market, due to rapid real estate expansion and government-led smart city projects such as the New Administrative Capital. Residential housing demand is increasing, especially in urban areas like Cairo, where modern villas and gated communities are being developed. Outdoor decks are increasingly used in recreational projects, resorts, and hospitality spaces along the Red Sea and Mediterranean coasts. Rising middle-class income is enabling investment in outdoor enhancements, including modular decks. Developers are integrating eco-friendly and UV-resistant decking materials to withstand Egypt’s climate.

Qatar Decks Market Trends

The decks market in Qatar is driven by strong infrastructure investments, particularly following the 2022 FIFA World Cup. The country is channeling resources into luxury hospitality, waterfront developments, and mixed-use complexes. High demand for premium decking solutions is observed in hotels, resorts, and public leisure facilities. Composite and PVC decking is preferred for its durability and resistance to harsh weather. Outdoor spaces in luxury apartments and villas are increasingly adopting modular deck solutions. Qatar’s Vision 2030 plan is enhancing sustainable construction, which supports eco-friendly deck adoption. The market is also supported by government-backed urban renewal projects and private investments in residential real estate.

Kuwait Decks Market Trends

TheKuwait decks market is gaining traction as developers focus on luxury residential properties and high-end commercial spaces. Outdoor living spaces such as terraces, balconies, and swimming pool areas are increasingly incorporating premium decking. Rising disposable incomes and cultural affinity for outdoor gatherings are fueling demand. Developers are turning to composite decking solutions to reduce long-term maintenance costs. Hospitality investments, including resorts and leisure facilities, are also adding to market opportunities. Government investments in real estate development and infrastructure expansion further strengthen the sector.

Key Middle East Decks Company Insights

Some of the key players operating in the Middle East decks industry include Al Zubaidi Modern Pergola Systems, Smithline Reinforced Composites.

-

Al Zubaidi Modern Pergola Systems is a leading player in the Middle East outdoor solutions market, specializing in pergolas, wooden and composite decks, and customized shading systems. The company caters to luxury villas, resorts, and commercial spaces, offering durable designs tailored for the region’s climate.

-

Smithline Reinforced Composites focuses on manufacturing and supplying composite-based construction materials, with a strong presence in decking solutions. Its wood-plastic composite (WPC) decks are well-suited for the Middle East’s extreme heat and offer eco-friendly, low-maintenance alternatives to traditional wood.

Arabian Outdoor Living and Green Paradise are some of the emerging market participants in the Middle East decks industry.

-

Arabian Outdoor Living is a premium provider of outdoor lifestyle products, including decks, pergolas, and landscaping solutions. The company is known for creating modern, stylish, and functional outdoor spaces, serving both residential and hospitality markets across the UAE and Saudi Arabia.

-

Green Paradise specializes in eco-friendly decking and outdoor construction solutions, emphasizing sustainability and innovation. With a focus on composite and recycled-material decks, the company caters to customers seeking environmentally responsible yet high-quality outdoor living products.

Key Middle East Decks Companies:

- Al Zubaidi Modern Pergola Systems

- Technical Supplies & Services Co. LLC

- Arabian Outdoor Living

- Smithline Reinforced Composites

- Danube Group

- Floors & Decks Middle East

- Green Paradise

- Woodfloors Middle East LLC

- Bloomsbury Outdoor Living

- Madirakshi Decking Systems

Recent Developments

-

In November 2024, Danube Home launched a premium flooring solutions collection (to include outdoors and commercial usage), catering to visual appeal + durability across UAE, Oman, and Bahrain.

Middle East Decks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 946.7 million

Revenue forecast in 2033

USD 1415.8 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end use, fastening method, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Egypt; Qatar; Kuwait

Key companies profiled

Al Zubaidi Modern Pergola Systems; Technical Supplies & Services Co. LLC; Arabian Outdoor Living; Smithline Reinforced Composites; Danube Group; Floors & Decks Middle East; Green Paradise; Woodfloors Middle East LLC; Bloomsbury Outdoor Living; Madirakshi Decking Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Decks Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East decks market report based on the material, application, end use, fastening method, and country:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Wood

-

Metal

-

Plastics & Composites

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Railing

-

Walls

-

Floors

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Fastening Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Deck Board Face Fastening

-

Deck Board Hidden Fastening

-

Deck Board Edge Fastening

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East decks market size was estimated at USD 890.6 million in 2024 and is expected to reach USD 946.7 million in 2025.

b. The Middle East decks market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 1415.8 million by 2033.

b. The wood segment held the highest revenue market share of 38.5% in 2024, largely because of its timeless aesthetic appeal and the traditional architectural preferences in the region.

b. Some of the key players operating in the decks market include Al Zubaidi Modern Pergola Systems, Technical Supplies & Services Co. LLC, Arabian Outdoor Living, Smithline Reinforced Composites, Danube Group, Floors & Decks Middle East, Green Paradise, Woodfloors Middle East LLC, Bloomsbury Outdoor Living, and Madirakshi Decking Systems.

b. The key factors driving the Middle East decks market are rapid urbanization, luxury housing growth, hospitality expansion, and increasing preference for sustainable outdoor living solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.