- Home

- »

- Medical Devices

- »

-

Middle East Disposable Endoscopes Market Report, 2033GVR Report cover

![Middle East Disposable Endoscopes Market Size, Share & Trends Report]()

Middle East Disposable Endoscopes Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Laparoscopes, Arthroscopes, Ureteroscopes, Cystoscopes, Bronchoscopes), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-764-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Disposable Endoscopes Market Summary

The Middle East disposable endoscopes market size was estimated at USD 26.17 million in 2024 and is projected to reach USD 85.99 million by 2033, growing at a CAGR of 13.96% from 2025 to 2033. The market is driven by growing awareness of hospital-acquired infections, expansion of advanced healthcare infrastructure in Gulf countries, rising medical tourism, and regulatory emphasis on safety and device traceability.

Key Market Trends & Insights

- Saudi Arabia disposable endoscopes market held the largest share of 35.13% of the middle east market in 2024.

- The disposable endoscopes industry in the UAE is expected to grow at the fastest rate over the forecast period.

- By product, the gastrointestinal endoscopes segment held the largest market share of 34.67% in 2024.

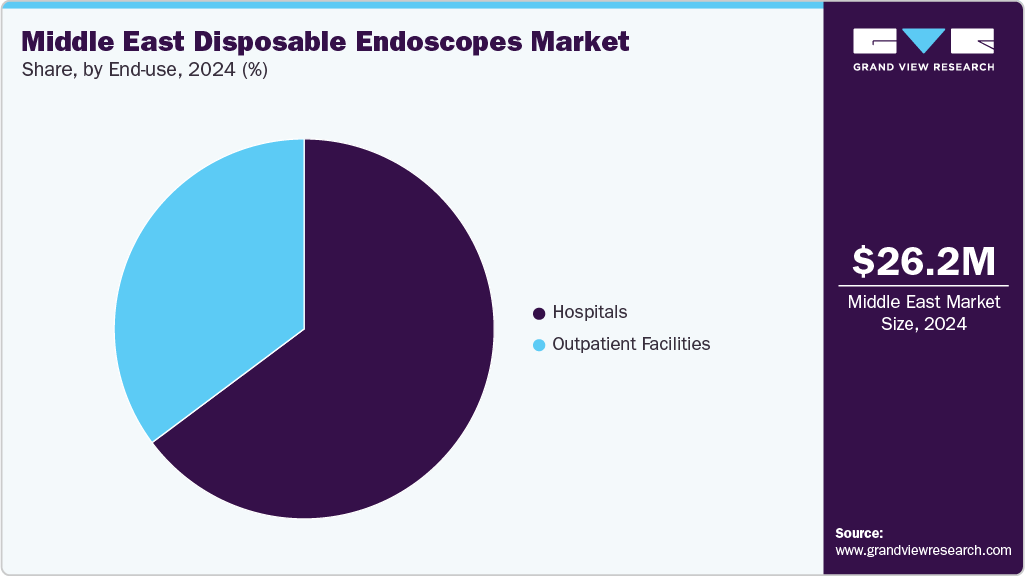

- By end use, hospitals segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.17 Million

- 2033 Projected Market Size: USD 85.99 Million

- CAGR (2025-2033): 13.96%

- Saudi Arabia: Largest market in 2024

- UAE: Fastest growing market

The growing availability of advanced single-use imaging technologies and hospitals' need for cost savings through fewer sterilization requirements and quicker turnaround times encourage adoption. The demand for disposable endoscopes in the Middle East is driven by heightened awareness of hospital-acquired infections and the need to reduce cross-contamination risks. Hospitals are prioritizing single-use devices as a safer alternative to reusable systems, aligning with global infection prevention protocols and regional health authority initiatives. In June 2023, a study published in the World Journal of Critical Care Medicine assessed ICU nurses’ knowledge of infection control practices in the Middle East. Among respondents, 38.9% from high-income countries and 43.5% from upper-middle-income countries were proficient, highlighting variation in awareness based on hospital product and country income.Growth in healthcare infrastructure and medical tourism across Gulf countries is expanding the addressable market for disposable endoscopes. Large-scale investments in tertiary care centers and specialized facilities are accelerating adoption, with Saudi Arabia and the UAE leading procurement of advanced endoscopic solutions. In January 2025, Zhejiang Geyi Medical Instrument Co., Ltd. showcased its advanced endoscopic solutions at Arab Health 2025 in Dubai, featuring high-definition imaging systems and disposable flexible endoscopes. The company highlighted innovations such as the 4K endoscope camera system and single-use digital flexible endoscopes, emphasizing their commitment to enhancing surgical precision and patient safety.

Cost efficiency and workflow optimization are further propelling market uptake. Eliminating sterilization and reprocessing requirements reduces operational overheads, shortens turnaround times, and improves patient throughput, making disposable endoscopes an attractive option for high-volume hospitals and outpatient centers.

Initiatives are undertaken to train healthcare professionals in advanced endoscopy techniques. As part of the Saudi-Japan 2030 initiative, a collaboration between the governments of Saudi Arabia and Japan, medical training for endoscopy techniques is included, supporting the advancement of the market. Moreover, notable programs in Kuwait include the National Program for Early Diagnosis of Colorectal Cancer and the Early Diagnosis Program for Breast Cancer. The successful implementation of such programs is expected to propel market growth during the forecast period.

Analyst Perspective Future Outlook

The Middle East disposable endoscopes market is positioned for substantial growth over the coming years, supported by rising healthcare investments, government-led initiatives, and an increasing focus on infection control standards. National programs such as Saudi Vision 2030 and the UAE Health Strategy 2031 are expected to drive demand for advanced medical technologies, including disposable endoscopes. In addition, the rising prevalence of gastrointestinal and respiratory diseases and the region's commitment to expanding medical tourism are expected to accelerate adoption across tertiary hospitals and specialty care facilities. These trends indicate a clear shift toward solutions that enhance patient safety while aligning with evolving healthcare priorities in the region.

Moreover, technological innovations such as AI-assisted imaging, advanced visualization systems, and wireless-enabled devices are anticipated to significantly enhance disposable endoscopes' clinical utility and cost-effectiveness. The market is expected to benefit from strategic partnerships between global device manufacturers and regional distributors, supported by government initiatives encouraging local production. At the same time, stricter regulatory guidelines around infection prevention and device reprocessing are expected to act as catalysts for faster adoption of single-use solutions. Overall, the analyst outlook remains highly optimistic, with innovation, regulatory momentum, and policy support creating a favorable ecosystem for sustained market expansion.

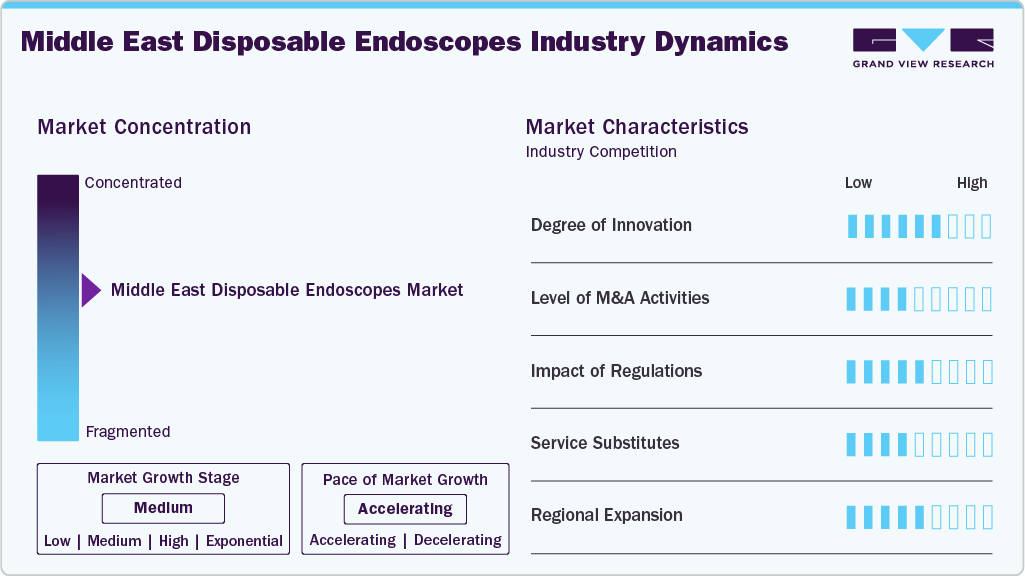

Market Concentration & Characteristics

The Middle East's disposable endoscope market continues to expand with developments in single-use digital imaging, portability, and infection-control features. Hospitals in the Gulf region are adopting advanced models with integrated visualization systems and higher resolution as healthcare environments change. Continuous R&D investment by global players ensures gradual technology transfer into the area.

The disposable endoscope industry continues to see few mergers and acquisitions. Due to fragmented local healthcare markets and limited device manufacturing capacity, the majority of market activity is focused on distribution partnerships and licensing agreements. Businesses rely less on large-scale consolidation and more on regional distributors, keeping competitive dynamics shaped more by organic growth than corporate restructuring.

Regulatory frameworks significantly impact market development. Strict approval procedures, safety validation requirements, and government post-market monitoring impact the launch and adoption of new products. Recent efforts to speed up device registration in Gulf countries have highlighted the importance of quality and traceability in disposable devices, which has also increased compliance requirements. Regulation serves as a driver for higher standards and a barrier to entry.

Advanced imaging systems, reusable endoscopes, and capsule endoscopes are used as alternatives in this region. While the demand for disposables is steadily rising due to increased awareness of infection risks, these alternatives are still widely available in hospitals. Due to their moderate competitive pressure, substitutes impact procurement and cost decisions. Hospitals with limited budgets often continue relying on reusable options, extending the transition period.

Expansion across the Middle East is accelerating, supported by large-scale investments in healthcare infrastructure, medical tourism, and national health reforms. Adoption is expanding rapidly in Saudi Arabia and the UAE, with secondary growth markets such as Egypt, Jordan, and Qatar also increasing procurement of disposable endoscopes. Regional demand is projected to strengthen further as hospitals shift procurement policies toward infection prevention and cost efficiency.

Product Insights

The gastrointestinal endoscopes segment dominated the Middle East disposable endoscopes market in 2024 and accounted for the largest revenue share of 34.67%. This is due to the high burden of gastrointestinal disorders, strong demand for minimally invasive diagnostics, and widespread adoption in both hospital and ambulatory settings. Rising preference for single-use scopes to prevent cross-contamination in gastroenterology units further reinforced the segment’s leading position.

The laparoscopes segment is anticipated to grow at the fastest CAGR during the forecast period. The growth of the laparoscopes segment in the disposable endoscopes market is fueled by various factors, including technological advancements, the increasing prevalence of chronic illnesses, and the rising demand for minimally invasive surgery. Minimally invasive procedures offer numerous advantages, such as reduced postoperative pain, lower doses of pain medication, smaller incisions, shorter hospital stays, and fewer hospital visits. Moreover, the segment is driven by the rise in the incidence of obesity, leading to an increased demand for bariatric surgeries and a preference for minimally invasive procedures.

End Use Insights

The hospitals segment dominated the Middle East disposable endoscopes market in 2024 and accounted for the largest revenue share of 64.79%, owing to the high patient volume, availability of advanced diagnostic and surgical facilities, and strong procurement capacity for single-use medical devices. Large tertiary hospitals and specialized centers are also prioritizing disposable endoscopes to strengthen infection-control protocols. Pricing pressure among hospitals is another critical factor that propels the demand for disposable endoscopes. This is attributed to the low procedure costs associated with disposable endoscopes.

The outpatient facilities segment in the Middle East is anticipated to grow at the fastest CAGR due to the rising shift toward minimally invasive procedures in ambulatory care, increasing preference for faster turnaround times, and cost benefits from avoiding sterilization and reprocessing. Expansion of day-care surgical centers and specialty clinics is further fueling demand for disposable endoscopes in this setting. Moreover, using disposable endoscopes in outpatient facilities enhances infection control measures. These devices create a safe and sterile patient environment by eliminating the risk of cross-contamination and infection transmission. This is particularly crucial in high-volume outpatient settings where infection prevention is paramount.

Country Insights

Saudi Arabia Disposable Endoscopes Market Trends

Saudi Arabia dominated the Middle East disposable endoscopes with market share of 35.13% in 2024. Saudi Arabia’s leadership is supported by large-scale healthcare infrastructure investments under Vision 2030, high adoption of advanced technologies in tertiary hospitals, and growing emphasis on medical tourism and specialized care. In January 2025, Fujifilm Middle East & Africa showcased advanced endoscopic imaging and AI-powered diagnostic solutions at Arab Health 2025 in Dubai, highlighting high-resolution and AI-integrated systems to enhance early detection and precision in gastrointestinal procedures.

UAE Disposable Endoscopes Market Trends

UAE disposable endoscopes market is anticipated to grow at the fastest CAGR over the forecast period. This growth is driven by strong government-backed investments in modern healthcare facilities, a rapidly expanding medical tourism industry, and accelerated adoption of advanced infection-prevention technologies in hospitals and specialty centers. Health Authority-Abu Dhabi (HAAD) has provided recommendations for the treatment of colorectal cancer, which is expected to drive demand for endoscopies. Moreover, the changes in HAAD reforms are anticipated to impact market growth.

Key Middle East Disposable Endoscopes Company Insights

Key participants in the middle east disposable endoscopes market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Middle East Disposable Endoscopes Companies:

- Ambu A/S

- Boston Scientific Corporation

- Karl Storz SE & Co. KG

- Olympus

- Al-Zahrawi Medical Supplies (Zahrawi Group)

- Eightwe Digital Transformations Pvt. Ltd (Medzell)

- Universal Medical Devices

- ProMedEx

- Gulf Med Medicines LLC

- Jana Medical Co.

Middle East Disposable Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.24 million

Revenue forecast in 2033

USD 85.99 million

Growth Rate

CAGR of 13.96% from 2025 to 2033

Actual data

2021 - 2023

Forecast data

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, End Use, and Country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE, Kuwait; Qatar; Oman

Key companies profiled

Ambu A/S, Boston Scientific Corporation, Karl Storz SE & Co. KG,Olympus, Al-Zahrawi Medical Supplies (Zahrawi Group), Eightwe Digital Transformations Pvt. Ltd (Medzell), Universal Medical Devices, ProMedEx, Gulf Med Medicines LLC, Jana Medical Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Disposable Endoscopes Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country level and provides an analysis on industry trends in each of the sub segments from 2021 to 2033. For the purpose of this study, Grand View Research, Inc. has segmented the Middle East disposable endoscopes market report based on product, end use, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Gastrointestinal Endoscopes

-

Colonoscope

-

Gastroscope (Upper GI Endoscope)

-

Duodenoscope

-

Sigmoidoscope

-

-

Bronchoscopes

-

Ureteroscopes

-

Laparoscopes

-

Laryngoscopes

-

Rhinoscopes

-

Cystoscopes

-

Hysteroscopes

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.