- Home

- »

- Medical Devices

- »

-

Middle East Disposable Trocars Market Size Report, 2033GVR Report cover

![Middle East Disposable Trocars Market Size, Share & Trends Report]()

Middle East Disposable Trocars Market (2025 - 2033) Size, Share & Trends Analysis Report By Tip (Bladeless Trocars, Optical Trocars, Blunt Trocars, Bladed Trocars), By Application (General Surgery, Urological Surgery, Pediatric Surgery), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-722-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Disposable Trocars Market Trends

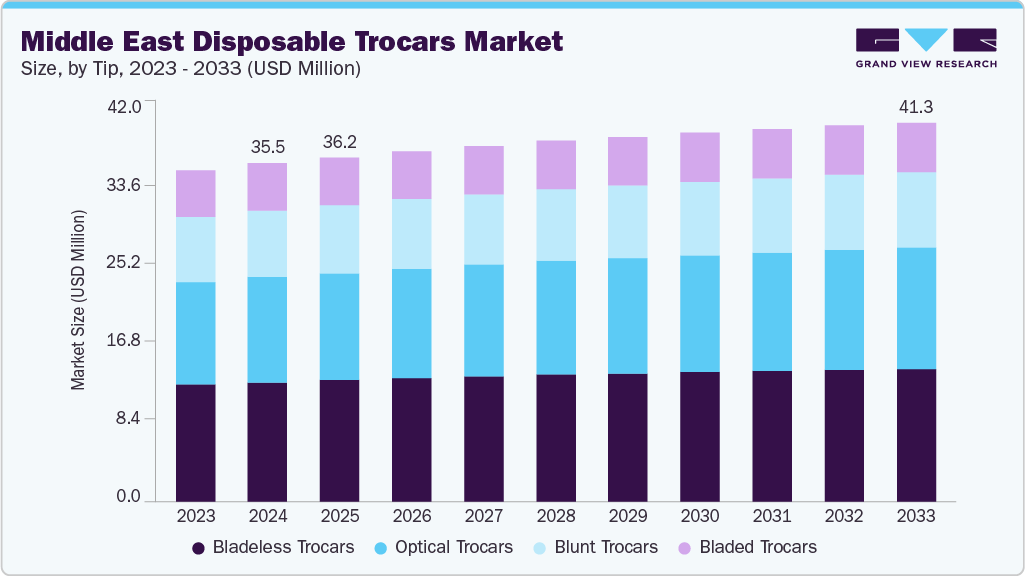

The Middle East Disposable trocars market size was estimated at USD 35.51 million in 2024 and is projected to reach USD 41.31 million by 2033, growing at a CAGR of 1.65% from 2025 to 2033. The market growth in the Middle East is driven by the increasing adoption of minimally invasive surgical procedures, including laparoscopic, bariatric, gynecological, and urological surgeries, which require reliable and sterile access devices. The expansion of private healthcare infrastructure and the rise in outpatient and day-surgery centers across the region, particularly in the Gulf countries, have further fueled the demand for single-use trocars, where infection control and operational efficiency are critical.

Moreover, the gradual integration of robotic-assisted surgical systems in leading hospitals, has created a growing need for advanced bladeless and optical trocars compatible with robotic platforms. The increased awareness of infection prevention following the COVID-19 pandemic, combined with evolving regulatory frameworks focused on sterility, is increasing the preference for disposable solutions over reusable alternatives. Furthermore, technological advancements, including universal sealing systems and ergonomically designed low-profile cannulas, continue to enhance surgeon comfort and drive adoption across the Middle East region.

Robotic procedures in the region increasingly depend on accurate trocar placement and benefit from advanced optical and specialized disposable trocars designed to integrate seamlessly with robotic platforms. As surgical practices in Middle East continue to embrace enhanced visualization and navigation technologies, there is a rising need for high-performance trocars that provide superior control, stability, and compatibility. This shift is accelerating the preference for disposable trocar solutions in robotic-assisted procedures, driven by the dual priorities of sterility and precision.

Governments and private healthcare providers are actively investing in advanced operating rooms and laparoscopic technology to enhance surgical outcomes and shorten hospital stays. A strong focus on infection control and sterility, particularly in high-end private hospitals and medical tourism destinations such as the UAE, is driving the preference for single-use trocars over reusable ones. While high costs and limited availability in rural areas remain challenges, the rise of day surgery centers, the growing adoption of robotic-assisted procedures, and collaborations with global medical technology companies are fueling increased trocar usage across the region.

The rising prevalence of cancer in the Middle East is playing a pivotal role in accelerating the demand for disposable trocars, particularly as healthcare systems across the region shift toward minimally invasive surgical (MIS) approaches for cancer diagnosis, staging, and treatment. According to the WHO and GLOBOCAN, the Middle East region has seen a steady rise in cancer cases, with countries like Egypt and Saudi Arabia, reporting significant increases in colorectal, gynecological (especially ovarian and uterine), gastrointestinal, and prostate cancers. These types of cancers often require laparoscopic interventions for biopsies, tumor resections, and staging surgeries-procedures where trocars are essential for accessing the abdominal cavity. The increasing cancer burden in the Middle East is driving more frequent use of laparoscopic surgeries, especially in oncology. As healthcare providers aim to offer safer, faster, and more effective treatments, disposable trocars have become critical components-addressing both clinical performance and infection control needs.

The healthcare landscape in the Middle East is also undergoing a major transformation, with a clear shift from inpatient to outpatient care models. This trend is being driven by both economic and clinical imperatives, and it has a direct impact on the growth of technologies and medical devices that support minimally invasive and day-care surgeries, such as disposable trocars. Outpatient care significantly reduces the cost burden on both governments and private insurers by lowering hospital admission rates and freeing up inpatient resources. Countries like Saudi Arabia and the UAE are increasingly promoting ambulatory surgical centers (ASCs) as part of their broader healthcare reform strategies (e.g., Saudi Vision 2030).

Market Concentration & Characteristics

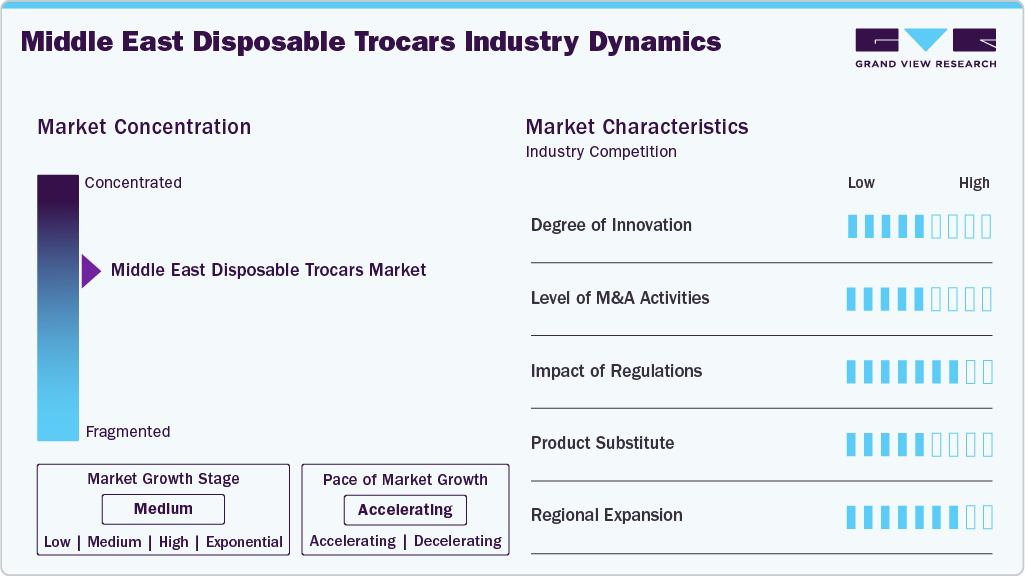

Innovation in the Middle East disposable trocars industry is moderate but increasing steadily, propelled by rising adoption of minimally invasive surgery (MIS) and expanding surgical infrastructure. While frontier innovations like bladeless entry systems or optical trocars are more prevalent in Western markets, premium and medical tourism hospitals, especially in the UAE and Saudi Arabia, are gradually integrating such technologies alongside ergonomic improvements and infection-resistant designs.

Regulations are increasingly shaping the disposable trocars market in the Middle East, as governments and health authorities adopt more structured and internationally aligned frameworks for medical device oversight. While regulatory maturity varies across the region, many countries, particularly in the Gulf Cooperation Council (GCC), are aligning their approval processes with global benchmarks such as the FDA and CE Mark standards.

The level of mergers and acquisitions (M&A) activity in the market has been relatively limited but gradually increasing, driven by broader trends in laparoscopic and minimally invasive surgery (MIS) across the region. While direct acquisitions focused solely on trocar technologies are rare, strategic investments and partnerships are becoming more common as regional and international medtech companies seek to strengthen their presence in the expanding MIS ecosystem.

Key product substitutes include reusable trocars, single-incision laparoscopic surgery (SILS) ports, and advanced robotic-assisted access systems that reduce dependence on traditional trocar-based entry methods. Despite these alternatives, disposable trocars remain the preferred choice across much of the Middle East region due to their sterility, convenience, and compliance with infection control protocols. They are especially favored in ambulatory surgical centers (ASCs), outpatient clinics, and medical tourism hubs where quick turnaround times and patient safety are paramount. The growing focus on infection prevention and streamlined workflows continues to reinforce the demand for single-use trocars throughout the region.

The disposable trocars market in the Middle East exhibits a notable concentration among key end users, primarily hospitals, ambulatory surgical centers (ASCs), and specialized surgical clinics. Large tertiary hospitals and academic medical centers in urban and regional hubs, such as those in the UAE, Saudi Arabia, and Egypt, drive a significant portion of demand due to their high surgical volumes and increasing adoption of advanced laparoscopic and robotic-assisted procedures.

Tip Insights

Based on tip, the bladeless trocars segment held the largest revenue share in 2024. This growth can be attributed to their superior safety profile and ease of use in minimally invasive procedures. Bladeless trocars minimize the risk of vascular and organ injury by separating tissue instead of cutting it during insertion, making them a favored option for laparoscopic and robotic-assisted surgeries. Their design supports fewer post-operative complications and quicker patient recovery. These advantages have led to their widespread use in high-volume procedures such as cholecystectomies, hernia repairs, and bariatric surgeries, particularly in hospitals and ambulatory surgical centers (ASCs). Moreover, their compatibility with advanced sealing systems and robotic platforms continues to boost their clinical value and expand their adoption across various surgical specialties.

The optical trocars segment is expected to witness the fastest growth over the forecast period, owing to the increasing need for precision and safety in minimally invasive surgeries. These trocars allow direct visualization of tissue layers during insertion via an endoscope, significantly reducing the risk of inadvertent injury to organs or vessels. Their use is especially critical in high-risk procedures like laparoscopic bariatric surgery or robotic-assisted hysterectomies, where safe trocar placement is essential. As robotic and image-guided surgeries continue to expand, optical trocars are becoming the preferred choice for surgeons seeking enhanced visibility and patient safety, fueling rapid adoption and segment growth.

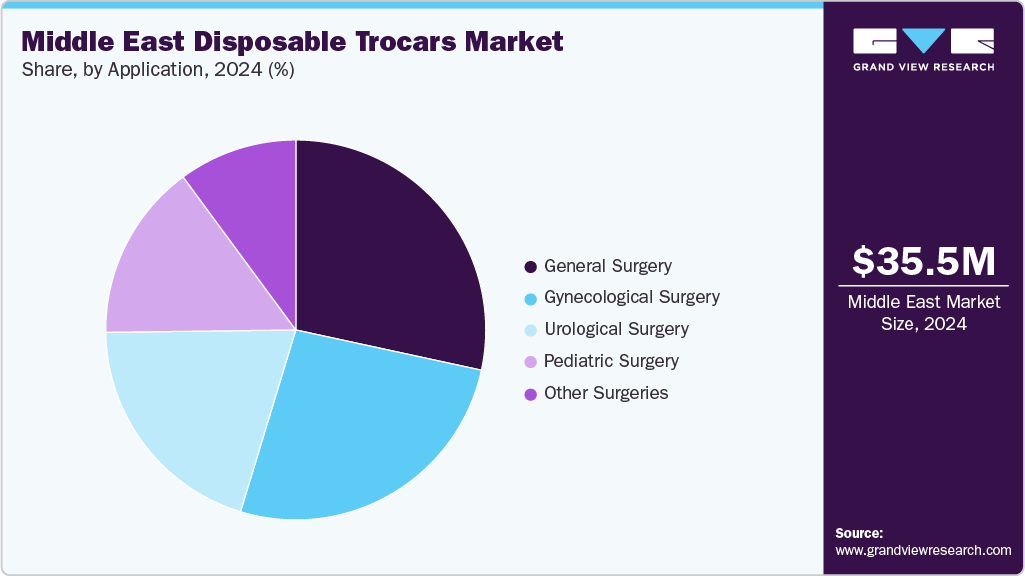

Application Insights

On the basis of application, the general surgery segment held the largest revenue share in 2024. This growth can be attributed to the high volume of routine laparoscopic procedures such as cholecystectomies, appendectomies, and hernia repairs. These procedures are some of the most commonly performed in hospitals and ambulatory surgical centers, driving steady demand for reliable, sterile access devices such as disposable trocars. General surgeries often involve multiple trocar insertions per case, leading to higher unit usage. Furthermore, the emphasis on minimizing infection risk and improving surgical turnaround times in high-throughput settings has strengthened the preference for single-use trocars in general surgery, firmly establishing this segment’s market leadership.

The gynecological surgery segment is expected to witness a significant CAGR over the forecast period. This can be attributed to the increasing prevalence of conditions such as uterine fibroids, endometriosis, ovarian cysts, and infertility, which often require minimally invasive surgical intervention. Laparoscopic hysterectomies, oophorectomies, and tubal ligations are commonly performed using disposable trocars to ensure sterility and reduce the risk of post-operative infections. The rise in outpatient gynecologic procedures in ambulatory surgical centers (ASCs), coupled with growing patient preference for faster recovery and reduced scarring, is accelerating the adoption of disposable, bladeless, and optical trocars.

Key Middle East Disposable Trocars Company Insights

Some of the key companies include Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Xpan Inc., among others. They provide a broad range of breast conserving surgery solutions through their strong distribution and supply channels across the world. Leading companies are involved in new product launches, strategic collaborations, mergers & acquisitions, and regional expansions to gain the maximum revenue share in the industry. Mergers & acquisitions help companies to expand their businesses and market presence.

Key Middle East Disposable Trocars Companies:

- Medtronic

- Ethicon (Johnson & Johnson)

- B. Braun SE

- Applied Medical Resources Corporation

- CooperSurgical, Inc.

- Teleflex Incorporated

- CONMED Corporation

- Xpan Inc.

- Stryker

Recent Developments

-

In March 2025, Nexus CMF introduced a new addition to its 2023 product lineup: the 1.9mm Disposable Trocar, designed with a cleaner and sharper needle point edge for enhanced precision and performance.

-

In December 2023, Xpan Inc., a medical device company specializing in minimally invasive surgical technologies, received 510(k) clearance from the U.S. Food and Drug Administration for its Xpan Universal Trocar System. It has successfully completed its initial clinical procedures in the U.S. This milestone marks a significant step forward in advancing access solutions for laparoscopic and robotic-assisted surgeries.

Middle East Disposable Trocars Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.25 million

Revenue forecast in 2033

USD 41.31 million

Growth rate

CAGR of 1.65% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and tip

Country scope

Saudi Arabia; UAE; Kuwait; Rest of Middle East

Key companies profiled

Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Xpan Inc.; Stryker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Disposable Trocars Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East disposable trocars market report based on application, tip, and country:

-

Tip Outlook (Revenue, USD Million, 2021 - 2033)

-

Bladeless Trocars

-

Optical Trocars

-

Blunt Trocars

-

Bladed Trocars

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Gynecological Surgery

-

Urological Surgery

-

Pediatric Surgery

-

Other Surgeries

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East

-

-

Frequently Asked Questions About This Report

b. The Middle East disposable trocars market size was estimated at USD 35.51 million in 2024 and is expected to reach USD 36.25 million in 2025.

b. The Middle East disposable trocars market is expected to grow at a compound annual growth rate of 1.65% from 2025 to 2033 to reach USD 41.31 million by 2033.

b. Bladeless trocars segment held the largest revenue share of 35.2% in 2024. This growth can be attributed to their superior safety profile and ease of use in minimally invasive procedures. Bladeless trocars minimize the risk of vascular and organ injury by separating tissue instead of cutting it during insertion, making them a favored option for laparoscopic and robotic-assisted surgeries.

b. Some key players operating in the Middle East disposable trocars market include Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Xpan Inc.; Stryker.

b. Key factors driving the market growth include the increasing adoption of minimally invasive surgical procedures, including laparoscopic, bariatric, gynecological, and urological surgeries, which require reliable and sterile access devices. The expansion of private healthcare infrastructure and the rise in outpatient and day-surgery centers across the region, particularly in the Gulf countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.