Middle East Distribution Meter Market Trends

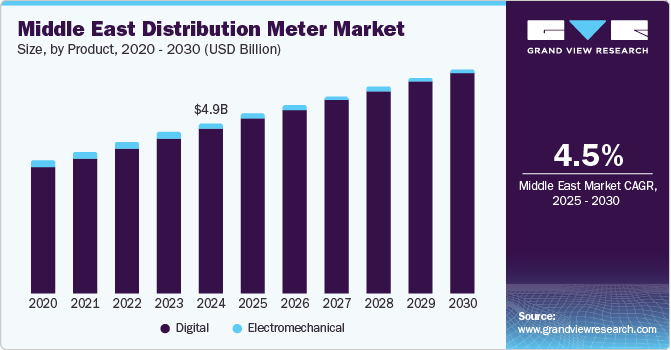

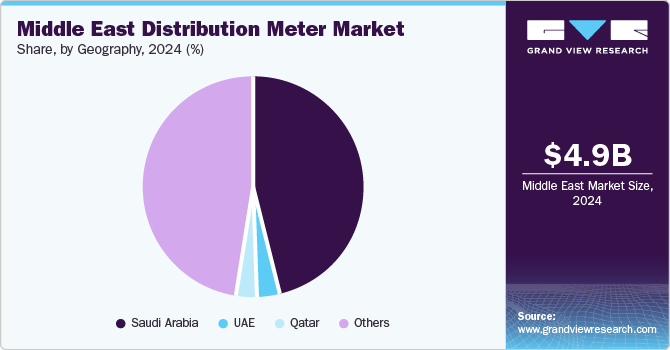

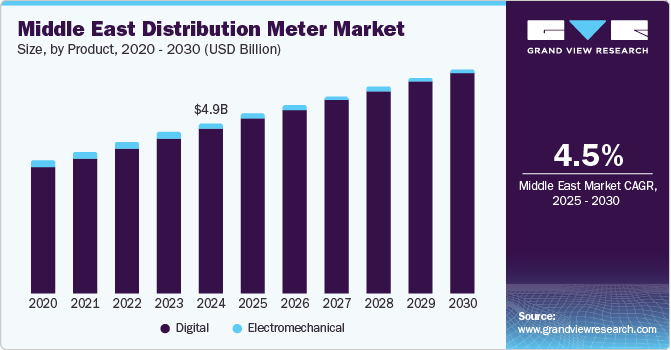

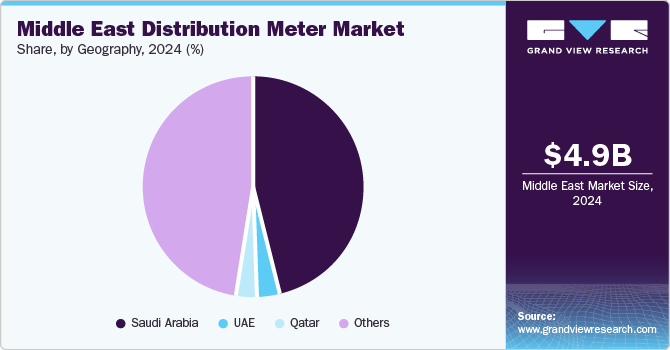

The Middle East distribution meter market size was valued at USD 4.96 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. One of the key growth drivers for this market is higher energy demand in the region. Increasing adoption of technology-driven devices and systems by businesses, unceasing growth in per capita electricity consumption, and continuously growing demand for uninterrupted power supply in economies such as Saudi Arabia, UAE, and others are fueling the growth of this market.

Owing to increased electricity demand and the imminent introduction of regulatory frameworks mandating smart meters’ installation. The energy-rich Gulf Cooperation Council (GCC) countries invest in infrastructure development to boost the oil & gas industries, thereby increasing their industrial base.

Government initiatives and electricity utility companies are expected to increase the installation of smart meters, thereby increasing market demand over the forecast period. The key objective of installation includes reducing transmission and distribution losses. Smart meters provide two-way communication between suppliers and consumers, clarifying supply and demand requirements in a particular region.

The surge in activities such as upgrading meters, generating capabilities, and transmission systems is expected to favorably impact the Middle East distribution meter market growth over the next few years. Furthermore, rising demand for advanced metering and smart grid infrastructure is anticipated to bolster the demand over the forecast period.

Product Insights

Based on products, the digital segment dominated the global industry with the largest revenue share of 96.5% in 2024. The digital segment incorporates significant opportunities over the forecast period owing to the potential benefits. It is expected to unite local and international technologies for distribution, automation, and smart grids. One of the key drivers behind the growth of the digital segment is the ever-increasing replacement of electromechanical with digital counterparts, especially smart meters, which incorporate high efficiency, reliability, and easier integration of renewable energy sources, such as solar energy.

Electromechanical meters, also referred to as Ferraris or analog meters, operate with the help of metallic discs. The rotation of the disc in a clockwise direction is used as a medium for the measurement of power consumption. Electromechanical meters are a traditional device that provides data on cumulative energy usage.

Country Insights

Saudi Arabia distribution meter market held significant revenue share of the regional industry in 2024. This is attributed to the increasing adoption of digital meters among commercial and residential users, the growing demand for energy-efficient systems and devices, efforts by government and organizations to enhance the share of renewable energy in overall consumption, and the emergence of technologies such as smart grids.

The UAE distribution meter market is expected to experience the fastest CAGR from 2025 to 2030. This is mainly driven by rising energy consumption, growing use of advanced technologies, the presence of multiple data centers in the country, and higher demand for uninterrupted power supply by numerous industries such as tourism, media and entertainment, aviation, healthcare, hospitality, and others.

Key Middle East Distribution Meter Company Insights

Some of the key companies in the Middle East distribution meter market include ABB, Universal Project Corporation, SMC, ZIV, Siemens, and others. To address the unprecedented growth in demand and rising competition, companies are adopting strategies such as innovation, collaborations, and expansion of networks.

-

Saudi Meter Company, one of the prominent organizations in the regional market, offers smart systems integration, smart products such as water and electric meters, and services including installations, maintenance, and testing commissioning. The company's smart electricity meters are equipped with sensors and communication capabilities.

Key Middle East Distribution Meter Companies:

- ABB

- Advanced Electronics Company

- ZIV

- Universal Project Corporation

- SMC

- PETRA SYSTEMS

- Landis+Gyr

- Siemens

- KFB Group

- Itron Inc.

- Echelon Industries Corporation

- Iskraemeco Group

- DZG Metering GmbH

Recent Developments

-

In July 2024, the Dubai Electricity and Water Authority (DEWA) announced that it had completed 100% of the installation of smart water meters in Dubai. The company also emphasized the development of smart and integrated systems using disruptive technologies while ensuring more savings for DEWA and its customers.

Middle East Distribution Meter Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 5.23 billion

|

|

Revenue forecast in 2030

|

USD 6.51 billion

|

|

Growth Rate

|

CAGR of 4.5% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, country

|

|

Country scope

|

Saudi Arabia; Qatar; UAE

|

|

Key companies profiled

|

ABB; Advanced Electronics Company; ZIV; Universal Project Corporation; SMC; PETRA SYSTEMS; Landis+Gyr; Siemens; KFB Group; Itron Inc.; Echelon Industries Corporation; Iskraemeco Group; DZG Metering GmbH

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Middle East Distribution Meter Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East distribution meter market report based on product, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Electromechanical

-

Digital

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Saudi Arabia

-

Qatar

-

UAE

-

Others