- Home

- »

- HVAC & Construction

- »

-

Middle East Distribution Transformer Market Report, 2030GVR Report cover

![Middle East Distribution Transformer Market Size, Share & Trends Report]()

Middle East Distribution Transformer Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Small Transformer, Medium Transformer, Large Transformer, Unit Substations), By Technology (Liquid Filled, Dry Type) And Segment Forecasts

- Report ID: 978-1-68038-639-4

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Middle East distribution transformer market size was valued at USD 2.99 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. The growth may be attributed to the growing adoption of smart grid solutions. Further, increasing the need for sustainable energy worldwide is also expected to fuel product demand over the forecast period. Infrastructure development in several countries across the Middle East may favorably impact growth prospects.

The growing population has significantly spurred electricity demand, thereby driving the industry. Smart grid installations need two-way, real-time communication and components incorporating similar capabilities to monitor system parameters remotely. It may further drive demand for innovative products with interactive information transfer capability. However, replacing highly durable traditional counterparts may challenge the industry in the coming years.

The need to monitor power consumption may spur the usage of alternative energy. Integration of backup conventional power sources and alternative sources requires the usage of smart grids and is expected to urge industry growth over the forecast period. High installation and transportation costs and the need for trained professionals may challenge product demand.

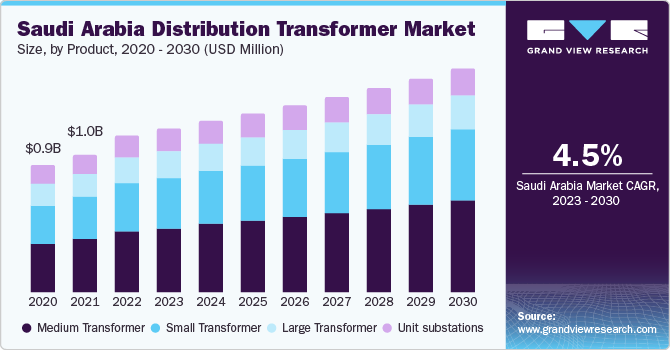

Product Insights

Medium distribution Transformers, typically within a range of 316 kVA to 2,499 kVA, accounted for the largest revenue share of 44.2% in 2022 and is expected to grow at the fastest CAGR of 3.8% during the forecast period. It is attributed to the growing population in cities including Riyadh, Dubai, and Abu Dhabi. The high population migration rate in the cities above is also expected to spur regional market demand. Advancements in sustainable development have resulted in the adoption of advanced products with copper-silver alloy windings to prevent them from self-annealing.

The small transformers segment is expected to grow at a significant CAGR of 3.7% during the forecast period. Small distribution transformers have a power rating of 0- 315kVA and are primarily used in an area with low population density. Increasing substitution of traditional overhead products with smart grid compatible pole mounted small devices is expected to surge demand over the next seven years. The product suits several diversified powers and light industrial or commercial applications.

Rapid industrialization is expected to be a key factor that drives the larger transformer demand across the regional market. However, lack of transportation facilities in remote areas may pose a challenge owing to the bulky design of these products. Unit substations may also grow steadily due to low installation and maintenance costs.

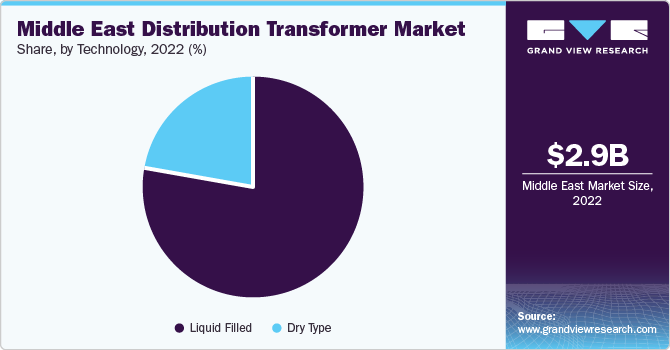

Technology Insights

The industry is expected to grow due to technologically advanced electrical equipment development. Developing various core materials and reducing core flux density is expected to reduce noise.

The liquid filled segment held the largest revenue share of 77.8% in 2022 and is anticipated to witness the fastest CAGR of 3.8% over the forecast period. It is attributed to advanced functional capabilities and efficient design. Pad mounted has numerous utility applications across the industrial, commercial, and residential sector and is expected to drive demand over the foreseeable future. Dry type technology is used particularly in rough environments with high fire safety requirements, such as mining sites, marine, and oil & gas industries.

The dry type segment is expected to grow at a significant CAGR of 3.5% during the forecast period. The increasing focus on energy efficiency and sustainability has propelled the region's demand for dry-type distribution transformers. Dry-type transformers offer advantages such as lower energy losses, reduced environmental impact, and improved fire safety compared to their oil-filled counterparts. It has prompted governments and utilities in the Middle East to prioritize the adoption of dry-type transformers to achieve their energy efficiency and sustainability goals.

Regional Insights

Electricity sector privatization in several Middle East economies, including Saudi Arabia, UAE, and Qatar, is expected to be a key industry growth factor over the next few years. Saudi Arabia accounted for the largest market share of 38.7% in 2022 and is expected to grow at the highest CAGR of 4.5% over the forecast period. Rapid growth in the industrial sector, primarily petrochemicals and oil & gas, is anticipated to propel demand in Saudi Arabia. The industry is also poised for growth owing to increasing penetration in Qatar's industrial and residential sectors.

The UAE distribution transformer market has grown considerably due to early technology adoption. Additionally, the high coastal region presence in Saudi Arabia, Qatar, and UAE may ease raw materials procurement, which is expected to propel demand over the next few years.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in July 2023, Saudi Arabia's Electrical Industries Co., through its subsidiary Saudi Power Transformers Co., secured a contract worth USD 40.78 million. The contract involves the transformers supply to Saudi Aramco, a petroleum refinery company. This achievement is expected to impact the company's fiscal position favorably. The following are some of the major participants in the Middle East distribution transformer market:

-

Abaft Middle East Transformer Ind. LLC

-

ABB

-

alfanar Group

-

Bawan Co.

-

EUROGULF TRANSFORMERS

-

General Electric

-

Intact Controls Transformer Industries LLC

-

Matelec Group

-

Al-Ojaimi Group

-

SGB SMIT

-

Siemens

-

Tesar Gulf Power Transformers and Distribution Equipment LLC.

-

The Saudi Transformer Co. Ltd.

-

United Transformers Electric Company

-

WESCOSA

Recent Developments

-

In December 2021, the consortium led by Hitachi Energy secured a contract from the Saudi Electricity Company and the Egyptian Electricity Transmission Company. The contract involves implementing an HVDC interconnection project in the Middle East and North Africa. As a result of this project, Saudi Arabia and the Arab Republic of Egypt can now exchange a maximum of 3,000 MW of electricity between them.

-

In November 2022, BMC ELECTROPLAST PVT LTD., an MSME unit based in India, provided current and voltage transformers to the FIFA World Cup 2022 held in Qatar. These transformers were installed in switchgear boards for internal power distribution control and protection. This project significantly expanded their reach into Middle East countries.

-

In June 2023, Larsen & Toubro, an Indian multinational conglomerate, secured two contracts in the Middle East. The projects entail enhancing electrical networks in sizable industrial facilities by installing gas-insulated substations and related high-voltage cable systems.

Middle East Distribution Transformer Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.10 billion

Revenue forecast in 2030

USD 4.00 billion

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, region

Country scope

Saudi Arabia; UAE; Qatar; Egypt; Rest of Middle East

Key companies profiled

Abaft Middle East Transformer Ind. LLC; ABB; alfanar Group; Bawan Co.; EUROGULF TRANSFORMERS; General Electric; Intact Controls Transformer Industries LLC; Matelec Group; Al-Ojaimi Group; SGB SMIT; Siemens; Tesar Gulf Power Transformers and Distribution Equipment LLC.; The Saudi Transformer Co. Ltd.; United Transformers Electric Company; WESCOSA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Distribution Transformer Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Middle East distribution transformer market on the basis of product, technology, and region:

-

Product Outlook (Revenue in USD Million, 2017 - 2030)

-

Small Transformer

-

Medium Transformer

-

Large Transformer

-

Unit substations

-

-

Technology Outlook (Revenue in USD Million, 2017 - 2030)

-

Liquid Filled

-

Pad Mounted

-

Pole Mounted

-

-

Dry type

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Egypt

-

Rest of Middle East

-

-

Frequently Asked Questions About This Report

b. The Middle East distribution transformer market size was estimated at USD 2.99 billion in 2022 and is expected to reach USD 3.10 billion in 2023.

b. The Middle East distribution transformer market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 4.0 billion by 2030.

b. Medium-range distribution transformers dominated the middle east distribution transformer market with a share of over 44% in 2022. This is attributable to rapid industrialization coupled with high rate of population migration in cities including Riyadh, Dubai, and Abu Dhabi.

b. Some key players operating in the middle east distribution transformer market include Abaft Middle East Transformer Ind. LLC, ABB, Alfanar Electrical Systems, Bawan, Eurogulf Transformer, General Electric Company, Intact Transformer, Matelec, Mohammed Al-Ojaimi Transformer Factory, Saudi Federal Transformer LLC, and SGB-SMIT.

b. Key factors that are driving the market growth include rising adoption of smart grid solutions and infrastructure development in several countries across the Middle East.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.