- Home

- »

- Biotechnology

- »

-

Middle East Exosomes Market Size, Industry Report, 2033GVR Report cover

![Middle East Exosomes Market Size, Share & Trends Report]()

Middle East Exosomes Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Kits & Reagents, Instruments, Services), By Workflow (Isolation Methods, Downstream Analysis), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-824-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Exosomes Market Summary

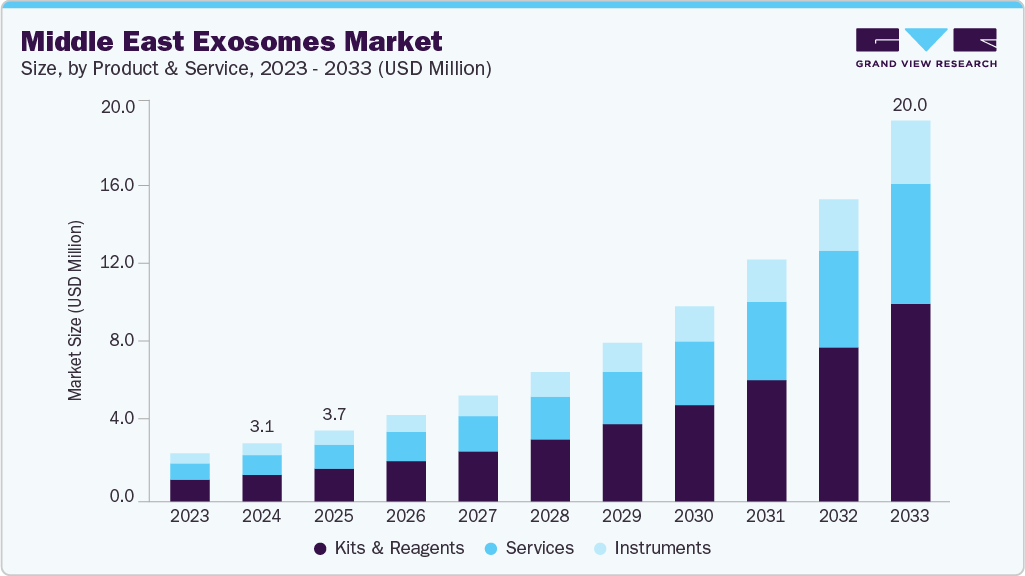

The Middle East exosomes market size was estimated at USD 3.07 million in 2024 and is projected to reach USD 20.03 million by 2033, growing at a CAGR of 23.38% from 2025 to 2033. Exosomes, or Extracellular Vesicles (EVs), are single-membrane vesicles released by diverse cell types, and they are detected in multiple bodily fluids, including urine, plasma, saliva, breast milk, semen, cerebrospinal fluid (CSF), bronchial fluid, and amniotic fluid. These vesicles serve as carriers of proteins and genetic material, playing a critical role in intercellular communication and emerging as valuable tools in diagnostics and therapeutics.

Growing Investments in Biomedical & Translational Research

Increasing investment in biomedical and translational research is emerging as a major catalyst for the growth of the exosomes market, as governments, private investors, and biotech companies allocate substantial funding toward next-generation diagnostics and therapeutics. This rise in capital flow is enabling institutions to accelerate research programs focused on understanding exosome biology, identifying novel biomarkers, and validating clinical applications across oncology, neurology, cardiology, and infectious diseases. As exosomes gain prominence as minimally invasive tools for disease detection and monitoring, research funding is increasingly directed toward the development of high-sensitivity assays, improved isolation technologies, and robust analytical platforms required to advance their clinical utility.

At the same time, the increase in translational research funding is narrowing the gap between laboratory discovery and real-world clinical adoption. Research organizations are now prioritizing projects that can demonstrate clear pathways to commercial viability, supporting the progression of exosome-based technologies from early-stage exploration to preclinical studies, clinical trials, and ultimately market-ready solutions. This shift is further supported by investor interest in emerging biotech startups focusing on exosome therapeutics, drug delivery systems, and regenerative medicine applications, which has led to strategic partnerships, increased venture capital inflows, and accelerated innovation cycles. As regulatory agencies begin to recognize the potential of exosome-related products, translational efforts are also expanding to establish standardization, quality control protocols, and regulatory frameworks that can enable broader market acceptance.

Overall, rising investment in biomedical and translational research is significantly strengthening the innovation pipeline for exosome technologies, expanding the scientific evidence base, and creating favorable conditions for commercialization. This infusion of capital is fostering a competitive landscape where both established industry players and emerging startups are prioritizing R&D excellence to capture growing demand in clinical diagnostics, therapeutic development, and personalized medicine. As a result, sustained research investment is expected to remain a critical driver of market expansion, accelerating the development of scalable, clinically validated exosome products and supporting long-term industry growth.

Advancements in Exosome Isolation and Analysis

Advancements in exosome isolation, purification, and characterization methods are significantly enhancing the accuracy, efficiency, and scalability of exosome-based research and clinical applications. Newer techniques, such as microfluidics, immunoaffinity capture, and automated high-throughput platforms, are improving yield and purity while reducing processing time compared to traditional ultracentrifugation. These innovations are enabling researchers to address challenges related to exosome heterogeneity and contamination more effectively, thereby strengthening the reliability of downstream analysis for diagnostics and therapeutic development.

At the same time, progress in characterization tools, including nanoparticle tracking analysis (NTA), advanced flow cytometry, electron microscopy, and multi-omics profiling, is providing deeper insights into exosome composition and function. The combination of improved isolation and advanced analytical technologies is supporting the development of clinically compliant workflows, fostering greater standardization, and accelerating the commercialization of exosome-based solutions across healthcare, biotechnology, and pharmaceutical sectors.

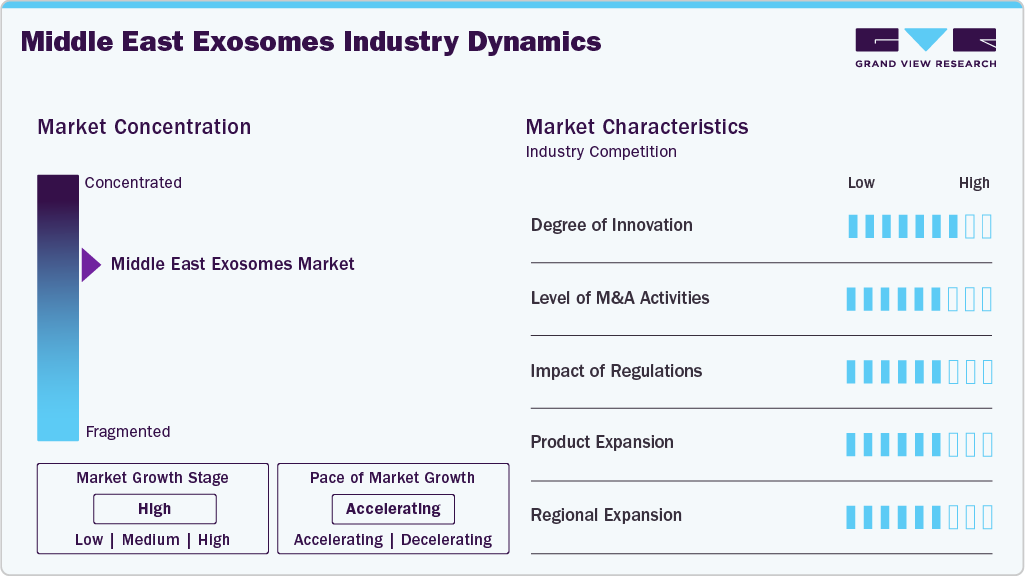

Market Concentration & Characteristics

The Middle East exosomes industry exhibits significant innovation, propelled by promising healthcare investments, expanding research capabilities, and notable adoption of advanced diagnostic and therapeutic technologies. Increasing collaboration between regional institutes and global biotech companies is further accelerating commercialization and supporting the rapid development of the market across key GCC countries.

Mergers and acquisitions are notable, driven by increasing investment in advanced healthcare technologies, rising interest from global biotech companies seeking regional expansion, and the strategic push by GCC nations to strengthen their precision medicine and biomedical research capabilities.

Regulatory frameworks are increasingly influencing the trajectory of the Middle East exosomes industry by tightening quality and safety requirements, standardizing clinical practices, and establishing clearer approval pathways that enable the responsible development and commercialization of emerging exosome-based technologies.

Key players are adopting the strategy of product and service expansion by broadening their exosome isolation kits, analytical platforms, and diagnostic solutions, while also introducing specialized services such as custom exosome profiling and therapeutic development support. This approach enables companies to address growing regional demand, strengthen market presence, and offer more comprehensive solutions across research, clinical, and biopharmaceutical applications.

The regional market is witnessing moderate regional expansion, supported by the increasing adoption of advanced biomedical technologies, growing research collaborations across GCC countries, and rising investment in precision medicine and cellular therapy capabilities.

Product & Service Insights

The kits and reagents segment accounted for the largest share of 45.67% in 2024, reflecting their essential role in enabling efficient exosome isolation, purification, and downstream analysis. These products are widely adopted for their ability to deliver standardized, high-quality, and reproducible results, which are critical for research, clinical diagnostics, and therapeutic development. Supported by rising investment in translational research and expanding use across oncology, neurology, and regenerative medicine, this segment is expected to maintain its strong growth momentum over the forecast period.

The services segment is anticipated to register a rapid growth rate during the forecast years, driven by rising demand for specialized exosome profiling, custom isolation, and advanced analytical services that support both research and clinical development. As organizations increasingly outsource complex workflows to achieve higher accuracy, scalability, and cost efficiency, service providers are expanding their capabilities in characterization, sequencing, and therapeutic development support. This growing reliance on outsourced expertise is expected to position the services segment as one of the fastest-growing areas within the exosomes market.

Workflow Insights

The downstream analysis segment held the largest share in 2024. It includes detection, quantification, labeling, and modification or engineering of exosomes. These procedures may involve advanced analytical techniques to assess exosome composition, validate functional activity, and support their use in diagnostics and therapeutic development. As demand for precise molecular insights and high-quality data continues to grow across research and clinical settings, downstream analysis remains a foundational component of exosome workflows, positioning the segment for sustained relevance and influence within the market.

The isolation methods segment is projected to grow at a lucrative CAGR over the forecast period. The choice of an optimal exosome isolation method depends on several factors, including the type and volume of the starting material (e.g., urine, cell culture media, plasma), the intended therapeutic application, route of administration, availability of specialized equipment, and the required purity and yield of the final product. As demand for scalable, high-efficiency isolation solutions increases, this segment is positioned for strong and sustained expansion.

Application Insights

The cancer segment held the largest market share of 33.01% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the broad range of exosome applications in oncology, including early detection, real-time monitoring of treatment response, biomarker discovery, and the development of targeted drug delivery platforms. With the rising prevalence of cancer and increasing demand for minimally invasive diagnostic tools, exosome-based solutions are gaining strong market traction. As innovation in oncology continues to accelerate, this segment is expected to remain a key driver of overall market growth.

The infectious diseases segment is anticipated to grow at a robust CAGR from 2025 to 2033. Exosomes are known to be involved in pathogen communication, immune regulation, and the transport of viral or bacterial components, making them valuable for the development of advanced diagnostic tools and the monitoring of disease progression. Their ability to serve as biomarkers for early detection and as carriers for targeted therapeutic delivery is driving strong interest across research and clinical settings. With the rising focus on rapid, accurate, and non-invasive diagnostic solutions, this segment is positioned for substantial expansion throughout the forecast period.

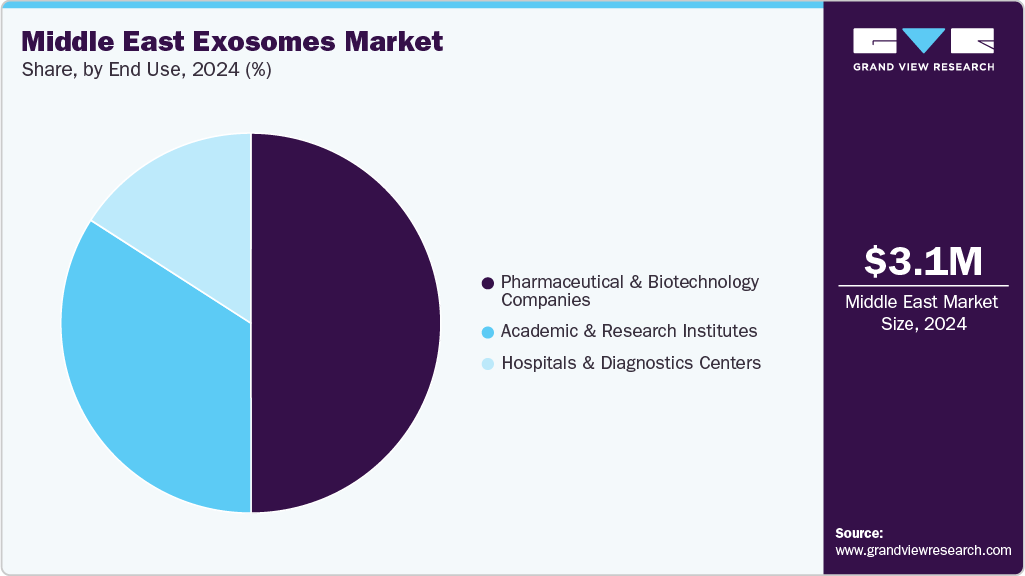

End Use Insights

The pharmaceutical & biotechnology companies segment captured the largest revenue share of 50.02% in 2024. The segment is experiencing strong growth driven by rising demand for extracellular vesicle-based therapeutics, vaccines, and advanced drug delivery platforms. Besides, increased investments in R&D, expanding clinical pipelines, and growing collaboration with academic institutions and service providers are accelerating the adoption of exosome technologies. As companies continue to prioritize precision medicine and next-generation biologics, this segment is expected to maintain its dominant position in the market over the coming years.

The academic & research institutes segment is anticipated to grow at a significant CAGR over the forecast period. This is due to the increasing focus on exploring exosome biology, identifying novel biomarkers, and developing new diagnostic and therapeutic applications. Supported by expanding research grants, infrastructure upgrades, and growing collaboration with industry partners, academic institutions are playing a central role in advancing scientific understanding and driving innovation within the exosomes market.

Country Insights

The Saudi Arabia exosomes industry is expected to grow notably over the forecast period due to ambitious healthcare reforms and substantial investments in biotechnology. Ongoing initiatives under Vision 2030 are strengthening the country’s research infrastructure, clinical capabilities, and adoption of advanced diagnostic technologies. As precision medicine and regenerative therapies gain momentum, Saudi Arabia is positioned to emerge as a key regional hub for exosome-related innovation.

The exosomes industry in Kuwait is expected to witness growth over the forecast period due to rising investments in advanced healthcare technologies and an increasing emphasis on precision medicine. Expanding research capabilities and collaborations with international biotechnology organizations are further supporting market development. As demand for innovative diagnostic and therapeutic solutions grows, Kuwait is expected to strengthen its position within the regional exosomes landscape.

Key Middle East Exosomes Company Insights

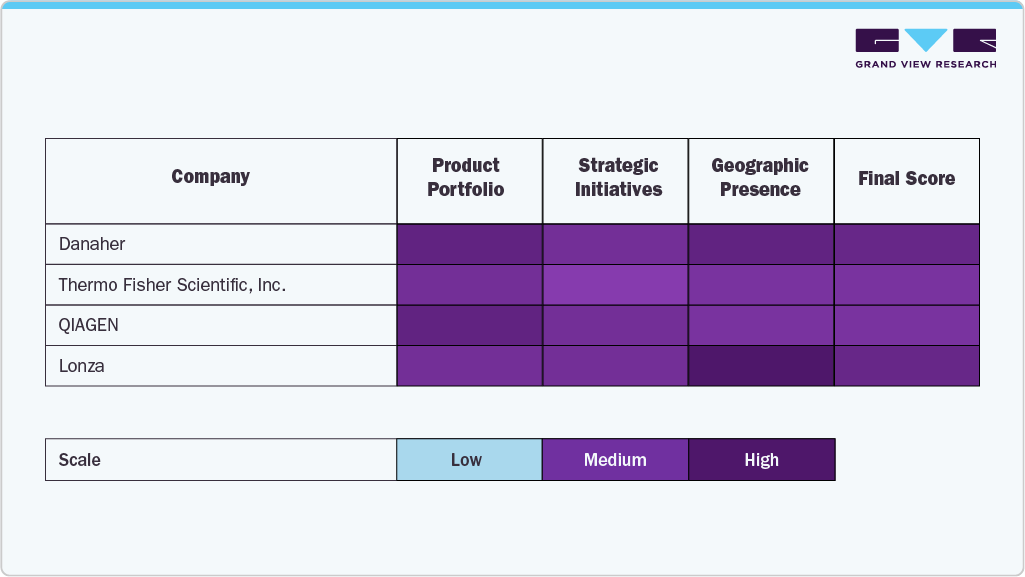

The market is characterized by the presence of leading biotechnology and life sciences companies that offer advanced exosome isolation, purification, characterization, and therapeutic development solutions. Companies such as Thermo Fisher Scientific, Danaher, Fujifilm Holdings Corporation, and QIAGEN have established strong regional footprints through distribution partnerships, academic collaborations, and technology-focused initiatives. Their portfolios encompass a range of instruments, consumables, reagents, and GMP-grade manufacturing services that support both research and clinical applications.

These companies continue to strengthen their competitive positions by expanding their exosome-related capabilities, including scalable manufacturing platforms, high-purity isolation technologies, and clinically compliant workflows. Investments in advanced analytical tools-such as flow cytometry, nanoparticle tracking, and next-generation sequencing-have also enhanced their ability to serve pharmaceutical, biotechnology, and research customers across the Middle East. Product innovation, regulatory alignment, and quality certifications remain key differentiators enabling these players to cater to the growing demand for extracellular vesicle-based therapies, diagnostics, and vaccines.

Strategic initiatives, including mergers and acquisitions, regional distributor agreements, and research partnerships with universities and healthcare institutions, are further shaping the competitive landscape. Many global players are increasingly focusing on localized training programs, technical support centers, and knowledge-sharing platforms to accelerate the adoption of exosome technologies. In addition, the rise of national healthcare transformation programs in Saudi Arabia, the UAE, and Qatar is attracting these companies to scale their presence and participate in long-term innovation roadmaps.

Overall, the market is moderately consolidated, with global leaders holding a strong share due to their broad product portfolios and technological depth. However, increasing interest from emerging biotechnology firms and regional research organizations may gradually intensify competition. As exosome-based therapeutics and diagnostics advance from research toward commercialization, companies with strong GMP capabilities, robust clinical-grade pipelines, and integrated workflow solutions are expected to retain a competitive advantage and influence future market dynamics.

Key Middle East Exosomes Companies:

- Danaher

- Hologic Inc.

- Fujifilm Holdings Corporation

- Lonza

- Miltenyi Biotec

- Bio-Techne Corporation

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Abcam plc

- RoosterBio, Inc.

Recent Developments

-

In March 2023, ExoCel Bio, a biotechnology company specializing in exosome-based aesthetic and regenerative solutions, launched its Exovex exosome product line in the UAE through a strategic distribution partnership with Medica Group. This expansion marks a notable advancement in the commercialization of exosome-based therapies within the Middle East market.

Middle East Exosomes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.73 million

Revenue forecast in 2033

USD 20.03 million

Growth rate

CAGR of 23.38% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & Service, workflow, application, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Danaher; Hologic Inc.; Fujifilm Holdings Corporation; Lonza; Miltenyi Biotec; Bio-Techne Corporation; QIAGEN; Thermo Fisher Scientific, Inc.; Abcam plc; RoosterBio, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Exosomes Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East exosomes market report based on product & service, workflow, application, end use, and country:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Kits & Reagents

-

Instruments

-

Services

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Isolation Methods

-

Ultracentrifugation

-

Immunocapture on beads

-

Precipitation

-

Filtration

-

Others

-

-

Downstream Analysis

-

Cell surface marker analysis using flow cytometry

-

Protein analysis using blotting & ELISA

-

RNA analysis with NGS & PCR

-

Proteomic analysis using mass spectroscopy

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cancer

-

Neurodegenerative Diseases

-

Cardiovascular Diseases

-

Infectious Diseases

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostics Centers

-

Academic & Research Institutes

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East exosomes market size was estimated at USD 3.07 million in 2024 and is expected to reach USD 3.73 million in 2025.

b. The Middle East exosomes market is projected to grow at a compound annual growth rate (CAGR) of 23.38% from 2025 to 2033, reaching USD 20.03 million by 2033.

b. Saudi Arabia held the largest share, 27.43%, of the overall revenue in 2024, supported by strong government investment in healthcare modernization, biotechnology, and advanced diagnostic capabilities. This dominance is further reinforced by the country’s expanding research infrastructure and growing adoption of exosome-based applications across clinical and translational settings.

b. Some key players operating in the Middle East exosomes market include Danaher; Hologic Inc.; Fujifilm Holdings Corporation; Lonza; Miltenyi Biotec; Bio-Techne Corporation; QIAGEN; Thermo Fisher Scientific, Inc.; Abcam plc; and RoosterBio, Inc. among others.

b. The Middle East exosomes market is witnessing growth driven by increasing investment in advanced biotechnology, expanding applications in diagnostics and therapeutics, and rising adoption of exosome-based solutions across research and clinical settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.