- Home

- »

- Advanced Interior Materials

- »

-

Middle East Fire Suppression Systems Market Report, 2033GVR Report cover

![Middle East Fire Suppression Systems Market Size, Share & Trends Report]()

Middle East Fire Suppression Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Fire Extinguishers, Sprinklers), By Application (Commercial, Industrial, Residential), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-739-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Fire Suppression Systems Market Summary

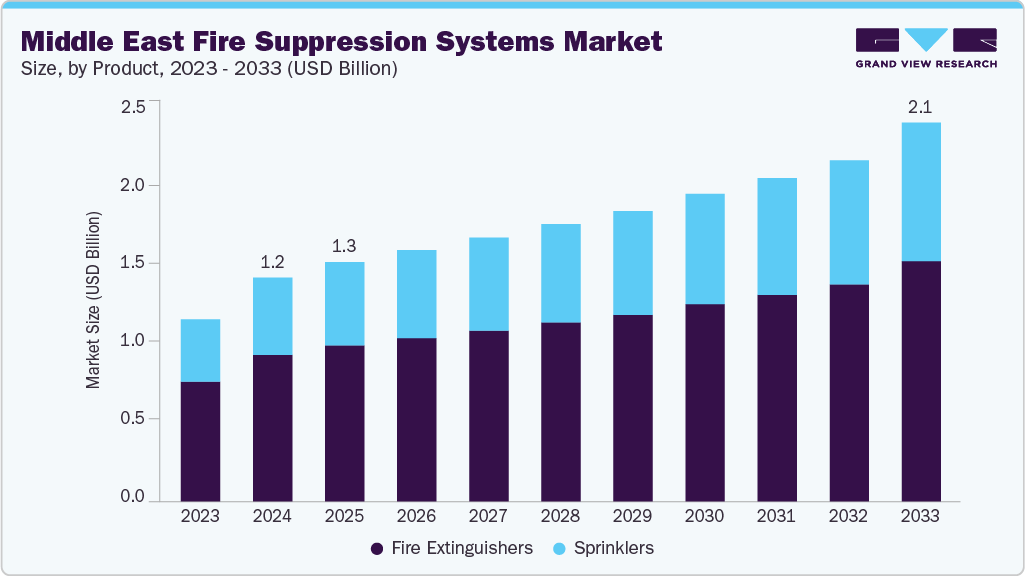

The Middle East fire suppression systems market size was estimated at USD 1,222.9 million in 2024 and is projected to reach USD 2,070.4 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The growth outlook is attributed to increasing enforcement of fire safety regulations, rising construction activity, and growing awareness about safety standards.

Key Market Trends & Insights

- The fire suppression systems market in Saudi Arabia is expected to grow at a substantial CAGR of 7.5% from 2025 to 2033.

- By product, the fire extinguishers segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue.

- In terms of application, the residential segment is poised to exhibit a strong CAGR of 7.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,222.9 Million

- 2033 Projected Market Size: USD 2,070.4 Million

- CAGR (2025-2033): 5.9%

Rapid urban development and expansion of commercial, residential, and industrial infrastructure across the region, especially in Gulf countries, are key demand drivers. The market is also benefiting from a growing emphasis on advanced technologies, such as clean-agent systems, water mist, and IoT-enabled fire suppression solutions that offer faster detection, real-time monitoring, and remote control. Sectors such as oil & gas, data centers, transportation, and high-rise buildings are adopting modern systems to protect critical assets.

Market Concentration & Characteristics

The industry is moderately fragmented, with a mix of global and regional players. Major international companies dominate large-scale, high-value projects in sectors, including oil & gas, data centers, and infrastructure, due to their technical expertise and regulatory certifications. In contrast, regional and local firms are more active in small to mid-scale commercial and residential segments, offering cost-effective solutions tailored to local codes. Product-wise, the market is more concentrated in advanced systems like clean-agent and automated solutions, while systems such as extinguishers are more fragmented. This dual structure creates both competitive and partnership opportunities across tiers.

The fire suppression systems market in the Middle East is witnessing growing innovation with the adoption of IoT-enabled systems, AI-based fire detection, and modular suppression units. Manufacturers are focusing on smart integration, early response technologies, and environmentally friendly agents. Increasing demand for automated and intelligent fire protection solutions is driving product development tailored to regional climate and infrastructure needs.

Mergers and acquisitions are increasing as global companies seek to expand their presence in the Middle East. Acquisitions of regional players help international firms gain local certifications, client networks, and regulatory understanding. These activities also enable the integration of specialized technologies and expand product portfolios, strengthening competitiveness in a market with rising safety standards and infrastructure investments.

Tightening fire safety regulations in the Middle East are reshaping the landscape. Governments are mandating advanced suppression systems, including in existing buildings, not just new projects. Updated building codes and enforcement of international standards are pushing demand for compliant technologies. These regulatory shifts are driving innovation, accelerating system upgrades, and raising the baseline for fire safety solutions.

Drivers, Opportunities & Restraints

Rapid urbanization and large-scale infrastructure development across the Middle East, particularly in Saudi Arabia, the UAE, and Qatar, are major growth drivers redefining the regional ecosystem. Smart cities, high-rise buildings, and mega-projects require advanced fire suppression systems to meet safety standards. This rising demand is reinforced by stricter building codes and growing awareness of fire safety in both public and private sectors.

There is a significant opportunity in retrofitting existing infrastructure with modern fire suppression systems. Many older buildings lack compliant systems, creating demand for clean-agent, smart, and low-maintenance solutions. Furthermore, the growing adoption of IoT-based safety technologies offers vendors a chance to deliver integrated fire safety systems aligned with smart city and digital transformation initiatives in the region.

One of the key challenges is the integration of advanced suppression systems into aging infrastructure. Many existing buildings and industrial facilities were not designed to accommodate modern systems, making upgrades complex and costly. In addition, a shortage of skilled local technicians and varying regulatory enforcement across countries can delay project implementation and affect system performance and compliance.

Product Insights

The sprinklers segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue. The fire extinguishers segment dominated the market with a 65.5% share in 2024. The growth is largely attributed to stricter safety regulations and mandatory installations in residential, commercial, and industrial spaces. Expanding infrastructure, smart city developments, and increased fire safety awareness are driving adoption. There is also rising interest in eco-friendly and smart extinguishers with IoT capabilities.

Sprinklers are expected to see notable growth in the Middle East market, as governments mandate their use in new constructions and renovation projects. The rise in high-rise buildings, commercial centers, and institutional developments supports increased adoption. Sprinklers are also being integrated into smart building systems, enhancing their appeal in premium infrastructure projects. Awareness around life safety and asset protection is prompting more developers to choose automated suppression solutions.

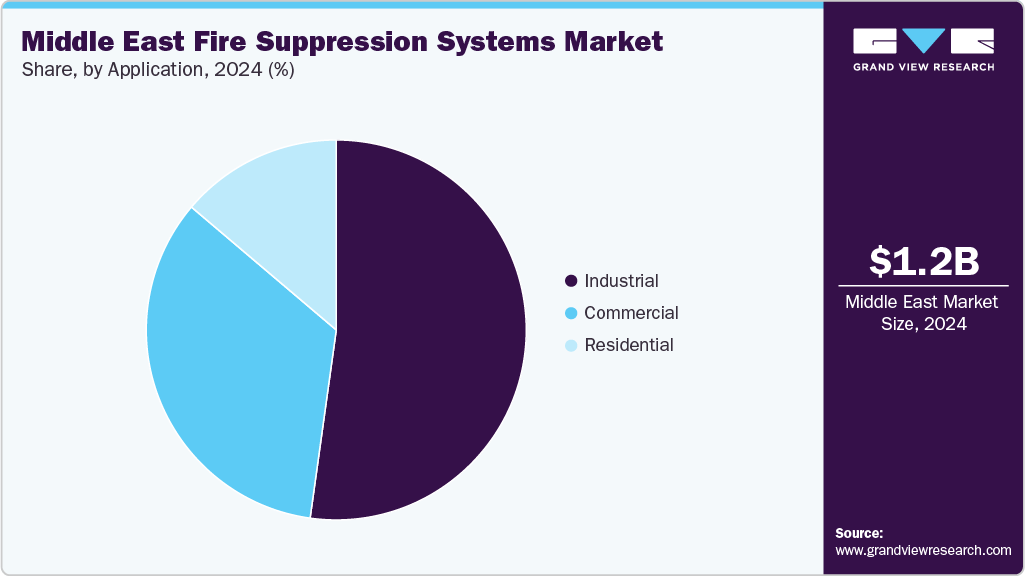

Application Insights

The residential segment is expected to grow at a significant CAGR of 7.6% from 2025 to 2033 in terms of revenue. the industrial segment dominated the market in 2024, accounting for a share of 52.2%, driven by expansion in sectors such as oil and gas, manufacturing, energy, and logistics. These facilities house flammable materials and complex machinery, requiring specialized suppression systems such as foam-based, water mist, or clean-agent solutions. Regulatory pressure and risk mitigation strategies are pushing industries to invest in advanced, automated systems. In essence, rising investment in industrial infrastructure, including refineries and warehouses, is increasing system installations.

The residential segment is anticipated to grow significantly, due to rising urbanization, population growth, and a surge in high-rise residential developments. Governments are updating fire codes to mandate suppression systems in multi-family buildings, villas, and affordable housing. Increased awareness of fire safety, combined with smart home integration, is driving demand for compact, automated systems like sprinklers and clean-agent extinguishers.

Country Insights

Saudi Arabia Fire Suppression Systems Market Trends

Saudi Arabia fire suppression systems industry logged 30.6% market share in 2024, showcasing its dominance, which is mainly linked to massive infrastructure developments under Vision 2030, including NEOM, industrial zones, and smart city projects. The government is enforcing stricter fire safety regulations across residential, commercial, and industrial sectors. High-rise buildings, logistics hubs, and expanding oil & gas operations are creating demand for advanced suppression systems.

UAE Fire Suppression Systems Market Trends

The UAE fire suppression systems industry is slated to grow at a CAGR of 7.1% from 2025 to 2033, fueled by rapid urbanization, smart city initiatives, and stringent enforcement of building safety regulations. Dubai and Abu Dhabi are leading investments in high-rise buildings, commercial centers, and hospitality infrastructure, all requiring robust fire protection systems. The government’s push for sustainability and smart technology adoption is accelerating demand for automated, IoT-integrated suppression solutions.

Key Middle East Fire Suppression Systems Company Insights

Some of the key players operating in the market include Fike Corporation, Halma Plc, and Honeywell International Inc.

-

Fike Corporation is a U.S.-based manufacturer specializing in explosion protection, pressure relief, and fire suppression solutions. In the Middle East, Fike is recognized for its advanced fire suppression systems, including clean agent, water mist, and industrial fire protection technologies. The company serves critical sectors such as oil & gas, power, pharmaceuticals, and data centers, offering high-performance systems designed to minimize downtime and protect high-value assets.

-

Halma Plc is a global group of life-saving technology companies headquartered in the UK, with a strong presence in the Middle East fire suppression market through its subsidiaries, like FirePro and Apollo Fire Detectors. Halma focuses on offering environmentally sustainable fire suppression systems and advanced fire detection technologies for industrial, commercial, and residential applications.

Key Middle East Fire Suppression Systems Companies:

- Fike Corporation

- Halma Plc

- Honeywell International Inc.

- Johnson Controls

- Robert Bosch GmbH

- Siemens AG

- SFFECO

- NAFFCO

- Hochiki Europe, LLC

- El Gendi Group

Recent Developments

-

In October 2024, Siemens Smart Infrastructure announced the completion of the acquisition of Danfoss Fire Safety, a Denmark-based subsidiary specializing in sustainable fire suppression technologies, particularly high-pressure water mist systems. This acquisition aims to strengthen Siemens's fire safety portfolio by integrating environmentally friendly and rapidly growing fire suppression solutions, enabling Siemens to better serve industries with rising fire safety demands, such as data centers, industrial processes, and tunnels.

-

In January 2023, Halma Plc acquired Thermocable (Flexible Elements) Ltd. to integrate Thermocable’s special detection technologies in its safety sector fire detection company, Apollo Fire Detectors Limited. The acquisition enabled Halma Plc to expand Apollo’s range of devices in the commercial and industrial fire detection markets.

Middle East Fire Suppression Systems Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1,306.7 million

Revenue forecast in 2033

USD 2,070.4 million

Growth Rate

CAGR of 5.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

Saudi Arabia; UAE; Oman; Qatar; Kuwait; Israel

Key companies profiled

Fike Corporation; Halma Plc; Honeywell International Inc.; Johnson Controls; Robert Bosch GmbH; Siemens AG; SFFECO; NAFFCO; Hochiki Europe, LLC; El Gendi Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Fire Suppression Systems Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2021-2033. For this study, Grand View Research has segmented the Middle East fire suppression systems market report on the basis of product and application

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Fire Extinguishers

-

Gas

-

Water

-

Dry Chemical Powder

-

Others

-

-

Sprinklers

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Residential

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Kuwait

-

Israel

-

Frequently Asked Questions About This Report

b. The Middle East fire suppression systems market size was estimated at USD 1,222.9 million in 2024 and is expected to reach USD 1,306.7 million in 2025.

b. The Middle East fire suppression systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033, reaching USD 2,070.4 million by 2033.

b. The fire extinguishers segment dominated the market in 2024 by accounting for a share of 65.5% due to stricter safety regulations and mandatory installations in residential, commercial, and industrial spaces. Expanding infrastructure, smart city developments, and increased fire safety awareness are driving adoption.

b. Some of the key players operating in the Middle East fire suppression systems market include Fike Corporation, Halma Plc, Honeywell International Inc., Johnson Controls, Robert Bosch GmbH, Siemens AG, SFFECO, NAFFCO, Hochiki Europe, LLC, and El Gendi Group.

b. Key factors driving the Middle East fire suppression systems market include rapid urbanization, strict fire safety regulations, growth in infrastructure and industrial projects, rising awareness of fire risks, and increasing adoption of smart, automated suppression technologies across residential, commercial, and high-risk industrial environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.