- Home

- »

- Advanced Interior Materials

- »

-

Middle East Green Mining Market Size, Industry Report, 2033GVR Report cover

![Middle East Green Mining Market Size, Share & Trends Report]()

Middle East Green Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Surface Mining, Underground Mining), By Application (Power Reduction, Emission Reduction, Water Reduction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-718-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Green Mining Market Summary

The Middle East green mining market size was estimated at USD 372.6 million in 2024 and is expected to reach USD 587.9 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The market is gaining momentum as governments tie resource development to national diversification agendas.

Key Market Trends & Insights

- The green mining market in the Middle East is expected to grow at a substantial CAGR of 5.7% from 2025 to 2033.

- By type, the surface mining segment held the largest revenue share of 63.4% in 2024.

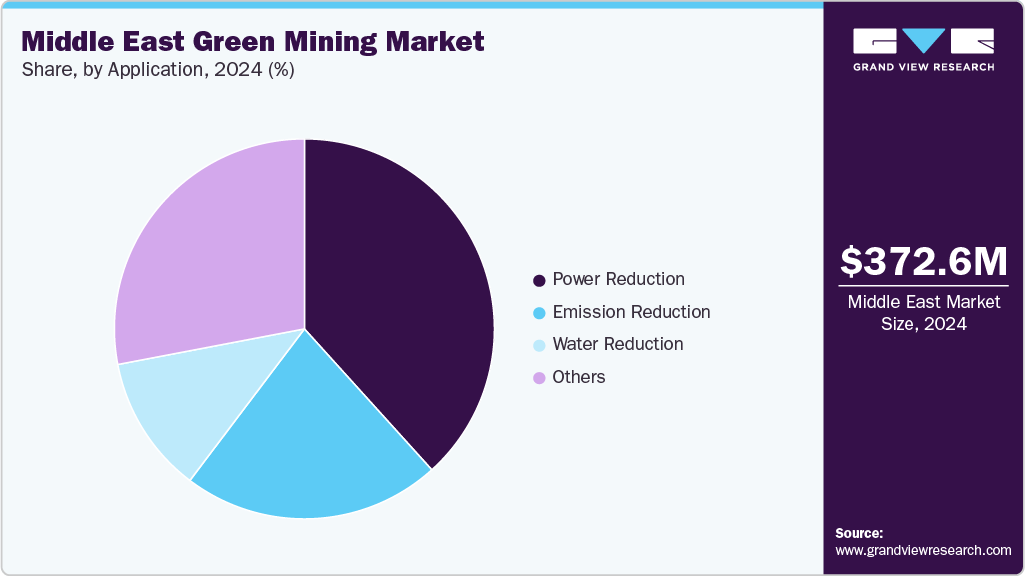

- By application, the power reduction segment held the largest revenue share of 38.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 372.6 Million

- 2033 Projected Market Size: USD 587.9 Million

- CAGR (2025-2033): 5.7%

Vision driven programs in Saudi Arabia, the UAE, Oman, and Jordan encourage investment that cuts emissions, reduces waste, and raises transparency. Clear permitting pathways, incentives for clean power, and local content rules push operators to build mines that meet modern environmental and social standards rather than retrofitting later. The region has world-class solar and strong wind corridors, which lower the cost of renewable electricity for power-hungry operations such as crushing, grinding, and refining. Pairing renewables with storage and high-efficiency gas turbines trims fuel bills and insulates producers from oil and gas price swings. This combination improves project bankability while helping companies progress toward net zero targets.

Water scarcity is a defining regional constraint, so companies are adopting technologies that minimize freshwater draw and tailings risk. Dry or filtered tailings, paste backfill, ore sorting to lift head grades, and closed-loop process water systems are moving from pilots to design standards. Advances in desalination efficiency and brine management make coastal projects more viable, and progressive rehabilitation plans protect scarce arable land and groundwater.

Global lenders and commodity buyers prefer suppliers with credible environmental, social, and governance performance. Green bonds, sustainability-linked loans, and long-term offtake contracts reward producers that verify lower carbon intensity via audited data. This access to cheaper capital and premium pricing strengthens the business case for electrified fleets, autonomous haulage that optimizes fuel use, and continuous emissions monitoring.

Real-time sensors, digital twins, and predictive maintenance raise throughput and cut energy per ton. Rail and port electrification, localized recycling of scrap metals, and recovery of byproducts such as gypsum or sulfuric acid support a circular materials ecosystem. Together, these forces are turning green practices from compliance costs into sources of competitive advantage, accelerating adoption across the Middle East mining value chain.

Drivers, Opportunities & Restraints

The primary drivers of the Middle East green mining market include strong government support for sustainable industrialization and diversification away from oil dependence. National strategies such as Saudi Vision 2030 and the UAE’s clean energy programs encourage investment in eco-friendly mining practices through incentives, regulatory reforms, and renewable energy integration. Rising global demand for responsibly sourced minerals also pushes regional miners to adopt technologies like electrified equipment, water recycling systems, and renewable power to meet international ESG standards.

Market opportunities are expanding as local and international companies seek to align with global sustainability trends. The abundance of renewable energy resources such as solar and wind in the Middle East creates a cost-effective pathway for mining firms to decarbonize operations. Partnerships with global technology providers, the growing appetite for green financing, and the emergence of circular economy practices open avenues for investment and innovation. Additionally, the region’s strategic location between Asia, Europe, and Africa positions it well to serve as a hub for responsibly mined and processed materials.

Despite the positive outlook, restraints continue to shape the pace of growth in the Middle East green mining industry. High initial costs of implementing advanced green technologies, limited regional expertise in specialized sustainable mining practices, and infrastructure gaps pose challenges. Water scarcity further increases operational complexities, as mining operations must balance production with sustainable resource use.

Type Insights

Surface mining held the revenue share of 63.4% in 2024. Large deposits of phosphate, bauxite, and copper in the region are more accessible through surface mining methods, making it a preferred choice for operators. Government initiatives promoting resource-based industrial development and downstream processing create steady demand for sustainable surface mining operations, encouraging companies to adopt eco-friendly practices at the extraction stage.

The underground mining segment in the Middle East green mining market is gaining traction due to the rising demand for minerals in deeper reserves that cannot be accessed through surface mining. Growing exploration for copper, zinc, gold, and rare earth elements across Saudi Arabia, Oman, and Jordan is pushing the adoption of underground techniques. Governments are encouraging mining companies to diversify production while meeting sustainability targets, which is fostering the development of environmentally responsible underground mining operations.

Application Insights

Power reduction held the revenue share of 38.3% in 2024. The mining industry is energy-intensive, with processes such as drilling, crushing, grinding, and material handling consuming significant power. Regional governments are pushing for reduced carbon emissions and greater reliance on renewable energy, so operators are investing in technologies that minimize electricity consumption while maintaining high productivity. National sustainability strategies and low-cost solar and wind energy availability across the region support this shift.

The emission reduction segment is expanding rapidly as regulators, investors, and global buyers strongly emphasize carbon-neutral supply chains. Mining is a significant source of greenhouse gas emissions through diesel-powered equipment, processing plants, and transport logistics. With countries like Saudi Arabia, UAE, and Oman committing to net-zero targets, mining companies are under pressure to curb emissions and align operations with national sustainability agendas. This drives large-scale investment in clean technologies that cut direct and indirect emissions across the mining value chain.

Regional Insights

Saudi Arabia Green Mining Market Trends

The Saudi Arabia held 18.6% revenue share of the Middle East green mining market. The green mining market in Saudi Arabia is primarily driven by the government’s commitment to diversify its economy under Vision 2030, which places mining as the third pillar of national growth alongside oil and petrochemicals. The Ministry of Industry and Mineral Resources actively encourages sustainable mining practices through regulatory reforms, licensing programs, and promoting environmentally responsible extraction methods. These initiatives foster an investment-friendly environment where companies are incentivized to adopt renewable energy, advanced water management systems, and eco-friendly mining technologies.

UAE Green Mining Market Trends

The UAE green mining market is witnessing growth, driven by the country’s long-term sustainability vision, which emphasizes clean energy integration and reduced dependence on hydrocarbons. Through national strategies like the UAE Energy Strategy 2050 and the UAE Net Zero 2050 initiative, the government is actively promoting environmentally responsible industrial practices, including mining. Policies encouraging investment in renewable power, energy-efficient systems, and sustainable infrastructure are creating a strong foundation for green mining growth across the country.

Key Middle East Green Mining Company Insights

Some of the key players operating in the market include Saudi Arabian Mining Company (Ma’aden), Manajem Al Arabia Mining Co. Ltd., and others

-

Saudi Arabian Mining Company, widely known as Ma’aden, was established in 1997 and is headquartered in Riyadh. It is the largest multi-commodity mining and metals enterprise in Saudi Arabia and among the fastest-growing globally. Ma’aden has set ambitious sustainability targets, including achieving 100% reliance on renewable energy and eliminating Scope 1 and 2 emissions intensity by 2040. It is investing in projects such as a 1,500 MW solar steam plant to reduce emissions at its alumina refinery. It is expected to cut carbon output by hundreds of thousands of tonnes annually.

-

Manajem Al Arabia Mining Co. Ltd., founded in 2004 and based in Jeddah, is a prominent privately owned mining company in Saudi Arabia. The company engages in mineral exploration, extraction, and trading, covering precious metals such as gold and silver, base metals including copper and zinc, and various industrial minerals such as quartz, silica, and dolomite. The company is committed to supporting Saudi Arabia’s mining development while protecting the environment and ensuring a clean earth for future generations.

Key Middle East Green Mining Companies:

- Saudi Arabian Mining Company (Ma’aden)

- Manajem Al Arabia Mining Co. Ltd.

- National Metallurgical Company (NMC)

- Alara Resources Limited

- Oman Mining Company (OMCO)

- Al Masane Al Kobra Mining Co. (AMAK)

- Arab Potash Company

- Emirates Global Aluminium

- Global Mines & Minerals

Recent Development

-

In July 2025, Saudi Arabia intensified its efforts to transform the mining sector as part of its economic diversification strategy, emphasizing a strategic balance between optimal resource utilization and environmental stewardship. The Ministry of Industry and Mineral Resources rolled out new initiatives to promote responsible mining practices across the value chain, focusing on sustainability in mining operations, water conservation, vegetation cover development, and emission reduction to ensure long-term environmental preservation.

-

In March 2023, the United Nations Industrial Development Organization (UNIDO) and Saudi Arabia deepened their cooperation to strengthen investments in local industry and promote responsible mining practices. This partnership aligns with Saudi Arabia’s Vision 2030 economic diversification strategy, which seeks to transform the mining sector into a global hub by implementing modern legal frameworks, enhancing transparency, and providing substantial financial incentives for investors.

Middle East Green Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 397.9 million

Revenue forecast in 2033

USD 587.9 million

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application

Regional scope

Middle East

Country scope

Bahrain; Kuwait; Saudi Arabia; UAE; Omar; Qatar

Key companies profiled

Saudi Arabian Mining Company (Ma’aden); Manajem Al Arabia Mining Co. Ltd.; National Metallurgical Company (NMC); Alara Resources Limited; Oman Mining Company (OMCO); Al Masane Al Kobra Mining Co. (AMAK); Arab Potash Company; Emirates Global Aluminium; Global Mines & Minerals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Green Mining Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Middle East green mining market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Surface Mining

-

Underground Mining

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Power Reduction

-

Emission Reduction

-

Water Reduction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East & Africa

-

Bahrain

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East green mining market size was estimated at USD 372.6 million in 2024 and is expected to reach USD 397.9 million in 2025.

b. The Middle East green mining market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 587.9 million by 2033.

b. The surface mining segment dominated the market with a revenue share of 63.4% in 2024.

b. Some of the key players of the Middle East green mining market are Saudi Arabian Mining Company (Ma’aden), Manajem Al Arabia Mining Co. Ltd., National Metallurgical Company (NMC), Alara Resources Limited, Oman Mining Company (OMCO), Al Masane Al Kobra Mining Co. (AMAK), Arab Potash Company, Emirates Global Aluminium, Global Mines & Minerals, and others.

b. The key factor driving the growth of the Middle East green mining market is the rising demand for environmentally responsible extraction methods supported by government sustainability initiatives and increasing investments in renewable energy integration within mining operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.