- Home

- »

- Advanced Interior Materials

- »

-

Middle East Modular Flooring Market Size Report, 2033GVR Report cover

![Middle East Modular Flooring Market Size, Share & Trends Report]()

Middle East Modular Flooring Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Flexible LVT, Rigid LVT, Carpet Tile, Rubber Flooring), By End Use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-704-5

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Modular Flooring Market Summary

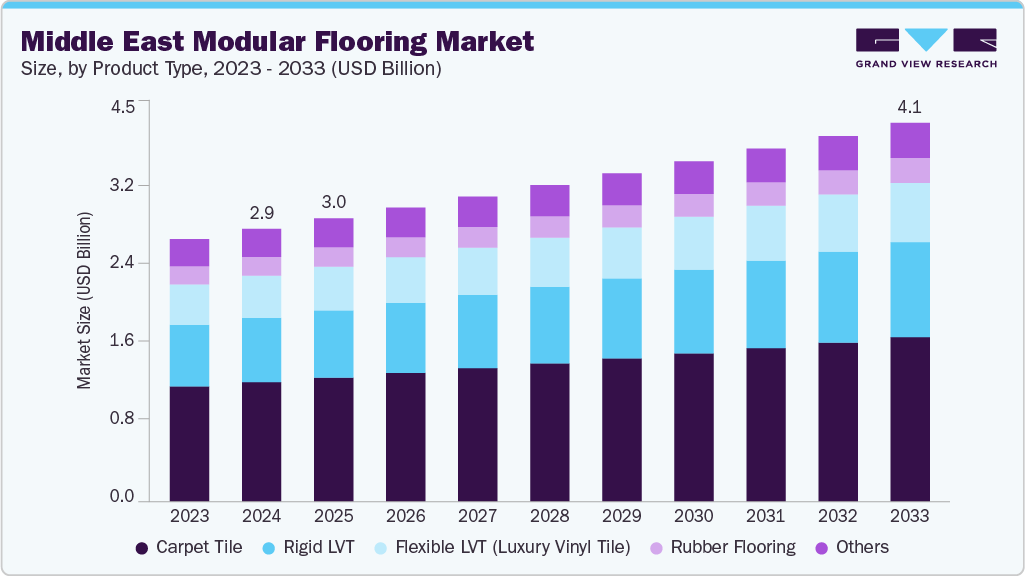

The Middle East modular flooring market size was estimated at USD 2.92 billion in 2024 and is projected to reach USD 4.06 billion by 2033, growing at a CAGR of 3.7% from 2025 to 2033. The demand for modular flooring in the Middle East is growing steadily due to a surge in construction activities across commercial, residential, and institutional segments.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East modular flooring market with the largest revenue share of 32.3% in 2024.

- By product type, the rigid LVT segment is expected to grow at the fastest CAGR of 4.4% over the forecast period.

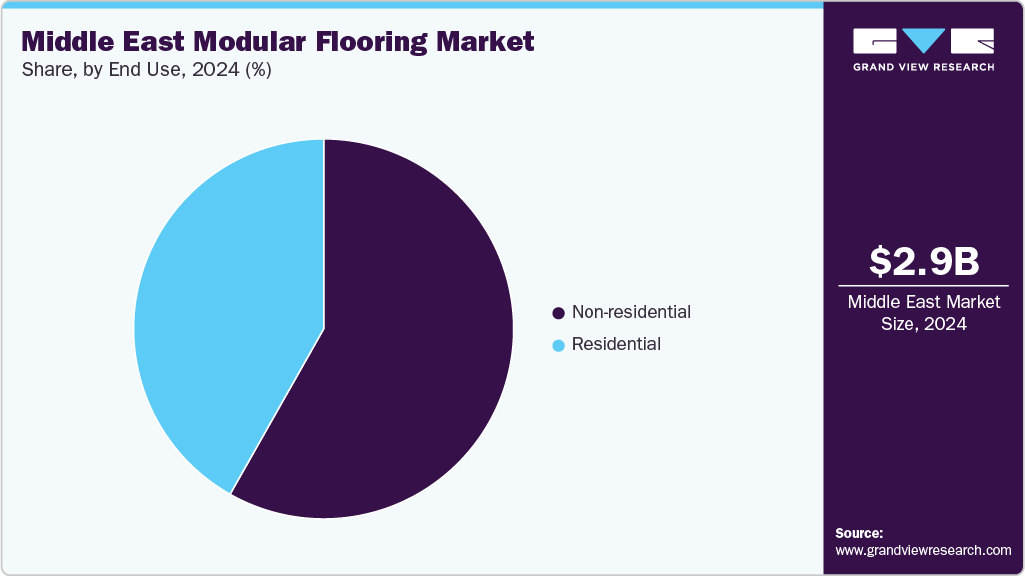

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 3.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.92 Billion

- 2033 Projected Market Size: USD 4.06 Billion

- CAGR (2025-2033): 3.7%

- Saudi Arabia: Largest market in 2024

- Egypt: Fastest market in 2024

Rapid urbanization, rising disposable incomes, and a strong push towards modern infrastructure have elevated the need for stylish, easy-to-install, and durable flooring options. In addition, the region’s growing hospitality, healthcare, and education sectors are consistently opting for modular flooring due to its design flexibility, minimal maintenance, and faster installation timelines, helping developers meet tight project schedules.

Key drivers include the increasing preference for customizable and sustainable building materials, along with the expanding real estate and tourism sectors. Modular flooring offers benefits such as quick installation, noise reduction, and enhanced aesthetics, which suit the requirements of modern interiors. Furthermore, rising investments in smart cities and large-scale government-backed development projects like NEOM in Saudi Arabia and Expo City Dubai are accelerating the demand. Product variety in terms of textures, patterns, and materials such as LVT, carpet tiles, and rubber tiles is appealing to both commercial and residential end users.

Manufacturers are focusing on antimicrobial surfaces, noise-cancellation properties, and eco-friendly raw materials in modular flooring solutions. Digital printing and 3D surface textures are enabling highly realistic finishes that mimic wood, stone, or ceramic, providing aesthetic versatility without compromising on durability. Hybrid product lines that combine rigid core and waterproof properties are gaining traction in the region’s hot and often humid climate. In addition, smart modular flooring solutions with integrated sensors for tracking movement, air quality, or temperature are emerging in premium commercial spaces.

Market Concentration & Characteristics

The Middle East modular flooring industry is moderately concentrated with a mix of global players like Tarkett, Shaw, and Interface, and strong regional distributors and suppliers. While global brands lead in commercial projects due to brand reputation and product quality, regional players offer competitive pricing and tailored solutions. Major construction firms and developers have long-term vendor partnerships, creating moderate entry barriers for new entrants. The market sees frequent innovation cycles, and distributors play a key role in product availability across fast-developing cities.

The threat of substitutes is moderate in this market. Traditional flooring materials such as marble, ceramic tiles, and hardwood still hold a significant share in the Middle East due to cultural preferences and durability. However, modular flooring is increasingly preferred in commercial spaces and modern residences due to lower installation time and maintenance. Technological advancements in surface finishes and durability have helped modular flooring compete effectively. Substitution risk remains primarily where premium aesthetics or natural finishes are prioritized, especially in luxury residences and religious structures.

Product Type Insights

The carpet tile segment led the market with the largest revenue share of 43.8% in 2024, largely due to its strong uptake in commercial offices, airports, educational institutions, and hospitality spaces. Its modularity, sound insulation, comfort underfoot, and easy maintenance make it a preferred choice in high-traffic, air-conditioned indoor environments. In addition, the ability to create custom patterns, incorporate brand colors, and replace individual tiles without full-floor disruption aligns well with the region’s high design and functional standards. Multinational corporations and premium hotels in cities like Dubai, Riyadh, and Doha particularly drive the demand for high-quality carpet tiles.

The rigid LVT segment is expected to grow at the fastest CAGR of 4.4% over the forecast period, driven by its superior water resistance, durability, and realistic appearance that mimics wood and stone. The product’s suitability for hot and humid climates, along with easy maintenance and installation through click-lock systems, makes it ideal for residential and commercial applications across the region. Demand is further fueled by expanding urban housing, hospitality projects, and retail environments that prioritize aesthetic appeal and long-lasting performance. Growing awareness of PVC-free and sustainable rigid LVT options is also adding to its momentum.

End Use Insights

The non-residential segment led the market with the largest revenue share of 58.2% in 2024, driven by large-scale commercial, hospitality, healthcare, and educational infrastructure projects. High-traffic areas such as airports, shopping malls, hotels, and offices favor modular flooring for its durability, acoustic benefits, and ease of replacement. Governments and private developers in the Gulf region are heavily investing in non-oil sectors, which include a strong pipeline of institutional and commercial spaces. Modular flooring's ability to meet safety standards, offer design flexibility, and support sustainability goals makes it a key choice in non-residential construction across the region.

The residential segment is expected to grow at the fastest CAGR of 3.5% over the forecast period, supported by increasing urbanization, rising disposable incomes, and a growing preference for modern, easy-to-install flooring solutions. Homeowners are opting for modular options like LVT and carpet tiles due to their durability, low maintenance, and aesthetic variety. The surge in residential construction, particularly in affordable and mid-range housing developments across countries like the UAE, Saudi Arabia, and Egypt, is further boosting demand. In addition, the rise of DIY culture and e-commerce platforms is enhancing the accessibility of modular flooring in the region.

Regional Insights

The Middle East modular flooring market is gaining traction due to rapid urban development and increasing commercial construction activity. With rising demand for energy-efficient and aesthetic interiors, especially in the office and hospitality sectors, modular flooring solutions are being widely adopted. Climate adaptability, low VOC emissions, and ease of maintenance make them a popular choice for new and retrofitted buildings. Import reliance remains high, but growing warehousing and distribution capabilities are improving product accessibility.

The modular flooring market in Saudi Arabia accounted for the largest revenue market share of 32.3% in 2024, driven by Vision 2030 and giga-projects such as NEOM, Qiddiya, and the Red Sea Project. The expansion of hotels, retail, and public sector buildings is generating demand for versatile flooring options. The shift towards modern design aesthetics, combined with increased construction of healthcare and educational institutions, has opened up opportunities for carpet tiles, LVT, and anti-bacterial flooring types.

The UAE modular flooring market is widely used in commercial buildings, luxury residences, and hospitality projects, especially in Dubai and Abu Dhabi. The country's emphasis on sustainability and innovation aligns well with the features of modular flooring, such as recyclability, acoustic control, and thermal efficiency. Expo City Dubai and several free zone developments continue to fuel demand. Consumer preference for high-end, customizable finishes is also encouraging imports of advanced flooring products.

The modular flooring market in Egypt is expanding due to rising infrastructure development and urban housing projects under Egypt Vision 2030. Government-driven residential and industrial parks in New Cairo and the New Administrative Capital are boosting demand. Although the market is still price-sensitive, increasing awareness about design flexibility and installation benefits is shifting preference from traditional tiles to modular options, especially in educational and institutional buildings.

The Qatar modular flooring market focuses on enhancing infrastructure ahead of global events, such as the 2030 Asian Games and other tourism initiatives, which are positively impacting the modular flooring market. The country’s commercial real estate development, particularly in hospitality, retail, and office spaces, is seeing rising adoption of carpet tiles and LVT. Sustainability goals under Qatar National Vision 2030 are also encouraging the use of eco-friendly and durable modular flooring materials.

The modular flooring market in Kuwait is supported by increasing renovation activities in the public and private sectors. Educational institutions, hospitals, and administrative buildings are transitioning towards modular flooring due to its resilience and lower life-cycle cost. Though still at an early growth stage compared to the UAE and Saudi Arabia, Kuwait's modular flooring market is receiving attention from international brands looking to expand in smaller but high-potential Gulf markets.

Key Middle East Modular Flooring Company Insights

Some of the key players operating in the market include Floorworld LLC, Tarkett Middle East LLC

-

Based in the UAE, Floorworld LLC is one of the region’s largest flooring suppliers, specializing in modular flooring solutions like luxury vinyl tiles (LVT), engineered wood, and carpet tiles. The company serves both residential and commercial sectors and is known for its wide range of customizable, durable, and easy-to-install flooring options.

-

Tarkett is a global leader in innovative flooring and sports surface solutions. Through its Middle East operations, the company offers modular flooring options such as carpet tiles, LVT, linoleum, and vinyl flooring. Tarkett focuses on sustainability, product circularity, and catering to sectors like healthcare, education, and hospitality.

Interface, Inc. and Flowcrete Group Ltd. are some of the emerging market participants in the modular flooring industry.

-

Interface is a U.S.-based modular flooring company with a strong presence in the Middle East via regional distributors. It is best known for its environmentally friendly carpet tiles and resilient flooring solutions. Interface emphasizes design flexibility and sustainability, targeting commercial spaces including offices, retail, and hospitality.

-

Flowcrete specializes in industrial and commercial resin flooring systems, including modular solutions for heavy-duty applications. Active in the Middle East and Africa, the company serves sectors like food processing, manufacturing, and pharmaceuticals. Flowcrete is known for durable, hygienic, and chemical-resistant flooring options.

Key Middle East Modular Flooring Companies:

- Floorworld LLC

- Al Aqili Furnishings

- Interface, Inc.

- Tarkett Middle East LLC

- Nordic Homeworx

- Zayaanco

- Flowcrete Group Ltd.

- Gerflor Group

- Saudi Industrial Flooring Co.

- Cape Industrial Flooring

Recent Developments

-

In July 2024, Interface officially launched two new collections in the Middle East: Etched & Threaded carpet tiles and Earthen Forms LVT.

-

In August 2025, Flowcrete Middle East unveiled its Expressions creative flooring range, a polyurethane-based collection available in 20 unique finishes. These include marbled, solid, and metallic-style tones.

Middle East Modular Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.03 billion

Revenue forecast in 2033

USD 4.06 billion

Growth rate

CAGR of 3.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Egypt; Qatar; Kuwait

Key companies profiled

Floorworld LLC; Al Aqili Furnishings; Interface, Inc.; Tarkett Middle East LLC; Nordic Homeworx; Zayaanco; Flowcrete Group Ltd.; Gerflor Group; Saudi Industrial Flooring Co.; Cape Industrial Flooring

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Modular Flooring Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East modular flooring market report based on the product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flexible LVT

-

Rigid LVT

-

Carpet Tile

-

Rubber Flooring

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East modular flooring market size was estimated at USD 2.92 billion in 2024 and is expected to reach USD 3.03 billion in 2025.

b. The Middle East modular flooring market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2033 to reach USD 4.06 billion by 2033.

b. The carpet tile segment held the highest revenue market share of 43.8% in 2024, largely due to its strong uptake in commercial offices, airports, educational institutions, and hospitality spaces.

b. Some of the key players operating in the Middle East modular flooring market include Floorworld LLC, Al Aqili Furnishings, Interface, Inc., Tarkett Middle East LLC, Nordic Homeworx, Zayaanco, Flowcrete Group Ltd., Gerflor Group, Saudi Industrial Flooring Co., and Cape Industrial Flooring.

b. Key factors driving the Middle East modular flooring market include rapid urbanization, growth in commercial construction, demand for quick-installation solutions, and increasing preference for sustainable and low-maintenance flooring

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.