- Home

- »

- Advanced Interior Materials

- »

-

Middle East Pumps Market Size, Share, Industry Report 2033GVR Report cover

![Middle East Pumps Market Size, Share & Trends Report]()

Middle East Pumps Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Centrifugal Pump, Positive Displacement Pump), By End Use (Agriculture, Water & Wastewater, Oil & Gas, Mining), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-738-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Pumps Market Summary

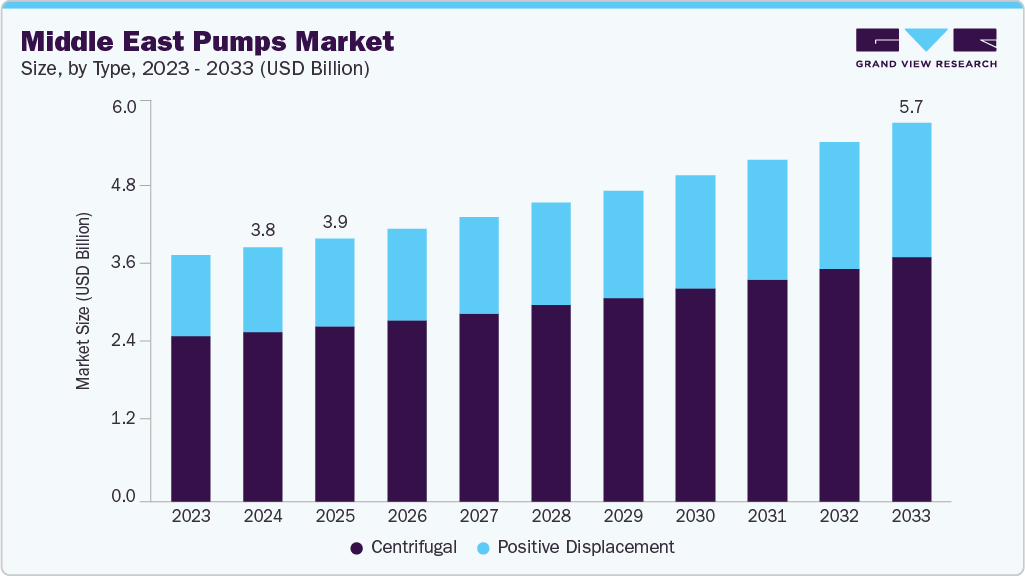

The Middle East pumps market size was estimated at USD 3,816.6 million in 2024 and is projected to reach USD 5,681.5 million by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The Middle East pumps industry is witnessing strong growth due to large-scale infrastructure projects across the region.

Key Market Trends & Insights

- Saudi Arabia dominates the Middle East pumps market with the largest revenue share of 38.9% in 2024.

- By type, the positive displacement segment is expected to grow at the fastest CAGR of 5.5% from 2025 to 2033.

- By end use, the water and wastewater segment is expected to grow at the fastest CAGR of 6.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3,816.6 Million

- 2033 Projected Market Size: USD 5,681.5 Million

- CAGR (2025-2033): 4.7%

Nations like Saudi Arabia, the UAE, and Qatar are heavily investing in urban development, transportation, and industrial facilities. The oil and gas industry continues to be a major driver for the pumps market in the Middle East. With abundant reserves in countries such as Saudi Arabia, the UAE, and Qatar, there is strong demand for pumps used in extraction, refining, and transportation processes.

Recent projects, including refinery expansions in Bahrain and LNG developments in the UAE, highlight continued investments in energy infrastructure. These developments fuel the requirement for specialized and high-performance pumping equipment.

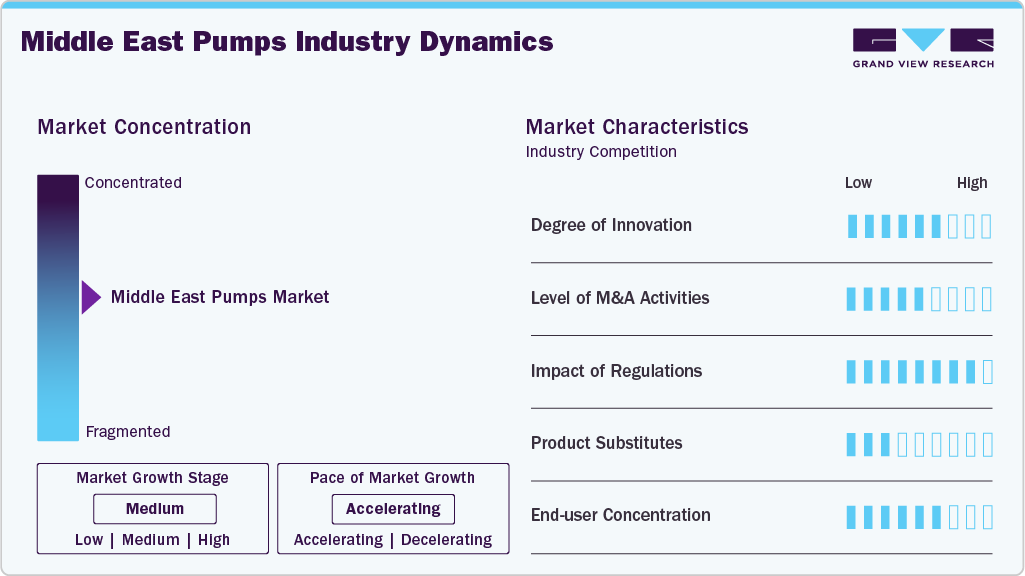

Market Concentration & Characteristics

The Middle East pumps industry is relatively concentrated, with a few global and regional players dominating key segments. Leading manufacturers from Europe, the U.S., and Asia supply advanced pumps for sectors like oil & gas, water treatment, and infrastructure projects. Local companies also participate but often rely on partnerships or distributorships with established international brands. This concentration allows major players to leverage technological expertise and strong client networks to maintain a competitive edge in the region.

The Middle East pumps industry shows moderate innovation, driven primarily by the need for energy-efficient and corrosion-resistant solutions. Companies are introducing advanced pump designs for desalination, wastewater treatment, and oil & gas applications. Smart pumping systems with automation and IoT integration are gradually gaining traction. Innovation is particularly encouraged in nations like Saudi Arabia and the UAE, where sustainability and operational efficiency are high priorities.

Mergers and acquisitions in the Middle East pump market are relatively selective, often aimed at expanding technological capabilities or regional presence. Global players sometimes acquire local distributors or form joint ventures to strengthen market access. Key deals are observed in the oil & gas and water infrastructure segments. These M&A activities help companies consolidate market share and offer integrated solutions to large-scale projects.

Regulatory frameworks in the Middle East strongly influence pump usage, especially in water, energy, and industrial sectors. Standards for energy efficiency, environmental compliance, and safety drive manufacturers to upgrade designs and performance. Governments in Saudi Arabia, the UAE, and Qatar are promoting sustainable practices, encouraging the adoption of advanced pumping solutions. Strict compliance requirements also create entry barriers for smaller, less-equipped players.

Drivers, Opportunities & Restraints

Rapid infrastructure development across the Middle East is a key driver for the pumps market. Urbanization, industrial expansion, and large-scale construction projects increase demand for pumping solutions. The oil & gas sector further fuels growth through extraction, refining, and transportation needs. Additionally, the expansion of desalination and wastewater treatment plants supports long-term market demand.

There are significant opportunities in smart and energy-efficient pumping technologies in the region. Governments in Saudi Arabia, UAE, and Qatar are investing in sustainable water and energy projects. Growing industrial diversification beyond oil, such as chemicals and food processing, creates new applications for advanced pumps. Partnerships, joint ventures, and local manufacturing can help companies tap into emerging markets.

High initial investment costs for advanced pumping systems can limit adoption, especially among smaller firms. Fluctuating oil prices may impact industrial spending and project financing. Stringent regulatory standards require continuous product upgrades and compliance efforts. Moreover, competition from low-cost local and regional manufacturers can pressure profit margins for global players.

Type Insights

The demand for the positive displacement pump segment is expected to grow at the fastest CAGR of 5.5% from 2025 to 2033. The centrifugal pumps segment led the market with the largest revenue share of 66.7% in 2024, due to their efficiency in handling large volumes of water and industrial fluids. They are widely used in desalination plants, municipal water supply, and oil & gas operations. Countries like Saudi Arabia, the UAE, and Qatar heavily rely on these pumps for large-scale infrastructure projects. Their simple design, low maintenance, and scalability make them the preferred choice across multiple sectors.

The positive displacement pumps segment is projected to grow at the fastest CAGR during the forecast period, driven by increasing demand in the oil, gas, and chemical industries. These pumps are ideal for handling viscous fluids, slurries, and high-pressure applications, common in regional industrial processes. Technological advancements, including smart and energy-efficient designs, are accelerating adoption. Growth is particularly strong in the UAE and Saudi Arabia, where specialized industrial projects require precise and reliable pumping solutions.

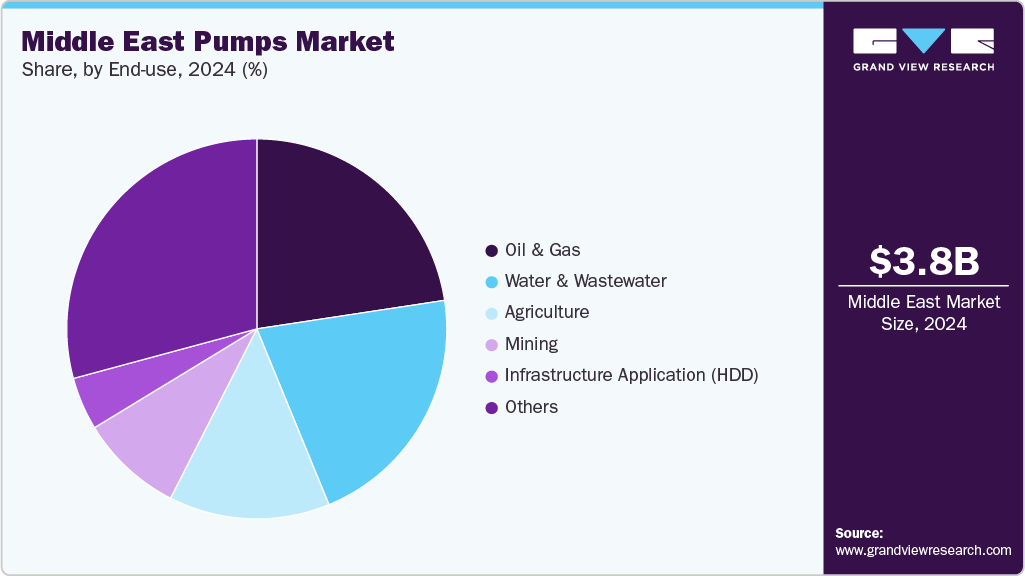

End Use Insights

The water and wastewater segment is expected to grow at the fastest CAGR of 6.1% from 2025 to 2033. The oil and gas sector segment led the market with the largest revenue share of 22.6% in 2024, due to the region’s vast hydrocarbon reserves. Pumps are critical in extraction, refining, and transportation processes, ensuring operational efficiency and safety. Countries like Saudi Arabia, the UAE, and Qatar heavily invest in advanced pumping systems for upstream and downstream operations. The dominance of this sector sustains high demand for both centrifugal and positive displacement pumps.

The water and wastewater segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing urbanization and water scarcity. Governments are expanding desalination, wastewater treatment, and recycling infrastructure in countries like Saudi Arabia, UAE, and Oman. Advanced pumps are required for efficient water distribution, treatment, and sludge handling. Rising awareness of sustainable water management is accelerating the adoption of innovative and energy-efficient pumping solutions.

Regional Insights

Saudi Arabia Middle East Pumps Market Trends

Saudi Arabia dominates the Middle East pumps market with the largest revenue share of 38.9% in 2024, due to its large-scale industrial, oil & gas, and infrastructure projects. The country’s extensive investments in refineries, petrochemical complexes, and desalination plants drive strong demand for advanced pumping systems. National initiatives like Vision 2030 support modernization and water management projects, further boosting the market. The presence of both international and local pump suppliers strengthens Saudi Arabia’s leadership in the regional market.

UAE Middle East Pumps Market Trends

The Middle East pumps market in the UAE is experiencing rapid growth in the pump market, fueled by urbanization, tourism, and industrial diversification. Expansions in water infrastructure, wastewater treatment, and renewable energy projects increase the adoption of efficient pumping solutions. Dubai and Abu Dhabi are key hubs for smart city and infrastructure initiatives that require reliable pumping systems. Continuous government support and private sector investments make the UAE a fast-growing market for pumps.

Key Middle East Pumps Company Insight

Some of the key players operating in the Middle East pumps industry include Ingersoll Rand, SLB, and Pentair

-

SLB plays a significant role in the Middle East pumps industry, supplying specialized pumping solutions for oil & gas and industrial applications. Its pumps are widely used in upstream and downstream operations, including extraction, refining, and transportation of hydrocarbons. The company integrates digital solutions and AI-driven monitoring to enhance pump efficiency and reliability in harsh environments. Regional projects in the UAE, Saudi Arabia, and Kuwait rely on SLB’s high-performance pumps for large-scale energy infrastructure. Strategic partnerships with Aramco and other regional operators reinforce their leadership in advanced pumping technologies.

-

Ingersoll Rand contributes to the Middle East pumps industry by providing industrial and process pumps for water, chemical, and oil & gas sectors. Its portfolio includes high-efficiency centrifugal and positive displacement pumps suited for demanding regional applications. The company focuses on energy-efficient designs and smart monitoring systems to optimize pump performance in large-scale projects. Ingersoll Rand’s brands, such as Gardner Denver and CompAir, are widely adopted across industrial plants and infrastructure projects in the UAE and Saudi Arabia. Mergers and regional partnerships have strengthened their capability to deliver tailored pumping solutions for the Middle East industry.

Key Middle East Pumps Companies:

- SLB

- Ingersoll Rand

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation.

- ITT INC.

- Sulzer Ltd

- EBARA CORPORATION.

Recent Developments

-

In February 2025, Sulzer strengthened its presence in the Middle East through the acquisition of Bahrain-based electromechanical services firm Davies and Mills. Completed in January 2025, this deal adds a sixth service center to Sulzer’s regional network. The new facility provides maintenance and repair services for pumps, motors, and other rotating equipment. With 53 additional employees, Sulzer enhances its service capabilities across Bahrain and Saudi Arabia, reinforcing its leadership in electromechanical solutions.

-

In July 2024, Flowserve Corporation obtained the intellectual assets and ongoing research and development associated with cryogenic Liquefied Natural Gas (LNG) submerged pump technology, packaging, and systems from NexGen Cryogenic Solutions, Inc., a company based in Arizona that specializes in the design, engineering, and testing of LNG pumps and turbines.

-

In October 2024, Ingersoll Rand expanded its portfolio by acquiring APSCO, Blutek, and UT Pumps, strengthening its presence in compressed air and fluid management. These acquisitions enhance its technological capabilities and market reach across key sectors like wastewater and biogas. The move aligns with the company’s strategy to drive long-term, high-return growth through targeted investments.

Middle East Pumps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,942.4 million

Revenue forecast in 2033

USD 5,681.5 million

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, end use

Region Scope

Middle East

Country scope

Saudi Arabia; UAE; Oman; Israel; Kuwait; Qatar

Key companies profiled

SLB; Ingersoll Rand; KSB SE & Co. KGaA; Pentair; Grundfos Holding A/S; Xylem; Flowserve Corporation; ITT INC.; EBARA CORPORATION; Sulzer Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East pumps market report based on type, end use and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Centrifugal Pumps

-

Centrifugal Pumps By Configuration

-

Single Stage

-

Multistage

-

-

Centrifugal Pumps By Design

-

Radial Flow Pump

-

Mixed Flow Pump

-

Axial Flow Pump

-

-

-

Positive Displacement Pump

-

Rotary Pump By Type

-

Gear Pump

-

Screw Pump

-

Vane Pump

-

Lobe Pump

-

Others

-

-

Reciprocating Pump By Type

-

Diaphragm Pump

-

Piston Pump

-

Plunger Pump

-

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Agriculture

-

Water & Wastewater

-

Mining

-

Oil & Gas

-

Infrastructure Application (HDD)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Israel

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East pumps market size was estimated at USD 3,816.6 million in 2024 and is expected to reach USD 3,942.4 million in 2025.

b. The Middle East pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 and reach USD 5,681.5 million by 2033.

b. Centrifugal pumps hold the largest market and accounted for 66.7% share, due to their efficiency in handling large volumes of water and industrial fluids. They are widely used in desalination plants, municipal water supply, and oil & gas operations. Countries like Saudi Arabia, UAE, and Qatar heavily rely on these pumps for large-scale infrastructure projects.

b. Some of the key players operating in the Middle East pumps market include SLB, Ingersoll Rand, KSB SE & Co. KGaA, Pentair, Grundfos Holding A/S, Xylem, Flowserve Corporation, ITT INC., EBARA CORPORATION., Sulzer Ltd.

b. The Middle East pumps market is primarily driven by rapid infrastructure development, including urbanization, industrial expansion, and large-scale water and wastewater projects. Strong demand from the oil & gas sector further fuels the need for advanced pumping solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.