- Home

- »

- Advanced Interior Materials

- »

-

Middle East Refractories Market Size, Industry Report, 2033GVR Report cover

![Middle East Refractories Market Size, Share & Trends Report]()

Middle East Refractories Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Iron & Steel, Cement & Lime, Glass & Ceramics, Non-Ferrous Metals), By Country (Oman, Qatar, Saudi Arabia, UAE), And Segment Forecasts

- Report ID: GVR-4-68040-734-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Refractories Market Summary

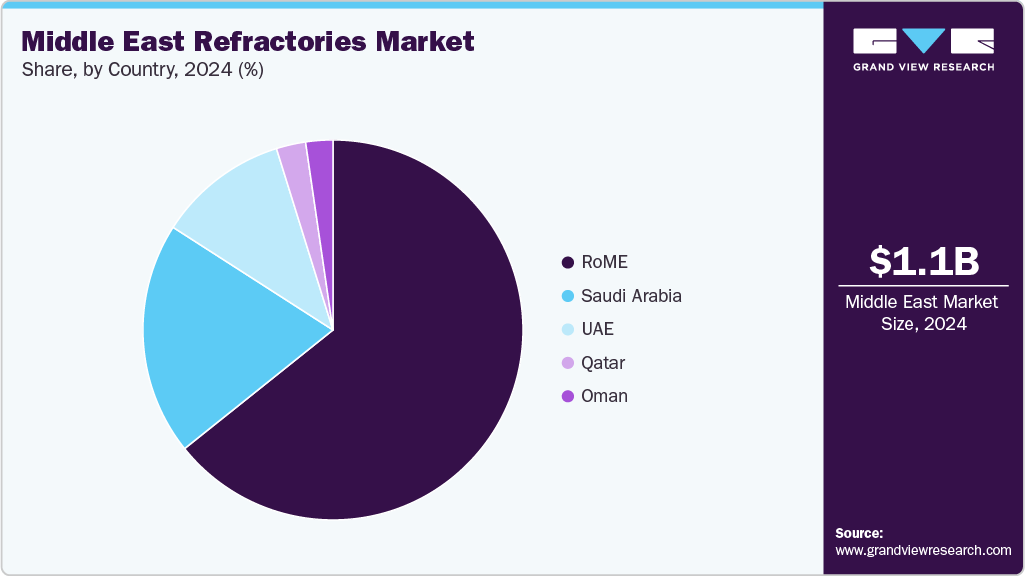

The Middle East refractories market size was valued at USD 1.11 billion in 2024 and is projected to reach USD 1.84 billion by 2033, growing at a CAGR of 5.9% from 2025 to 2033. Steel and cement capacity additions are the primary engine for refractory demand in the Middle East.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East refractories market with the largest revenue share of 19.8%.

- By end use, iron & steel accounted for the largest revenue share of over 64.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.11 Billion

- 2033 Projected Market Size: USD 1.84 Billion

- CAGR (2025-2033): 5.9%

New electric arc furnaces and direct reduced iron modules tied to national industrial programs are expanding hot metal throughput, which raises needs across ladles, continuous casting, and reheating. As utilization rises, cement kilns serving housing, logistics parks, and hospitality projects require frequent lining and kiln hood upgrades. Each round of maintenance and relining sustains steady consumption even when greenfield activity pauses.

Large aluminum smelters in the Gulf and copper and other alloy projects rely on high-alumina and carbon-containing refractories for pots, anode baking furnaces, cast houses, and furnaces handling aggressive slags. Debottlenecking and efficiency projects in smelters lift demand for longer campaign life products and precise installation services. Downstream rolling and extrusion lines also need reliable thermal linings for homogenizing and heat treatment.

Energy and chemicals projects create a deep base of high-temperature applications. Hydrogen and ammonia programs, gas processing, catalytic crackers, steam reformers, sulfur recovery, and fired heaters depend on shaped and monolithic refractories with tight thermal shock and corrosion resistance. As operators chase higher thermal efficiency, they shift toward lighter insulating linings and engineered monolithics that cut heat loss and fuel consumption. Turnarounds across refineries and petrochemical complexes generate predictable spikes in orders for specialized bricks, castables, and gunning mixes.

Megaprojects and infrastructure plans across Saudi Arabia, the UAE, Qatar, and Oman stimulate glass, lime, and ceramics output, which multiplies refractory needs. Float glass, container glass, and fiberglass furnaces require silica, zircon, and aluminosilicate products with strict purity and dimensional control. New water, power, and waste-to-energy assets contribute with boilers, incinerators, and flue systems that must be lined for reliability and safety. The cumulative effect is a broadening customer base that values local inventory, rapid installation, and technical support.

Regional stocking hubs, basic brick finishing, and refractory recycling are gaining traction as buyers seek security of supply and lower total cost of ownership. Digital monitoring of shell temperatures and predictive maintenance lengthen campaign life and reduce unplanned downtime, which raises willingness to invest in premium materials. Environmental rules and corporate decarbonization targets favor low cement castables, low iron compositions, and products with longer service life, keeping value growth healthy even where volumes are steady.

Drivers, Opportunities & Restraints

National development plans are spurring the construction of new plants, the expansion of existing production lines, and large-scale infrastructure projects. These activities require consistent use of refractories in kilns, furnaces, ladles, and reactors, ensuring steady consumption. Energy transition initiatives, including hydrogen and ammonia projects, are further adding new high-temperature applications that enhance demand for advanced refractory solutions.

Regional governments encourage domestic manufacturing to reduce reliance on imports, creating scope for local producers and service providers to establish themselves. Growing preference for energy-efficient and long-lasting refractory products opens avenues for suppliers offering high-performance castables, insulating linings, and digital monitoring systems. Recycling and circular economy practices present additional potential, as industries increasingly value environmentally responsible solutions and reduced waste handling costs.

Price fluctuations in key raw materials such as bauxite, magnesite, and zircon often strain procurement strategies. Moreover, downtime in large smelters or steel plants during downturns can sharply reduce consumption volumes, impacting market stability.

End Use Insights

Iron & steel held the revenue share of 64.6% in 2024. The iron and steel segment is a central growth driver for the Middle East refractories industry, supported by rising investments in steelmaking capacity to meet domestic infrastructure and export requirements. Countries such as Saudi Arabia and the UAE are commissioning new electric arc furnaces, direct reduced iron plants, and continuous casting facilities under industrial diversification programs. These units rely heavily on refractory linings for blast, ladles, tundishes, and reheat furnaces. As utilization rates climb, regular relining cycles and maintenance sustain recurring demand, making steel production one of the most reliable sources of refractory consumption.

The glass and ceramics segment is anticipated to register the fastest CAGR over the forecast period, driven by expanding construction, packaging, and consumer goods demand. Float glass, container glass, and fiberglass production facilities require high-purity refractories with excellent thermal shock resistance and chemical stability to withstand continuous operation at elevated temperatures. Similarly, ceramic tile and sanitaryware plants, which are growing in response to regional housing and infrastructure projects, rely on kilns and furnaces lined with specialized refractory products. The scale of these industries is rising in tandem with mega urban development plans, ensuring a steady pipeline of refractory requirements.

Country Insights

Saudi Arabia Refractories Market Trends

Saudi Arabia accounted for the largest revenue share of 19.8% in 2024. The growth of the refractories market in Saudi Arabia is strongly driven by large-scale investments in steel, cement, and nonferrous metals under the country’s Vision 2030 industrial diversification agenda. Expansions in electric arc furnaces, direct reduced iron plants, and cement kilns tied to infrastructure megaprojects such as NEOM and the Red Sea Development Project are generating significant demand for high-performance refractories. These facilities require consistent maintenance, relining, and advanced refractory solutions for furnaces, ladles, kilns, and reactors, ensuring recurring consumption alongside capacity addition.

UAE Refractories Market Trends

The refractories market in the UAE is witnessing growth fueled by robust investments in construction, infrastructure, and downstream industries. Steelmaking capacity expansions to support high-rise buildings, transport networks, and free zone developments are a major driver, as electric arc furnaces and continuous casting units depend heavily on refractory linings. Cement production is also scaling up to meet the requirements of housing and hospitality projects, sustaining steady demand for kiln linings and related refractory products.

Key Middle East Refractories Companies Insights

Key players operating in the Middle East refractories market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Refractories Companies:

- Al Karawan Group of Companies

- Almatis

- Industrial Ceramics Middle East (ICLME)

- Isolite Insulating Products

- Luyang Energy Saving Materials

- Pennekamp Middle East LLC

- Rath Group

- Saint Gobain

- Unifrax

Recent Developments

- In August 2025, DGC Refractories announced a major expansion of its regional operations by establishing DGC Petrocare Arabia LLC in the Kingdom of Saudi Arabia. This strategic move enables DGC to offer its full-service supply of premium-shaped refractory materials and technical consultation across the Middle East’s key industrial sectors, particularly alumina refining and petrochemical production, where advanced thermal performance and material durability are essential to operational success.

Middle East Refractories Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.16 billion

Revenue forecast in 2033

USD 1.84 billion

Growth rate

CAGR of 5.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, countries

Regional scope

Middle East

Country scope

Oman; UAE; Saudi Arabia; Qatar; RoME

Key companies profiled

Almatis; Industrial Ceramics Middle East (ICLME); Al Karawan Group of Companies; Pennekamp Middle East LLC; Saint Gobain; Rath Group; Unifrax; Isolite Insulating Products; Luyang Energy Saving Materials

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Refractories Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East refractories market report on the basis of end use and country:

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Iron & Steel

-

Cement & Lime

-

Glass & Ceramics

-

Non-Ferrous Metals

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Oman

-

Qatar

-

Saudi Arabia

-

UAE

-

RoME

-

-

Frequently Asked Questions About This Report

b. The Middle East refractories market size was estimated at USD 1.11 billion in 2024 and is expected to reach USD 1.16 billion in 2025.

b. The Middle East refractories market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 1.84 billion by 2033.

b. The iron & steel segment dominated the market with a revenue share of 64.6% in 2024.

b. Some of the key players of the Middle East refractories market are Almatis, Industrial Ceramics Middle East (ICLME), Al Karawan Group of Companies, Pennekamp Middle East LLC, Saint Gobain, Rath Group, Unifrax, Isolite Insulating Products, Luyang Energy Saving Materials, and others.

b. The rising demand from the steel, cement, and glass industries drives the Middle East refractories market's growth. Increasing infrastructure development and industrialization across emerging economies further support this growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.