- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Returnable Packaging Market Size Report, 2033GVR Report cover

![Middle East Returnable Packaging Market Size, Share & Trends Report]()

Middle East Returnable Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Wood), By Product Type (Pallets, Crates, IBCs, Drums & Barrels, Dunnage), By End Use (Food & Beverage, Automotive, Consumer Durables, Healthcare), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-761-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Returnable Packaging Market Summary

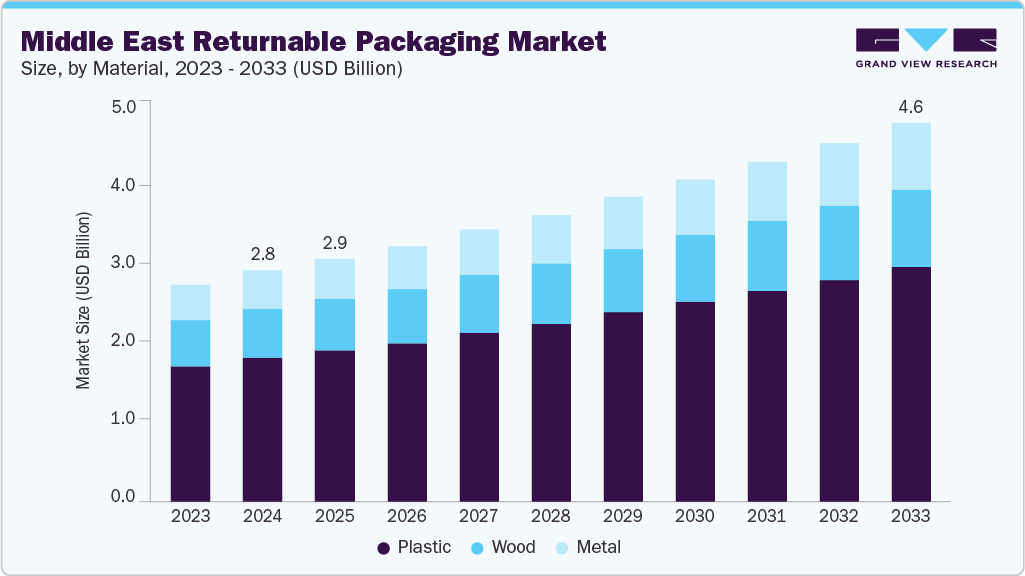

The Middle East returnable packaging market size was estimated at USD 2.78 billion in 2024 and is projected to reach USD 4.56 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Growing consumer awareness around sustainability is pushing companies in the Middle East to adopt returnable packaging, as it reduces waste and aligns with environmental commitments. This trend also helps businesses strengthen brand reputation and customer loyalty.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East returnable packaging market with the largest revenue share of 37.88% in 2024.

- The Middle East returnable packaging market in Saudi Arabia is expected to grow at a substantial CAGR of 6.1% from 2025 to 2033.

- By material, the metal segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033 in terms of revenue.

- By product type, the IBCs segment is expected to grow at a considerable CAGR of 6.8% from 2025 to 2033 in terms of revenue.

- By end use, the healthcare segment is expected to grow at a considerable CAGR of 6.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2.78 Billion

- 2033 Projected Market Size: USD 4.56 Billion

- CAGR (2025-2033): 5.7%

- Saudi Arabia: Largest market in 2024

The Middle East market is moving from one-way disposables toward closed loop packaging driven by national circular economy agendas and retailer commitments to reduce waste. Large-scale logistics and petrochemical investments are catalyzing pilots and commercial rollouts of durable returnable transport items, while digital traceability and sensor-enabled monitoring are maturing to support asset tracking and utilization analytics. This transition is pragmatic and industry led, blending sustainability goals with operational efficiency.Drivers, Opportunities & Restraints

Commercial pressure to cut total cost of goods movement and to improve supply chain resilience is a primary commercial driver for returnable packaging adoption. Key sectors such as food processing, fast moving consumer goods and industrial manufacturing face recurrent transit and handling costs that favor reusable assets, and regional infrastructure upgrades make reverse logistics more feasible. Policy nudges, such as extended producer responsibility and national sustainability roadmaps, strengthen corporate procurement decisions.

There is a clear opportunity to scale pooled service models where third party providers supply, manage and refurbish pooled returnable packaging as a service to retailers and manufacturers. E-commerce and cross border trade expansion create predictable, high frequency flows that benefit from standardised returnable trays and crates, and digital platforms can monetise visibility by optimising cycle times and redeployment. Localising repair and remanufacturing hubs can further lower lifecycle cost and generate new logistics and circular-economy business lines.

Broader adoption is constrained by significant upfront capital requirements for durable assets and the need for interoperable standards across countries and trading partners, which raises coordination and compliance costs. Reverse logistics in a region with long distances and variable customs or waste rules increases collection complexity, while sector specific hygiene and regulatory concerns, particularly in food and pharma, add cleaning and certification burdens that erode short term economic advantages. Raw material price volatility and limited secondary markets for end of life components further increase perceived risk.

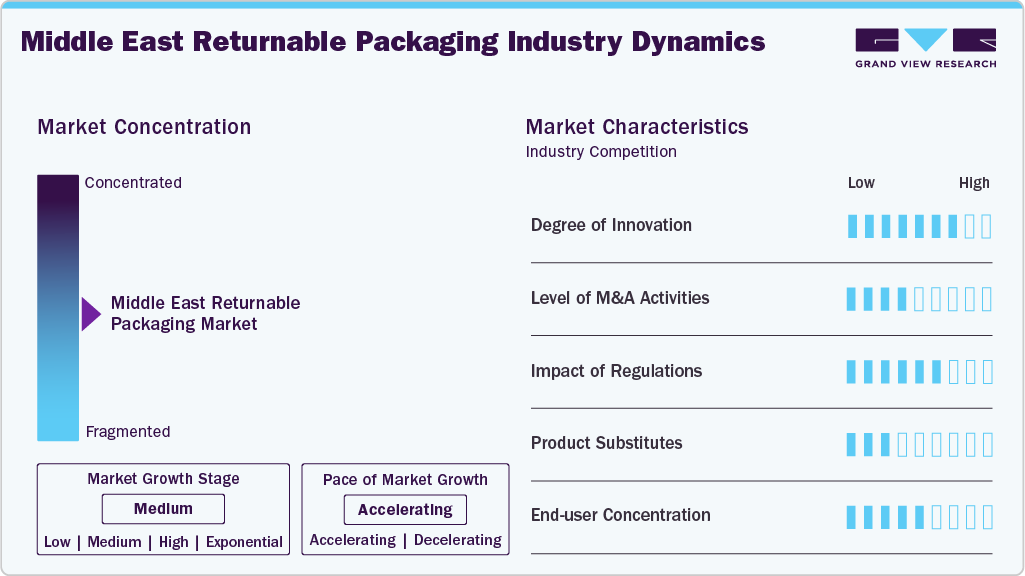

Market Concentration & Characteristics

The market growth stage of the Middle East returnable packaging market is medium, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like IFCO, Nilkamal Limited, TMF Corporation, Premier Handling Solutions, Robinson Industries, IGPS, Fibertech Plastics, Tosca, Monoflo International, ORBIS, and others significantly shape the market dynamics. These leading players often drive innovation, introducing new products, technologies, and applications to meet evolving industry demands.

The presence of single-use and disposable packaging remains a competitive challenge for the Middle East returnable packaging market. Lightweight cardboard, corrugated containers, and conventional plastic wraps offer lower upfront costs and ease of use, particularly for short transit or low-value goods. However, companies increasingly weigh total lifecycle costs and environmental impact, which is gradually shifting preference toward durable, reusable solutions despite the initial investment.

Regulatory frameworks promoting sustainability and waste reduction are shaping the adoption of returnable packaging in the Middle East. National circular economy strategies, extended producer responsibility mandates, and sector-specific hygiene regulations encourage businesses to implement reusable systems. Compliance with these evolving standards not only mitigates legal risks but also enhances corporate ESG credentials, positioning returnable packaging as both a regulatory and strategic advantage.

Material Insights

Plastic segment dominated the Middle East returnable packaging market, accounting for a revenue share of 62.33% in 2024, and is forecasted to grow at a 5.7% CAGR from 2025 to 2033. The adoption of plastic returnable packaging in the Middle East is being driven by its lightweight, durable, and corrosion-resistant characteristics, which reduce handling costs and damage rates in transit. Increasing demand from fast-moving consumer goods and e-commerce sectors encourages companies to invest in standardized plastic crates and bins, which can be easily cleaned and reused multiple times. This flexibility makes plastic solutions a preferred choice for cost-conscious supply chains.

The metal segment is anticipated to grow at a the fastest CAGR of 6.5% over the forecast period. Metal returnable packaging is gaining traction due to its high strength and ability to protect sensitive industrial goods during long-haul transport. Sectors such as automotive and heavy machinery rely on robust metal containers to ensure safe delivery of parts across regional and international logistics networks. The durability of metal packaging also aligns with corporate sustainability initiatives by extending asset lifecycle and reducing the need for frequent replacements.

Product Type Insights

Pallets segment dominated the Middle East returnable packaging market, accounting for a revenue share of 56.51% in 2024, and are forecasted to grow at a 5.5% CAGR from 2025 to 2033. Pallets are increasingly becoming a strategic asset in the Middle East returnable packaging market as companies seek standardized solutions for efficient warehouse handling and transportation. Their compatibility with automated material handling systems and forklifts drives operational efficiency, while reusable pallets help businesses reduce procurement costs and environmental footprint. Growing industrial consolidation and cross-border trade amplify the need for durable, returnable pallet solutions.

The IBCs segment is anticipated to grow at a substantial CAGR of 6.8% over the forecast period. Intermediate bulk containers (IBCs) are seeing strong adoption due to the rising volume of liquid and bulk product distribution in sectors such as chemicals, oils, and food ingredients. Their stackability, modularity, and leak-proof design allow manufacturers to optimize storage and reduce transport costs. Regulatory compliance for safe handling of hazardous and consumable liquids further positions IBCs as a reliable, reusable packaging choice.

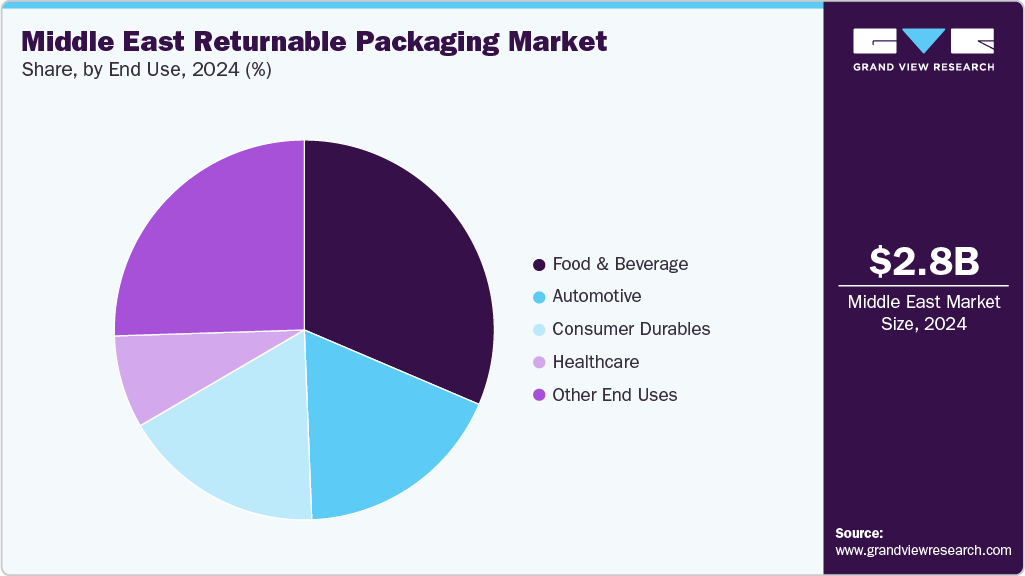

End Use Insights

Food & beverage segment led the Middle East returnable packaging market, accounting for a revenue share of 34.12% in 2024 and is expected to grow at a CAGR of 5.7% through the forecast period. Returnable packaging is increasingly critical for the food and beverage sector as companies prioritize hygiene, freshness, and cost efficiency in supply chains. Reusable crates, trays, and containers facilitate safe transport from processing plants to retailers while minimizing waste. Rising consumer demand for sustainable packaging also encourages food and beverage companies to integrate returnable solutions into distribution networks.

The healthcare segment is expected to expand at a substantial CAGR of 6.7% over the forecast period. In the healthcare sector, returnable packaging adoption is driven by strict regulatory standards for sterilization, safety, and contamination control. Hospitals, laboratories, and pharmaceutical distributors increasingly rely on reusable containers and trays to transport medical instruments, vials, and sensitive supplies efficiently. The combination of operational cost savings and adherence to hygiene protocols makes returnable solutions an essential component of modern healthcare logistics.

Country Insights

Saudi Arabia returnable packaging market held the largest share of 37.88% in terms of revenue in 2024 and is expected to grow at the fastest CAGR of 6.1% over the forecast period. In Saudi Arabia, returnable packaging adoption is being propelled by large-scale industrial growth and the government’s strong push toward sustainability under Vision 2030. Expanding FMCG and food processing sectors are increasingly seeking cost-efficient, durable packaging solutions to manage long-distance distribution across the Kingdom’s vast geography. Investments in modern logistics infrastructure, including warehousing and reverse logistics networks, further enable companies to implement closed-loop systems, reducing waste and improving supply chain resilience.

UAE Returnable Packaging Market Trends

The UAE market is driven by its status as a regional trade hub with high import-export volumes, which creates a strong need for standardized, reusable packaging to optimize cross-border logistics. Retailers and e-commerce players are actively adopting returnable solutions to enhance operational efficiency and align with rising consumer expectations for sustainable practices. Government initiatives promoting circular economy practices, alongside investments in smart warehousing and advanced tracking technologies, support the scalability of returnable packaging systems across the country.

Key Middle East Returnable Packaging Company Insights

The Middle East Returnable Packaging Market is highly competitive, with several key players dominating the landscape. Major companies include IFCO, Nilkamal Limited, TMF Corporation, Premier Handling Solutions, Robinson Industries, IGPS, Fibertech Plastics, Tosca, Monoflo International, and ORBIS. The Middle East returnable packaging market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Middle East Returnable Packaging Companies:

- IFCO

- Nilkamal Limited

- TMF Corporation

- Premier Handling Solutions

- Robinson Industries

- IGPS

- Fibertech Plastics

- Tosca

- Monoflo International

- ORBIS

Recent Developments

-

In November 2024, LATAM Cargo Group launched a pioneering initiative in Chile by replacing traditional wooden and conventional plastic pallets with recycled plastic pallets made from beverage boxes. These new pallets, made from 50% recycled and 50% virgin high-density polyethylene (HDPE), were more resistant, durable, and had a lifespan of about 10 years, significantly longer than conventional pallets. This move was part of LATAM’s commitment to achieving zero waste to landfill by 2027 and improving sustainability through circular economy practices.

-

In January 2024, IFCO launched Dora, a reusable plastic pallet designed for the fresh grocery supply chain, across Europe in January 2024. Dora is over 25% lighter than traditional wood pallets, which lowers transportation costs, and it supports dynamic loads up to 1,250 kg. Made from 100% high-quality HDPE, Dora is durable, washable, and more hygienic, with less than 1% damage rate compared to 25% for wood pallets. It fits standard Euro pallet dimensions and integrates smoothly into automated logistics. Dora can be reused up to 10 times more than wood pallets, and damaged pallets are fully recycled within IFCO’s circular pooling system, promoting sustainability and cost efficiency.

Middle East Returnable Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.92 billion

Revenue forecast in 2033

USD 4.56 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Material, product type, , end use, and country

Regional scope

Middle East

Country Scope

Saudi Arabia; UAE; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

IFCO; Nilkamal Limited; TMF Corporation; Premier Handling Solutions; Robinson Industries; IGPS; Fibertech Plastics; Tosca; Monoflo International; ORBIS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Returnable Packaging Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East returnable packaging market report based on material, product type, end use, and country.

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Metal

-

Wood

-

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pallets

-

Crates

-

IBCs

-

Drums & Barrels

-

Dunnage

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Automotive

-

Consumer Durables

-

Healthcare

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The Middle East returnable packaging market size was estimated at USD 2.78 billion in 2024 and is expected to reach USD 2.92 billion in 2025.

b. The Middle East returnable packaging market is expected to grow at a compound annual rate (CAGR) of 5.7% from 2025 to 2033, reaching USD 4.56 billion by 2033.

b. Food & beverage led the Middle East returnable packaging market in terms of revenue, accounting for a market share of 34.12% in 2024 as more companies are prioritizing hygiene, freshness, and cost efficiency in supply chains.

b. Some of the major companies in the Middle East returnable packaging market include IFCO, Nilkamal Limited, TMF Corporation, Premier Handling Solutions, Robinson Industries, IGPS, Fibertech Plastics, Tosca, Monoflo International, and ORBIS

b. The Middle East returnable packaging market is driven by growing consumer awareness around sustainability, which is pushing companies in the region to adopt returnable packaging, as it reduces waste and aligns with environmental commitments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.