- Home

- »

- Medical Devices

- »

-

Middle East Soft Contact Lenses Market Size Report, 2033GVR Report cover

![Middle East Soft Contact Lenses Market Size, Share & Trends Report]()

Middle East Soft Contact Lenses Market (2025 - 2033) Size, Share & Trends Analysis Report By Usage (Disposable, Traditional), By Application (Corrective, Non-Corrective), By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-758-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Soft Contact Lenses Market Summary

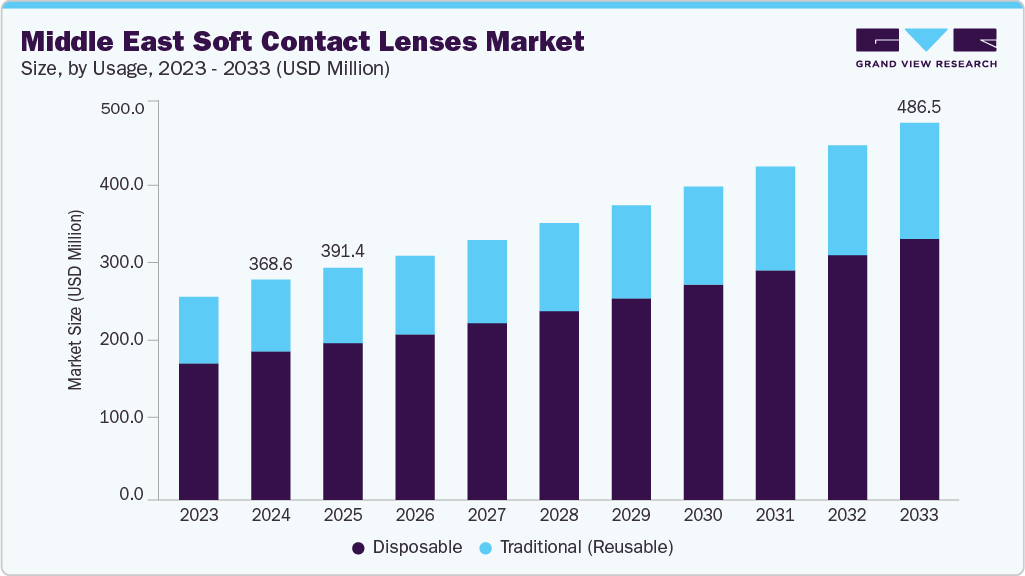

The Middle East soft contact lenses market size was estimated at USD 368.62 million in 2024 and is projected to reach USD 633.29 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The industry is undergoing a significant expansion, driven by a convergence of demographic shifts, evolving consumer preferences, and proactive healthcare initiatives.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East soft contact lenses market with the largest revenue share of 46.5% in 2024.

- The UAE market is expected to grow at a CAGR of 8.1% from 2025 to 2033.

- By usage, the disposable segment is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033.

- By application, the corrective (prescription) segment held the largest revenue share of 81.4% in 2024.

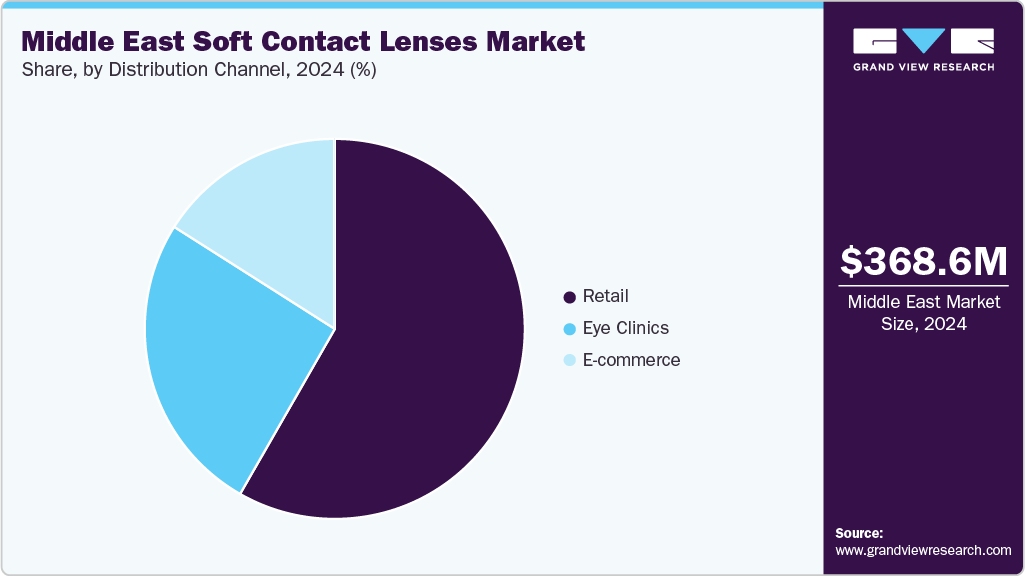

- By distribution channel, the retail segment held the largest revenue share of 58.3% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 368.62 Million

- 2033 Projected Market Size: USD 633.29 Million

- CAGR (2025-2033): 6.2%

- Saudi Arabia: Largest market in 2024

- UAE: Fastest-growing country from 2025 to 2033

A primary driver is the rising prevalence of vision disorders such as myopia, hyperopia, astigmatism, and presbyopia, which is increasing the demand for corrective vision solutions. In addition, the market is heavily influenced by a strong consumer preference for cosmetic and colored lenses, which are widely viewed as fashion accessories. This trend is particularly prominent among the younger population, where rising disposable incomes and the influence of social media play a significant role in purchasing decisions, further fueling the Middle East soft contact lenses industry.Technological innovations and new product developments are key to the market's evolution. There is a growing preference for advanced silicone hydrogel lenses due to their superior oxygen permeability, which enhances comfort and suitability for extended wear.

Regarding government initiatives and partnerships, both public and private sectors actively work to improve eye care. A notable initiative is the Noor Dubai Foundation, a non-profit organization that provides therapeutic, preventative, and educational programs to combat vision impairment in developing countries. In May 2024, Alcon inaugurated its Middle Eastern region headquarters in Jeddah and also announced a partnership with the Saudi Society of Optometry to educate optometrists and raise vision correction awareness.

Usage Insights

The disposable segment dominated the market with a revenue share of 67.2% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth is driven by increasing consumer demand for convenience and hygiene and a rising prevalence of vision disorders. This segment, which includes daily disposables and other short-term wear lenses, is gaining popularity because these lenses eliminate the need for cleaning and storage, reducing the risk of eye infections and discomfort. Major players continuously innovate to meet this demand. For instance, in June 2025, Johnson & Johnson announced the launch of ACUVUE OASYS MAX 1-Day MULTIFOCAL for ASTIGMATISM, available in the Canada and the U.S. The new daily disposable lens is designed to provide clear and stable vision for patients with astigmatism and presbyopia and offer all-day comfort.

The traditional (reusable) segment is expected to grow on the back of a combination of cost-effectiveness and continuous advancements in material technology. This segment, which includes monthly and bi-weekly lenses, appeals to users who wear contact lenses full-time, as they are often more economical per-use than daily disposables. A key driver is the silicone hydrogel materials, which provide a high level of oxygen permeability, enhancing comfort and allowing for safer extended wear. This has made reusable lenses more appealing for a wider range of patients. Major players such as Alcon, Inc., and CooperVision maintain a strong presence in the region with their well-established reusable lenses, such as Alcon's AIR OPTIX plus HydraGlyde and CooperVision's Biofinity lines. The availability of these products through various optical stores in the region shows a sustained demand for reusable lenses.

Applications Insights

The corrective (prescription) segment held the highest revenue share of 81.4% in 2024. The growth is driven by the rising prevalence of vision disorders, such as myopia, presbyopia, and astigmatism. The increasing diagnosis and awareness of refractive errors have significantly boosted demand for corrective lenses, a convenient and aesthetic alternative to glasses. A key driver is the increasing screen time and near-work activities, which contribute to the rising rates of vision problems, particularly among younger populations. Product expansion has centered on creating more specialized and comfortable lenses for patients, with several companies in the region providing a range of corrective lenses.

The non-corrective (cosmetic/plano) segment is expected to grow at the fastest CAGR over the forecast period. The market is primarily driven by a strong consumer preference for enhancing one's aesthetic appearance. These lenses, widely seen as fashion accessories, are a major draw for the region's younger population, heavily influenced by beauty trends on social media and celebrity endorsements. Unlike corrective lenses, the non-corrective segment faces fewer regulatory hurdles for occasional use. It is more accessible to a broader consumer base, making it a lucrative market for local as well as international brands.

Distribution Channel Insights

The retail segment held the highest revenue share of 58.3% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth is driven by the consumer demand for professional, in-person services. Traditional optical stores and eye care centers are the main points of sale, offering a trusted environment for an experienced eye exam, a proper lens fitting, and personalized consultations with optometrists. This channel is particularly crucial for new users, who require guidance on proper lens handling, hygiene, and care to ensure eye health. Consumers rely on these retailers for immediate product availability and for establishing long-term relationships with a trusted eye care professional. Major optical chains and independent retailers with a strong physical presence in the region include MAGRABi, Al Jaber Optical, Barakat Optical, and Yateem. They operate extensive networks of stores in various locations across the region, providing a wide selection of lenses from international and local brands.

The e-commerce segment in the Middle East industry is expected to grow with the rising consumer demand for convenience, competitive pricing, and a vast selection of products. E-commerce channels provide an easy alternative to traditional retail, allowing consumers to purchase various lenses, from corrective to cosmetic, with the added benefit of home delivery. This shift has been particularly prominent among the younger, digitally native population, who are comfortable with online transactions and seeking deals and promotions. Sales and promotions are a major driver of this fast-moving e-commerce segment, with retailers frequently offering discounts and special deals to attract and retain customers. The prevalence of these sales is fueled by consumer demand for competitive pricing and value.

Common sales strategies include bulk-buy deals, such as "Buy 1, Get 1 Free" and percentage-based discounts of up to 50% off on specific brands or product lines. E-commerce platforms and online retailers that dominate this space, such as Eyewa and Adasat, leverage these strategies effectively. For instance, optical retailer Adasat runs promotions such as "Buy 1 Get 1" on monthly contact lenses. These sales strategies are essential for customer acquisition and regional market expansion.

Country Insights

The Saudi Arabia soft contact lenses industry dominated the market with a revenue share of 46.5% in 2024. The market is transforming significantly, driven by demographic, social, and technological factors. A key trend is the increasing prevalence of vision disorders such as myopia and astigmatism, particularly among a youthful population that is spending more time on digital devices. This has created a growing demand for corrective lenses as a modern and convenient alternative to traditional eyeglasses.

UAE Soft Contact Lenses Market Trends

The soft contact lenses industry in the UAE is expected to grow at the fastest CAGR over the forecast period. The market is dynamic and heavily shaped by the region's high disposable income and strong focus on personal appearance. A key trend is the significant demand for vision correction and cosmetic lenses, which are widely embraced as part of a modern lifestyle. Consumers strongly prefer advanced, high-performance materials such as silicone hydrogel and favor the convenience and hygiene offered by daily disposable lenses.

Kuwait Soft Contact Lenses Market Trends

The Kuwait soft contact lenses industry is experiencing robust expansion and is shaped by the rising incidence of visual conditions such as myopia and hyperopia. The strong preference for silicone hydrogel lenses highlights consumers' desire for comfort and breathability. Hydrogel lenses are also on the rise, appealing to those seeking alternatives. Furthermore, the growing awareness about eye health, alongside the availability of innovative lens materials, is encouraging a shift towards daily and monthly disposable lenses. E-commerce platforms are expanding access, while the popularity of cosmetic and colored lenses is gaining traction, catering to diverse consumer preferences.

Qatar Soft Contact Lens Market Trends

The soft contact lens industry in Qatar is also on a growth trajectory. The combination of high screen exposure and urban living is leading to a greater demand for both functional and aesthetic contact lenses. Daily disposables are particularly favored for their convenience and hygienic benefits, while digital health initiatives and free eye screenings are helping to identify vision problems such as myopia and astigmatism earlier. Online distribution channels are providing wider access to a variety of products, especially among a tech-savvy youth demographic eager for diverse styles and solutions.

Oman Soft Contact Lens Market Trends

The Oman soft contact lenses industry is steadily progressing, fueled by heightened awareness of eye health and an increase in refractive errors among the youth. Lifestyles that prioritize digital device usage are prompting a rise in demand for contact lenses. Disposable lenses are becoming increasingly popular due to their hygienic features and fit with modern, busy lifestyles. While traditional retail and clinics remain key channels, a shift towards e-commerce is beginning to take shape. The appeal of cosmetic lenses among younger consumers aligns with broader regional trends toward aesthetic enhancement, supported by public health initiatives that promote eye health awareness.

Turkey Soft Contact Lens Market Trends

The soft contact lenses industry in Turkey is rapidly changing, driven by a growing need for vision correction and an increasingly fashion-conscious population. Factors such as an aging demographic and greater use of digital devices are contributing to a rise in refractive errors. Consumers are leaning towards innovative silicone hydrogel lenses and daily disposables, appreciated for their comfort and hygiene. The retail landscape is evolving, with a notable increase in e-commerce that enhances access to both functional and colored cosmetic lenses. Influencer culture and fashion trends significantly influence consumer choices, blending vision correction with personal style. The introduction of online consultations and digital prescriptions is further personalizing the experience, hastening the adoption of soft contact lenses for both corrective and cosmetic purposes.

Key Middle East Soft Contact Lenses Company Insights

Some key companies in the Middle East industry include CooperVision, Bausch+Lomb Health, and Optical Products Trade Inc., among others.

-

Alcon, Inc., is a leader in eye care and is dedicated to helping people see better through its surgical and vision care businesses. It offers a wide range of daily disposable, color-enhancing, reusable contact lenses as well as a portfolio of ocular health products.

Key Middle East Soft Contact Lenses Companies:

- CooperVision

- Bausch+Lomb Health

- Optical Products Trade Inc.

- Johnson & Johnson Middle East, Inc.

- Alcon, Inc.

Recent Development

-

In June 2025, Johnson & Johnson introduced the TECNIS Odyssey, a new intraocular lens for cataract patients across Europe, the Middle East, and Canada. The lens is designed to provide high-quality, clear, and continuous vision at all distances and in any lighting condition, aiming to reduce the need for glasses.

Middle East Soft Contact Lenses Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 391.42 million

Revenue forecast in 2033

USD 633.29 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Usage, application, distribution channel, country

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Turkey

Key companies profiled

CooperVision; Bausch+Lomb Health; Optical Products Trade Inc.; Johnson & Johnson Middle East, Inc.; Alcon, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to the country, country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Soft Contact Lenses Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East soft contact lenses market report based on usage, application, distribution channel, and country.

-

Usage Outlook (Revenue, USD Million, 2021 - 2033)

-

Disposable

-

Traditional (Reusable)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Corrective (Prescription)

-

Non-Corrective (Cosmetic/Plano)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

E-commerce

-

Eye Clinics

-

Retail

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Turkey

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.