- Home

- »

- HVAC & Construction

- »

-

Middle East Steel Utility Poles Market, Industry Report, 2030GVR Report cover

![Middle East Steel Utility Poles Market Size, Share & Trends Report]()

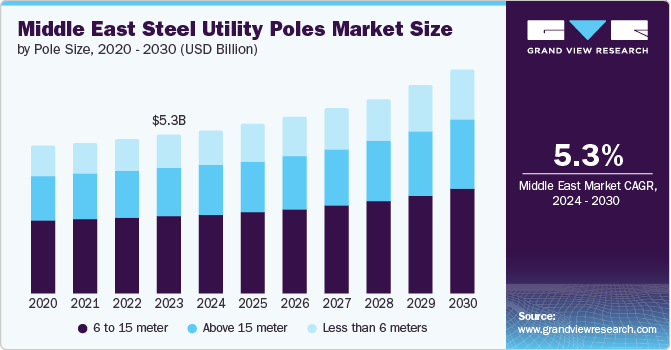

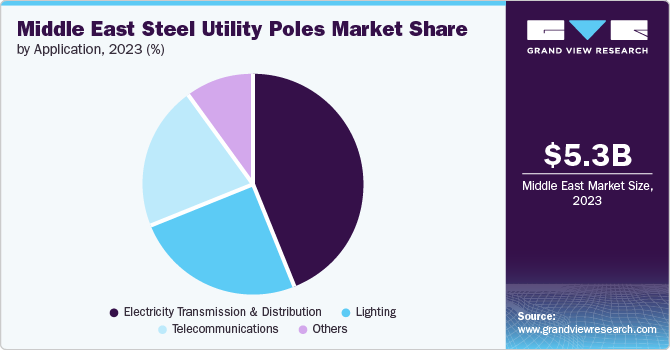

Middle East Steel Utility Poles Market Size, Share & Trends Analysis Report By Pole Size (Less Than 6 Meter, 6 to 15 Meter, Above 15 Meter), By Application (Lighting, Telecommunications), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-629-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Middle East Steel Utility Poles Market Trends

The Middle East steel utility poles market size was valued at USD 5.29 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The rapid urbanization and infrastructure development taking place across various Middle Eastern countries proliferate the market. As cities expand and populations increase, there is a growing need for reliable and efficient utility infrastructure, including electricity transmission and distribution networks. Steel utility poles are preferred for their durability, strength, and resistance to harsh environmental conditions, making them popular for supporting power lines in urban areas.

Countries in the region are investing heavily in renewable energy sources such as solar and wind power, which require robust support structures for their transmission lines. Steel utility poles offer a cost-effective solution for these projects, as they can withstand the weight of heavy cables and equipment while providing long-term reliability. The shift towards renewable energy generation drives the demand for steel utility poles as a critical component of modern energy infrastructure.

Governments in the region are implementing policies to upgrade aging infrastructure, improve grid stability, and reduce transmission losses. Steel utility poles are vital in modernizing power grids by providing a sturdy framework for overhead power lines, enabling utilities to deliver electricity more efficiently to consumers. The regulatory push towards grid modernization creates opportunities for steel utility pole manufacturers to meet the growing demand from utilities and energy companies.

Poles Size Insights

6 to 15 meter pole size dominated the market and accounted for a share of 48.8% in 2023. The Middle East region is witnessing a surge in renewable energy projects, particularly solar power installations. Solar farms require sturdy support structures for mounting solar panels, making steel utility poles an essential component of these projects. The shift towards renewable energy sources drives the demand for taller poles to support solar panels effectively.

Less than 6-meter pole size is anticipated to register the fastest CAGR over the forecast period. The increased demand for shorter utility poles in residential and urban areas has significantly contributed to the expansion of the market for steel utility poles that are less than 6 meters in height. These compact utility poles play a critical role in providing structural support for streetlights, traffic signals, signage, and various other types of equipment, underscoring the dynamic nature of urban infrastructure and the requisite for efficient and dependable utility support systems.

Application Insights

Electricity transmission & distribution accounted for the largest market revenue share in 2023. The rising demand for constant and reliable electricity across the Middle East has increased requirements for efficient transmission and distribution infrastructure. Utility poles, particularly those designed for electricity transmission and distribution, play a vital role in enabling the smooth and efficient flow of power across cities and towns. This demand is further amplified by the installation of renewable energy sources and the transition from conventional to renewable sources of electricity, reflecting the region's commitment to sustainable energy practices and infrastructure development.

The telecommunications segment is expected to register the fastest CAGR during the forecast period. The expansion of the telecommunications sector in the Middle Eastern countries has been a significant catalyst for industry growth. The increasing utilization of high-speed internet has been instrumental in propelling the advancement and modernization of telecommunication infrastructure. Furthermore, the development of the entertainment sector, encompassing the rising demand for satellite television, mobile phones, internet services, and computers, has further propelled the need for telecommunication infrastructure, thus fostering market growth.

Country Insights

Saudi Arabia Steel Utility Poles Market Trends

Saudi Arabia steel utility poles dominated the market in 2023. The completion of large-scale electrical interconnection projects, such as establishing the longest 380kV overhead transmission line connecting the Al-Qassim and Medina regions, has resulted in a heightened demand for overhead power distribution poles in Saudi Arabia. The nation's strategic development initiatives, exemplified by Vision 2030, have catalyzed infrastructure and construction endeavors, consequently leading to a marked upsurge in the requisition of steel utility poles, particularly for electricity transmission and distribution purposes.

Qatar Steel Utility Poles Market Trends

Qatar steel utility poles is anticipated to register the fastest CAGR over the forecast period. The region is witnessing a rising trend in beautifying road infrastructure, offering potential growth opportunities for the market. In Qatar, the Supervisory Committee of Beautification of Roads and Public Places has embarked on projects to install ornamental light poles, reflecting the nation's commitment to advancing urban aesthetics and infrastructure. Consequently, this trend has precipitated heightened demand for steel utility poles, particularly those tailored for decorative and practical illumination, propelling market expansion.

Key Middle East Steel Utility Poles Company Insights

Some of the key companies in the steel utility poles market include Al-Babtain Power & Telecom, Arabian Steel Pipes manufacturing, Europoles Middle East LLC, Galvanco, and Energya Steel-KSA. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Al-Babtain Power & Telecom (ABPT) offers a variety of steel utility pole products catering to different applications within the power transmission and telecommunication sectors. These include high-voltage transmission poles, medium-voltage transmission poles, distribution poles, monopole poles, lattice towers, street lighting poles, and high mast lighting systems.

-

Galvanco offers a wide range of steel utility poles that meet various industry needs and specifications. These utility poles are known for their durability, strength, and longevity, making them popular for infrastructure projects.

Key Middle East Steel Utility Poles Companies:

- Al-Babtain Power & Telecom

- Arabian Steel Pipes manufacturing

- Europoles Middle East LLC

- Galvanco

- Energya Steel-KSA

- Transrail Lighting Limited

- Inara Lighting Company

- Metrosmart International

- TECHNOPOLE

- Alcopole

Recent Developments

-

In October 2022, Al-Babtain Power & Telecom announced signing two contracts worth USD 52 million with Elsewedy Electric T&D and Giza Cable Industries Company. The contracts are expected further to strengthen the company’s presence in the industry and enhance its capabilities in delivering power and telecom solutions.

Middle East Steel Utility Poles Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 7.43 billion

Growth Rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Volume in thousand units, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pole size, application and country

Country scope

Qatar, Saudi Arabia and UAE

Key companies profiled

Al-Babtain Power & Telecom; Arabian Steel Pipes manufacturing; Europoles Middle East LLC; Galvanco; Energya Steel-KSA; Transrail Lighting Limited; Inara Lighting Company; Metrosmart International; TECHNOPOLE; Alcopole

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Steel Utility Poles Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East steel utility poles market report based on pole size, application, and country.

-

Pole Size Outlook (Volume, Thousand Units) (Revenue, USD Million, 2018 - 2030)

-

Less than 6 meters

-

6 to 15 meter

-

Above 15 meter

-

-

Application Outlook (Volume, Thousand Units) (Revenue, USD Million, 2018 - 2030)

-

Electricity Transmission & Distribution

-

Lighting

-

Telecommunications

-

Others

-

-

Regional Outlook (Volume, Thousand Units) (Revenue, USD Million, 2018 - 2030)

-

Middle East

-

Saudi Arabia

-

Qatar

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."