- Home

- »

- Automotive & Transportation

- »

-

Middle East Third-party Logistics Market Size Report, 2033GVR Report cover

![Middle East Third-party Logistics Market Size, Share & Trends Report]()

Middle East Third-party Logistics Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (DTM, ITM, VAL), By Transport, By End Use (Retail, Manufacturing, Automotive), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-851-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Third-Party Logistics Market Summary

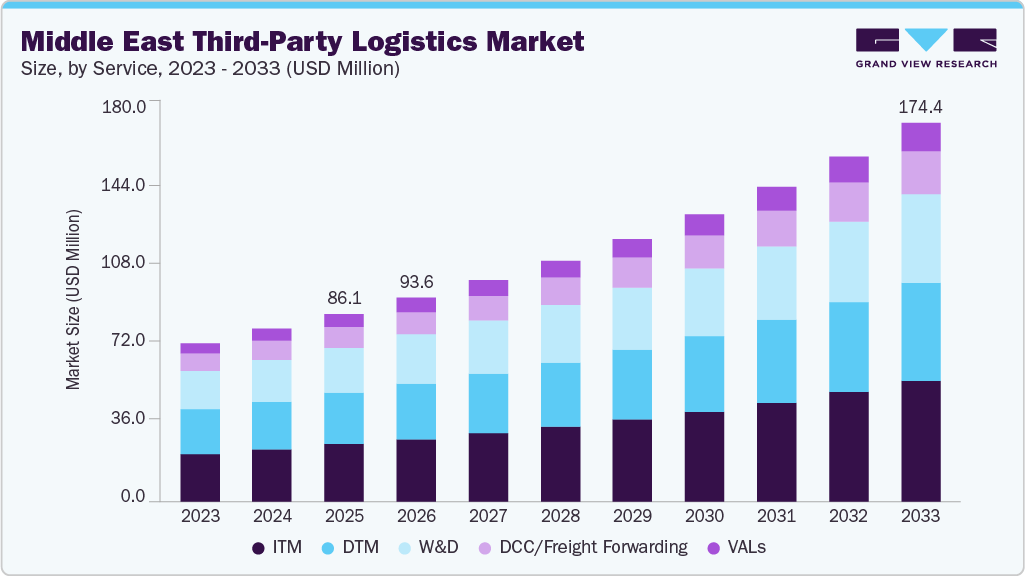

The Middle East third-party logistics market size was estimated at USD 86.11 billion in 2025 and is projected to reach USD 174.37 billion by 2033, growing at a CAGR of 9.3% from 2026 to 2033. The Middle East third-party logistics market is gaining momentum, driven by rising demand from retail, healthcare, FMCG, and automotive sectors across the GCC and Levant regions.

Key Market Trends & Insights

- Middle East third-party logistics market accounted for a 10.3% share of the global 3PL market in 2025.

- UAE in the Middle East third-party logistics held a dominant position in 2025.

- By services, the ITM segment accounted for the largest share of 30.4% in 2025.

- By transport, the roadways segment held the largest market share in 2025.

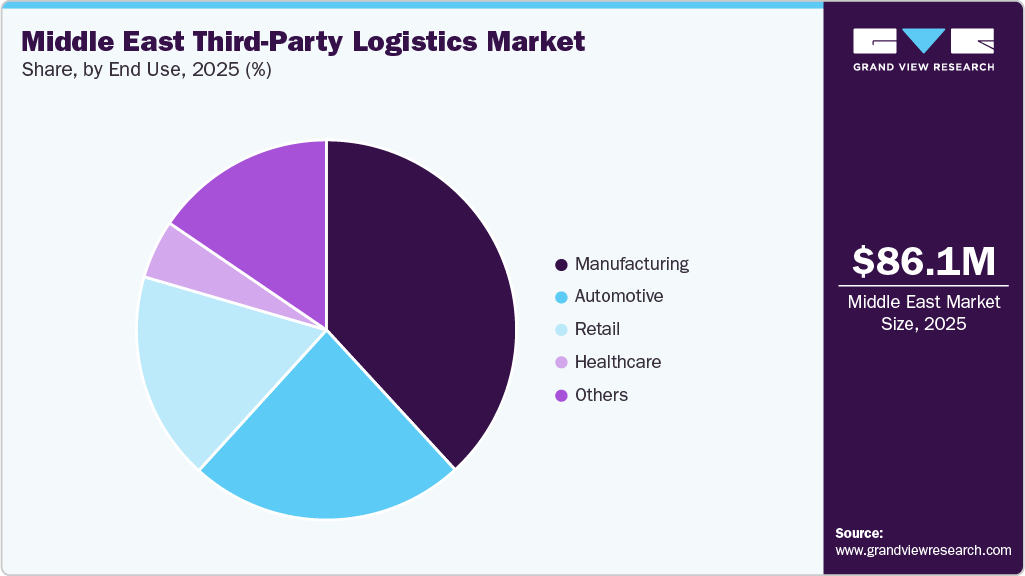

- By end-use, the manufacturing segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 86.11 Billion

- 2033 Projected Market Size: USD 174.37 Billion

- CAGR (2026-2033): 9.3%

- UAE: Largest market in 2025

Rapid growth in e-commerce, increasing re-export trade, and the expansion of free zones are fueling the need for advanced warehousing, distribution, and last-mile delivery solutions. Investments in bonded warehouses, smart fulfilment centres, and multimodal transport corridors, linking ports such as Jebel Ali, Khalifa, and Dammam with regional hubs, are improving speed and reliability.Adoption of digital tools, including real-time shipment tracking, warehouse automation, and data-driven inventory management, is enhancing operational efficiency. However, regulatory variations across countries, high logistics costs, and limited availability of trained logistics professionals continue to pose challenges for market expansion.The Middle East e-commerce sector is experiencing rapid growth across the GCC and Levant regions, led by countries including the UAE, Saudi Arabia, and Kuwait. The increase in online shopping is supported by widespread smartphone penetration, the adoption of digital payments, and the rise of social commerce platforms. In Saudi Arabia, e-commerce sales grew by over ~31% in 2024, driven by the FMCG, electronics, and fashion sectors. This growth is fueling demand for reliable third-party logistics providers capable of managing high-volume, time-sensitive last-mile deliveries, reverse logistics, and fulfilment operations. Regional players such as Aramex, Fetchr, and DHL are expanding dedicated e-commerce hubs and same-day delivery services to meet increasing consumer expectations, making e-commerce a key driver for 3PL adoption in the Middle East.

Logistics infrastructure investments are accelerating across the Middle East, enhancing 3PL capabilities. Strategic developments in Dubai South, Jebel Ali Free Zone, Khalifa Port, and King Abdullah Economic City provide bonded warehouses and smart fulfilment centres that simplify customs clearance, storage, and regional distribution. Multimodal transport corridors, such as the planned GCC railway network and Saudi Arabia’s North-South railway, improve connectivity between ports, airports, and inland hubs. 3PL providers like Kuehne + Nagel, Expeditors, and CEVA Logistics are leveraging these infrastructures to offer integrated logistics solutions that combine warehousing, freight forwarding, and last-mile delivery. These investments enhance speed, reliability, and cross-border trade efficiency, particularly in sectors such as automotive, healthcare, and FMCG.

Digitalization presents significant growth opportunities for 3PL providers in the Middle East. The use of IoT sensors, RFID tracking, warehouse management systems (WMS), AI-powered demand forecasting, and autonomous robotics enables higher operational efficiency and transparency. DHL, Aramex, and Kuehne + Nagel have implemented smart warehouses in the UAE and Saudi Arabia featuring automated sorting, robotic picking, and real-time inventory monitoring. Predictive analytics and digital platforms optimize routes, reduce delivery delays, and provide customers with enhanced visibility. The adoption of these technologies is particularly critical for e-commerce, FMCG, and healthcare supply chains, where speed, accuracy, and traceability are essential, creating opportunities for 3PL providers to differentiate and scale operations.

The Middle East 3PL market faces challenges due to high operational costs and a shortage of trained logistics personnel. Transportation costs, fleet maintenance, customs handling, and port fees contribute to elevated logistics expenses. Cross-border trucking within the GCC, for instance, can incur significant tolls, fuel, and regulatory compliance costs. Additionally, there is a limited pool of professionals skilled in warehouse automation, digital logistics, and supply chain management, forcing companies to rely on expatriates or invest in intensive training programs. These factors increase operating costs and can limit the speed of service expansion, constraining the overall growth potential of the 3PL market in the region.

Service Insights

The international transportation management (ITM) segment held the largest market share of 30.4% in 2025. ITM services are widely adopted for managing cross-border freight, customs coordination, multimodal routing, and regulatory compliance across GCC and Levant trade lanes. Growth in this segment is driven by expanding regional trade, increasing outsourcing of freight forwarding activities, and rising demand for end-to-end visibility and cost optimization. Leading 3PL providers in the Middle East, including DHL Supply Chain, Kuehne + Nagel, DB Schenker, and CEVA Logistics, are strengthening their ITM capabilities through investments in digital freight platforms, transportation management systems, and strategic carrier partnerships.

The value-added logistics (VALs) segment is expected to be the fastest-growing service area, expanding at a 10.9% CAGR, supported by specialized services such as cold chain handling, co-packing, labeling, and order customization. This trend underscores the region’s shift toward integrated, flexible, and technology-enabled logistics solutions to meet the evolving demands of businesses and consumers.

Transport Insights

The roadways segment dominated the Middle East 3PL market, accounting for over 33.1% in 2025. Growth is supported by expanding GCC highway networks, logistics corridors, and public-private partnerships that enhance regional freight connectivity. Government investments in road infrastructure, such as Saudi Arabia’s Vision 2030 transport initiatives and the UAE’s national logistics strategy, are further boosting road transport efficiency and reliability.

The airways segment is expected to be the fastest-growing, expanding at a CAGR of 10.1% over the forecast period. This growth is driven by the rapid expansion of air cargo hubs in the UAE, Qatar, and Saudi Arabia, rising demand for time-sensitive e-commerce shipments, and strategic development of regional airports, including Dubai International, Abu Dhabi International, and Hamad International, as global logistics gateways. Increasing adoption of temperature-controlled air freight for pharmaceuticals and high-value goods is also accelerating growth in air-based 3PL services.

End-Use Insights

The manufacturing sector accounted for the largest revenue share of the Middle East 3PL market in 2025, supported by strong activity across petrochemicals, metals, construction materials, and industrial processing. Manufacturing supply chains in Saudi Arabia, the UAE, and Oman rely extensively on cross-border sourcing and export-oriented distribution, increasing demand for third-party logistics services. Freight flows are largely routed through major regional ports such as Jebel Ali, Dammam, Jubail, and Yanbu, requiring coordinated international transportation management, bonded warehousing, and inventory staging near production hubs.

Industrial zones, including Jubail Industrial City and Ruwais, have increased outsourcing of logistics functions to improve customs coordination, reduce port dwell time, and enhance supply chain visibility. Ongoing industrial diversification initiatives under Saudi Vision 2030, the National Industrial Development and Logistics Program, and the UAE’s Operation 300bn are supporting sustained manufacturing-led demand for 3PL services.

The retail sector is expected to emerge as the fastest-growing end-use segment over the forecast period. Growth is driven by the expansion of organized retail, cross-border e-commerce, and centralized fulfilment models across the UAE and Saudi Arabia. Retailers are increasingly outsourcing warehousing, last-mile delivery, and reverse logistics to 3PL providers to support high order volumes, faster delivery timelines, and multi-channel distribution requirements, particularly in major consumption hubs such as Dubai, Riyadh, and Jeddah.

Country Insights

The UAE third-party logistics industry held a dominant market share of 48.3% in 2025, supported by its role as the primary logistics gateway for the Middle East, Africa, and South Asia. The country benefits from an integrated logistics ecosystem anchored by Jebel Ali Port, Khalifa Port, Dubai International Airport, and Al Maktoum International Airport, enabling seamless sea-air and multimodal operations. Growth is driven by strong re-export activity, regional distribution hub demand, and rising cross-border e-commerce flows serving GCC and African markets.

The expansion of free zones such as JAFZA, Dubai South, and KIZAD continues to attract multinational manufacturers and retailers that rely on 3PL providers for bonded warehousing, customs brokerage, and value-added services. Increasing adoption of automation, robotics, and digital freight platforms further strengthens the UAE’s position as the regional 3PL hub.

Kingdom of Saudi Arabia Third-party Logistics Market Trends

The Kingdom of Saudi Arabia third-party logistics industry held a significant share in 2025, driven by large-scale economic diversification and infrastructure development initiatives. Saudi Arabia’s logistics demand is closely linked to Vision 2030 programs, including the National Industrial Development and Logistics Program, which aims to position the Kingdom as a global logistics hub connecting Asia, Europe, and Africa. Expansion of industrial cities such as Jubail, Yanbu, and MODON zones is increasing demand for inbound raw material logistics, domestic distribution, and export-oriented freight forwarding. Major port investments at Jeddah Islamic Port and King Abdullah Port, along with the expansion of the national rail freight network, are reshaping cargo movement patterns. Growing domestic consumption, large-scale construction projects, and giga-project developments are further accelerating outsourcing of transportation, warehousing, and project logistics to 3PL providers.

Qatar Third-party Logistics Market Trends

Qatar third-party logistics market is shaped by infrastructure-led demand and long-term supply chain localization efforts. The country’s logistics activity is centered around Hamad Port and Hamad International Airport, which have become critical gateways for import-driven supply chains supporting construction, energy, and food security initiatives. Expansion of LNG production capacity under the North Field project has increased demand for specialized logistics services, including heavy lift transportation, equipment handling, and industrial warehousing.

Qatar’s focus on enhancing domestic manufacturing and reducing import dependency has driven growth in bonded storage, cold chain logistics, and last-mile distribution. Additionally, increased government spending on infrastructure maintenance and urban development is sustaining demand for project logistics and contract logistics services across Doha and emerging industrial zones.

Oman Third-party Logistics Market Trends

Oman third-party logistics market is gaining traction due to its strategic positioning as an alternative trade corridor outside the Strait of Hormuz. Development of Duqm Port, Sohar Port, and Salalah Port has strengthened Oman’s role in bulk cargo handling, transshipment, and industrial logistics. Growth is supported by rising activity in mining, petrochemicals, fisheries, and renewable energy projects, which require specialized transportation and storage solutions.

Oman’s logistics strategy emphasizes port-led industrialization, encouraging manufacturers to colocate near ports and outsource logistics operations to 3PL providers. Improved road connectivity linking ports to Saudi Arabia and the UAE is increasing cross-border freight movement, while customs modernization initiatives are reducing clearance timelines and enhancing supply chain efficiency.

Kuwait Third-party Logistics Industry Trends

Kuwait third-party logistics industry held a dominant position in 2025, supported by rising public infrastructure investment and modernization of trade logistics. Expansion and redevelopment of Shuwaikh Port and Shuaiba Port are improving cargo handling efficiency and supporting higher import volumes for construction materials, consumer goods, and industrial equipment. Kuwait’s logistics demand is also driven by government-backed housing projects, refinery upgrades, and power generation investments, which increase the need for project cargo logistics and domestic transportation services. Growth in organized retail and food imports has boosted demand for temperature-controlled warehousing and last-mile delivery solutions.

Key Middle East Third-party Logistics Company Insights

Some of the key players operating in the market include DHL Supply Chain & Global Forwarding (Deutsche Post AG), CEVA Logistics AG, DSV A/S, and United Parcel Service of America, Inc.

-

Founded in 1969 and headquartered in Bonn, Germany, DHL Supply Chain & Global Forwarding operates as a division of Deutsche Post AG. The company provides third-party logistics and supply chain management services across the Middle East, including contract logistics, freight forwarding, warehousing, transportation management, customs clearance, and value-added logistics services. DHL serves multiple end-use industries such as automotive, healthcare, retail, industrial manufacturing, and technology, supported by a broad regional network of logistics facilities and digital supply chain management platforms.

-

Founded in 1907 and headquartered in Atlanta, Georgia, U.S., United Parcel Service of America, Inc. (UPS) is a global logistics and package delivery company. Through its Supply Chain Solutions business, the company offers third-party logistics services in the Middle East, including freight forwarding, customs brokerage, warehousing, e-fulfillment, and last-mile delivery. UPS operates logistics facilities across key Middle Eastern markets and utilizes digital tools such as shipment tracking systems and automated sorting technologies to support supply chain operations.

Key Middle East Third-party Logistics Companies:

- DHL Supply Chain & Global Forwarding (part of Deutsche Post AG)

- Aramex International LLC

- CEVA Logistics AG

- Kuehne + Nagel International AG

- DB Schenker (brand of Schenker AG)

- DSV A/S

- Federal Express Corporation (FedEx)

- United Parcel Service of America, Inc. (UPS)

- Gulf Agency Company Limited (GAC)

- Al-Futtaim Logistics (part of Al-Futtaim Group)

Recent Developments

-

In November 2025, Al Khayyat Investments (AKI) launched AKI Logistics, marking its entry into the UAE third-party logistics market. The company introduced end-to-end 3PL services for retail, healthcare, and FMCG customers, including warehousing, customs clearance, cold chain handling, value-added logistics, and last-mile delivery, supported by logistics hubs in Dubai.

-

In April 2025, Expeditors International of Washington, Inc. inaugurated a new warehousing and fulfilment facility at Dubai South’s Logistics District. The site strengthens the company’s Middle East third-party logistics capabilities by supporting warehousing, container freight station operations, inventory management, order fulfilment, and transportation management services.

-

In June 2024, Kuehne + Nagel International AG broke ground on a new e-commerce fulfilment and distribution centre in EZDubai, Dubai South. The facility is strategically located near Al Maktoum International Airport and Jebel Ali Port, strengthening the company’s Middle East third-party logistics and e-commerce fulfilment capabilities through bonded logistics corridor connectivity.

Middle East Third-party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 93.58 billion

Revenue forecast in 2033

USD 174.37 billion

Growth rate

CAGR of 9.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, transport, end use, Country

Regional scope

Middle East

Country scope

UAE; KSA; Qatar; Oman; Kuwait

Key companies profiled

DHL Supply Chain & Global Forwarding (Deutsche Post AG); Aramex International LLC; CEVA Logistics AG; Kuehne + Nagel International AG; Schenker AG (DB Schenker); DSV A/S; Federal Express Corporation; United Parcel Service of America, Inc.; Gulf Agency Company Limited; Al-Futtaim Logistics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East third-party logistics market report based on service, transport, end-use, and country.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Dedicated Contract Carriage (DCC)/Freight forwarding

-

Domestic Transportation Management (DTM)

-

International Transportation Management (ITM)

-

Warehousing & Distribution (W&D)

-

Value Added Logistics Services (VALs)

-

-

Transport Outlook (Revenue, USD Million, 2021 - 2033)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Retail

-

Healthcare

-

Automotive

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

Qatar

-

Oman

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East third-party logistics market size was estimated at USD 86.11 billion in 2025 and is projected to reach USD 174.37 billion by 2033.

b. The international transportation management (ITM) segment held the largest market share of 32.3 % in 2025. ITM services are widely adopted for managing cross-border freight, customs coordination, multimodal routing, and regulatory compliance across GCC and Levant trade lanes. Growth in this segment is driven by expanding regional trade, increasing outsourcing of freight forwarding activities, and rising demand for end-to-end visibility and cost optimization.

b. Some key players operating in the Middle East third-party logistics market include TDHL Supply Chain & Global Forwarding (Deutsche Post AG), Aramex International LLC, CEVA Logistics AG, Kuehne + Nagel International AG, Schenker AG (DB Schenker), DSV A/S, Federal Express Corporation, United Parcel Service of America, Inc., Gulf Agency Company Limited, Al-Futtaim Logistics.

b. Key factors that are driving the market growth include rising demand from retail, healthcare, FMCG, and automotive sectors across the GCC and Levant regions. Rapid growth in e-commerce, increasing re-export trade, and the expansion of free zones are fueling the need for advanced warehousing, distribution, and last-mile delivery solutions.

b. The Middle East third-party logistics market is expected to grow at a compound annual growth rate of 9.3% from 2026 to 2033 to reach USD 174.37 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.